LINTHICUM, MD, January 2, 2020— NFM Lending is pleased to honor Sergeant Danny Austin as the NFM Salute for January 2020.

Danny served in the U.S. Air Force from 1969 to 1981. He served three tours in Vietnam, treating wounded soldiers as a Rescue Medic. For his own peace of mind and to avoid his parents worrying about him, Danny kept his location a secret by having friends mail letters home from other places. He didn’t come clean until 15 years later when he could no longer suppress the memories and emotions.

Vietnam took a toll on Danny both physically and mentally. He not only suffers from tremors, but also severe PTSD. Explaining how it impacts his daily life, Danny says:

“Sporadic stress; little things can set you off. I still cringe every time I hear a helicopter going over and I still cringe every time I hear a siren coming. Fireworks used to be such a pleasure when I was a child, but I don’t enjoy them anymore because it has that percussion sound that I don’t think ever leaves your ears.”

However, thanks to Sophie’s Companions for Veterans, his life has recently changed. Danny received Duke; a rescue dog that will be trained for service to assist with his disabilities. The bond between them was instantaneous. For the last five years, Danny has been unable to have a good night’s sleep but slept completely uninterrupted the first night with Duke. Danny’s wife, Judy, has also benefited from Duke. She suffers from anxiety after recently recovering from a long battle with cancer. She feels much calmer now. Danny says their future is bright with Duke there to help them heal.

To any soldiers who might be suffering from depression or PTSD, Danny would like to send the following message:

“What you go through is a balancing act. I was pretty good for a lot of years of just pushing it all back and not letting it affect me, but it somehow manifested itself back up to the surface. Getting into the American Legion and helping other veterans, seeing their difficulties and seeing so many suicides, it made me open up and seek help. I wish more veterans would do that. For any veteran –no matter what state, county, or wherever you live– there’s a place to reach out called Veterans’ Services. These people are sent from God because they bend over backwards to let you know what’s available to you. They’ll let you know what compensations are available to you. They fight for you.”

NFM Salute is an initiative in which one military member or Veteran is chosen each month to be honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” will be featured on the website with a biography and information about his or her service, and NFM Lending will make a donation to a military or Veteran non-profit in the Salute’s name.

NFM Lending is proud to donate $2,000 to Sophie’s Companions for Veterans on Danny’s behalf. NFM looks forward to the opportunity to continue to honor military and Veterans through the NFM Salute initiative.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 39 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram.

New Year’s is an ideal time to make resolutions to hit the gym, eat healthier, and make better choices. For many homeowners, the process of making their home marketable can feel overwhelming, and the prep stage often gets put on the backburner. Why not resolve to make 2020 the year to get your home ready to go to market? Here are some ideas to get you started.

A clean home is a happy home! Use the new year as an excuse to really give your home a deep clean and get rid of unnecessary items. When your home looks clean, it gives a positive impression that you take care of your property. Along with eliminating your home’s dirt and grime, take a moment to go through your belongings and get rid of things you don’t need anymore. Try starting with one room and sift through it thoroughly. Beginning the cleaning process now will not only make your house less cluttered, but will also reduce the amount of packing to be done once your home is sold.

Despite the popularity of house flipping reality shows, many people will not be attracted to homes that need heavy repairs or upgrades. A home that needs major fixes means the buyer will have to invest even more money into the purchase, and that can make a sale less likely to happen. If you needed another reason to get problem areas fixed, improving utility issues can increase your home equity. Take action to get everything in your home in working order before it opens to prospective buyers.

The exterior of your home is the first thing buyers will see when your home is on the market. If they aren’t intrigued by the outside, they may not want to look at the inside, either. You don’t need to do any fancy landscaping, simply mowing the lawn and trimming overgrown vegetation can do wonders. Additionally, consider giving your house a fresh coat of paint if it’s looking faded.

Before you officially declare your home for sale, it’s important to find a realtor who understands your needs and can help you get the best price for your home. An experienced agent will be able to guide you through the selling stage and know how to market your home. You may have to try out a few agents before you find one that’s a good fit for your situation, but having a competent agent is well worth the search.

