By Ashley Gower

May 2, 2024Dreaming of shedding years off your mortgage and saving a ton on interest? You’re not alone. From millennials and Gen Z to those who are preparing to retire, many homeowners are prioritizing early mortgage payoff. Here we’ll explore powerful techniques to pay off a mortgage early like biweekly payments, lump sum payments, and even the potential of mortgage refinance. We’ll answer all your burning questions, like “Is it really better to pay off my mortgage early or invest?” Let’s unveil the best ways to pay off your mortgage early and help you craft a personalized plan for financial freedom.

Why Pay Down your Mortgage Faster?

Now that you’re a homeowner, you aren’t paying your landlord’s mortgage and instead you’re building equity in your own place. Now picture yourself with that same home and free from a monthly mortgage payment, with the financial freedom to invest, travel, retire, or just breathe a little easier. That’s the magic of early payoff.

What are some advantages to paying off your mortgage early?

- Save Money on Interest: The longer it takes to pay off a loan, the more interest is paid over that time. Early payoff can mean tens or even hundreds of thousands saved in the long run (depending on loan size).

- Fast-Track to Financial Freedom: Being mortgage-free means a significant chunk of your income is freed up. Depending on your investment strategy, this could allow you to invest more aggressively, save additional money for retirement sooner, or simply enjoy a more comfortable lifestyle.

- Tap Into your Home Equity: A larger dent in your mortgage balance increases your equity. Your home’s equity can be a valuable resource for unexpected expenses or home improvements.

- Peace of Mind, Priceless: There’s a priceless serenity that comes with knowing your home is truly yours, with no monthly payment hanging over your head.

What is the Best Way to Pay Off Your Mortgage Early?

There’s no one-size-fits-all approach to early mortgage payoff. The ideal strategy depends on your financial situation, risk tolerance, and long-term goals. Consider these factors when creating your plan:

- Current Financial Situation: Analyze your income, expenses, and existing debt to determine how much extra you can comfortably allocate towards your mortgage.

- Risk Tolerance: Are you comfortable with a potentially tighter budget in exchange for faster payoff?

- Long-Term Goals: Do you prioritize early financial freedom or are there other financial goals you want to focus on?

Once you’ve considered these factors, you can choose the strategies that best suit you.

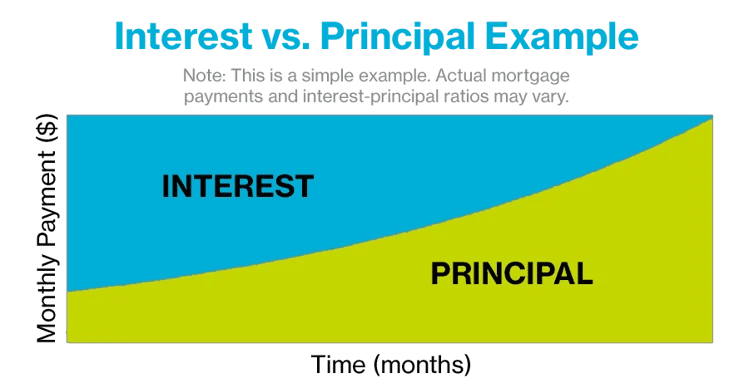

Understanding Principal Vs. Interest

Before we delve into specific strategies, let’s solidify the role of interest vs principal in your mortgage payment. This is key to maximizing your payoff efforts.

- Interest: The fee you pay for borrowing money (expressed as APR).

- Principal: This is the actual amount of money you borrowed for your mortgage to purchase the home.

- Amortization: The calculation of how your loan is paid down over a specific amount of time when regular payments are made.

Note: There are other costs added to your total monthly mortgage payment (local property taxes, homeowners insurance, HOA fees, etc.), but we’re only discussing principal and interest right now.

Every monthly payment is divided between interest and principal. In the early years of your loan, a larger chunk goes towards interest, with a smaller amount chipping away at your principal balance.

Example: For simplicity, let’s imagine your monthly Principal and Interest (P&I) payment is $1,000. Every loan is amortized over time, meaning monthly payments are split between principal and interest, reducing the loan balance over the span of your loan term. In the beginning, maybe $700 goes to interest and only $300 reduces your loan amount. The next month, your overall principal is reduced by $300 and the interest is now calculated upon your new, lower balance. That’s why early payoff is so powerful – it allows you to pay down the principal faster, reducing the overall interest you pay over time.

Related: Take a look at our amortization calculator.

