Paying property taxes each year is part of the reality of being a homeowner, but there’s a way you could minimize this expense. A homestead exemption can save you money on your property taxes, and you don’t need to be a farmer to take advantage of it! Learn what the homestead exemption is and how it can give you a break on your taxes.

What is the Homestead Tax Exemption?

The homestead exemption benefits homeowners by offering two things: protection from certain creditors in case of bankruptcy or the death of a spouse, and a reduced property tax. We’ll be discussing the latter here. Property tax is determined by your home’s assessed value, which your local government determines based on several factors. The homestead exemption reduces how much of your assessed value gets taxed, potentially saving you hundreds of dollars in taxes.

For example, if your home’s assessed value is $250,000 and your property tax totals 1%, you would pay $2,500 in property taxes. However, if you have a homestead exemption of $20,000, only $230,000 of your home would be taxed, lowering your property tax to $2,300 and saving you $200.

The deduction amount varies widely by state and county; sometimes it’s a flat amount or a percentage of your assessed value or acreage. Having a homestead exemption in effect is beneficial outside of the upcoming tax season—it gives you a cushion against rising property values since you won’t have to pay the full amount.

Eligibility

Each participating state and county will have their own specifications, but a general requirement for eligibility is that you own your home and live in it as your primary residence. You can’t receive an exemption on a second home or investment property, and you’re limited to one per household. If you’re also part of a special population, such as being a senior citizen, a Veteran or surviving spouse, or disabled, you may qualify for additional property tax exemptions. Applying for the homestead exemption usually involves sending proof that you live in and own your home. Some local jurisdictions may require you to refile for an exemption each year, but some may not. If you move, you’ll have to file a new application. Similarly, if you bought a home within the past year, apply for a homestead exemption as soon as possible to reap the tax benefits. Be sure to consult a tax advisor for your area’s terms and eligibility requirements.

Few people like paying property taxes, but having a homestead exemption can ease your tax burden. It’s simple to find out whether you qualify, and any tax savings will truly add up when all is said and done.

If you have any questions about the home buying process, contact one of our licensed Mortgage Loan Originators. If you are ready to buy a home, click here to get started!

Terms and requirements vary by location, programs may not be available in all areas. NFM Lending is not a tax advisor. You should refer to a licensed tax advisor and your local area’s department of assessment and taxation regarding your unique financial situation.

The Veterans Affairs (VA) loan is just one benefit military members can use as a reward for their service. Its generous terms and flexible requirements have helped numerous families achieve homeownership, but there are still things many people get wrong about the VA loan. Here are some of the most common myths about the VA loan, debunked.

Myth: The VA loan is Only for Active-Duty Military and Veterans

You wouldn’t be wrong if you thought active-duty service members and veterans were the most prominent beneficiaries of the VA loan, but they aren’t the only populations that can use it. National Guard and Reserve members may be eligible for a VA loan if they have served six or more years or have at least 90 consecutive days of active duty, as well as an acceptable type of discharge as determined by the VA. Surviving spouses may also be able to use a VA loan if they can obtain a certificate of eligibility (COE) and meet certain conditions, like remaining unmarried at the time of application and if the Veteran died while serving or due to a service-related disability.

Myth: The VA Loan is Bad for Sellers

The VA loan has made homeownership possible for millions of military families since 1944, but there are still sellers who are wary of it. Some believe that because VA loans don’t require a down payment or private mortgage insurance (PMI), military buyers are riskier. This couldn’t be further from the truth. VA financing can fully cover the mortgage prices in many cases, and it will guarantee up to 25% of the loan in case of default. VA buyers also have more money to put towards the offer.

Another misconception is that sellers have to pay all of the buyer’s fees at closing. To maintain affordability, the VA limits homebuyers from paying certain unallowable fees. The VA states sellers have to pay for a termite inspection, real estate agent fees, brokerage fees, and buyer broker fees. There are more closing costs that VA buyers can’t pay, but that doesn’t mean the seller is obligated to pick up the tab for all of them. Lenders and agents may cover some of the unallowable fees, and buyers can negotiate with sellers to pay them. It’s important to note that sellers can’t pay more than 4% in seller’s concessions for a VA loan.

