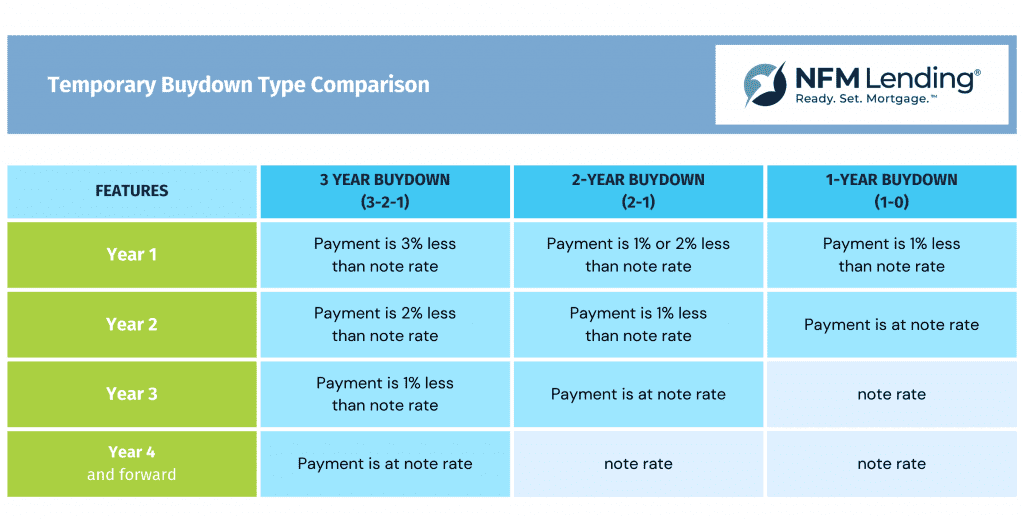

While both options involve lowering your interest rate, temporary and permanent buydowns have key differences:

Temporary buydowns can be a good idea for first-time home buyers who are shocked by the speed at which mortgage rates have risen, and who will deplete their savings on the down payment and closing costs. The temporary payment reduction allows borrowers to replenish savings or spend the money on home upgrades.

The most favorable time to take advantage of a buydown is when the seller or builder is offering to contribute cash towards closing. Sometimes this can happen as an incentive to get a buyer to purchase their home or to encourage the purchase of a home in a newly built community. If this isn’t an option, a buyer can often still pay down the rate themselves.

Final Thoughts

Now that you understand temporary buydowns, it’s crucial to weigh the pros and cons against your individual financial situation and homebuying goals. Consulting with a mortgage professional is the best way to determine if a temporary buydown aligns with your needs. They can assess your eligibility, calculate potential costs and savings, and guide you through the entire mortgage process.

Beyond temporary buydowns, there are other strategies to navigate the homebuying journey in today’s market. Our team of home loan experts is dedicated to helping you explore all your options. Additionally, check out our blog for informative articles on various mortgage programs, down payment assistance, and tips for first-time homebuyers.

Let us empower you to make informed decisions and turn your dream of homeownership into reality. Contact us today to schedule a free consultation!