Strategies for Early Mortgage Payoff

Pro Tip: Before changing your payment strategy, confirm if your mortgage servicer allows extra principal payments without penalties.

Alright, now that you’re armed with that knowledge, let’s explore some strategies to conquer your early mortgage pay-off strategy. Get ready, these may surprise you!

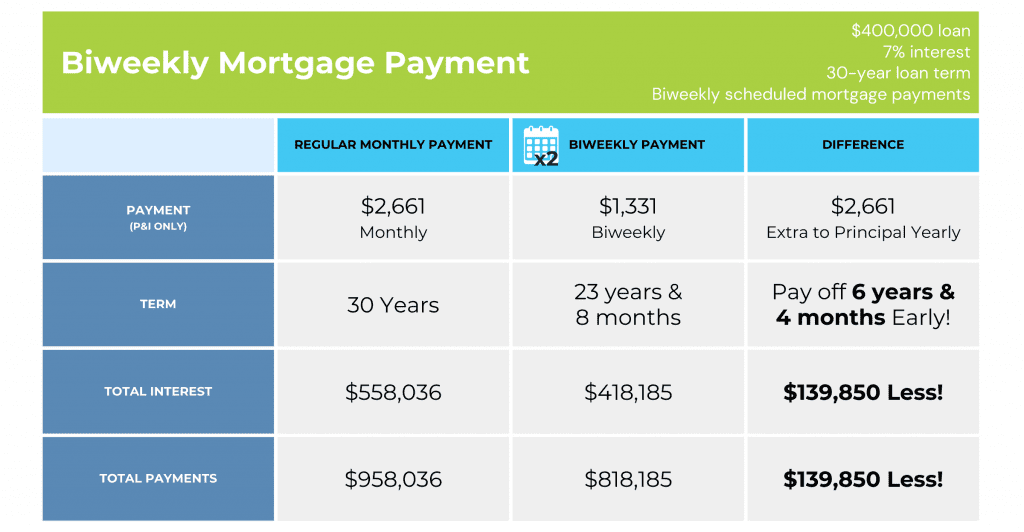

The Biweekly Mortgage Payment:

One popular way that some homeowners pay down their principal more quickly is to make biweekly payments. Instead of paying one monthly payment, you pay half the payment every 2 weeks.

Here’s a simple example to show the power of a biweekly payment. Let’s say you have a home loan for $400,000 with a 7% interest rate on a 30-year mortgage. In the example below you would pay $139,850.33 less in interest over the life of the loan with biweekly mortgage payments than if you made standard monthly payments!

There are online calculators available to determine these payments, or we can talk and run the numbers for you!

How Does a Biweekly Mortgage Payment Work?

Because a year has 52 weeks, this works out to 26 biweekly payments. This essentially allows you to make 13 full payments a year instead of 12. That one extra payment really compounds over time! When you pay your principal balance down faster, there’s less money to charge interest on, which lowers the amount of overall interest paid.

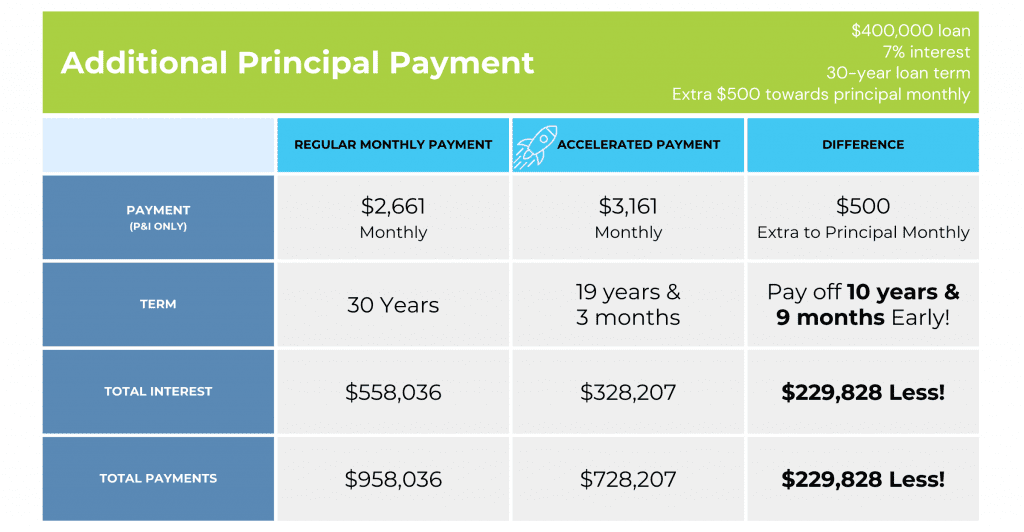

Make an Additional Principal Payment

Similar to biweekly payments, you can make an extra payment towards the principal each month. Even a small amount can make a big difference over time. Let’s revisit our example: $400,000 loan at 7% interest with a 30-year loan term. If you consistently put an extra $500 towards the principal each month, you could save a significant amount of money on interest payments in the long run.