Myth: VA Loans Have No Closing Costs

Even with the cost-saving features of the VA loan, it’s not entirely a free ride. There are still closing costs, including a funding fee unique to the VA loan. The funding fee is a one-time payment that helps reduce taxpayer expense to fund the loan. The fee ranges from 1.4-3.6% of the loan amount depending on the down payment amount. Though a down payment isn’t required, the more you can contribute, the lower your fee. You can pay it upfront at closing, roll it into your mortgage, or ask the seller to pay it. For any subsequent uses of your VA loan, the funding fee can be higher if you have a down payment less than 5%. There are a few situations in which the fee may be waived, like in cases of a service-related disability or for an eligible surviving spouse. If you’re concerned about closing costs, consider asking your lender for a lender credit or negotiate with the sellers for a contribution. Again, sellers can pay up to 4% in closing costs.

Myth: The VA Appraisal is Too Strict

The mandatory VA appraisal is another thing that makes the VA loan distinct from other loans, and many people are intimidated by it. Properties need to have an appraisal done to assess fair market value and the home’s safety and sanitary conditions. The appraisal is not the same as a home inspection, as a true inspection is more thorough. An independent appraiser will review the home against the VA’s list of minimum property requirements (MPRs). Issues appraisers will look for include exposed wiring, termite damage, and adequate drainage. If the home doesn’t meet the MRPs, the problems will need to be fixed before proceeding. Sellers and buyers should negotiate expenses. An appraisal also uses housing market data to see whether the proposed loan amount is comparable to that of similarly valued homes. Though the VA appraisal may seem tedious, it’s not much different than a standard appraisal. Homeowners who have maintained their home shouldn’t be too worried about major issues appearing.

Myth: VA Loans Can Only be Used Once

Luckily, the VA loan can be taken out multiple times as long as you have entitlement to use. Entitlement is how much the VA will guarantee the lender if you default. When you first use a VA loan, you have full entitlement. This means you can buy a home at any given price with no down payment, so long as your lender approves you for a mortgage. If you’ve fully paid off and sold your VA-financed home, your full entitlement is restored for your next purchase. It’s even possible to have more than one loan out at once if you use any remaining entitlement to buy another home. Be aware that if you’re buying with reduced entitlement, you’ll likely need a down payment.

The VA loan isn’t just a lucrative loan program, it’s a benefit you’ve earned through service. The intricacies of the loan have led to misunderstandings among military homebuyers and home sellers alike, which is why it’s crucial to work with a lender and real estate agent with a strong track record of working with VA homebuyers.

If you have any questions about the home buying process, contact one of our licensed Mortgage Loan Originators. If you are ready to buy a home, click here to get started!

For informational purposes only. You should refer to the VA for specific guidelines regarding your eligibility.

“Amortization” might sound complex and confusing, but it’s easy to understand once you know how it works.

What is Loan Amortization?

Amortization is when a loan’s balance is gradually reduced through routine payments. With an amortized loan (such as a mortgage), most of the initial loan payments will go towards the interest but will increasingly go towards the principal over time until the balance is zero. An amortized repayment structure makes becoming a homeowner more accessible and beneficial. Instead of having to pay back all the money you borrowed to buy a home in one large payment, amortization lets you pay off your mortgage in manageable chunks. Another perk is that with every principal payment, you’re increasing home equity and paying down your home faster. Making extra principal payments can help you pay off your mortgage early and save money in the long run; check that doing so will not result in prepayment penalties.

