With the oldest turning 26 this year, most Gen Z’ers aren’t quite ready for homeownership — but a burgeoning set of this young generation plans to buy in the next few months, NFM Lending found.

How can lenders target and capture the latter? We can sum up the most effective strategy with one word: Influencers.

In the last decade, social media influencers revolutionized how companies reach their target audiences. In return, this spawned a new generation of consumers who are too savvy for traditional marketing methods.

Gen Z’ers view their favorite content creators as trusted peers and expect products to be authentic and personalized to their individual needs. They prefer to receive information through videos, on apps like YouTube and TikTok.

While TikTok isn’t yet the most popular social media platform, with 1 billion monthly active users globally compared to Facebook’s 3 billion, it’s growing, garnering the second-highest number of downloads of any non-gaming app in January 2021 with 62 million.

Sixty percent of the app’s users are Gen Z, providing a well-stocked pool of potential new loan applicants. To tap into it, NFM Lending launched an in-house influencer division in January 2022, led in part by Scott Betley, otherwise known as @ThatMortgageGuy on TikTok, Instagram, Facebook and YouTube.

In just a year and a half since, NFM Lending expanded to 16 in-house influencers, creating increasingly popular informative and entertaining videos.

Betley grew his fanbase to more than 1 million followers across all platforms as of this post’s publish date as a testament to their efficacy. He’s clocked more than 10 million views to his most popular videos — several of which compare the plight of Gen Z’ers saving for down payments to Boomers enjoying homes they bought affordably in the 1980s.

One of the talented creators recruited for NFM’s in-house influencer team is Jordan Nutter, aka @ANutterHomeLoan, whose satirical yet educational posts elicit genuine belly laughs. Jordan has over 240k followers across all platforms and hundreds of thousands of views on her videos. She is best known for her phone call reenactments inspired by real-life conversations with her clients. Jordan has immersed herself in the division’s success and was promoted to become its Vice President earlier this year.

How does NFM’s strategy stand out from other mortgage companies? NFM Lending takes its strategy a step further than its competitors. When visiting an influencer’s profile, users are guided to an optional intake form where they can share their financial statuses, contact information and how soon they plan to buy.

“It’s the roadmap to their homebuying journey,” NFM Lending Managing Director Gregory Sher explains. “The ‘Timeframe to Purchase’ field sets the clock in motion and allows us to create workflows to help the consumer accomplish their goal.”

NFM Lending’s clever method is the mouth of a funnel that narrows as it nurtures users deeper into the mortgage landscape. From 30.7 million TikTok views from Gen Z users in July 2023 (up 21.8% from June), NFM Influencers generated 1,401 leads. These became 24 prequalification applications and, finally, 20 loan originations. Of these leads, 941 asked for a real estate agent introduction.

Beyond creating leads and loan applications, the intake form provides data sets that offer unique insights into the behaviors and circumstances of Gen Z homebuyers.

Based on the numbers collected between July 2021 and 2023, we learned that:

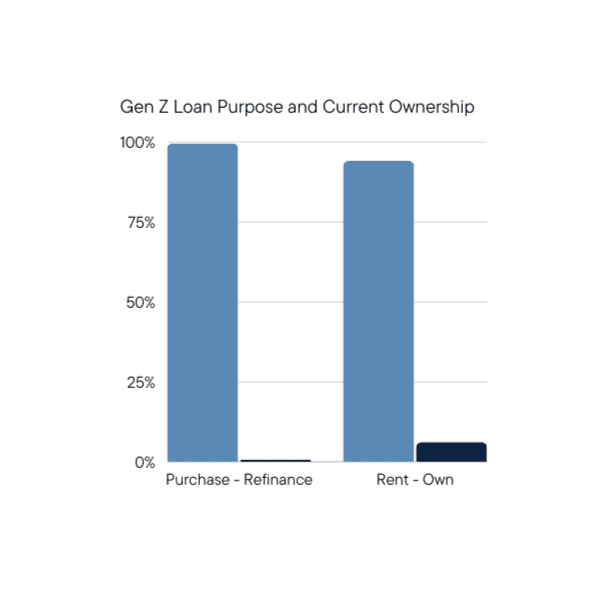

Nearly all Gen Z respondents currently rent and plan to own

NFM Lending data confirms that most of this younger generation is headed toward homeownership for the first time. Of the 2,191 Gen Z’ers who shared their current ownership through our intake form in that timeframe, 93.9% were renters. Similarly, 99.4% of 2,575 said they’d use their mortgages to buy homes, rather than to refinance or build.

But with rents at record highs, we’re in a historically difficult time for renters to save for down payments. In July 2023, the national median rent was $2,038, which equals a whopping 75% of Gen Z’s median income of $32,500. That makes it especially tough for them to set aside piles of cash, but to put 20% down for the median U.S. home price of $416,100, they’d need to stack up $83,220.