Figuring out how much your house is worth and how much you could potentially make from a sale can be a bit confusing. Work with your agent to perform a competitive market analysis to get an estimate of your home’s value. Once you have an idea of its value, you and your agent can discuss an ideal selling price. Finding that sweet spot for your asking price will help optimize future profits and attract buyers.

Don’t feel like you need to fulfill all these resolutions at once. Start with one and make it your goal to work your way through them. In no time, your home will be ready to show off to prospective buyers. What better way to start the new year than to make your home the best it can be!

If you have any questions or want more information about the home selling process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

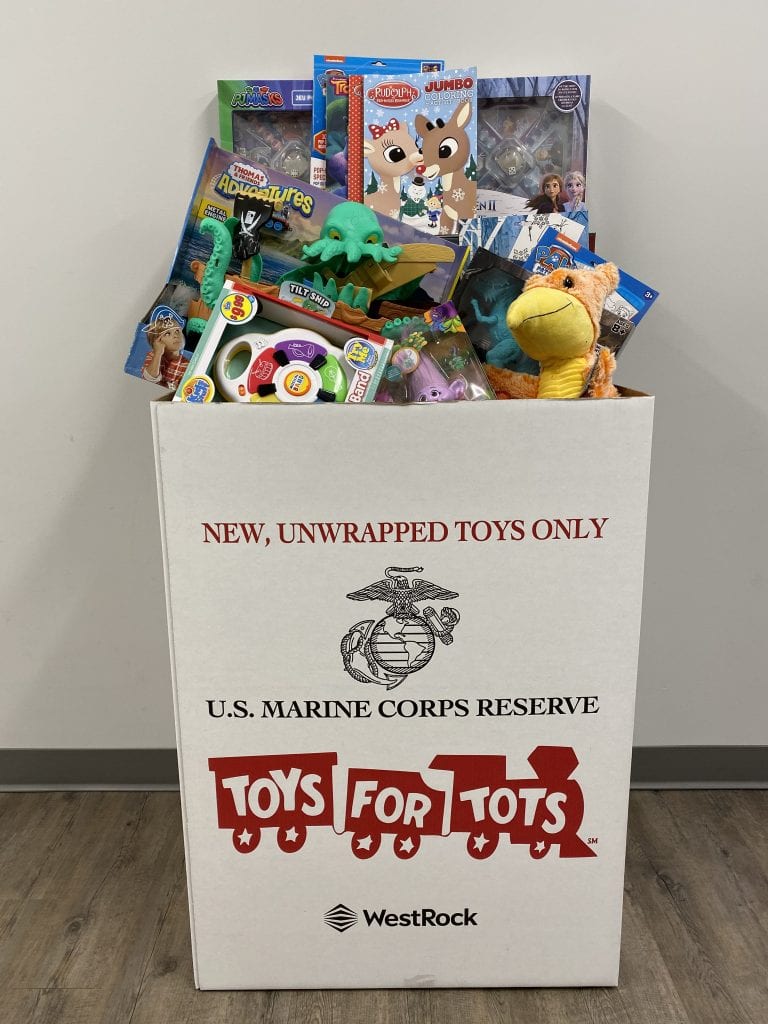

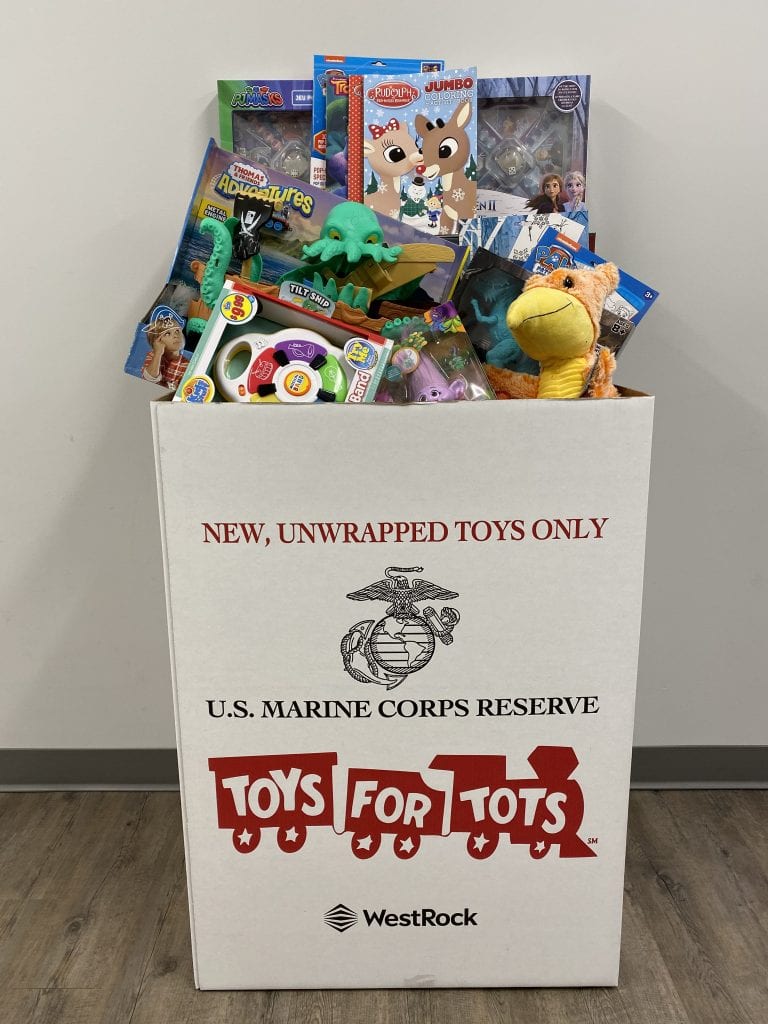

LINTHICUM, MD, December 19, 2019— NFM Lending is pleased to announce the successful completion of its first Toys for Tots drive. From December 6th to December 17th, NFM Lending collected toys to assist under privileged families during the holidays. This year, NFM Lending provided the Anne Arundel County Toys for Tots with more than 50 toys, games, stuffed animals, and more for local children.

“It’s in NFM Lending’s DNA to give back to the community,” said Madison Grey, HR Director and team lead for the drive. “Part of our NFM C.A.R.E.S program focuses on encouraging the development and wellbeing of families. For us, this means so much more than just assisting them in buying a home. We are especially fond of Toys for Tots because it allows us to bring surprise and wonderment to the children of families in need.