Mortgage Amortization: A Closer Look

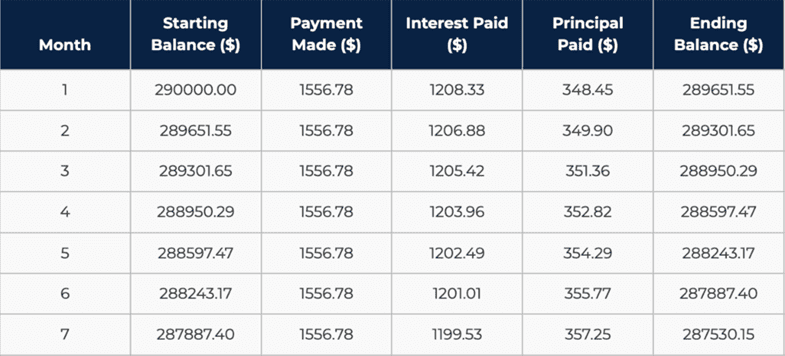

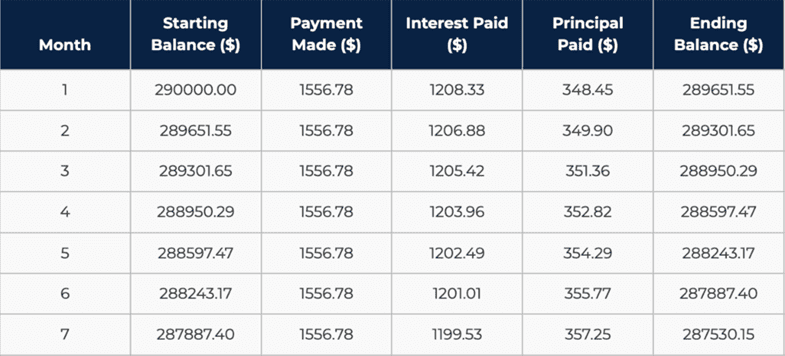

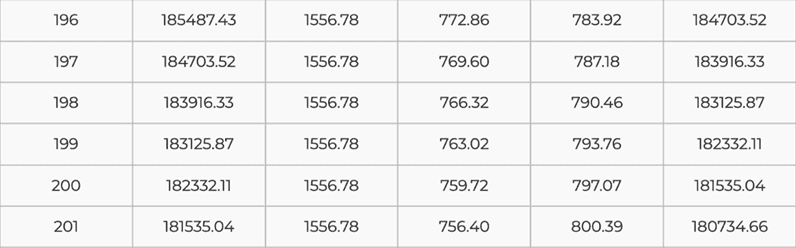

If you were to get a 30-year fixed-rate mortgage of $290,000 at 5% interest, your monthly payment would be $1,556.78. In the first month, $1208.33 of that payment goes towards the interest, while only $348.45 is distributed to the principal. Each month afterward, a little bit more of the payment contributes to the principal.

At 196 months, the portion that goes to your principal becomes greater than the interest portion, $783.92 versus $772.86, respectively. This shift continues for the rest of the 30-year loan term until the loan is paid off.

Most adjustable-rate mortgages (ARM) are amortizing, too. For hybrid ARMs where there’s an initial fixed-rate period, the loan follows a normal amortization schedule. Once the adjustable period begins, the loan will re-amortize each time the rate and monthly payment adjust. When you’re reviewing mortgage options with your Loan Originator, they’ll give you an amortization schedule so you can see the payment breakdown. You can also use an amortization calculator to get an estimate for a rough calculation.

Maintaining a mortgage is a massive financial responsibility, and it takes time to pay it off. When you understand how mortgage repayment is structured, you can make better financial decisions and feel confident that you’re breaking down your loan, one payment at a time.

If you want to know more about how to pay off your mortgage faster, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

Everyone knows that computers can be hacked, but homes? It’s true—house hacking is a thing, but it has nothing to do with the internet or databases. More and more people are turning to house hacking to afford homeownership, but is it right for you?

What is House Hacking?

House hacking is an investment strategy where you buy a property to serve as your primary residence, with the intention of renting out part of it to subsidize your mortgage. You can even become a house hacker if you already own your home. The concept of house hacking isn’t exactly new, but it has recently become more popular among aspiring homeowners due to increasing housing costs.

Traditionally, house hacking involves buying a multifamily home (like a duplex) and renting out the other unit, but that’s not the only way you can get into house hacking. You can put individual rooms, entire floors, or accessory dwelling units (ADU) up for rent—there can be a lot of flexibility! Additionally, you can decide whether you want to host short or long-term renters.

The “hack” in house hacking stems from the idea that you can buy a home and make passive income from it without going through the more complex steps of purchasing a home outright as an investment property. When you buy an investment property that you don’t plan on living in, you’ll have fewer mortgage options available and usually, a larger down payment. With house hacking, your investment property is your primary residence, so you can take advantage of a conventional, FHA, or VA loan to finance your house. This method can make buying a home more affordable, especially for new homeowners.

Financial Benefits

Perhaps the most enticing part of house hacking is being able to significantly lower or even eliminate your monthly mortgage payment. The passive income generated from renting out your home will reduce your financial burden, saving you money over time. As a homeowner, you can reap all the benefits of homeownership, including property appreciation, certain tax deductions, and building home equity. In fact, building home equity with this investment strategy may be quicker than if you were the sole party making payments.

Things to Consider

Landlord Responsibilities

Homeownership means you no longer have a landlord, but house hacking means you’ll become one yourself. This type of responsibility is not for everyone. As the owner, you’ll be responsible for fixing and maintaining the property, or at least paying for repairs. The tenants you choose can make or break a house hacking venture (and your sanity), so it’s essential to vet and find candidates who are responsible and reputable. Still, you may have to have uncomfortable rent conversations with your tenants. You can hire a property manager to help with daily operations, though it will affect your total gains.

