LINTHICUM, MD, July 31, 2015— NFM Lending is proud to announce that it was ranked #4 of 50 Best Companies to Work For by Mortgage Executive Magazine. This is the second year in a row that NFM Lending has been recognized as one of the 50 Best Companies to Work For.

Mortgage Executive Magazine conducted an extensive online survey of more than 10,000 Mortgage Loan Originators (MLOs) from over 200 mortgage companies and banks. The survey was limited to licensed MLOs who were presently employed by the companies they were rating. The survey asked participants to rate the company’s culture, loan processing, underwriting, compensation, management, marketing, and technology. The winning selections were based on total MLO votes and average rating score. NFM Lending was ranked #4 of 50 based on average score given by employees.

“Of all the awards, the Best Companies to Work For award means by far the most to me,” said David Silverman, founder and CEO of NFM Lending. “It’s not about numbers or profitability; rather, it’s about how we treat each other and what we stand for as a company. It’s one thing to feel you have a great culture, but when you continue to have your fellow employees vote over and over that they love where they work…that’s real!”

NFM Lending prides itself on its exceptional culture. The company has an open door policy which allows an open line of communication between management and staff. Employees are encouraged to voice their questions and concerns directly to management, so that they can be addressed promptly and correctly. In addition to a competitive salary and a comprehensive benefits package, NFM Lending loan originators receive ongoing support and assistance from qualified support and operations staff, paid time off, and opportunities for trips and giveaways.

In addition to this most recent award, NFM Lending has been recognized many times in the last few years for its exceptional company culture. It was named one of the Washington Post’s Top Work Places in the Washington, D.C. area in 2015; a 2015 Top Mortgage Employer by National Mortgage Professional Magazine; and a Top Work Place in the Baltimore area by The Baltimore Sun in 2012, 2013, and 2014. NFM Lending is proud of all the work its team does to make it a great company to work for.

For more information please contact:

NFM Lending

Toll Free: 1-888-233-0092

pr@nfmlending.com

www.nfmlending.com

Twitter: @nfm_lending

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.”

To view the online press release, click here.

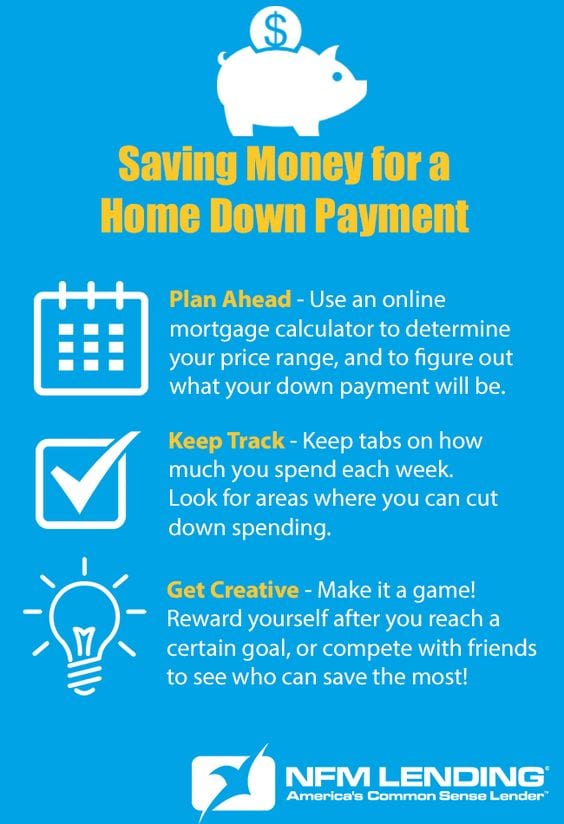

Like any major purchase, a home purchase will require you to put down a certain percentage of the total price as a down payment. The bigger the down payment, the less you will borrow from the mortgage company or bank, and the less your payments will be. With every day expenses and current bills, it can be difficult to find money to begin saving for a down payment. By planning ahead and getting creative, you can begin to save up for a down payment for the mortgage loan that best suits your needs. Here are three ways to save for a down payment and help come up with the savings you need to land the house of your dreams.