There are online calculators available to determine these payments, or we can chat and run the numbers for you!

Important! Be sure to clearly communicate to your lender that any extra payments should be applied to the principal, not interest.

Rounding Up: Small Change, Big Impact

Don’t underestimate the power of small changes. Consider rounding up your monthly payment to the nearest hundred and applying the difference towards the principal. This might seem insignificant, but over the years, it can make a dent in your loan amount.

For example, rounding up a $1,950 payment to $2,000 translates to an extra $50 towards the principal each month. Over a 30-year loan term, that’s a total of an extra $18,000 you’ve put towards your loan principal and $18,000 less that interest has had to compound on!

Windfall Warrior:

Tax refunds, bonuses, or unexpected financial windfalls can be powerful tools for early mortgage payoff. Instead of spending them all, consider putting all or part of that money towards a lump sum payment on your mortgage principal.

Let’s say you receive a hefty $5,000 tax refund. Putting that entire amount towards your principal can significantly decrease your loan balance, reducing your future interest payments.

More Early Payoff Strategies for the Ambitious Homeowner

Should I Refinance My Mortgage to Pay it Off Faster?

Refinancing your mortgage can be a strategic move for early payoff. It involves replacing your existing loan with a new one, typically with a shorter term (like a 15-year loan) and ideally a lower interest rate. For example, if you were to refinance and get a 2% lower interest rate, you could save thousands of dollars on interest over the life of the loan.

Another benefit of a shorter loan term: With a 15-year loan, you’ll be putting more money towards your principal balance each month. This allows you to pay off your house much faster and save on overall interest costs. While your monthly payment will increase because the loan term is shorter, it won’t double (which is a common misconception with shorter term mortgages).

Important to consider: There are closing costs associated with refinancing a mortgage. These upfront fees can be significant. Let’s discuss this to make sure the long-term savings from a lower interest rate outweigh the upfront costs of refinancing.

Purchasing with a 15-Year Fixed-Rate Mortgage Option:

If it fits well into your budget, a 15-year fixed-rate mortgage might be an option when purchasing a new home. While the monthly payments will be higher than a 30-year loan, you’ll build equity much faster and save a ton on interest in the long run. Let’s discuss your options and we can give you advice on what would be best for you with your personal budget and finances.

Related: Check out our calculator to compare 2 mortgage options!

Should I pay off my mortgage early or Invest?

It might not all be about “can I pay down my mortgage early?”, a better question might be “should I?”

- Cash Flow Flexibility: Putting extra money towards your mortgage might mean tightening your belt in other areas. Make sure you have a solid budget and an emergency fund saved up before diving in. Financial experts recommend 3-6 months’ worth of your expenses set aside for an emergency.

- Investment Opportunities: The money you put towards early payoff could potentially generate a higher return if invested elsewhere. However, the stock market has inherent risks, while paying off your mortgage guarantees a return in the form of saved interest. Let’s discuss this and talk with your financial advisor to discuss where your bucks will make the most bang!

Ultimately, the decision depends on your financial goals and risk tolerance, but it is important to know all of your options!

Own Your Future, One Payment at a Time

Remember, paying off your mortgage early is a marathon, not a sprint. Be patient, stay disciplined, and celebrate your milestones along the way.

Let’s talk! We can run all kinds of scenarios for you on your current and potential mortgage options. We’ll see how funds can be allocated and the long-term impact of those choices. We’d love to help you calculate your individual situation!

NFM Lending is not a Financial Advisor, Tax Advisor or Credit Repair Company. You should consult with a Financial Advisor, Tax Advisor or Credit Repair Company to learn more. Refinancing an existing loan may result in the total finance charges being higher over the life of the loan.

These blogs are for informational purposes only. Make sure you understand the features associated with the loan program you choose, and that it meets your unique financial needs. Subject to Debt-to-Income and Underwriting requirements. This is not a credit decision or a commitment to lend. Eligibility is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Not all programs are available in all areas. Offers may vary and are subject to change at any time without notice. Should you have any questions about the information provided, please contact us.