Local Limitations

Before you create a rental listing, make sure you’re allowed to rent out your house. If your neighborhood has an HOA, they may have guidelines about how you can use the property. If you’re thinking of renting out an ADU, such as a furnished basement, you need to check with your local zoning authorities, as ADUs must meet certain requirements for safety and livability.

Privacy

Just like having roommates in a rental, house hacking limits your privacy. Consider whether your lifestyle is compatible with sharing spaces with other people. Would having tenants cramp your style if you also live with a partner or have children? Of course, the amount of privacy also depends on how your home is set up; ADUs and multifamily properties will give you more privacy.

Cost Analysis

House hacking can be lucrative, but it isn’t a get-rich-quick scheme. Make sure to consider the financial impact of any investment. Location is always a key factor when buying a home, and if you’re hacking your house, it will affect rental demand and how much you can reasonably charge for rent. You can use rental listing sites to gauge how much to charge for rent in your area. If you’ve found a promising property, compare your estimated mortgage payments with the total estimated rent payments. Don’t forget to factor in cost of repairs! Understand that there may be periods of vacancy, so be sure you can still cover your mortgage if you’re not bringing in full rental income.

Be sure to get pre-approved and work with a lender and real estate agent who understand the concept of house hacking. Their knowledge will be invaluable when you’re considering properties and loan types. House hacking may not be for everyone, but it can be an accessible way to make homeownership possible.

If you have questions about home equity, contact one of our licensed Mortgage Loan Originators. If you’re ready to begin the home buying process, click here to get started!

You probably already know that credit score plays an important role when buying a home, but understanding how credit affects your ability to buy a home goes beyond a simple number. Let’s breakdown some of the most common credit questions from aspiring homeowners.

Will it help my credit score to close a credit card I’m not using?

You might think closing a seldom-used credit card will improve your credit score, but this is the last thing you should do. When you close your credit card, you’re reducing your available credit, which will drive down your score. Instead, use your card for small purchases every now and then and pay it off in full. Consider designating it for minor recurring payments, such as a subscription service. Doing this will prevent the bank from closing your account for inactivity and can benefit your score since you won’t carry a balance.

What’s the difference between a FICO score and the score I get from free credit score sites?

You’ve probably seen ads for sites that let you check your credit score for free, but they don’t always paint a full picture of your credit health. If you’ve relied on the information from one of these sites, it may come as a surprise if your lender reveals a credit score that’s very different. FICO is the primary model mortgage lenders use to review your credit, but some credit sites use a totally separate model called VantageScore. Since FICO scores and VantageScores are calculated differently, there can be a sizable disparity between the numbers. For home buying purposes, it’s better to refer to your FICO score. To get your free FICO credit score, visit the Experian site.

Will it hurt my credit score to apply with other lenders?

When you find a lender to get pre-approved, they’ll perform a hard credit inquiry to get a detailed look at your credit situation. A hard credit pull will slightly decrease your score because your credit report is being accessed for application approval, but soft credit pulls (like checking your credit score) won’t affect it. The drop is usually 5-10 points, and your score will rebound in a few months if there are no negative changes to your credit. If you still aren’t sure which lender to choose, you’ll have a 3 to 4-week window where any hard mortgage credit pulls will be counted as a single inquiry and won’t further reduce your score. If your credit goes through another hard inquiry after that timeframe, it will affect your score.

What’s the quickest way to increase my credit score?

Increasing your credit score is like working out—you won’t see the results you want overnight. The best way to improve your credit score is to establish and maintain good credit habits.

Paying bills on time may not sound like a huge deal, but payment history accounts for a whopping 35% of your FICO score! Consistently making timely payments will increase your credit score and make you seem more reliable as a borrower. Keep in mind that making the minimum payment will prevent your score from falling if you’re tight on funds, while paying it in full will have a larger impact on your credit.

Just because you’re able to pay with credit doesn’t mean it’s a good idea to use all of it at once. The percentage of how much credit you’re using in relation to available credit is called your credit utilization ratio, and it accounts for 30% of your FICO score. When you’re close to your credit limit, it hurts your score and makes you appear financially risky. Aim to keep your utilization ratio low and use around 30% of your available credit. You can determine your ratio by dividing the total credit limit of your credit cards by your total balance and multiply that number by 100.

Paying down debt is another way to improve your score. It will also reduce your debt-to-income ratio (DTI), which will increase how much you can afford for a home. Pay special attention to debt with high interest, as it will accumulate rapidly.

