By Ashley Gower

Jun 19, 2024It’s National Homeownership Month and what better way to celebrate than knocking down barriers to homeownership! We’ll bust some common myths and shed light on some lesser-known facts for first-time homebuyers, giving you even more insight as you prep for achieving your homeownership goals! Let’s get into it.

Don’t believe it? It’s true! While having no credit history presents a challenge, it doesn’t disqualify you.

Having an established credit history and a good credit score can improve your chances of qualifying for a mortgage. But if you are looking to buy a house with no credit, there are options available. The key is to demonstrate your financial responsibility. Here are some ways to do that:

- Go Through Manual Underwriting: Manual underwriting is ideal for home buyers with no credit because it allows lenders to verify payment history in other ways. You can request proof of on-time payments from your landlord, insurance company, utility companies and more to verify that you pay your bills on time every month.

- Get a Cosigner: Having a cosigner could be a huge plus for someone with no credit history. But keep in mind that being a cosigner can be a large risk since they also assume responsibility for the loan, even if you are the one who fails to make payments.

- Making Rent Count: Paying rent consistently demonstrates financial responsibility and can positively impact mortgage eligibility.

- Cash Flow Assessment: Talk to your lender about assessing your cash flow by reviewing financial account transaction patterns, balance trends and other observations over time.

Before you disqualify yourself due to not having a long credit history, let’s talk!

We will shout this from the rooftops for as long as it takes: You DON’T Need to Put 20% Down to Buy a Home!

In fact, the median buyer puts down just 13%, and this amount reduces to 8% for first-timers and buyers under the age of 32 (NAR 2023 study).

While a 20% down payment might offer a potentially lower interest rate and no PMI, it’s not always the most strategic move for everyone.

Here’s why:

- Opportunity Cost: Putting a larger down payment might mean delaying your homeownership journey. The sooner you buy, the sooner you start building equity (see fact #3).

- Financial Flexibility: Keeping some cash reserves allows for unexpected expenses or future investments.

- Forced Appreciation: A popular option is to put in a good down payment (3-10%), then make home improvements or renovate right away. You can improve the home you’re in and immediately make an impact on your net worth. Just make sure to focus on improvements with the best return on investment.

The size of your down payment should be a strategic decision based on your unique financial situation. We can help you run the numbers and find the sweet spot that balances affordability with long-term financial goals.

No matter how much money you need for a down payment, saving up that nest egg can be a big challenge. But did you know that many people, not just low-income buyers, qualify for down payment assistance programs? These programs are designed to help first-time homebuyers bridge the gap between their savings and the down payment amount, and some don’t even have a first-time homebuyer requirement!

The eligibility requirements could be based on:

- Income

- Location

- Credit score

- Property type

And they can come in the form of:

- Grants – Never have to be repaid

- Loans – Repaid at low or no interest

- Forgivable loans – Debt forgiven, often after 5-10 years

- Tax credits – Save money on federal taxes

Plus, there are programs available in every state through state and local agencies, city or county administrators, employers, or non-profit sources.

The biggest challenge? Figuring out which programs are available in your area and what you qualify for.

That’s where we can help! Just reach out, and we’ll connect you with the resources you need.

The American Dream used to be a sprawling McMansion, but times have changed. Today’s savvy homebuyers are prioritizing smart space utilization over square footage. Here’s why:

- Affordability: Smaller homes generally cost less.

- Less Maintenance: Less space means less cleaning and upkeep.

- Focus on Functionality: It’s all about creating a space that perfectly suits your needs.

Don’t get us wrong, a spacious home is great if that’s your jam. But before you get swept up in square footage, consider how you’ll actually use the space. Could you maximize a smaller home with storage solutions, efficient layouts, and clever use of outdoor areas? Perhaps the money saved on a smaller home could be used to invest in an architect who can help you create a truly functional living space.

