LaTasha Rowe with former U.S. Attorney General, Loretta Lynch, and Fitbit Head of Legal Operations, Emelita Hernandez-Bravo.

LINTHICUM, MD, November 1, 2019— NFM Lending is pleased to honor Boatswain’s Mate 1st Class Matthew “Random” Dunn as the NFM Salute for November 2019.

BM1 Dunn was a member of the U.S. Navy as a Navy Seal, serving from December 1996 to October 2006. He was part of SEAL Team 2 and SEAL Team 5 as a Sniper Instructor and a Basic Underwater Demolitions Instructor (BUDs). He joined the Southern California chapter of the Knuckle Draggerz Veterans Club in May 2013 and was elected Chapter President shortly after. On August 18th, 2013, BM1 Dunn was tragically killed in a motorcycle accident at just 39 years old.

BM1 Dunn was nominated by his club brother, Mitch Akers.

“Random was so humbled and cared about everybody. He lived his life to the fullest. He was a great asset and brother of the club. He will be sorely missed.”

NFM Salute is an initiative in which one military member or Veteran is chosen each month to be honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” will be featured on the website with a biography and information about his or her service, and NFM Lending will make a $1,000 donation to a military or Veteran non-profit in the Salute’s name.

Selected NFM Salutes may choose from one of the following three non-profits: Platoon 22, Any Soldier, and the Gary Sinise Foundation. Akers chose Platoon 22 to receive this month’s donation in BM1 Dunn’s honor. NFM looks forward to the opportunity to continue to honor military and Veterans through the NFM Salute initiative.

NFM Lending is a mortgage lending company currently licensed in 37 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram.

LINTHICUM, MD, October 17, 2019 — LaTasha Rowe, General Counsel at NFM Lending, will speak during the “Compliance and Legal Implications of Dealing with Regulators” session at the Women, Influence & Power in Law (WIPL) 2019 event in Washington, D.C, on Friday, October 18, 2019.

Rowe is speaking to educate attendees on how developing a good relationship with regulators can lead to a more productive examination experience.

The three-day event offers an opportunity for some of the most influential women in law from around the world to hear from industry thought-leaders and exchange ideas on everything from technology to negotiating to crisis management.

“I am excited to be a panelist at WIPL.” said Rowe. “While the legal profession is our commonality, we come from all walks of life. Events such as WIPL help continue the conversation that when women and minorities have a seat at the table, WE ALL WIN.”

LaTasha Rowe with former U.S. Attorney General, Loretta Lynch, and Fitbit Head of Legal Operations, Emelita Hernandez-Bravo.

NFM Lending is a mortgage lending company currently licensed in 37 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram.

LINTHICUM, MD, October , 2019— NFM Lending is proud to be a Sponsor for the 15th annual BARCStoberfest 5k and 1-mile run/walk and festival on October 26, 2019. This event will benefit the Baltimore Animal Rescue and Care Shelter (BARCS). This will be NFM Lending’s first year sponsoring the event.

BARCS is Maryland’s largest animal shelter and pet adoption center. All proceeds will support the more than 12,000 animals that come through their doors each year that require shelter, food, and medical care. It will also enable them to remain a vital resource to our community through their innovative programs. They are expecting over 3,000 attendees and are hoping to raise over $350,000 dollars this year.

“BARCS does such amazing work in the lives of pets and owners in our community.” said Gene DiPaula, Director of Marketing/PR. “We were astounded to learn that the organization rescues, on average, 30 unwanted, abused, and stray animals every day. And they do such a wonderful job at placing these pets in loving homes where they can thrive. We knew we wanted to support this organization, whose mission falls in line with our own NFM C.A.R.E.S. philanthropy initiatives. We look forward to being a part of BARCStoberfest and their other important fundraising endeavors for years to come.”

NFM Lending looks forward to being part of such an important and impactful mission.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 37 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram.

Mortgage calculators are important tools for both homebuyers and homeowners. These calculators can help estimate your monthly mortgage payments as well as how much you can afford when purchasing a home. There are various types of mortgage calculators out there, but NFM offers three of the most popular for free: Mortgage Payment Calculator, Affordable House Calculator, and Refinance Calculator. If you’re wondering exactly how mortgage calculators work, let us break it down.