I’m not planning on buying a home right now, but how can I financially prepare when I’m ready?

Even if homeownership isn’t in your immediate future, it’s never too early to put yourself in a solid financial position for when the time is right! Improving your credit worthiness will play a significant factor in being able to buy a home, but there are other areas that are important, too.

The period where you’re gearing up to buy is an ideal time to start a home savings fund. If you can put a portion of your paycheck into savings each month, the amount will grow over time. You might also want to create a budget to manage your expenses and see where you can cut back. While the “requirement” of needing 20% down to buy a home is a misconception, it’s wise to have a solid level of savings when you apply for a mortgage. In addition to reducing existing debt, avoid taking out new, unnecessary debt. This doesn’t necessarily mean you need to be debt-free to buy a home, but having fewer debts means a lower DTI ratio and more purchasing power.

There are numerous myths about credit out in the wild, and it’s easy to believe them if you’re unfamiliar with how credit scores work. When you have a basic understanding of best credit practices, you can be better prepared when you apply for a mortgage.

If you have any questions or want more information about loan programs, contact one of our Licensed Mortgage Loan Originators. If you are ready to begin the homebuying process, click here to get started!

NFM Lending is not a credit repair agency, financial advisor, or debt settlement company.

Purchasing a home is one of the most significant decisions you’ll make in your life, and you shouldn’t entrust that task to just any lender. You want to be sure there are real, caring people working on your loan application who know what to do. With September being National Mortgage Professional Month, we’re taking a special inside look at a few of the amazing people who make mortgages happen at NFM Lending.

Danny Allbritton, Loan Originator, NMLS#1618459

Introduce yourself and what you do at NFM.

Hello! My name is Danny Allbritton, and I have been at NFM now for about six years now. I am a Mortgage Loan Originator located in Columbus, OH, and I am currently licensed to originate mortgage loans in Ohio and Maryland and am looking to expand to many other states soon!

What does your average day look like?

My average day consists of prioritizing all of my tasks to fit in a day. I start my day about 4-5 times a week at 4:15 am to workout at 5:00 am. Doing this has really helped me mentally prepare for what each day will throw at me. Being in sales, you can only plan your day so much before multiple impromptu events happen. I make a to-do list each night so I know what my priorities are for the next day. When I get to the office, I review my list and prepare for any meetings I have for that day. I will call new clients in the morning, as well as touch base with all my real estate partners to provide them with updates on any communication I have had with their clients. My number one job is to help more families get into their homes while alleviating as much stress as possible. Whether that be a first-time homebuyer or a repeat buyer, it brings me joy to assist in the financing process for them. On a daily basis, communication is my number one priority for my clients and real estate partners. I average 3-4 hours per day on the phone to keep everyone updated and on the same page and to keep the ball rolling.

Matt Beard, Processor

Introduce yourself and what you do at NFM.

My name is Matt Beard, but all my work colleagues call me Matty. I started with NFM in 2016, with no mortgage or office experience. I was hired as a Junior Processor, which is a great entry level position for anyone looking to start a career in the mortgage industry.

I was extremely fortunate I had the opportunity to learn from 2 of the smartest people I know in the mortgage industry, my branch’s Sales Team Lead and Operations Manager. They are both a wealth of knowledge, and truly great people. Having great mentors really help to expedite my career growth, and I was promoted to Processor about 8 months after joining the team. Each branch has a different workflow, but for my particular branch, all the processors are contract to close. So once the contract comes over and the application is executed, we manage the file all the way through closing.

What does your average day look like?

I start my day by reviewing my top 5 priorities list, which I write down the day prior. We work in a very fast-paced environment, so it’s important to manage your priorities because new issues are always popping up, and it’s very easy for the day to get away from you. I then clear my new emails/voicemails from the day prior, which is typically in the range of 40+ emails. Not all of those will require a return action, but it’s important to get them cleared early because we want to make sure we reply to clients in a timely manner. Not to mention there’s a whole lot of new emails on the way.

Next, I like to concentrate on my approved loans so I can work on getting them back in to my Underwriter for the clear-to-close (CTC). The Underwriter’s SLA (Service Level Agreement) turn times have a 4pm cut-off, so I really like to get all my resubmissions in prior to 4pm so I no they will be reviewed the following day for CTC. I spend the last couple hours of the day working on new submissions. It’s typically a bit quieter and there are fewer interruptions, so it’s easier for me to properly review new loan files. I cannot speak for any other lenders, but for the processing position at my branch, we take the time to pre-underwrite the loan file before we submit to our Underwriting department.

