June is the best month of the year – It’s National Homeownership Month! As a local lender, we’re dedicated to helping people achieve sustainable homeownership and their American Dream. We believe in the power of owning a home, and we’re thrilled to celebrate the countless benefits it brings to individuals, families, and communities this month – and every single day of the year!

The Importance of Homeownership

Homeownership is more than just having a roof over your head – it’s a dream, it’s stability and control of your environment, and it’s a powerful tool for building wealth. Beyond the personal benefits, research shows that stable housing plays a crucial role in children’s well-being, strengthens communities, and contributes to a thriving economy.

We love telling the stories of happy homeowners, especially the ones that capture the joy and fulfillment that comes with ownership after overcoming challenges and hurdles. These new homeowners are the reason everyone at the NFM Family of Lenders is passionate about getting people and families into the homes they love.

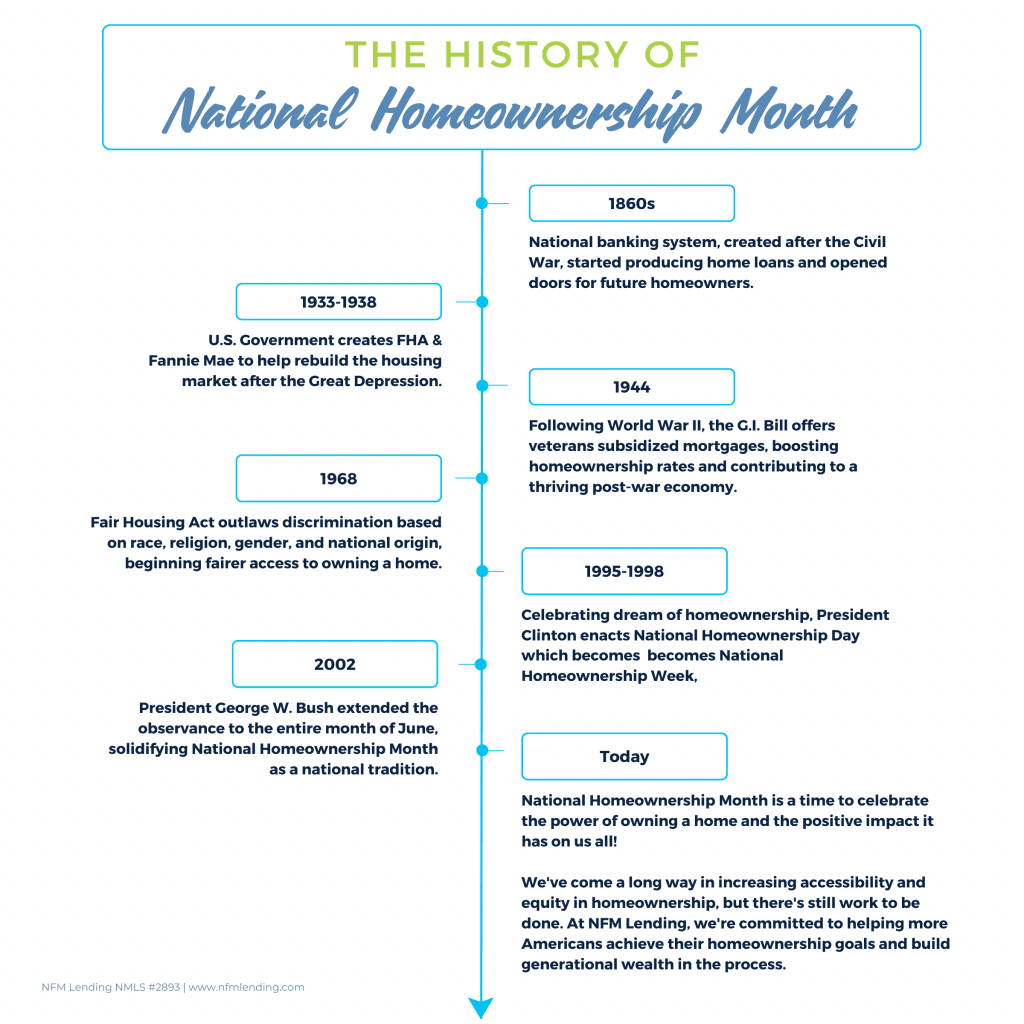

The History of National Homeownership Month

To get a glimpse into why we celebrate Homeownership Month nationally, here’s a timeline of homeownership and this special month in the United States. These events have paved the way for more Americans to achieve the dream of homeownership:

Homeownership Rates in the US: A Reason to Celebrate

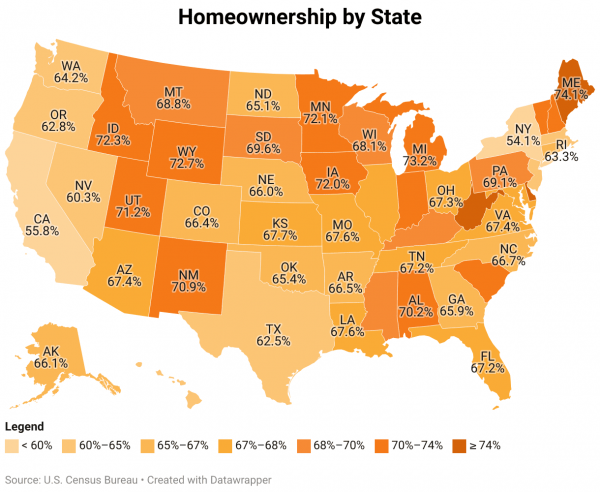

Homeownership rates in the US have steadily climbed over the years, offering a reason to celebrate progress. In 1900, the homeownership rate stood at 46.5%. By 2000, it had risen to 66.2%, and it continues to hover near that mark today. National Homeownership Month allows us to reflect on these gains and express gratitude for the increased accessibility of homeownership.

Here’s an interactive data visualization that lets you explore homeownership and renter-occupied housing rates by state.

Homeownership Rates Across Minorities

Single women can celebrate having the highest rate of first-time homeownership (19%) behind married couples (59%), and overtaking single men (10%). Especially since women in the U.S. were not allowed to finance the purchase of real estate without a husband or male cosigner until the 1970s.

However, despite overall growth in minority homeownership, racial and ethnic disparities persist. According to the Census Bureau, the homeownership rate for non-Hispanic White Americans sits at 73.8% (4th quarter 2023), compared to 63% for Asian Americans, 49.8% for Hispanic Americans, and 45.9% for Black Americans. We still have work to do in ensuring equal access to homeownership for all.

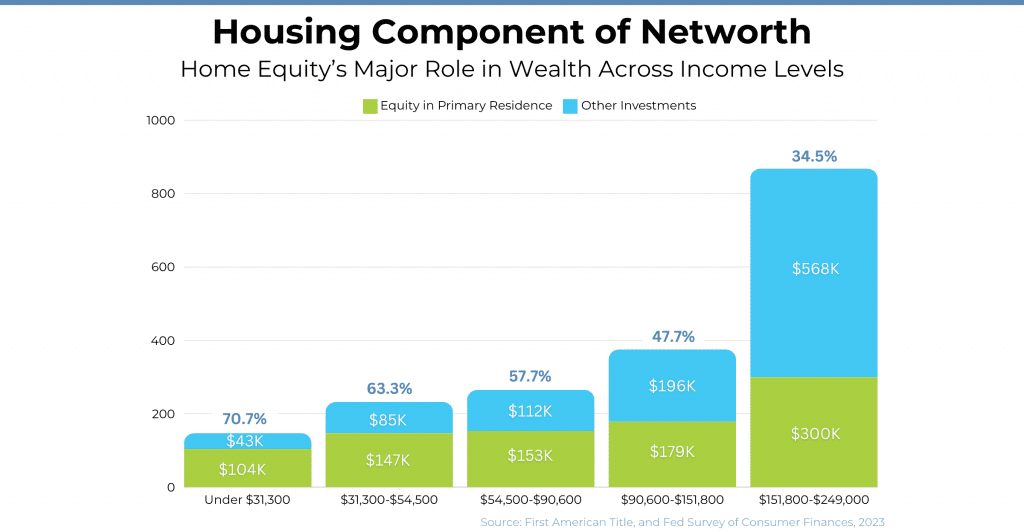

Net Worth and Homeownership: Wealth Building at Home

Owning a home is a powerful tool for building wealth, particularly for low and middle-income families. Statistics show a significant gap in net worth between homeowners and renters. In 2022, the Federal Reserve reported a median net worth of $396,200 for homeowners, compared to just $10,400 for renters. This means the average homeowner has nearly 40 times the net worth of a renter. (see graph below):

Here’s what Economist at First American Title, Ksenia Potapov, has to say about the wealth gap between renters and homeowners:

“Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated by monthly mortgage payments . . .”

So, what’s the secret behind the #1 wealth builder for low- and middle-income Americans? Here are some key factors:

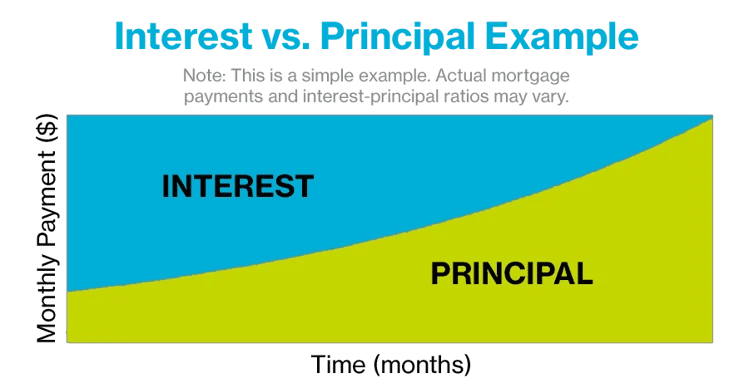

- Forced Savings: Your monthly mortgage payment acts like a form of forced savings. Unlike rent payments that vanish each month to build a landlord’s equity, mortgage payments contribute to your long-term wealth accumulation.

