Jane Floyd and her team at NFM Lending celebrated the opening of their new location on Wednesday, September 16, 2015. The new location is 14497 North Dale Mabry Highway Suite 235N, Tampa, FL 33618.

The branch celebrated the move by hosting a Grand Opening celebration. Jan Ozga, President of NFM Lending, attended with other Executives, management staff, and employees to congratulate the branch on this exciting change.

For more information about Jane Floyd and her branch, click here to visit their website.

Congratulations!

The new TILA-RESPA Integrated Disclosures (TRID) will take effect on October 3, 2015. As this date approaches, you may have heard a few terms and phrases you haven’t heard before. Whether you’ve been through the home purchase process many times before, or you’re preparing to buy your first home, it’s important to familiarize yourself with these terms and to understand what they mean for you, the consumer.

The new TILA-RESPA Integrated Disclosures (TRID) will take effect on October 3, 2015. As this date approaches, you may have heard a few terms and phrases you haven’t heard before. Whether you’ve been through the home purchase process many times before, or you’re preparing to buy your first home, it’s important to familiarize yourself with these terms and to understand what they mean for you, the consumer.

TILA-RESPA

TILA refers to the Truth in Lending Act. This law requires mortgage companies and other lending institutions to disclose all costs and fees associated with a borrower’s transaction. RESPA stands for Real Estate Settlement Procedures Act. This law requires lenders, loan servicers, and brokers to provide borrowers with disclosures regarding the costs associated with real estate settlements. RESPA also prohibits anti-competitive practices that can inflate the costs of real estate transactions, such as kickbacks.

TRID

TRID stands for TILA-RESPA Integrated Closing Disclosures. TRID is a new Rule which applies to most residential mortgage transactions, that combines the Good Faith Estimate, the Truth-in-Lending statement, and the HUD-1 into two new forms: the Loan Estimate and the Closing Disclosure. Therefore, TRID is the integration of the TILA and RESPA disclosures.

Loan Estimate

A Loan Estimate (LE) is a form that the consumer receives within three days of applying for a mortgage. It details everything you need to know about the loan you have applied for, including the estimated interest rate, monthly payment, closing costs, and any other fees. It will also inform you of any special features in the loan, such as a prepayment penalty.

Closing Disclosure

A Closing Disclosure (CD) is a form the consumer receives at least three days before closing on a residential mortgage. This form includes loan terms, projected monthly payments, and what closing costs will be involved. The three-day window allows you to compare these terms and costs to the ones estimated in your LE, and to ask your lender any questions you may have about your loan before closing.

Creditor

The Creditor in a mortgage transaction is your mortgage lender. This is the financial institution supplying the funds for the loan, and instituting the terms and conditions of the loan.

Consumer

The Consumer in a mortgage transaction is the borrower, or the person(s) taking out the loan.

Consummation

Consummation is the date on which the consumer becomes contractually obligated to the creditor on the loan.

Knowing the terminology involved in loan transactions that start after the TRID deadline will help you be better prepared and avoid delays in your loan closing. For more information about TRID, and about what NFM Lending is doing to prepare for TRID, click here. If you are ready to purchase a home, click here to contact one of our licensed mortgage Loan Originators today to get started!

LINTHICUM, MD, August 28, 2015— NFM Lending is proud to announce David Silverman, CEO, has been named one of the 100 Most Influential Mortgage Executives in America by Mortgage Executive Magazine for 2015.

LINTHICUM, MD, August 28, 2015— NFM Lending is proud to announce David Silverman, CEO, has been named one of the 100 Most Influential Mortgage Executives in America by Mortgage Executive Magazine for 2015.

Each year, Mortgage Executive Magazine recognizes mortgage executives that have built their companies and service their clients and employees through service, dedication and hard work. The winning executives were asked to provide their insights on the mortgage industry’s opportunities and challenges today. Silverman spoke about NFM Lending’s increased focus on selective recruiting:

“The biggest opportunity for NFM Lending this year is to be selective with our origination recruits and focus on better, not bigger. Fortunately, the demand for service and product remains very high with a smaller supply of human capital across the industry. We believe this is a great time to be selective as well as bring new blood into the mortgage space and train them up.”

This is the third year in a row that Silverman has received this award.

“I am truly honored to be recognized again amongst so many spectacular leaders in our industry,” said Silverman. “All I can do is continue to work towards being the best leader I can be for my company and those that I am blessed to have on my team making me look good. I surround myself with the best, and occasionally some of it rubs off on me.”