NFM truly cares about each and every client. We want to put you in the best financial position possible and get you into your dream home, perfect second home, or great investment property. We are going to answer the phone when you call, and we take pride in thoroughly explaining the process and the “why” behind our documentation requests. If something comes up during the loan process and we run into a guideline issue that we cannot find a workaround on, we will help you find another lender that has more flexibility and can get you approved! We never want to lose a deal, but the most important thing is to make sure the customer is happy and that we are providing a WOW service to our clients and referral partners.

Vanita Singh, Underwriter

Introduce yourself and what you do at NFM.

I am a Level 1 Conventional Underwriter working remotely for NFM for the past year. I was in the mortgage industry many years ago as a processor and underwriter assistant. I left the business after the market crash in 2007. I spent the next few years working in risk management for an online bank and then took some time off to be a stay-at-home mom to my two boys.

What does your average day look like?

My typical workday includes reviewing at least two new loans for conditional approval. The review includes evaluating credit history, income documents, and assets. In that review, I am looking to see that the loan applicant is financially responsible and has the ability to repay the mortgage loan. I look for discrepancies or possible misrepresentation of facts. I spend some time researching information and then requesting explanations from the borrowers via their mortgage processors.

Many cases involve reading and interpreting guidelines to ensure the final approval is allowable under the rules set in place. Some situations that fall into a gray area need to be brought to senior underwriters and managers to come up with an out-of-the-box solution.

During the course of the day, I also respond to emails from processors, closers, and team leads to make sure loans get closed and funded in a timely manner. The remainder of the time is spent reviewing conditions on approved loans such as property appraisals, title work, explanations for discrepancies, additional assets, and income.

Sarah Rogers, Closer II

Introduce yourself and what you do at NFM.

My name is Sarah Rogers, and I am a Closer with NFM Core. I have been in the finance industry for 14 years, of which the past six have been in the mortgage industry as a Closer.

What does your average day look like?

On an average day, I receive multiple communications on loans, inclusive of notification a loan is clear-to-close and ready to finalize. I review each file to ensure accuracy by reviewing data, conditions, and figures to insure we have all items needed before closing. I communicate with the title company to complete the final numbers and review that we are meeting program guidelines, as well as state and federal regulations. Once NFM balances with title and agrees on the final numbers, the closing disclosure is sent to the branch for their review and approval. Once this final step is complete, the closing package is prepared and sent to the title company.

These are just some of the passionate, friendly, and hard-working people who make up NFM Lending. Throughout our many branch locations and at our corporate headquarters, there are numerous people essential to the mortgage process who care about the needs of borrowers. We hope this glimpse into the daily life these mortgage professionals has demystified what happens behind the scenes and shown how NFM strives to create a personable mortgage experience.

If you have questions about becoming a homeowner, contact one of our licensed Mortgage Loan Originators. If you’re ready to begin the home buying process, click here to get started!

You may know the basic steps of getting mortgage approval, but what happens after you sign your closing documents? Many people aren’t familiar with loan servicing until they have a mortgage of their own, but understanding it is important if you’re planning on becoming a homeowner. Read on to learn what loan servicing is and how it works.

What is Loan Servicing?

The life cycle of a mortgage doesn’t end when you get approved for a loan, it’s merely the beginning. Once you officially assume the loan and start making payments on it, your payments will go towards the principal and interest, as well as additional costs included in your escrow account, like home insurance, property taxes, and private mortgage insurance (PMI). The entity that manages your payments is your loan servicer, and the act of paying these expenses is called loan servicing. Your loan servicer oversees making timely payments on your behalf. They can also explain your options to avoid foreclosure if you’re having trouble making mortgage payments. These alternate options include a forbearance plan and loan modification. If you still can’t keep up with payments, your servicer may suggest a short sale or a deed in lieu of foreclosure, which are less financially damaging than a foreclosure. One of the goals of loan servicing is to keep you on track with your payments and help you maintain ownership of your home. It’s not just standard mortgages that get serviced—refinances, home equity line of credit* (HELOC), and home equity loans also require it.

How Does it Affect Me?

When homeowners receive a notice that their mortgage has been sold to a third party, they may be confused or worried. If this happens you, don’t worry, there’s nothing wrong. The terms of your loan won’t change, only the address where you mail your payment and who you mail it to. Your lender has 15 days to notify you of the loan ownership transfer, and you have a 60-day grace period in case you accidentally send an on-time payment to the old address.