- Equity Accumulation: When you own a home, you build equity as the value increases (appreciates) and through regular monthly mortgage payments. This equity becomes yours when you sell, providing a historically significant financial return.

Home Value – Loan Amount = Equity

Equity: the cornerstone of wealth building

Housing equity is the largest component of net worth for most owner-occupied households. Owning a home, even at a more affordable price point, can significantly contribute to your overall financial well-being through appreciation. This is especially evident for Black and Hispanic homeowners and those with lower-to-mid range incomes.

Benefits of Homeownership: More Than Just Financial Gain

Owning a home offers a variety of advantages that go far beyond just financial rewards. In fact, the impact on your physical, mental, and financial well-being can be life-changing. A 2013 study by two professors at the University of North Carolina at Chapel Hill documents a range of social benefits associated with homeownership.

- Building Strong Families and Communities: The sense of satisfaction, stability, quality, freedom, and control that comes with homeownership extends to other important aspects of life, such as education, employment, healthcare, and retirement savings. Homeownership can also positively impact families and children.

- Investing in Your Neighborhood: Studies suggest that homeownership can contribute to a stronger economy and a more vibrant community. Homeowners are more likely to be invested in their neighborhoods, which can lead to increased property values and a thriving local economy. They’re also more likely to participate in local activities and take pride in their surroundings, fostering a stronger sense of belonging and connection with neighbors.

Working Towards an Inclusive Housing Market

National Homeownership Month is a time to celebrate progress, but we acknowledge that significant barriers still prevent many Americans from achieving the dream of homeownership. Here at NFM Lending, we are committed to addressing these challenges head-on.

Recognizing that racial and social inequities, limited financial literacy, and systemic issues have historically disadvantaged certain communities in homeownership, we believe that advocacy and tailored financial solutions are key to closing these gaps. By providing access to funding for home construction and ownership, we can promote inclusive growth in the housing market.

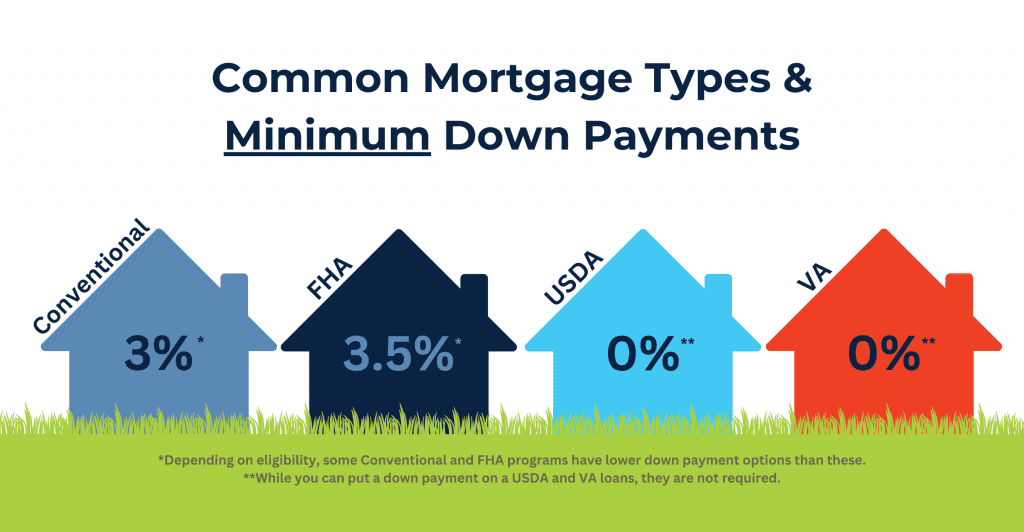

We’re strong believers in creating a housing market that’s open to everyone. That’s why NFM offers special programs and resources to empower first-time homebuyers, low and moderate-income families, and communities of color. These initiatives aim to make homeownership a reality for everyone. And we want everyone to experience the joy and stability that comes with owning a home! You can learn more about our equity, and inclusion initiatives on our website.

Celebrating Homeownership and Looking Ahead

National Homeownership Month is a time to celebrate the power of owning a home and the positive impact it has on individuals, families, and communities. We’ve come a long way in increasing accessibility and equity in h, but there’s still work to be done. Here at NFM Lending, we’re committed to helping more people achieve their homeownership goals and build generational wealth in the process.

If you don’t know where to start, give us a call! We’re here for you before, during, and throughout your entire homeownership journey.