Planning Ahead

Saving money for a down payment may take a while, so it helps to have a plan. Start by researching what kind of home you are looking to buy, and the average price of those homes in the area. Then, use an online mortgage calculator to find out what kind of down payment options are best for you, based on your price range. For example, if the homes in the neighborhood you are looking to buy average at $200,000, the standard 20% down payment will be $40,000. Remember, there are loans available with lower down payment options, such as 10% and as low as 3.5%. Talk to your Loan Originator to find out which loan option is right for you.

Once you determine your down payment goals, open a separate savings account. If you’re a first-time home buyer, you can open an investment retirement account (IRA). An IRA will accumulate interest, and first-time home buyers can withdraw up to $10,000.00 from their IRA without a penalty fee. Consult a CPA for more information. Having a separate account for your down payment savings prevents you from accidentally confusing the money with your regular spending money, and it is a good way to track your progress.

Saving money will be easier if you have goals in mind. Set realistic weekly, biweekly, or monthly savings goals, and stick to them. If your workplace offers this option, set up your direct deposit so that a portion of each paycheck automatically goes into the savings account you have set aside for your down payment.

Hold Yourself Accountable

Saving money will probably require a lifestyle change, and some habits are difficult to break. For instance, if you are used to going out to eat for lunch five days a week, it will be hard to start trying to pack a lunch every day. Set up a time a few times a month, or even once a week, to sit down and go over your expenditures from the week(s) before. Seeing when and how often you make unnecessary purchases can motivate you to make the changes you need to make. Have a close friend or significant other help hold you accountable, (if you’re buying a home together, you can do this for one another).

Providing incentives for yourself can also be a helpful tactic. Set monthly savings goals, and reward yourself at the end of the month if you meet your goals. If your goal is to save $500.00 in a month, and you reach that goal, reward yourself with a small splurge—go out to dinner with friends, or buy yourself something new. This will encourage you to meet your savings goals, and the splurge will be guilt-free, because you have already met your goal for the month.

Get Creative

Although the process of saving for a down payment may seem daunting, it doesn’t have to be a chore. There are lots of fun, creative ways to save money. One idea is to earn extra money on the side. Offer to do some odd jobs, such as babysitting, dog walking, home repairs, or housework for your friends or neighbors. If you’re crafty, open an Etsy store and sell your items online. You might be surprised by how much your woodworking, knitting, graphic design, or other skills are in demand. You can also sell clothes or household goods that you’re not using anymore on sites like Craigslis and eBay, or at your local consignment store.

Another way to get creative about saving is to turn it into a game. Have a competition with a friend or family member who is also trying to save money, and see who can save the most by a particular deadline. If you’re buying a home with your significant other, compete with one another, and see how much you can save together!

The decision to buy a home is one of the biggest financial decisions you will ever make. It is important to plan and prepare carefully. Saving money for a down payment can be difficult, but it is well worth the challenge. If you’re thinking about buying a home soon, get started by talking to one of our licensed Mortgage Loan Originators today.

LINTHICUM, MD, June 19, 2015 — NFM Lending is pleased to announce that it has been ranked a 2015 Top Workplace in the Washington, D.C. area by the Washington Post.

LINTHICUM, MD, June 19, 2015 — NFM Lending is pleased to announce that it has been ranked a 2015 Top Workplace in the Washington, D.C. area by the Washington Post.

NFM Lending received the award at a ceremony held on Thursday, June 18, 2015. Since its founding in 1998, NFM Lending has grown from a small mortgage brokerage to a lender with retail branches throughout the United States; the company has locations in 29 states, with 7 locations in the D.C. area, including its corporate headquarters. NFM prides itself on its company culture.

“This event is an additional confirmation that the culture of NFM Lending is one that promotes hard work in a healthy work environment,” said LaTasha Rowe, General Counsel at NFM. “As an executive it is easy to say that this is a great company to work for. But my opinion really doesn’t matter if our employees don’t believe it as well. Tonight begins the work NFM Lending must do to improve our ranking next year. Congratulations to our stellar staff!”

Each year, the Washington Post distributes a survey to the employees of Washington, D.C. area companies, asking them to evaluate their workplaces. The survey asks participants to rank their companies on quality of leadership, work-life balance, pay and benefits, and more. This year, NFM Lending was among 150 small, midsized, and large companies that made the final cut for inclusion on the Top Workplace list.