NFM Lending is proud to support many charities and non-profits through donations and volunteer work. NFM has also been involved in charitable efforts with The Ronald McDonald House Charities Maryland, Any Soldier, Johns Hopkins Department of Gynecology and Obstetrics, and Baltimore Animal Rescue and Care Shelter, to name a few.

For more information about NFM Lending’s charitable work, click here.

NFM Lending is a mortgage lending company currently licensed in 39 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram.

LINTHICUM, MD, December 9, 2019— NFM Lending is proud to announce that it was named a Top Workplace in the Baltimore area by The Baltimore Sun. This is the eighth consecutive year that NFM Lending has received this honor.

Each year, The Baltimore Sun distributes a survey to employees of Baltimore area workplaces. The survey analyzes the job satisfaction and engagement of the employees along with the values and organizational health of the company.

“NFM doesn’t speak about culture, we live it,” said Jan Ozga, President of NFM Lending, “This is NFM’s eighth year in a row receiving this acknowledgement. Our borrower and referral partner experiences begin and end with the employees of our NFM Family. Our primary focus is to continue to foster a culture of family and employee innovation that sets us apart from any company.”

NFM Lending prides itself on its exceptional culture. The company fills the employees’ work environment with encouragement and teamwork, building a positive workplace that rewards both commitment and performance. Employees are also encouraged to voice their questions and concerns directly to management so that they can be addressed promptly and correctly. Managers often surprise staff members for their birthdays, and the company holds contests, holiday celebrations, and other initiatives to encourage collaboration and show employees their appreciation.

