By Marina Locks

Nov 7, 2013Do you know what the difference is between Interest Rate and APR? These two items are key terms to know when researching mortgage loans. Here are their definitions:

Interest rate is the rate at which interest is paid by borrowers for the use of money that they borrow from a lender. This is important to note when comparing quotes for different loans since it directly affects your monthly payments.

Annual Percentage Rate (APR) describes the interest rate for a whole year (annualized), rather than just a monthly fee/rate, or more simply, it is a finance charge expressed as an annual rate. The APR is a broader measure of cost to you of borrowing money, and reflects not only the interest rate but also the points, broker fees, and other charges that you have to pay to get the loan, including some of your closing costs. For that reason, your APR is usually higher than your interest rate. The APR can help consumers understand the differences between the interest rate and the fees paid at closing. This was established as a part of the Truth in Lending Act.

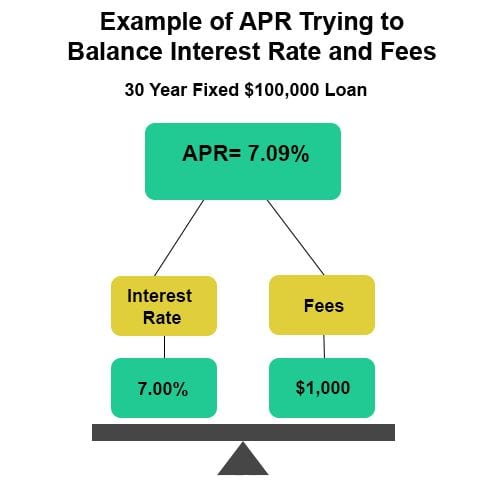

Below is a diagram that shows how APR tries to balance (and incorporate) both interest rates and fees.

How APR is Determined

To calculate the APR, the fees required to finance the loan are added to the interest rate. These are able to be combined by amortizing (paying off debt in regular installments over a period of time) the fees over the course of the loan, and calculating a new rate.

If you have any questions about interest rate and APR during your loan process, click here to talk to one of our Licensed Mortgage Loan Originators today!

These blogs are for informational purposes only. Make sure you understand the features associated with the loan program you choose, and that it meets your unique financial needs. Subject to Debt-to-Income and Underwriting requirements. This is not a credit decision or a commitment to lend. Eligibility is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Not all programs are available in all areas. Offers may vary and are subject to change at any time without notice. Should you have any questions about the information provided, please contact us.