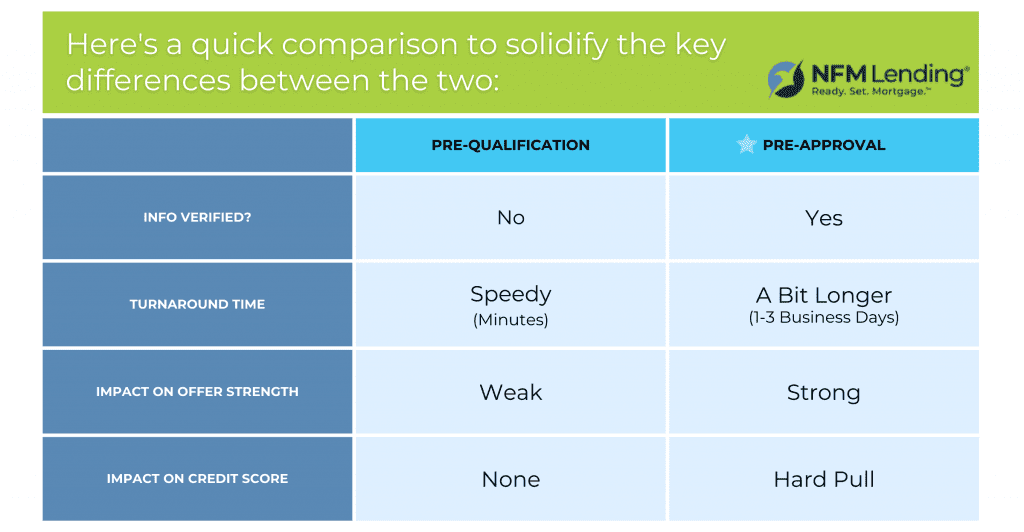

Equal housing lender. Make sure you understand the features associated with the loan program you choose, and that it meets your unique financial needs. Subject to Debt-to-Income and Underwriting requirements. This is not a credit decision or a commitment to lend. Eligibility is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Refinancing an existing loan may result in the total finance charges being higher over the life of the loan. Not all programs are available in all areas. Offers may vary and are subject to change at any time without notice. Qualifying credit score needed for conventional loans. LTV’s can be as high as 96.5% for FHA loans. FHA minimum FICO score required. Fixed rate loans only. W2 transcript option not permitted. Veterans Affairs loans require a funding fee, which is based on various loan characteristics. For USDA loans, 100% financing, no down payment is required. The loan amount may not exceed 100% of the appraised value, plus the guarantee fee may be included. Loan is limited to the appraised value without the pool, if applicable. The pre-approval may be issued before or after a home is found. A pre-approval is an initial verification that the buyer has the income and assets to afford a home up to a certain amount. This means we have pulled credit, collected documents, verified assets, submitted the file to processing and underwriting, ordered verification of rent and employment, completed an analysis of credit, debt ratio and assets, and issued the pre-approval. The pre-approval is contingent upon no changes to financials and property approval/appraisal. For Arizona originators: AZ# BK-0934973. In Alaska, business will only be conducted under NFM Lending and not any of our affiliate sites.