In addition to this most recent award, NFM Lending has been recognized many times for its exceptional company culture and service. It has been named one of the Washington Post’s Top Work Places in the Washington, D.C. area for the last five years. Also in 2019, it was named as one of Mortgage Executive Magazine’s 50 Best Companies to Work For, as well as a finalist for the Baltimore Business Journal’s Best Places to Work. NFM Lending is proud of each member of its team and the work they do to make NFM a Top Workplace.

NFM Lending is a mortgage lending company currently licensed in 39 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram.

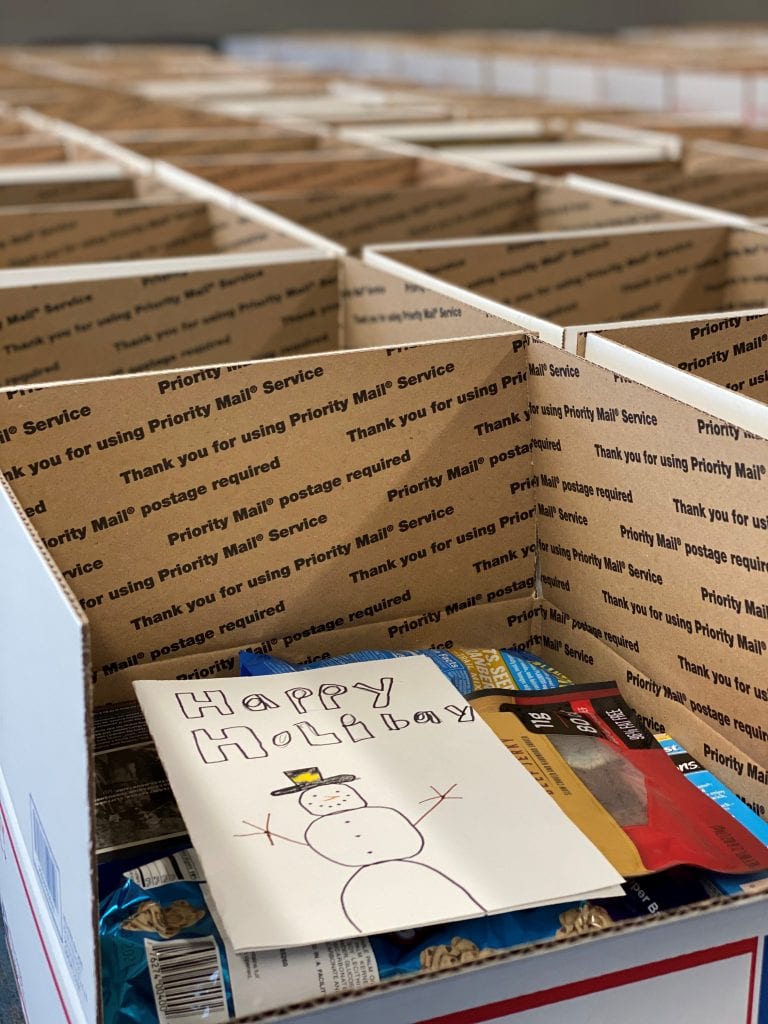

On Thursday, November 21, 2019, NFM Lending completed its 12th annual “Support Our Troops Drive,” sending 250 care packages to 125 groups of U.S. soldiers stationed overseas. Employees spent the months of October and November collecting supplies and goodies. With the help of AnySoldier® we were able to connect with soldiers to see what items they requested. Groups were sent two care packages: one with toiletries and holiday decorations; one with snacks, puzzle books, and more. Both included hand-written letters donated from local students. The packages were sent to soldiers around the world, including: Kuwait, Germany, Afghanistan, Saudi Arabia, Iraq, Bahrain, Qatar, Turkey, Poland, South Korea, Djibouti, Norway, and Japan.