Sometimes lenders service their own loans, but this isn’t always the case. When you agree to the mortgage terms, you won’t be able to choose or change who your servicer is, nor opt-out of having your loan sold. You could pay off your mortgage to stop dealing with a servicer altogether, or refinance, but even then, you won’t have any say in who services the refinanced loan. The best thing you can do if you get a new servicer is to keep making timely mortgage payments and always review and maintain your mortgage statements for record-keeping purposes. If you have any questions about your statement, you should contact your servicer.

Mortgage servicing is essential to the mortgage industry because it ensures the loan and other necessary costs are paid off. For homeowners, servicers provide structure to ensure they can keep and stay in their homes.

If you have questions about becoming a homeowner, contact one of our licensed Mortgage Loan Originators. If you’re ready to begin the home buying process, click here to get started!

* NFM Lending does not service HELOC loans in-house

Much of what real estate agents do gets reduced to putting a home on a listing site and getting a commission when it sells. You might think real estate agents have it easy, but they employ many skills to help people become homeowners. Read on as we shed some light on what real estate agents do and why they’re essential if you’re buying or selling a home.

Before the Sale

For sellers, the real estate agent is responsible for listing your home for sale. To price your home, they’ll conduct a comparative market analysis to see how much similar homes in your area have sold for. In addition to managing the listing, agents and their teams work hard to market your home. Their marketing strategies can include professional photography and staging services, social media posts, and flyers to attract people. Holding an open house is a time-tested, effective way to get interested buyers in the door, literally! Agents frequently spend their weekends showing off properties for a few hours.

For buyers in the initial phases of house hunting, the real estate agent is tasked with getting to know what you’re looking for in your future home. They’ll get to know your needs, likes, dislikes and budget to recommend properties you may like. In a way, real estate agents are like matchmakers for homes. If you find a house you’re interested in, the agent will arrange a time to show it to you. Agents also need to have a strong understanding of their local markets. When you’re exploring various communities, tap into your agent’s knowledge to get an idea of a neighborhood’s characteristics.

A real estate professional who represents the home seller is called a seller’s or listing agent, while agents working for the homebuyer is a buyer’s agent. The main difference between them is that they have a fiduciary obligation to serve your interests as a buyer or seller. Having an agent who has no conflict of interest with the other party will give you peace of mind when it’s time to work out a deal.

During the Sale

Once you’ve found a house you want to purchase, the buyer’s agent will help you submit a competitive offer. It’s important to craft an offer that appeases the sellers while also complying with state and local real estate laws. Should there be any dispute regarding the offer or other concerns, your agent is there to be an intermediary between you and the seller. With all the duties you have to juggle when buying a home, the last thing you should involve yourself in is direct discussion with the other party. When reviewing the seller’s disclose, your agent can offer insight into what each item means. If you have concerns after conducting a home inspection, your agent can help you renegotiate your offer.

Once your home has an offer on the table, it can be beneficial to review it with your real estate agent, especially if you’ve received multiple bids. Offer letters are full of financial jargon, and you have a limited window to respond to offers (24-72 hours is typical)—using your agent as a resource makes a lot of sense. Though you are ultimately in charge of choosing the offer that’s best for you, your listing agent can translate what the offers entail and negotiate with the homebuyers via their buyer’s agent.

Whether you’re the buyer or the seller, time is of the essence in a real estate transaction. Agents need to be on the clock and ready to act when clients, seller’s/buyer’s agents, lenders, and title companies contact them. In addition to having open availability and timely communication, great real estate agents offer moral support to their clients. The home buying and selling process is often stressful and hectic, but having an encouraging and persistent real estate agent on your side can prevent you from feeling discouraged and lost.

Finalizing the Sale

On or a few days before you close, be sure to do a final walkthrough with your agent to ensure the home is still in working condition. This is your last opportunity to check that no new issues have come up since the home inspection and that the sellers have fixed any items that were stipulated in your offer. Although it’s not required for agents to attend closing, many choose to be present or send a representative from their team to make sure everything goes smoothly. Along with the closing attorney, your agent can clarify terms in the closing documents and answer questions.

When it comes to making one of the most significant purchases in your life, it makes sense to work with a professional who understands the ins and outs of real estate and who is dedicated to your best interests. After you finally walk through the door of your new home, you’ll be glad you hired an amazing real estate agent.

If you have questions about becoming a homeowner, contact one of our licensed Mortgage Loan Originators. If you’re ready to begin the home buying process, click here to get started!