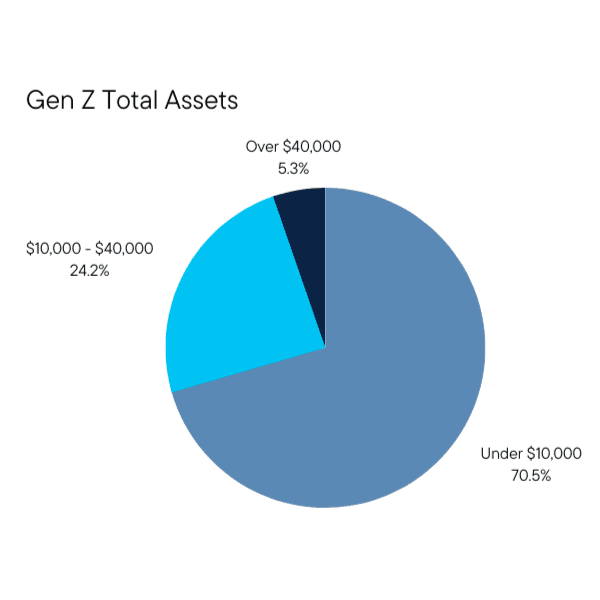

Of 922 respondents who revealed the value of their assets, including savings, to NFM Lending, just 5.3% had more than $40,000. Most had less than $10,000 (70.5%) and the rest had $10,000-$40,000 (24.2%).

Fortunately, down payment assistance programs can help, as can mortgage products that require less than 20% down. Take, for example, the NFM Zero Down Flex, which has no income cap and offers 100% financing for conventional loans.

And as Gen Z learns to navigate their unique circumstances, a burgeoning set is ready to buy.

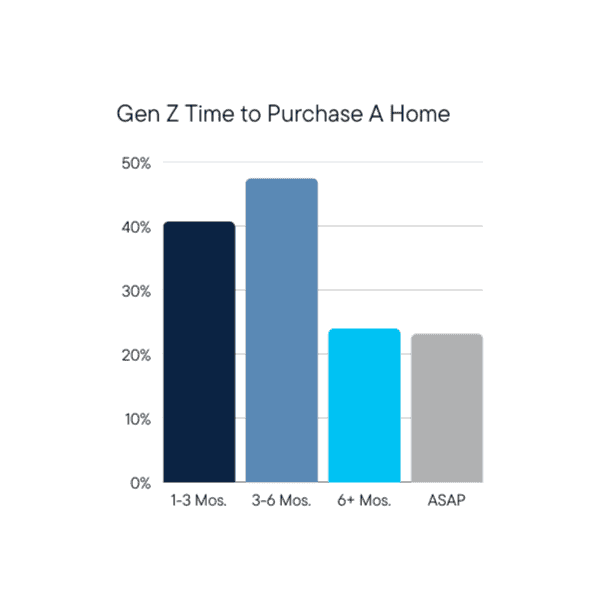

One-third of Gen Z respondents expect to buy in 3-6 months

While 87% of respondents to a Gen Z Planet study said they’d love to own homes one day, the dream feels out of reach for many. A Freddie Mac survey found that 34% of Gen Z’ers worry they’ll never afford to buy places of their own, with insufficient credit history, lack of stable income and student loan debt cited as their primary obstacles.

And yet, of the 1,920 Gen Z’ers who shared with NFM Lending how soon they plan to buy homes:

-

- 27.1% said they expect to in 3-6 months

-

- 25.9% selected 1-3 months

-

- 23.9% responded 6+ months

-

- 23.1% put ASAP

Altogether, 53% of the Gen Z TikTok users who offered their information to NFM Lending planned to buy homes within six months. But does that mean their incomes qualify for mortgage loans? Our data is promising.