NFM Lending has prospered under Silverman’s leadership, and continues to receive national recognition. The company was named one of the 50 Best Companies to Work For in 2015 by Mortgage Executive Magazine; one of the Washington Post’s Top Work Places in the Washington, D.C. area in 2015; a Top Mortgage Employer by National Mortgage Professional Magazine in 2015; and a Top Work Place in the Baltimore area by The Baltimore Sun in 2012, 2013, and 2014.

NFM Lending was founded in March of 1998 by David Silverman and his wife Sandy. The company started as a small brokerage shop with 4 loan originators and is now a multi-state lender with more than 350 employees, 39 retail branches, and is licensed in 29 states.

For more information please contact:

NFM Lending

Toll Free: 1-888-233-0092

pr@nfmlending.com

www.nfmlending.com

Twitter: @nfm_lending

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.”

For information on NFM Lending, please email pr@nfmlending.com.

To view the online press release, click here.

Investing in a rental property can be a great way to earn additional revenue. Perhaps you’re a homeowner looking for wealth-building opportunities. Or perhaps you’re simply interested in property management. Owning a rental property is an investment of time and money, and it’s important to carefully consider everything that is involved before you make the decision. Here are some tips to consider if you’re thinking about becoming a landlord.

Investing in a rental property can be a great way to earn additional revenue. Perhaps you’re a homeowner looking for wealth-building opportunities. Or perhaps you’re simply interested in property management. Owning a rental property is an investment of time and money, and it’s important to carefully consider everything that is involved before you make the decision. Here are some tips to consider if you’re thinking about becoming a landlord.

Make Sure you Have Time

Owning a rental property isn’t your typical investment. You are responsible for the maintenance and upkeep of the property. If something breaks, it is your responsibility to fix it in a timely manner, or hire someone to fix it. If a tenant is late on rent, you need to make sure that the payment goes to the mortgage company on time regardless, and take the necessary steps to prevent future late payments. And if you want the property to appreciate in value, you need to take the time and money necessary to do routine maintenance to the property, and add updates. If you’re already working long hours, or have a family or kids to take care of, think carefully about the changes you would need to make to your current schedule before making your decision.

Choose the Right Property

The right rental property can make all the difference in the return you see on your investment. Make sure you take location into consideration. The school district, crime rate, amenities, and your potential renter base are all important factors in how profitable your property will be. Choose a neighborhood that you’re familiar with, and has a high demand for rentals. Unless you have the time and resources to devote to a fixer-upper, choose a property that requires minimal cosmetic maintenance. Bring a contractor with you to go and look at properties to determine what it will cost to renovate the property before it’s available to rent.

Choose the Right Tenants

Before you start to advertise your rooms/apartments for rent, take some time to come up with a screening process. Call your applicants’ previous landlords to make sure that they have a positive rental history, and use an online service to run a background check. It can also help to talk to more experienced landlords. They can give you tips and insight about what to look for in each applicant you screen.

Decide on a Rent Amount

Choosing tenants goes hand-in-hand with choosing a rent amount. Spend some time researching property values and rent amounts in the neighborhood where your property is. Sites like Zillow and Rentometer can provide you with a good starting point. Make sure you factor in not only the cost of the property, but maintenance costs, utilities (unless your tenants pay these themselves), and any updates you’ve made since purchasing the property.

Like any investment, purchasing a rental property comes along with risks. It is important to do your research, consult experts, and take your time to ensure you make the right decision. If you are ready to start looking at possible investment properties, click here to contact one of our licensed mortgage loan originators today!

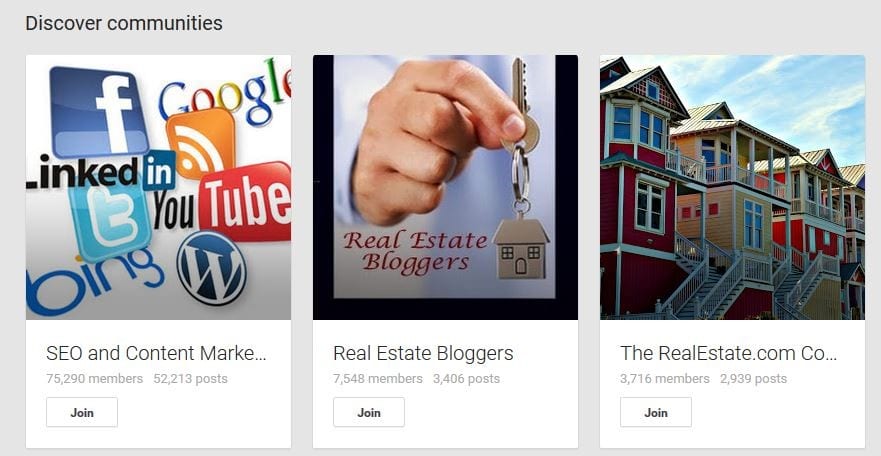

When you think about branding yourself as a real estate agent on social media, Google Plus may not be the first social network that comes to mind. If you have a successful Facebook page or Twitter account, then another social media account might not seem necessary; however, Google Plus offers its users many perks that can benefit you and increase your online visibility. Here are four Google Plus tips to help improve your branding and online reach.

