By Kelsey Trumbull

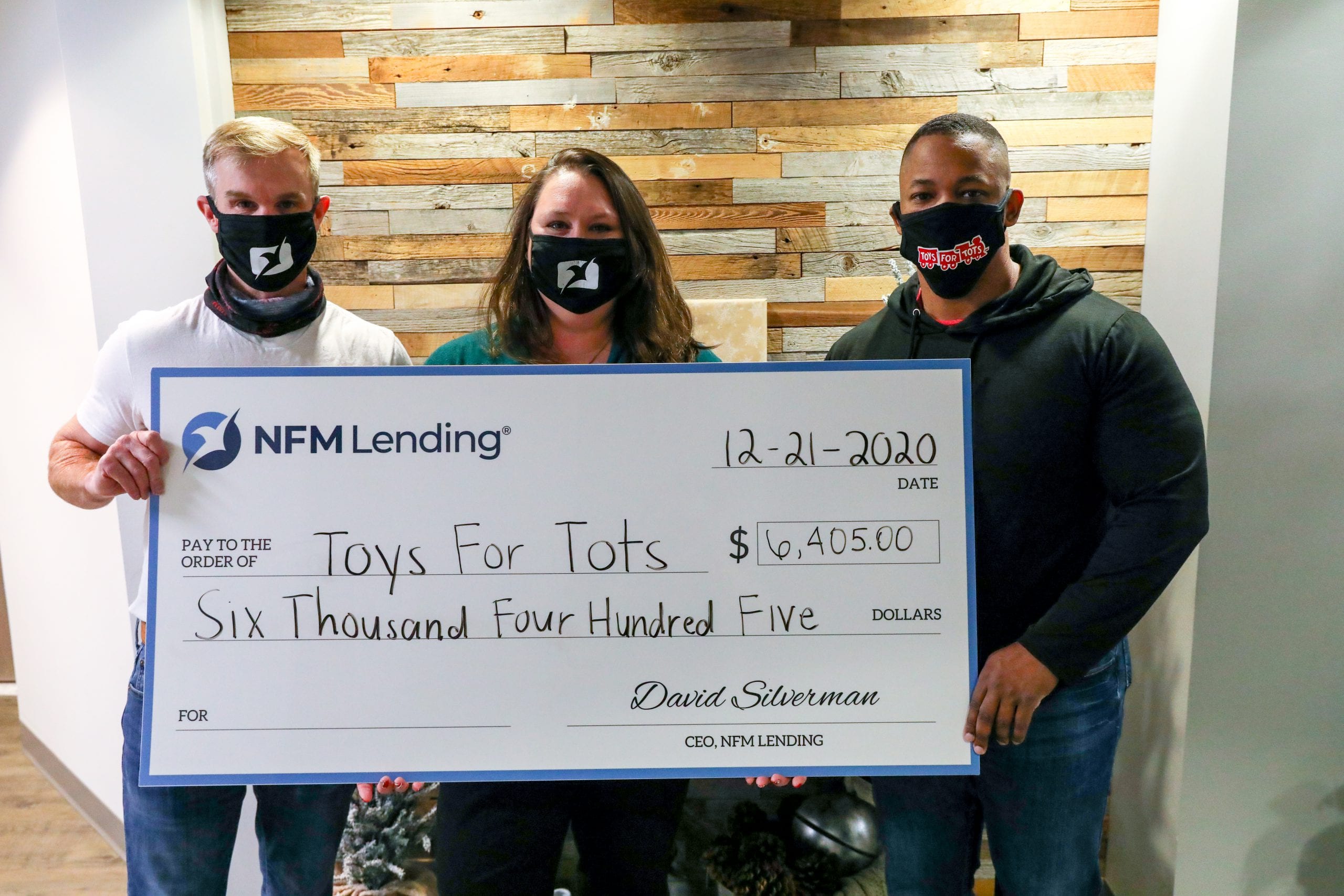

Dec 29, 2020LINTHICUM, MD, December 31, 2020— NFM Lending is proud to continue its partnership with Toys for Tots this holiday season. Due to the COVID-19 pandemic, NFM’s donation was monetary. From November 30th to December 15th, employees raised money to donate towards the purchase of toys for under privileged children. This year, NFM Lending provided their local chapter, Anne Arundel County Toys for Tots, with $6,405.00.

“Giving back to the community is a part of who we are at NFM Lending. As a part of our NFM C.A.R.E.S. program, we focus on the development and wellbeing of children,” said Liz Snead, Human Resources Generalist Team Lead. “We are proud to partner with Toys for Tots again this year to make the holiday season a little brighter for the children of families in need.”

NFM Lending is proud to support many charities and non-profits focused on the wellbeing of children and improving their lives. NFM has also been involved in charitable efforts with The Ronald McDonald House Charities Maryland, Mickie’s Miracles, JAFCO, and St. Jude’s Children’s Research Hospital, to name a few.

For more information about NFM Lending’s charitable work, click here.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 41 states in the U.S. The company was founded in Baltimore, Maryland in 1998. NFM Lending and its family of companies includes Main Street Home Loans, BluPrint Home Loans, and Freedmont Mortgage Group. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram.

These blogs are for informational purposes only. Make sure you understand the features associated with the loan program you choose, and that it meets your unique financial needs. Subject to Debt-to-Income and Underwriting requirements. This is not a credit decision or a commitment to lend. Eligibility is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Not all programs are available in all areas. Offers may vary and are subject to change at any time without notice. Should you have any questions about the information provided, please contact us.