Since 2008, NFM Lending has sent over 1,500 packages to our service members stationed overseas. We are proud to support the courageous men and women who serve our country and wish them a safe and happy holiday season.

Please enjoy this behind-the-scene look into how we got these boxes packed and shipped out in just 4 days!

LINTHICUM, MD, December 1, 2019— NFM Lending is pleased to honor Specialist Jerry Williams as the NFM Salute for December 2019.

Jerry served in the U.S. Army from 1968 to 1969 in both Ft. Hood, Texas and Chu Lai, Vietnam. He was a member of H-Troop 17th Cavalry as a gunner on an armored personnel carrier (APC).

Jerry passed away in December 2011 at just 66 years old.

Jerry’s son, Jeremy, who served in the Marine Corps Reserves, 1st Battalion, 24th Marines, was initially nominated for the NFM Salute but instead chose to recognize his father. Jeremy describes him as an overall incredible man and loving father.

“He loved me and my sister unconditionally. I’ve never felt that kind of love from anybody. My dad was always there to help. I respect what he did. He went over there and served selflessly. He was a very good man; I wish I could be half the man that he was.”

NFM Salute is an initiative in which one military member or Veteran is chosen each month to be honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” will be featured on the website with a biography and information about his or her service, and NFM Lending will make a $1,000 donation to a military or Veteran non-profit in the Salute’s name.

Selected NFM Salutes may choose from one of the following three non-profits: Platoon 22, Any Soldier, and the Gary Sinise Foundation. Jeremy chose the Gary Sinise Foundation to receive this month’s donation in his father’s honor. NFM looks forward to the opportunity to continue to honor military and Veterans through the NFM Salute initiative.

NFM Lending is a mortgage lending company currently licensed in 39 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram.

When you’re ready to start house hunting, you’ll likely come across homes in neighborhoods that have a rather consistent and harmonious look. It’s a good guess that these homes are part of an HOA, or Homeowners Association. What is an HOA, you ask?

An HOA is an organized group of homeowners within a particular subdivision, planned community, or condominium who create and enforce rules for their properties and residents. There is typically a board of directors who will hold regular meetings to discuss budgets and review rules and regulations. If you agree to live in an HOA community, those rules are legally binding.

Members of an HOA are required to pay dues on a monthly, quarterly, or yearly basis. They can range in cost from $50 to thousands of dollars, depending on the area and living situation. A community that offers a bunch of amenities will have higher fees than one that does not.

The fees you pay will cover the costs of varying things. Some communities might offer a pool or clubhouse, 24/7 security, trash pickup, a state-of-the-art gym, or even landscaping. It could also cover snow removal or emergency repairs. You should ask for a report of how fees are disbursed for a better understanding of what exactly you’re paying for.

You should be aware that an HOA can raise its fee. Make sure to ask what projects are in process and if there is an emergency fund before making a decision. If they don’t have a reserve fund, you could be on the hook to pay extra or raised fees to fix something unpredictable, such as a roof on a communal building after a storm.

Homes in an HOA are held to a higher standard than you might find elsewhere. The value of your property can increase because the community is going to remain visually appealing; lawns will be mowed, no scrap cars in the front yard, etc. Any issues you have regarding a neighbor can be handled through the HOA rather than personally getting involved. However, an HOA can become a nuisance if they are poorly managed or are extremely limiting.

Every HOA has different rules, known as covenants, conditions and restrictions, or CC&Rs. Depending on the conditions, you might not be able to make changes to your home that are seemingly insignificant. This can include painting your home a new color, installing solar panels, making renovations, or even changing the color of your front door. You might have to keep your lawn manicured to a certain length or watered even during a drought. Review the CC&Rs so you know all the details before you make a final decision.

When looking for your future home, you should carefully weigh the pros and cons of living in an HOA. Make sure to consider all factors, including costs and rules, to help you determine if this is the right option for you.