NFM Lending was also named a 2015 Top Mortgage Employer by National Mortgage Professional Magazine earlier this year, and a Top Workplace by The Baltimore Sun in 2012, 2013, and 2014. NFM Lending is proud of these accomplishments, and the work its team does to make it a Top Workplace.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states across the United States. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to their customers and their community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.”

For more information about NFM Lending, please contact:

NFM Lending

Toll Free: 1-888-233-0092

pr@nfmlending.com

Twitter: @nfm_lending

For the full press release, click here.

LINTHICUM, MD, June 18, 2015 — The Consumer Financial Protection Bureau (CFPB) announced Wednesday, June 17, 2015, that implementation of the new TILA-RESPA Integrated Disclosures (TRID), which will replace the Good Faith Estimate, the HUD-1, and the Truth in Lending Statement, may be delayed from August 1 until October 1, 2015.

Richard Cordray, Director of the CFPB, said that the delayed deadline was implemented to correct an administrative error. Cordray’s full statement, published on the CFPB website, is below:

“The CFPB will be issuing a proposed amendment to delay the effective date of the Know Before You Owe rule until October 1, 2015. We made this decision to correct an administrative error that we just discovered in meeting the requirements under federal law, which would have delayed the effective date of the rule by two weeks. We further believe that the additional time included in the proposed effective date would better accommodate the interests of the many consumers and providers whose families will be busy with the transition to the new school year at that time.”

NFM Lending will continue to prepare its employees and clients for TRID. For more information about what NFM Lending is doing to prepare for these important changes, visit www.nfmlending.com/ready-for-TRID.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states across the United States. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to their customers and their community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.”

For more information about NFM Lending, please contact:

NFM Lending

Toll Free: 1-888-233-0092

pr@nfmlending.com

Twitter: @nfm_lending

Preparing to purchase a home is an exciting time. It is also one of the most important financial decisions you will make in your life. So, as you prepare to take this step, it’s important to do as much research as possible. These tips and strategies will help you ensure a smooth, successful home buying experience.

Preparing to purchase a home is an exciting time. It is also one of the most important financial decisions you will make in your life. So, as you prepare to take this step, it’s important to do as much research as possible. These tips and strategies will help you ensure a smooth, successful home buying experience.

The home buying process can be stressful, but it should also be enjoyable. By being prepared, and having the right professionals at your side, you can find your dream home, and make this an experience to remember. If you are ready to get started on the path to home ownership, talk to one of our licensed mortgage loan originators today.

LINTHICUM, MD, May 29, 2015 — NFM Lending is pleased to welcome Roger Dennis to the NFM Lending family. Dennis will operate out of NFM Lending’s Corporate Office, located at 505 Progress Drive, Suite 100, in Linthicum, MD.

Dennis has more than 13 years of experience in the lending, real estate, and construction industries in the Washington, D.C. area. He plans to continue to focus on this area, offering Conventional, FHA, VA, USDA, FNMA, Jumbo, and many other loan options. Dennis looks forward to further growth with NFM Lending, while continuing to provide unparalleled customer service and responsiveness.

“I am very excited to be part of the NFM team,” said Dennis. “NFM has an outstanding reputation, both locally and nationwide, for its commitment to the community and its excellence in lending. By working with my team, my clients understand that they are working with one of the best lenders in the industry, and that they have the competitive advantage in the Washington, D.C. metro market.”

Dennis is currently growing his team and is actively recruiting qualified Mortgage Loan Originators, for both full and part-time positions. Their team goal is to continue to provide the highest level of commitment and dedication to every borrower, ranging from first time homebuyers to seasoned buyers looking for second homes or investment properties. Visit his web page to learn more: https://nfmlending.com/rdennis.

For more information please contact:

NFM Lending

Toll Free: 1-888-233-0092

pr@nfmlending.com

www.nfmlending.com

About NFM Lending

NFM Lending (formerly NFM, Inc.) is a mortgage lending company currently licensed in 29 states across the country. The company was founded in Baltimore, Maryland in 1998. NFM attributes its success in the mortgage industry to a steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.”

Click here for full press release.