Google Plus is a highly valuable tool for real estate professionals. In this competitive industry, online presence and branding are essential. Using Google Plus business pages can improve your online visibility, help you educate potential clients more effectively, and build relationships with other industry professionals. Click here for more information about Google Plus.

Google Plus is a highly valuable tool for real estate professionals. In this competitive industry, online presence and branding are essential. Using Google Plus business pages can improve your online visibility, help you educate potential clients more effectively, and build relationships with other industry professionals. Click here for more information about Google Plus.Your credit score is the numerical value assigned based on the information on your credit report. Credit-reporting bureaus use complex and proprietary algorithms to calculate these, but the most widely used are FICO scores. FICO scores can range from 300 to 850, and they give potential lenders an idea of how much of a financial risk you are. To them, the higher the score, the more likely you are to repay the debt and not be late on payments or go into default.

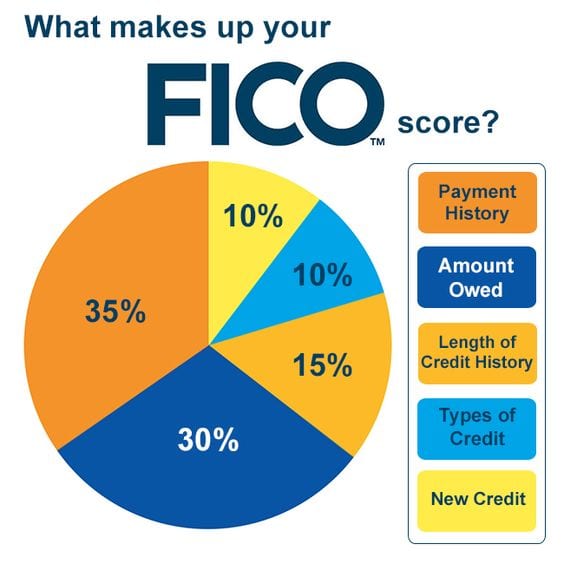

How Are Credit Scores Calculated

Each type of credit score uses algorithms to calculate the potential risk by adding value to items such as payment history and number of credit inquiries. For FICO scores, there are 5 factors used to calculate credit scores. Each factor has different weight in how much they affect your credit score.

Knowing your FICO score and credit worthiness is important, especially if you are looking to get a new loan. You can use websites that provide free credit scores, but often these websites provide you with an estimate rather than your actual score. The Consumer Financial Protection Bureau (CFPB) published a report on the differences between credit scores available to consumers and those to lenders, so make sure you do your research before you submit an application for a loan. Should you have any questions about credit scores, whether you qualify for a mortgage loan with your current credit score, or how to apply for a loan, click here to contact one of our licensed mortgage loan originators today!

On Tuesday, July 21, 2015, the Consumer Financial Protection Bureau (CFPB) issued a final rule delaying the effective date for the TILA-RESPA Integrated Disclosures (TRID) to October 3, 2015.

The new Loan Estimate and Closing Disclosure documents will replace the Good Faith Estimate, the HUD-1, and the Truth in Lending Statement on most residential loan transactions. This change is anticipated to have wide-reaching effects on the mortgage and real estate industries.

The TRID changes were originally scheduled to take place August 1, 2015; however, after pressure from Congress and industry groups to delay this deadline, or to provide a grace period, the CFPB issued a proposal to move this date to October 3, 2015. The proposal was open for public comment on the CFPB website until July 7, 2015. In their press release announcing the delay, the CFPB stated that it believes scheduling the effective date on a weekend will “facilitate implementation by giving industry time over the weekend to launch new systems configurations and to test systems.”

NFM Lending is continuing to prepare its employees and clients for TRID. For more information about this new rule, and what NFM Lending is doing to prepare, click here.