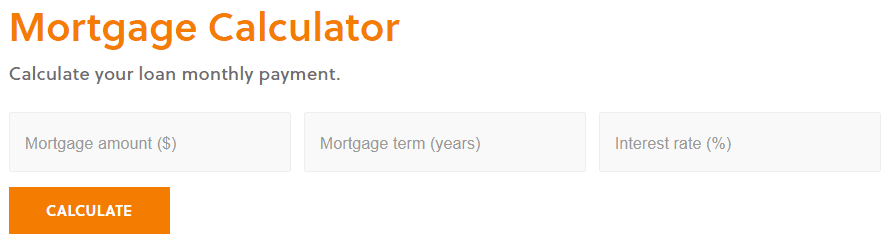

Mortgage Payment Calculator

If you just want a quick estimate of what your monthly mortgage payment should be, this calculator is ideal. Input your total mortgage, the mortgage term in years, and the interest rate. You will receive a monthly payment estimate (principle and interest) based on those numbers.

For example, if your total mortgage is $250,000 for a Conventional 30-year loan with a 5% interest rate, your principle and interest monthly payment would be $1,342.05.

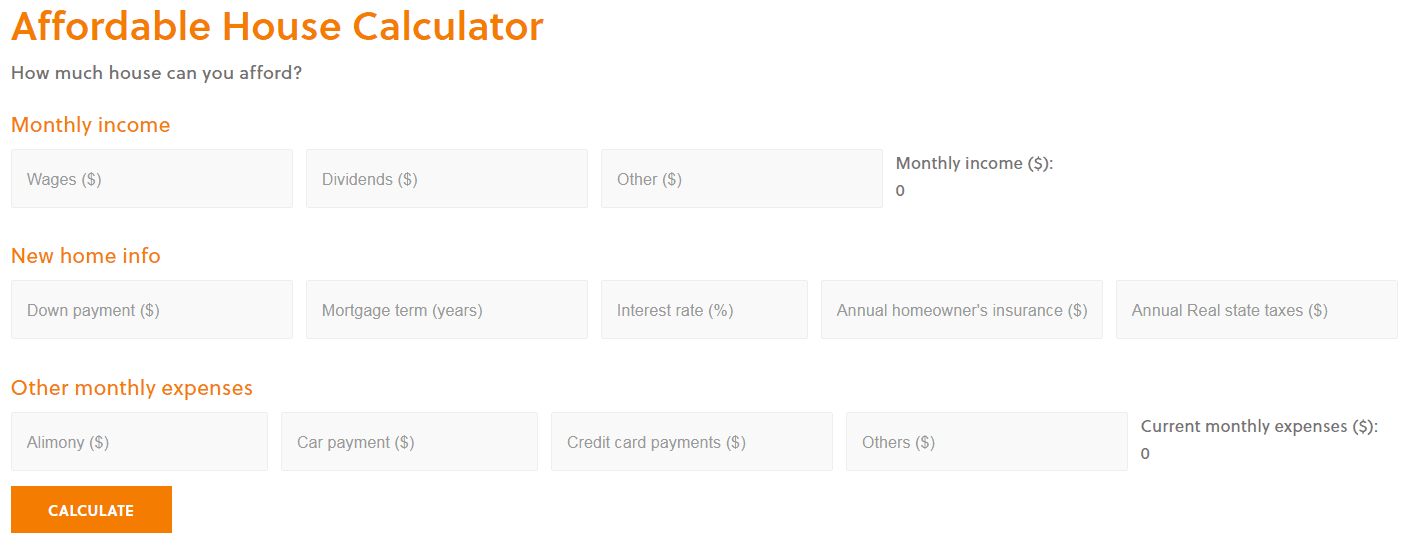

Affordable House Calculator

If you’re thinking of buying a home, the affordable house calculator should be the first one you use. This calculator predicts how much you can afford to spend on a home – which is important to know prior to starting the homebuying process. Input information about your monthly income (wages, dividends, and any other relevant income information), new home information (down payment, mortgage term in years, interest rate, annual home owner’s insurance, and annual real estate taxes), and other monthly expenses (such as alimony, car, or credit card payments). This calculator will provide a suggested new home value, mortgage amount, and affordable monthly payment so you have a better understanding of how much you can afford to spend on a home.

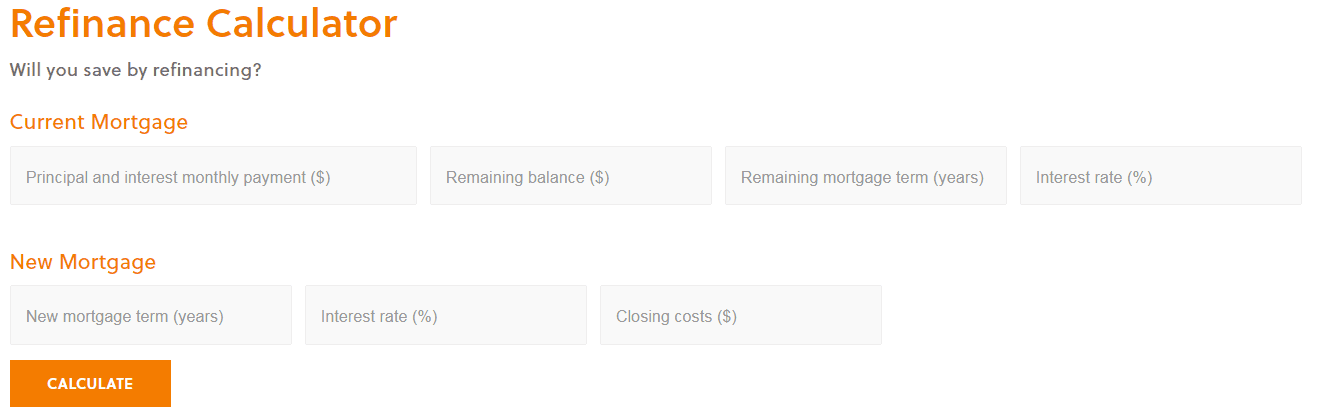

Refinance Calculator

Are you considering refinancing your mortgage? Use our refinance calculator to help you find out how much money you can save. You’ll need to input data about your current mortgage: principal and interest monthly payment, remaining balance, remaining mortgage term in years, and interest rate. Next, provide information about your new mortgage: mortgage term in years, interest rate, and closing costs. The calculator will then give an estimated new monthly payment, in addition to monthly savings, interest savings, closing costs, and the amount of time it will take for you to recoup your costs.

After using our calculators, you can email yourself the results. Remember, these calculators are for your convenience, and the figures input on these calculators are only estimates and are not 100% accurate.

To learn more about using one of our mortgage calculators or getting exact costs, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying or refinancing process, click here to get started!

LINTHICUM, MD, October 1, 2019— NFM Lending is pleased to honor Colonel Christine Ege as the NFM Salute for October 2019.

COL Ege is serving in the US Army as a veterinarian and is currently in her 21st year of continuous active duty service. She passionately supports the Department of Defense through biomedical research.

2018-2019 has been a tough period for COL Ege and her family. She was living overseas in Thailand with her entire family but separated to move back to the States. As her husband and one teenage child moved to Maryland in the first stage of the move to set up the purchase of a home and car, she was diagnosed with breast cancer. Remaining in Thailand with a young adult and one teenager still in school, she made the decision to complete her diagnostic testing in Thailand and then leave the country the day after her daughter finished 8th grade.

Upon arrival to the US, and the reuniting of her family, she began treatment at the Walter Reed National Military Medical Center. For the remainder of 2018, she was in treatment, which appears to be successful.

2019 has been COL Ege’s comeback year. October 2019 is an important month as she will be running in the Army Ten Miler, a goal she had in 2018 prior to her cancer diagnosis. She has spent the year going through medication changes, dealing with side effects of the cancer treatment, side effects of multiple medications, starting a new position, and the difficulty of regaining her physical strength and mobility. October 2019 is also the month she is being promoted to Colonel.

COL Ege was nominated by her loan originator, Jason Fox, who worked with the Eges while she was in Thailand and her husband was in Maryland.

“Just through my interaction with COL Ege, it is apparent she is a very strong woman. She always has a positive attitude, a smile on her face, and she fights hard.”

Throughout this time, COL Ege has been resilient. Any one of the challenges she has faced could be enough to knock someone down, but she has kept her head up, sought out assistance through her friends, coworkers, and medical personnel to help her through the difficult times.

As a research veterinarian and now as a breast cancer survivor, COL Ege continuously calls attention to the need for ethical biomedical research in animal disease models. She is proud to serve in the military with a mission to improve Soldier brain health and to find treatments and cures of infectious diseases affecting the Warfighter.

NFM Salute is an initiative in which one military member or Veteran is chosen each month to be honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” will be featured on the website with a biography and information about his or her service, and NFM Lending will make a $1,000 donation to a military or Veteran non-profit in the Salute’s name.

Selected NFM Salutes may choose from one of the following three non-profits: Platoon 22, Any Soldier, and the Gary Sinise Foundation. COL Ege has chosen Platoon 22 to receive this month’s donation to support all who are facing difficulties. Suicide is not the solution.

NFM looks forward to the opportunity to continue to honor military and Veterans through the NFM Salute initiative.

NFM Lending is a mortgage lending company currently licensed in 37 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram.

When applying for a loan, one of the most important factors that will come into play is your credit score. Before you start the loan application process, you should have a clear understanding of how your credit score affects your mortgage rate so you can assess your financial situation.

Most lenders use the FICO (Fair Isaac Corporation) model for credit scores. This model provides consumers a numerical value on a scale between 300-850. Typically, the higher your credit score, the lower the interest rate the lender will offer to you. Lenders use your credit score to determine how reliable you’ll be as a borrower and the likelihood that you’ll repay the loan as agreed upon. Essentially, they want to make sure you’ll make your mortgage payments on time each month. A lower score might indicate that a borrower could make late payments or even miss some. This is all part of your credit history, which they will also take into consideration.

Not necessarily. It mostly impacts which type of loan you’ll qualify for and the interest rate you’ll receive. A conventional loan usually requires a minimum of a 620 credit score, whereas an FHA loan has a minimum of 580. However, it’s important to note that while some loan programs accept lower credit scores, they might require a larger down payment or some other way to mitigate the lender’s risk in taking on the loan. In addition, even though someone with a 580 credit score COULD qualify for an FHA loan, it does not mean that they will; it is at the discretion of the lender within the guidelines of the loan programs.

A borrower has obtained a conventional fixed-rate 30-year loan of $200,000 with 10% down, meaning the amount borrowed is $180,000. She has a 750 credit score and received a 4% interest rate. Her monthly mortgage payment is $859 (not factoring in other fees, such as private mortgage insurance (PMI) or real estate taxes that may be included in the payment). Now, say that borrower dropped to a 650 credit score. She instead received a 5% interest rate. That increases her monthly mortgage payment to $966. That 100 point difference between credit scores ultimately means an extra $107 added to her mortgage payment each month. While that might not seem like a big deal, keep in mind the duration of the loan is 30 years. Having a higher interest rate means a yearly difference of $1,284; over 30 years that totals $38,520.

If you’re interested in comparing interest rates and monthly mortgage payments, use our mortgage calculator.

Don’t worry if your credit isn’t the best right now. Raising your credit score can take a lot of time, patience, and discipline. However, if you follow these simple guidelines you will soon notice a positive change in your credit and ultimately your financial future. You’ll be able to qualify for better rates when it’s finally time to buy a home.

To learn more about credit scores and interest rates, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

*The figures used in this example are hypothetical and the results are intended for illustrative and educational purposes only. **NFM Lending is not a credit repair company. Please contact a credit repair company for more information on how to improve your credit score.

LINTHICUM, MD, September 3, 2019— NFM Lending is pleased to honor PFC Willie Woods as the NFM Salute for September 2019.

Willie is a Veteran of the U.S. Marine Corps, serving during World War II. He is a member of the Montford Point Marines, the first all African American unit in the U.S. Marine Corps. In June 2012, the members of the Montford Point Marines were awarded the Congressional Gold Medal. At 93 years old, Willie resides in Washington, D.C., with his wife of 71 years, Delores.

Willie was nominated by his granddaughter, Alisha Wooten.

“He has served his country and family proud. He is an exceptional leader and example. We are very proud of his accomplishments.”

NFM Salute is an initiative in which one military member or Veteran is chosen each month to be honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” will be featured on the website with a biography and information about his or her service, and NFM Lending will make a $1,000 donation to a military or Veteran non-profit in the Salute’s name.

Selected NFM Salutes may choose from one of the following three non-profits: Platoon 22, Any Soldier, and the Gary Sinise Foundation. Willie chose Any Soldier to receive this month’s donation. NFM looks forward to the opportunity to continue to honor military and Veterans through the NFM Salute initiative.

NFM Lending is a mortgage lending company currently licensed in 37 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram.

LINTHICUM, MD, August 30, 2019— NFM Lending is pleased to announce the successful completion of its fifth annual School Supply Drive. From August 5th to August 23rd, NFM Lending collected school supplies to fill backpacks with pens, pencils, folders, markers and other tools that will prepare students in Baltimore County for a successful school year. This year, NFM Lending provided the Baltimore County Public School District with 25 filled backpacks for children attending their schools.

“NFM C.A.R.E.S is our calling,” said Madison Grey, HR Director and team lead for the drive. “We express this with our commitment to Children, Animals, Rebuilding, Encouraging and Service – it’s in our DNA. We recognize the struggle some families face to send their children properly equipped for school; knowing that our community is in need makes us personally and professionally responsible. A new backpack and supplies bring a smile to a student and hope for a parent. NFM wishes all families success.”

NFM Lending is proud to support many charities and non-profits through donations and volunteer work. NFM has also been involved in charitable efforts with The Ronald McDonald House Charities Maryland, AnySoldier, Johns Hopkins Department of Gynecology and Obstetrics, and St. Jude’s Children’s Research Hospital, to name a few. For more information about NFM Lending’s charitable work, click here.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 37 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram.

NFM Lending is proud to announce that as a part of our effort to better serve the Hispanic community, our online loan application is now offered in Spanish. All Mortgage Loan Originators websites now feature the option to complete the loan application in English or Spanish. Simply click on the Apply Now tab on the website of your preferred Mortgage Loan Originator and choose between English and Español. This feature will allow our Spanish-speaking clients to have a smoother and more streamlined homebuying experience.

[vc_column el_class=”nfm-history” width=”1/2″][minti_video]https://vimeo.com/353471194/7bc30ec3a5[/minti_video][/vc_column]

If you are ready to begin the homebuying process, click here to get started!

If you’re ready to buy a home, you should prepare to have an earnest money deposit. This can be an extremely important part of the homebuying process as it essentially lets a home seller know how serious you are as a buyer. So, what is earnest money?

An earnest money deposit, otherwise known as a good faith deposit, is a sum of money that you pay to the seller to let them know you are ‘earnest’ and will follow through on the contract. It is the closest thing to being able to ‘put your money where your mouth is.’ The money doesn’t go directly to the seller but will be held in escrow or a trust by a third-party who holds all finances during the transaction until the sale is finalized and complete. Once the sale is complete, the deposit will go towards your down payment or closing costs, so no additional money is necessary.

The amount of earnest money is not a set amount and will vary based on the market. Typically, it is about 1-3% of the purchase price of the home, but it ultimately depends on the seller. In a buyer’s market you can expect to put down a smaller deposit, however, in a seller’s market you could be going up against multiple bids so a larger deposit will likely be required. If desired, you can try to negotiate the amount down.

You can receive your earnest money back if the sale doesn’t go through, but it depends on why it didn’t. If you have the right contingencies, or conditions, in the contract and the seller doesn’t meet them, you can get your money back. For example, if the seller agreed that the home appraisal will match the sale price, but it comes back lower, you can back out of the deal. If you decide that you no longer are interested in the house or if you fail to meet the timeline specified in the contract, the seller has the right to keep your money. That’s why it is so important you’re completely serious and ready to purchase the home when you submit the deposit.

To learn more about earnest money, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!