By Alena Kairys

Dec 28, 2022“Amortization” might sound complex and confusing, but it’s easy to understand once you know how it works.

What is Loan Amortization?

Amortization is when a loan’s balance is gradually reduced through routine payments. With an amortized loan (such as a mortgage), most of the initial loan payments will go towards the interest but will increasingly go towards the principal over time until the balance is zero. An amortized repayment structure makes becoming a homeowner more accessible and beneficial. Instead of having to pay back all the money you borrowed to buy a home in one large payment, amortization lets you pay off your mortgage in manageable chunks. Another perk is that with every principal payment, you’re increasing home equity and paying down your home faster. Making extra principal payments can help you pay off your mortgage early and save money in the long run; check that doing so will not result in prepayment penalties.

Mortgage Amortization: A Closer Look

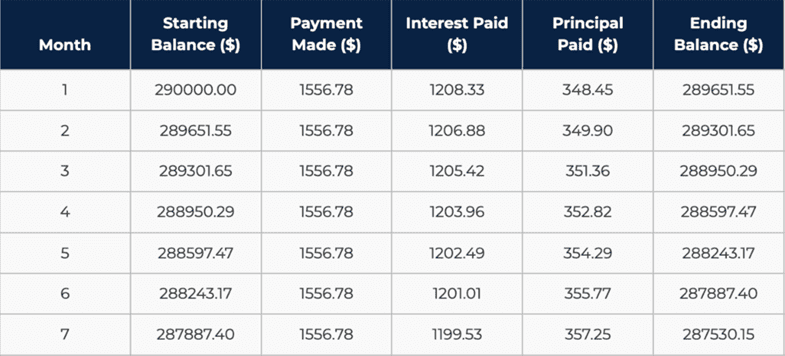

If you were to get a 30-year fixed-rate mortgage of $290,000 at 5% interest, your monthly payment would be $1,556.78. In the first month, $1208.33 of that payment goes towards the interest, while only $348.45 is distributed to the principal. Each month afterward, a little bit more of the payment contributes to the principal.

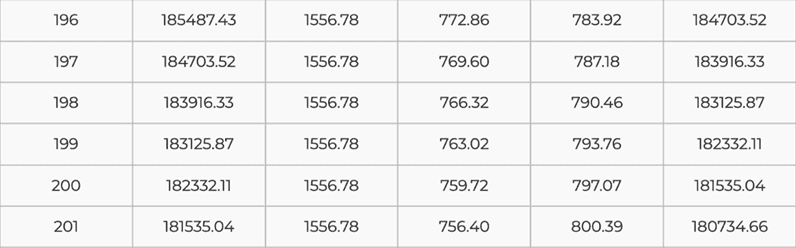

At 196 months, the portion that goes to your principal becomes greater than the interest portion, $783.92 versus $772.86, respectively. This shift continues for the rest of the 30-year loan term until the loan is paid off.

Most adjustable-rate mortgages (ARM) are amortizing, too. For hybrid ARMs where there’s an initial fixed-rate period, the loan follows a normal amortization schedule. Once the adjustable period begins, the loan will re-amortize each time the rate and monthly payment adjust. When you’re reviewing mortgage options with your Loan Originator, they’ll give you an amortization schedule so you can see the payment breakdown. You can also use an amortization calculator to get an estimate for a rough calculation.

Maintaining a mortgage is a massive financial responsibility, and it takes time to pay it off. When you understand how mortgage repayment is structured, you can make better financial decisions and feel confident that you’re breaking down your loan, one payment at a time.

If you want to know more about how to pay off your mortgage faster, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

These blogs are for informational purposes only. Make sure you understand the features associated with the loan program you choose, and that it meets your unique financial needs. Subject to Debt-to-Income and Underwriting requirements. This is not a credit decision or a commitment to lend. Eligibility is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Not all programs are available in all areas. Offers may vary and are subject to change at any time without notice. Should you have any questions about the information provided, please contact us.