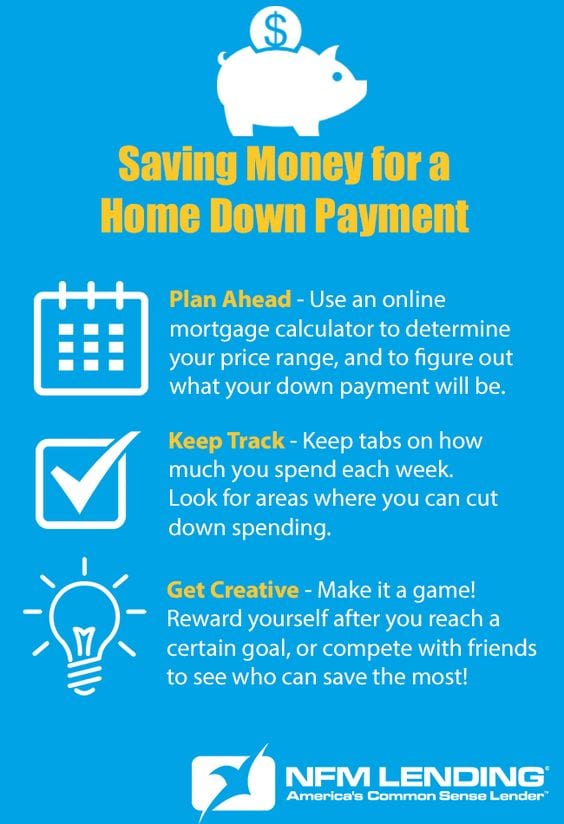

Like any major purchase, a home purchase will require you to put down a certain percentage of the total price as a down payment. The bigger the down payment, the less you will borrow from the mortgage company or bank, and the less your payments will be. With every day expenses and current bills, it can be difficult to find money to begin saving for a down payment. By planning ahead and getting creative, you can begin to save up for a down payment for the mortgage loan that best suits your needs. Here are three ways to save for a down payment and help come up with the savings you need to land the house of your dreams.

Planning Ahead

Saving money for a down payment may take a while, so it helps to have a plan. Start by researching what kind of home you are looking to buy, and the average price of those homes in the area. Then, use an online mortgage calculator to find out what kind of down payment options are best for you, based on your price range. For example, if the homes in the neighborhood you are looking to buy average at $200,000, the standard 20% down payment will be $40,000. Remember, there are loans available with lower down payment options, such as 10% and as low as 3.5%. Talk to your Loan Originator to find out which loan option is right for you.

Once you determine your down payment goals, open a separate savings account. If you’re a first-time home buyer, you can open an investment retirement account (IRA). An IRA will accumulate interest, and first-time home buyers can withdraw up to $10,000.00 from their IRA without a penalty fee. Consult a CPA for more information. Having a separate account for your down payment savings prevents you from accidentally confusing the money with your regular spending money, and it is a good way to track your progress.

Saving money will be easier if you have goals in mind. Set realistic weekly, biweekly, or monthly savings goals, and stick to them. If your workplace offers this option, set up your direct deposit so that a portion of each paycheck automatically goes into the savings account you have set aside for your down payment.

Hold Yourself Accountable

Saving money will probably require a lifestyle change, and some habits are difficult to break. For instance, if you are used to going out to eat for lunch five days a week, it will be hard to start trying to pack a lunch every day. Set up a time a few times a month, or even once a week, to sit down and go over your expenditures from the week(s) before. Seeing when and how often you make unnecessary purchases can motivate you to make the changes you need to make. Have a close friend or significant other help hold you accountable, (if you’re buying a home together, you can do this for one another).

Providing incentives for yourself can also be a helpful tactic. Set monthly savings goals, and reward yourself at the end of the month if you meet your goals. If your goal is to save $500.00 in a month, and you reach that goal, reward yourself with a small splurge—go out to dinner with friends, or buy yourself something new. This will encourage you to meet your savings goals, and the splurge will be guilt-free, because you have already met your goal for the month.

Get Creative

Although the process of saving for a down payment may seem daunting, it doesn’t have to be a chore. There are lots of fun, creative ways to save money. One idea is to earn extra money on the side. Offer to do some odd jobs, such as babysitting, dog walking, home repairs, or housework for your friends or neighbors. If you’re crafty, open an Etsy store and sell your items online. You might be surprised by how much your woodworking, knitting, graphic design, or other skills are in demand. You can also sell clothes or household goods that you’re not using anymore on sites like Craigslis and eBay, or at your local consignment store.