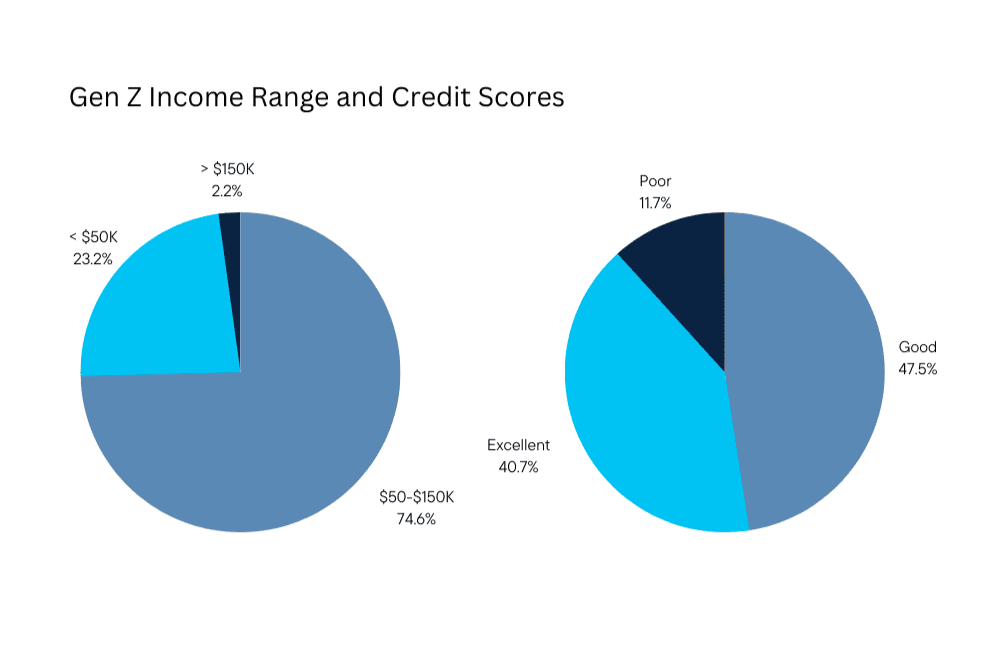

Nearly 75% of Gen Z respondents earn $50,000-$150,000

NFM Lending found that most Gen Z respondents made enough money to satisfy lender requirements. Of the 858 respondents who shared their incomes:

-

- 74.6% had an annual household income of $50,000-$150,000

-

- 23.2% earned less than $50,000

-

- 2.2% made more than $150,000

In terms of credit, of 1,129 respondents, 40.7% said they had an Excellent score, while 47.4% reported a Good one. And though nearly 12% admitted to having a low score, data showed that was more likely due to their lack of credit than being irresponsible with payments.

“In other words, they need more open trade lines such as credit cards that show a good pay history,” Sher says.

Being that they’re just setting off in their adulthood, it’s understandable that Gen Z’ers need some guidance while establishing themselves financially.

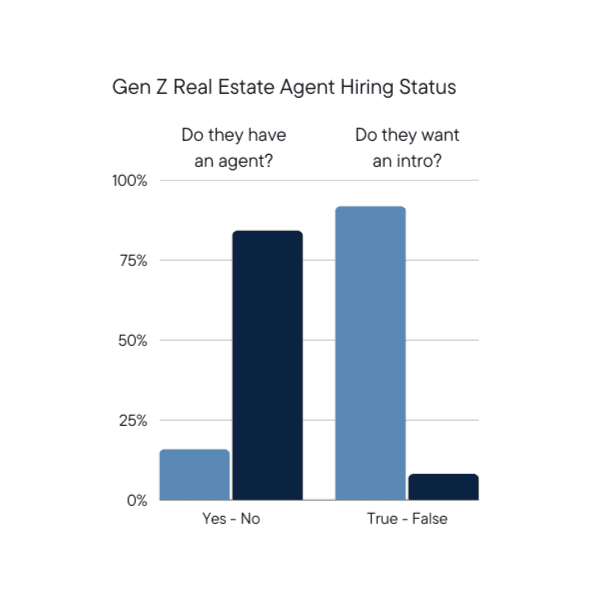

91.8% of Gen Z respondents asked for a real estate agent introduction

As first-time homebuyers, this young generation could use assistance navigating the housing market.

Traditionally, the path to homeownership involved finding a real estate agent who recommended a lender from their carefully curated Rolodex. Lately, however, that sequence started to flip. Many homebuyers today start off by shopping for a lender to see which loans they qualify for.

Through its intake form, NFM Lending reaches buyers in the infancy stage of their journeys, long before they’re ready to meet with a real estate agent. Of the respondents who shared their status of hiring a pro for their search, 84.1% of 2,178 said they didn’t yet have an agent and 91.8% of 756 respondents welcomed an introduction to one.

This change in the process allows loan officers to send prepped homebuyers to real estate agents with warm handoffs. They can source their personal directories and the roster of talented folks at Clever Real Estate, an NFM Lending partner, to suggest the pro that might work best with each buyer.

However, it also gives loan officers a new level of responsibility. They must effectively explain terms and concepts, like credit history and down payment assistance, to buyers who may be new to hearing them.

“As a result of where Gen Z’ers are in the process — super early — working with a lender that excels in financial literacy has never been more important,” Sher notes.

Indeed, most Gen Z’ers aren’t quite ready to buy their first homes, but with its influencer strategy and intake form, NFM Lending is prepared to support them when they are. In the meantime, our data provides unique insights to inform the greater mortgage industry on the best ways to do so.

Click to learn more about The Creator Collective (NFM Lending’s Influencer Division) or to apply for a home loan.