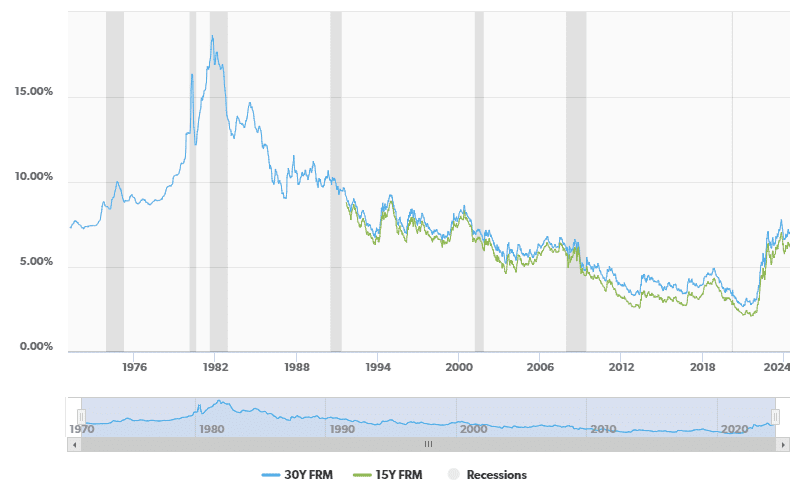

While interest rates might seem high right now (June, 2024), they’re a far cry from the crazy rates of the past. In October 1981, interest rates peaked at a whopping 18.63%…yikes!

Source: Freddie Mac Primary Mortgage Market Survey 4/30/1971 – 06/13/2024

Other than a great lender, a great buyer’s real estate agent can make your homebuying experience amazing!

Did you know that in 2023, 89% of homebuyers used a real estate agent? The majority of those that did not have a real estate agent were newly constructed homes. A buyer’s agent acts as your champion throughout the homebuying process, offering a wealth of expertise and guidance. Here’s how they can help:

- Finding Your Perfect Match: They’ll help you assess your needs and wants in a home, then search for properties that fit the bill within your budget.

- Negotiation Master: They’ll advocate for you during negotiations to help you secure the best possible price.

- Hidden Gem Hunter: They can tap into unlisted properties to expand your search options.

- Paperwork Powerhouse: They’ll handle the majority of the home offer paperwork, saving you time and stress.

- Your Knowledge Hub: They’ll answer your questions, explain processes, and ensure you stay on top of deadlines.

Need a buyer’s agent connection? We know excellent, hard working professionals in your area who can help you find your perfect home, just reach out!

According to the National Reserve, homeowners have roughly 40 times more net worth than renters.

That’s a staggering statistic! Here’s why:

- Equity on Your Side: With every mortgage payment, you build equity in your home, essentially paying into your own investment.

- Stable Housing Costs: Owning a home means predictable monthly payments, unlike rising rents that can strain your budget.

- Long-Term Security: Homeownership provides a sense of stability and a place to call your own, contributing to overall financial well-being.

Buying a home can be a big leap, but for many people, the long-term financial stability is well worth it now and for generations to come. That’s why we love homeownership!

Thinking about skipping the school district research because you don’t have kids? Think again! 30% of buyers between the ages of 33-42 named “quality of the school district” as a top factor when choosing their neighborhood.

(2023 NAR Home Buyers and Sellers Generational Trends)

Buyers often seek districts that provide well-equipped schools, including libraries, sports facilities, science labs and technology resources. The presence of these amenities suggests a commitment to providing a comprehensive educational experience, making the surrounding properties more desirable. In fact, In fact, according to the Urban Institute, “A 1 percent increase in school spending increases house prices on net by 1.03 percent”.

Even for those without children, a good school district can be a smart investment, as it often translates to higher resale value when you decide to sell.

Student loan debt is a reality for many millennials and Gen Z buyers, but don’t let it discourage you from homeownership! Here’s the good news:

- Debt-to-Income Ratio is Key: Lenders consider your overall debt-to-income ratio, which focuses on your monthly payment amount, not just your total debt number.

- Many Qualify: A report by the National Association of Realtors shows that 38% of first-time buyers have student loan debt.

We can help you understand how your student loans will impact your mortgage eligibility and explore your options. Don’t count yourself out!

According to a Pew Research Center survey, the majority of Americans (57%) prefer spacious living with houses further apart, even if it means a commute to amenities. However, a significant portion (42%) favor walkable communities with smaller homes closer together.

Here’s a breakdown of where most homes are sold:

- Suburbs/Subdivisions: 33%

- Small Towns: 27%

- Rural Areas: 23%

- Urban Areas: 12%

- Resort Areas: 5%

Source: NAR 2023 Profile of Homebuyers and Sellers

Did these Facts About Homeownership Surprise You?

If any of these facts for first-time homebuyers got you wondering if homeownership could be possible for you, let’s chat! We will set up a no-cost consultation to learn more about you, your goals, and your options.

These blogs are for informational purposes only. Make sure you understand the features associated with the loan program you choose, and that it meets your unique financial needs. Subject to Debt-to-Income and Underwriting requirements. This is not a credit decision or a commitment to lend. Eligibility is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Not all programs are available in all areas. Offers may vary and are subject to change at any time without notice. Should you have any questions about the information provided, please contact us.