Another way to get creative about saving is to turn it into a game. Have a competition with a friend or family member who is also trying to save money, and see who can save the most by a particular deadline. If you’re buying a home with your significant other, compete with one another, and see how much you can save together!

The decision to buy a home is one of the biggest financial decisions you will ever make. It is important to plan and prepare carefully. Saving money for a down payment can be difficult, but it is well worth the challenge. If you’re thinking about buying a home soon, get started by talking to one of our licensed Mortgage Loan Originators today.

LINTHICUM, MD, June 26, 2015 — Elysia Stobbe, an NFM Lending Branch Manager in Jacksonville, FL, will speak at a Home Buyers Expo on Saturday, June 27, 2015. The event is hosted by the Northeast Florida Association of Realtors (NEFAR) and The Florida Times-Union.

LINTHICUM, MD, June 26, 2015 — Elysia Stobbe, an NFM Lending Branch Manager in Jacksonville, FL, will speak at a Home Buyers Expo on Saturday, June 27, 2015. The event is hosted by the Northeast Florida Association of Realtors (NEFAR) and The Florida Times-Union.

Stobbe was invited to speak at the expo as a recognized expert in the mortgage industry. She will deliver two seminars at the expo, the first titled “3 Massive Mortgage Money Mistakes to Avoid” and “Why Shopping for the Best Interest Rate can cost you Money”; the second titled “7 Massive Mortgage Mistakes to Avoid” and “VA, FHA & Conventional Financing Highlights.”

“I am thrilled to be a part of the FL Times Union Home Buyer’s Expo!” said Stobbe. “An educated consumer is our best client. I consider it a professional responsibility and I am passionate about empowering home buyers to understand the details about how their mortgage affects their home buying options. I am proud to help raise the standard in mortgage lending by giving home buyers the tools and questions to ask when shopping for a mortgage. I hope that my new book, How to Get Approved for the Best Mortgage Without Sticking a Fork in Your Eye, helps home buyers make smarter decisions with their loan options.”

The Home Buyers Expo will take place from 9:00 a.m. to 3:30 p.m. at the University of North Florida (UNF) University Center. The event is expected to draw attendance from more than 1,500 prospective home buyers and sellers. It will feature speakers on various industry topics, as well as informational booths hosted by real estate agents, builders, mortgage companies, home improvement vendors, and more.

For more information about sponsorship or attendance, call (904)-359-4024. To contact Elysia Stobbe, call her at (904) 446-9007 or visit her website: www.nfmlending.com/estobbe.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states across the United States. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to their customers and their community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.”

For more information about NFM Lending, please contact:

NFM Lending

Toll Free: 1-888-233-0092

pr@nfmlending.com

Twitter: @nfm_lending

LINTHICUM, MD, June 26, 2015 — Elysia Stobbe, a NFM Lending Branch Manager in Jacksonville, FL, released her book, How to Get Approved for the Best Mortgage Without Sticking a Fork in Your Eye, on June 26, 2015.

LINTHICUM, MD, June 26, 2015 — Elysia Stobbe, a NFM Lending Branch Manager in Jacksonville, FL, released her book, How to Get Approved for the Best Mortgage Without Sticking a Fork in Your Eye, on June 26, 2015.

The book walks potential home buyers through the steps of applying for a home loan: from types of loans, to choosing a mortgage professional, the application process, fees and paperwork, mortgage insurance, and more. Stobbe believes there is a plethora of confusion and misunderstanding among first time homebuyers about loan programs and choosing a mortgage lender. She wrote this book using her expertise to help home buyers understand their options, and navigate the mortgage process successfully.

“My commitment to client service has driven my passion for the individual personal experience in the mortgage industry, and how the regulations and requirements affect real people in real time,” said Stobbe. “With this book I’m privileged and excited to share my knowledge and experience. After reading this book, you will have an understanding of the requirements of the lenders that loan money to home buyers, what loan options you have, and how to navigate government regulations and requirements to your advantage.”

Stobbe has over 12 years of experience in the mortgage industry, and has closed over $250 million in residential mortgage loans. She has been interviewed by the Wall Street Journal and the Washington Post about her mortgage lending expertise. Stobbe has also been ranked a Top Lender in Northeast Florida by Jacksonville Business Journal three years in a row, and recognized as a 2014 Top 50 Business Influencer by Advantage Magazine.

To purchase How to Get Approved for the Best Mortgage Without Sticking a Fork in Your Eye, click here. To contact Stobbe directly, visit her website at www.nfmlending.com/estobbe, contact her at 904-446-9007 or email her at estobbe@nfmlending.com.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.