Note: This blog was originally published in September 2014 and has been updated.

One of life’s classic conundrums is whether it’s better to rent or buy a home. Making the transition from renter to homeowner is a significant milestone, and it’s one that should be considered carefully. If you’re still weighing your options, here are some significant points to consider when deciding if you should rent or buy a home.

Renting

Benefits

Renting comes with less commitment than owning. Leases can be short or long term—common leasing periods include month-to-month, six months, and one year. For people who move around frequently, renting allows for more flexibility. It’s also easier to move out if you’re just renting since you have minimal financial responsibility in the matter.

Renting can be a better choice if you’re a student or are just starting your career and have less savings. There is a lower barrier to entry when you rent, as you just need to pay an application fee, security deposit, and first and last rent payments. During tax season, you won’t have to pay property taxes since you don’t own the home.

Living in a rental means maintenance duties are shared between you and your landlord. Though each situation varies, landlords are usually responsible for paying for and scheduling general maintenance. This can be a beneficial if you prefer someone else handling the day-to-day issues.

Drawbacks

There are plenty of renting horror stories involving rundown properties and unethical landlords. Though not every rental agreement is nightmare-inducing, it’s a risk that comes with relying on someone else to keep you housed. Agreeing to a lease sometimes means abiding by guest restrictions and pet bans, among other rules.

As a renter, you’re limited in what you can change in the house. Any alterations, whether it’s repainting a room or replacing flooring, require permission from the property owner. If the home needs major repairs, your landlord may be slow or even reluctant to fix them. Your freedom varies depending on your landlord, lease, and state tenant laws, but you generally can’t make unilateral decisions regarding the house.

Even if you are allowed to make improvements, any equity created will benefit your landlord, not you. Your rent goes towards the property’s mortgage payments, upkeep, and taxes, but this has no long-term advantages for you. Additionally, your rent payments can fluctuate due to local market forces. You may start out with a reasonable rent, only to have it skyrocket the next leasing period.

Owning

Benefits

The ability to build equity in your home is an attractive key feature that makes homeownership distinct from renting. Equity is how much ownership you have in your home, and it can be increased through mortgage payments, certain home improvements, and a rising local housing market. Once you’ve built enough equity in your home (usually 20% or more), you can leverage it to finance home repairs or other expenses using a home equity loan or a home equity line of credit (HELOC). With all the effort and love you put into your home, you deserve to let your home work for you! Being able to say that you own your home is priceless and something to be proud of.

It’s normal to want to make your living space reflect your personality and needs, and owning a home allows you customize it the way you want it. You can paint your living room any color you want, renovate your kitchen, or schedule a repair without going through your landlord’s red tape. Homeownership gives you the freedom to create the home of your dreams.

Owning a home allows you to build financial security over time. When you sell your home, you can use the money from the sale to put towards in your next home or another investment. The value of your home’s equity can also be passed on to your beneficiaries, creating generational wealth. Unlike other investments like stocks, property ownership tends to be very stable, and the land it sits on has inherent value.

Drawbacks

Although you will never have to worry about increasing rent as a homeowner, you’ll need to be conscious of property taxes and insurance costs. These necessary and unavoidable fees can increase from year to year, and they won’t disappear after you’ve paid off your mortgage.

Though the benefits of homeownership are rewarding, it takes work and money to maintain the quality of your home. You may be able to complete some rapids yourself, but others will require a professional. Throughout the year, you’ll need to schedule various checkups for your home, such as pest control, HVAC servicing, and chimney cleaning. Emergency repairs are rare, but often more expensive. Aim to have at least 1-4% of the home’s purchase price in reserves to finance maintenance costs.

If you own, the moving process will be more complex than if you were renting. Selling a home involves hiring a real estate agent, working with buyers, and being flexible if a deal falls through. It’s not something you can easily walk away from, and the housing market is constantly changing.

Renting and buying both have upsides and downsides, but it’s up to you to decide which makes the most sense for your financial situation and life goals. Even if you aren’t quite ready to own a home in the immediate future, you can still take steps to put yourself in a better position to buy when the time is right. Paying down debt, increasing savings, and improving your credit score will go a long way into preparing for the homebuying journey. It’s never too early to find a Loan Originator to guide you and make you feel more confident in the process. Renting means answering to someone else when it comes to making decisions about your house, while owning a home puts the power in your hands.

If you have questions about becoming a homeowner, contact one of our licensed Mortgage Loan Originators. If you’re ready to begin the home buying process, click here to get started!