If you have questions about HOAs or the homebuying process, contact one of our Licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

LINTHICUM, MD, November 18, 2019— NFM Lending will sponsor Mickie’s Miracles Raise it Up for Pediatric Epilepsy Gala and Poker Tournament taking place on November 23, 2019. This event will benefit families affected by Pediatric Epilepsy.

The Raise It Up event will take place at Fashion Island Hotel in Newport Beach, CA and will include dinner, live and silent auctions, entertainment, and special features. Mickie’s Miracles is a global awareness, education, and advocacy nonprofit focused on helping families impacted by Pediatric Epilepsy connect with a Pediatric Epileptologist “in order to stop fighting a ghost.”

“NFM Lending is honored to partner with Mickie’s Miracles and CHOC Children’s in the fight to stop pediatric epilepsy.” said David Silverman, CEO of NFM Lending. “Mickie’s Miracles works with premier epilepsy centers worldwide offering relief to the children and families who are impacted by providing much needed treatment and education. We are proud to support this amazing organization and their continued mission.”

Working together with level 4 epilepsy centers the world, Mickie’s Miracles “warrior families” will urgently receive diagnosis and treatment. Proceeds will also procure advanced surgical technology and fund Infantile Spasms research and transitional care at CHOC Children’s Neuroscience Institute. NFM Lending is proud to support Mickie’s Miracles and looks forward to working with such an incredible organization.

NFM Lending is a mortgage lending company currently licensed in 37 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram

There are many types of mortgages out there, but if you are Veteran looking to buy a home, you should consider a VA loan. The features of this loan make it a great option for many Veterans and their families. Before we discuss those features and benefits, let us first answer: what is a VA Loan?

Through the original Servicemen’s Readjustment Act, also known as the GI Bill of Rights, the Veterans Affairs loan began in 1944. VA loans are guaranteed by the United States Department of Veterans Affairs (VA). The loan was specifically designed to provide eligible American Veterans and their families with a federally guaranteed home so they could take part in the American dream.

VA loans offer no down payment requirement (for qualifying consumers) and often do not require Private Mortgage Insurance (PMI). Additionally, if refinancing an existing VA loan, the qualified borrower can take cash out of their home up to take out up to 95% of the appraised value as determined by VA. Some states also offer additional resources to Veteran homeowners, such as property tax reductions.

A Veteran, active duty, or honorably discharged may be eligible for a VA loan if he/she meets the following requirements:

More information about eligibility for VA loans can be found on the VA website.

Our nation’s heroes deserve to achieve the American dream of homeownership. VA loans are there to help make it happen. If you would like to see if you qualify for this loan, contact one of our Licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

LINTHICUM, MD, November 4, 2019— NFM Lending will sponsor the Little Smiles Philadelphia’s Monte Carlo Night taking place on November 9, 2019. This event will benefit children undergoing treatment for life-altering illnesses in the Greater Philadelphia region.

The event will take place at Lincoln Financial Field and will include food, tours, entertainment, raffle prizes, and of course, casino style games.

“My very close friend’s daughter is a miracle survivor of a rare and deadly form of Leukemia,” said David Silverman, CEO of NFM Lending. “Not only did she benefit from the work of Little Smiles, but she was able to get a successful bone marrow transplant from her brother and is now clear of the disease. It’s an honor for NFM to help this incredible organization continue their mission.”

Little Smiles is a volunteer-driven, nonprofit 501(c)3 children’s charity. The organization’s mission is to help children in local hospitals, hospices, shelters, and similar care facilities by allowing them to “be a kid again.” Working together with local professionals, such as doctors, nurses, child life specialists, and social workers, the organization works to help bring “little smiles” to these children, giving them special event tickets, toys and electronics, pizza parties, and more.

NFM Lending is proud to support many charities and non-profits through donations and volunteer work. NFM has also been involved in charitable efforts with The Ronald McDonald House Charities Maryland, Any Soldier, Johns Hopkins Department of Gynecology and Obstetrics, and St. Jude’s Children’s Research Hospital, to name a few.

For more information about NFM Lending’s charitable work, click here.

NFM Lending is a mortgage lending company currently licensed in 37 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram.