LINTHICUM, MD, August 15, 2018— NFM Lending has announced the promotion of Tempe, Arizona Branch Manager, Ryan Sandell, to Vice President, Western Region. Sandell will help expand NFM’s growing footprint in the West using his proven track record and established relationships with realtors and builders throughout the region. The Sandell Team of NFM Lending currently boasts three of the top 1% loan originators in the country, each with less than six years of experience in the mortgage business.

“It has been incredible watching Ryan grow his team in Arizona,” said Jan Ozga, President of NFM Lending. “He’s doubled his production in 2 short years, demonstrating his ability to scale and make sound hiring decisions simultaneously. Using his current blueprint, Ryan will expand his footprint to Nevada, California and beyond. I marvel at his high mortgage IQ and can’t wait to see his continued ascent to the top of the mortgage ranks.”

“I am grateful for this opportunity and eager to grow the NFM brand throughout the Western United States,” said Sandell. “Joining NFM Lending was the best decision I could have made to grow my team, and now to have the opportunity to recruit loan originators who are focused on taking their production to the next level is truly exciting. NFM has really shown me a commitment to providing the best programs and resources to support their branches, and I am looking forward to sharing that with others.”

The Sandell Team of NFM Lending is currently hiring Loan Originators through the West and Southwest United States.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998 and this year is celebrating its 20th anniversary. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.

LINTHICUM, MD, August 7, 2018 — NFM Lending is pleased to announce the opening of a new branch in New Market, Maryland. The branch is located at 164 West Main Street, New Market, MD 21774, and will be led by Branch Manager Jason Fox. The NFM Lending branch will focus its lending platform throughout the Frederick metropolitan area. NFM Lending offers Conventional, FHA, VA, USDA, FNMA, Jumbo, and many other loan options to fit every borrower’s need.

“I am thrilled to be joining the NFM Family,” said Jason Fox, Branch Manager. “The technology and abundance of local programs NFM has to offer is going to help my clients, as well as my referral partners, with an even smoother streamlined mortgage process with up-to-the-minute updates for a transparent mortgage transaction.”

The branch’s goal is to continue to provide the same commitment and dedication to borrowers, ranging from first time homebuyers to seasoned buyers looking for their next home, a second home, or investment properties.

“Jason has a unique hybrid business fueled by a combination of old-school hard work with a new-school emphasis on technology,” said Greg Sher, Chief Business Development Officer. “Jason cares deeply about his clients and delivering a smooth process. We’re honored he chose to come to NFM Lending. He’s going to make us better!”

Fox is currently seeking qualified Mortgage Loan Originators for full and part-time positions.

For more information, please contact:

Jason Fox

Branch Manager

NMLS # 179208

240-367-9525

jfox@nfmlending.com

www.nfmlending.com/MD338

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998 and this year it celebrates its 20th Anniversary. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.

LINTHICUM, MD, August 2, 2018— NFM Lending is pleased to honor Sergeant Cristian J. Blandin as the NFM Salute for August 2018.

Shortly after graduating high school and completing his first semester of college, Sgt. Blandin voluntarily joined the Army, serving from 2009 to 2013. Upon completion of basic training in Fort Jackson, South Carolina, he was sent to Fort Huachuca, Arizona for Human Intelligence Advanced Individual training. Later that year, he moved to his duty station in Fort Bragg, North Carolina, where he learned he was going to do a 12-month deployment to Afghanistan at 19 years old.

“I arrived with my unit (Charlie Company of 519th Military Intelligence Battalion) in July 2010,” said Sgt. Blandin. “By far one of the best experiences in my life. I say that because less than 1% of Americans join the Army, and the percentage of soldiers that deploy to combat is less than that. I was one of the few. Of course I was scared because not only was this my first time going to war, I also had a daughter I had to think about.”

Sgt. Blandin and two members of his unit supported the 101st Airborne Division as part of their Humint Collection Team (HCT). During their first combat patrol they were hit by a roadside Improvised Explosive Device (IED). Sgt. Blandin was supposed to be in the vehicle that was hit with the IED but had been switched out. Thankfully, there weren’t any casualties.

During that campaign (Operation Enduring Freedom X – XI), Sgt. Blandin was battlefield-promoted to Specialist as he was the acting Team Leader (TL) for a short period of time during their TL’s absence. The majority of time he spent as the Assistant TL. Sgt. Blandin and his unit returned to the States in the summer of 2011, where he was later promoted to Sergeant. He was honorably discharged in March 2013. He then attended Campbell University to finish his degree in Business Administration and pursued a career in business.

Sgt. Blandin resides in Northern Virginia, and enjoys shooting, filming and spending time with his children. He is still active in the Veteran community and stays in close contact with his Army buddies. He currently works as a Mortgage Loan Originator for NFM Lending.

JC Jimenez and Carlos Ilanos, Branch Managers at NFM Lending, had only great things to say about Sgt. Blandin.

“Cristian Blandin is a leader,” said Jimenez. “He is a natural at helping others. He has quickly become the “go to person” by many of his peers for his knowledge and will to share it. Serving our country with all of his being is just what fits in what we know of him. Realtors, clients, colleagues; we all feel proud to deal with him. Great to have him in our team. Grateful for his service. My most profound respect for his character.”

“I was blown away when I met Cristian,” said Ilanos. “With great love he served our country and now was joining us to help people fulfill their homeownership dream. When you meet Cristian, you can see all the character traits that serving our country requires: loyalty, duty, respect, selfless service, honor and integrity. It is a great privilege to have him part of our NFM family.”

NFM Salute is an initiative in which one military member or Veteran is chosen each month to be honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” will be featured on the website with a brief biography and information about his or her service, and NFM Lending will make a $1,000 donation to a military or Veteran non-profit in the Salute’s name. Sgt. Blandin chose Platoon22 to receive this month’s donation. As an organization that focuses on stopping soldier suicide, Sgt. Blandin explained his choice: “Thank a Veteran any chance you get and please remember that suicide and depression is the number one killer for Veterans. It’s not easy coming back.”

Selected NFM Salutes may choose from one of the following three non-profits: Platoon 22, AnySoldier, and the Gary Sinise Foundation. NFM looks forward to the opportunity to continue to honor military and Veterans through the NFM Salute initiative.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998 and this year is celebrating its 20th anniversary. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.

LINTHICUM, MD, July 25, 2018— NFM Lending is proud to announce that Pamela Knouse, Director of Operations, has been honored as an Elite Woman in Mortgage by Mortgage Professional America for her service and dedication to NFM Lending.

The Elite Women In Mortgage program recognizes inspiring and influential women in the mortgage business who are changing the status quo in a male-dominated industry. According to their website, the women who made the list “have overcome obstacles and broken barriers to become some of the industry’s top professionals. [They are] record-breakers, innovators, mentors and trendsetters who inspire the success of their peers every day and are using their collective influence to change the face of America’s mortgage industry.”

Knouse received the Elite Women 2018 award for her endless dedication to better her team and NFM. She is responsible for streamlining NFM’s operations, advancing the company’s, its clients’, and its partners’ interests, and spearheading the implementation of several of the company’s top initiatives. She has a proven track record of success as Director of Operations and is well-respected by her peers for her motivation to excel, desire to find solutions to problems, and her selfless and caregiving attitude.

“Pam is an unbelievable asset to our company and we are blessed to have her on our team,” said Bob Tyson, Chief Operation Officer/Chief Administrative Officer of NFM Lending. “Her tireless work effort and can-do attitude is something we all should try to emulate.”

Knouse was profiled in the Elite Women 2018 July issue of Mortgage Professional America Magazine, both in print and online.

“I am truly honored to be chosen as one of the MPA’s Elite Women in Mortgage,” said Knouse. “It is an achievement that I share with the team of people I work with every day at NFM Lending and those I have worked with throughout the years that have mentored me and taken the time to help me grow. My advice to women in leadership in the mortgage business is best said by Hillary Clinton, ‘Women are the largest untapped reservoir of talent in the world.’ As women in leadership, we have to continue to mold our teams and mentor them to succeed. We can make a difference and we do have a voice, so always let it be heard!”

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998 and this year is celebrating its 20th anniversary. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.

LINTHICUM, MD, July 25, 2018— NFM Lending is proud to announce that LaTasha Rowe, General Counsel, has been honored as an Elite Woman in Mortgage by Mortgage Professional America for her service and dedication to NFM Lending.

The Elite Women In Mortgage program recognizes inspiring and influential women in the mortgage business who are changing the status quo in a male-dominated industry. According to their website, the women who made the list “have overcome obstacles and broken barriers to become some of the industry’s top professionals. [They are] record-breakers, innovators, mentors and trendsetters who inspire the success of their peers every day and are using their collective influence to change the face of America’s mortgage industry.”

Rowe received the Elite Women 2018 award for her tireless dedication to better NFM and their employees. She has been instrumental in reshaping NFM Lending in many ways, including spearheading approval with Fannie Mae, Freddie Mac and Ginnie Mae, as well as managing the rebranding of the company’s trade name to NFM Lending. She has thrived as General Counsel and is well-respected by her peers for her passion, relentless effort, and experience in the industry.

As half of NFM Lending’s workforce are women and minorities, Rowe knows firsthand how much an organization can thrive when diversity and inclusion are present.

“Differing cultures and backgrounds are the foundation of the country,” said Rowe. “I am proud NFM Lending takes diversity seriously and creates an environment where the main goal is to be the best we can for our consumers. I firmly believe that we outpace our peers in serving women and minorities because our company very much looks like the communities we serve.”

Rowe was profiled in the Elite Women 2018 July issue of Mortgage Professional America Magazine, both in print and online.

“We are incredibly lucky to have LaTasha on our team,” said Bob Tyson, Chief Operation Officer/Chief Administrative Officer of NFM Lending. “Her knowledge and resourcefulness have helped drive NFM to the next level. The passion, empathy and competency that she brings to the table is something that cannot be understated.”

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998 and this year is celebrating its 20th anniversary. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.

If you’re looking to buy a home, be prepared to meet a few challenges with today’s housing market. Not only is there a shortage of homes, but the available housing stock is aging. These challenges might seem discouraging but taking a look at the 2018 housing market and what options you have as a homebuyer, it is still possible to find a home to make your own.

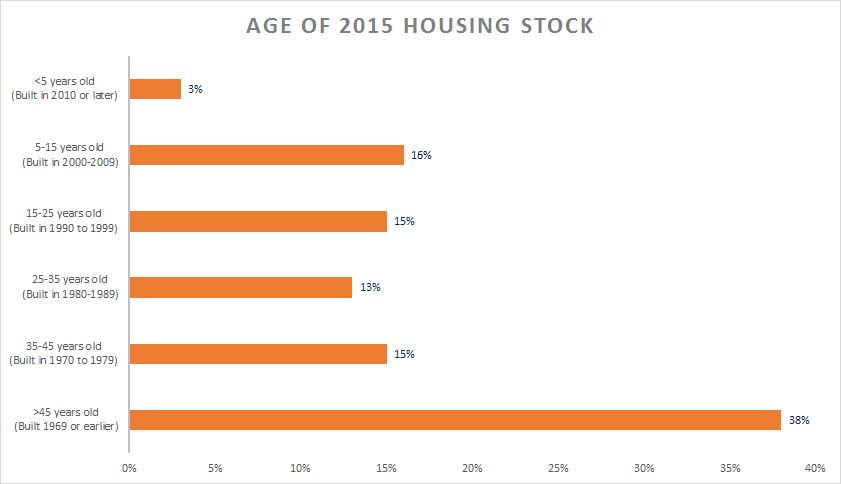

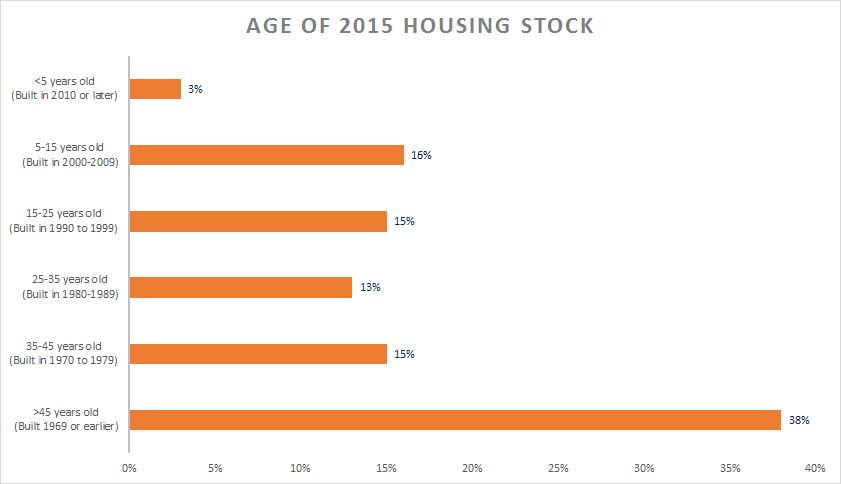

As of 2015, 66% of the US owner-occupied housing stock was built before 1980, with around 38% built before 1970, according to the National Association of Home Builders (NAHB). Many of these homes are going to need repairs, renovations, or updates.

And while there are a lot of new homes being built throughout the country, buyers should not turn away from an older home that may need some TLC. There are many renovation and repair loan options available, such as the FHA 203(K) or Fannie Mae’s HomeStyle® loan. FHA 203(k) are a type of federally insured mortgage loans that are used to fund renovations and repairs of single family properties. Fannie Mae’s HomeStyle® Renovationloan permits borrowers to include financing to renovate or make home repairs a purchase or refinance transaction. Find more information about how to finance renovations or home improvements.

Every home is unique and will require varying repairs and updates. But with these mortgage loan options, your dream of renovating an older home and becoming a homeowner are possible!

You can also keep in mind the possibility of building your home from the ground up as there are many construction loans options available as well.

If you have any questions about renovation loans or want more information about the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

As you move through the homebuying process and have to choose a mortgage, each option will present an interest rate. This rate determines how much you must repay the lender as a part of your monthly mortgage payment. While you might be familiar with interest rates, there is probably a component of mortgage rates you haven’t heard of—the G-Fee. If you just asked yourself ‘what is a G-Fee and what does it have to do with my interest rate’, you’re not alone.

So, what is a G-Fee?

Short for ‘Guarantee Fee’, the G-Fee covers the servicing of Fannie Mae, Freddie Mac or Ginnie Mae (government-sponsored enterprises, or GSEs), who provide government backing for some mortgage loans. Think of it as insurance for the loans they buy and/or sell to ensure payments of both principal and interest are made in the instance the borrower defaults. This fee is only included in interest rates for single-family loans.

G-Fees are only a small contributor to the overall interest you pay. The majority goes to whoever bought your loan (a bank or investors) and the servicer who collects your monthly payments. The G-Fee is typically not disclosed to borrowers and if they have an impact on interest rates, it is usually minor. However, even as the smallest contributor, you should know how they could potentially impact your rate.

The Federal Housing Finance Authority (FHFA) oversee the GSEs and can adjust G-Fees if they choose. These adjustments don’t always have to do with the economy, the Federal Reserve policy, or even the housing market. In 2012, for example, Congress used increased G-Fees to bridge the gap incurred by payroll tax cuts.

What does it have to do with my interest rate?

You might be wondering if such a small fee can impede your ability to buy a home. Simply put—yes, it can. An increase in G-Fees means there could be an increase on interest rates in general. As the borrower paying interest, that means more money out of your pocket. However, if the G-Fee is lowered it benefits the borrower and makes buying a home more affordable.

When choosing a mortgage, there are options that impact the interest rate throughout the life of your mortgage, such as Fixed-Rate or Adjustable Rate (ARM) mortgages. You can also consider locking in your interest rate to ensure yours will stay the same regardless of changes.

As small as G-Fees may be, it is important to know what they are and the potential impact they present. You can consider your mortgage options and make an informed decision on which is right for you.

If you have any questions about G Fees, locking in an interest rate, mortgages, or the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

LINTHICUM, MD, July 2, 2018— NFM Lending is pleased to honor Personnelman First Class Catherine L. Clapp, USN, Retired, as the NFM Salute for July 2018.

Following family tradition and looking to gain work experience, PN1 Clapp joined the Navy right out of high school, serving from 1979 to 1999. Her father also served in the Navy, as well as three of her four siblings.

Throughout her 20-year career, PN1 Clapp served in New Orleans, LA; London, England; Arlington, VA; San Diego, CA; Pensacola, FL; and Naples, Italy. She held numerous positions, including: Education Services Officer/Enlisted Classifier with Personnel Support Detachment; NATO Coordinator with Bureau of Naval Personnel; Assistant Classified Documents Officer with Submarine Development Group 1, Det B; and Operation Deep Freeze Coordinator and Enlisted Placement Officer for Physical Security with Bureau of Naval Personnel, just to name a few. During her time on the submarine squadron she was the only woman on the team of 150.

PN1 Clapp received numerous awards and honors, including: Navy Commendation Medal, Navy/Marine Corp Achievement Medal (3 awards), and Navy Unit Commendation (2 awards).

PN1 Clapp retired after serving 20 years in the U.S. Navy. She currently works at NFM Lending as an Appraisal Desk Assistant. She enjoys reading with her book club, volunteering at Concord Point Lighthouse as a volunteer lighthouse keeper and is a “die-hard” walker. She also occasionally works at the Maryland Science Center as an Observatory Assistant, operating the telescope and assisting guests.

PN1 Clapp currently resides in White Marsh, Maryland with her cat, Toby.

PN1 Clapp was nominated by Maria Hinerman, a coworker and the Marketing Manager at NFM Lending.

“I met Cassie when she attended New Hire Orientation,” said Hinerman. “In conversation, Cassie mentioned she was a Veteran and had served in the Navy for 20 years. Although she spoke briefly about her service, I was blown away by all that she had done and the places she had been. Even during this short interaction, it was clear how welcoming and kind she is.”

NFM Salute is an initiative in which one military member or Veteran is chosen each month to be honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” will be featured on the website with a brief biography and information about his or her service, and NFM Lending will make a $1,000 donation to a military or Veteran non-profit in the Salute’s name. PN1 Clapp chose the Gary Sinise Foundation to receive this month’s donation.

Selected NFM Salutes may choose from one of the following three non-profits: Platoon 22, AnySoldier, and the Gary Sinise Foundation. NFM looks forward to the opportunity to continue to honor military and Veterans through the NFM Salute initiative.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998 and this year is celebrating its 20th anniversary. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.

LINTHICUM, MD, June 22, 2018 — NFM Lending is pleased to announce that it has been ranked a 2018 Top Workplace in the Washington, D.C. area by the Washington Post. This is the fourth consecutive year that NFM Lending has received this award.

NFM Lending received the award at a ceremony held Thursday, June 21, 2018. Since its founding in 1998, NFM Lending has grown from a small mortgage brokerage to a lender with locations throughout the United States, including 7 locations in the D.C. area.

“‘Culture Erodes Strategy.’ We live by these words at NFM,” said Jan Ozga, President. “It is true that great culture starts with great leadership, but in my eyes, great leadership starts with responding to the great ideas of your staff. If you want a happy and dedicated group, start by actually listening to what they say. It’s an honor for all of us at NFM to make Top Workplace for the fourth year in a row!”

Each year, the Washington Post distributes a survey to the employees of Washington, D.C. area companies, asking them to evaluate their workplaces. The survey asks participants to rank their companies on quality of leadership, work-life balance, pay and benefits, and more. This year, NFM Lending ranked among the top 20 out of 55 midsized companies that made the final cut for inclusion on the Top Workplace list.

In 2018, Mortgage Executive Magazine named NFM Lending one of the 50 Best Companies to Work for, as well as one of the Top 100 Mortgage Companies In America. The Baltimore Sun also named NFM a Top Work Place in Baltimore for 2017, in addition to being named a Top Mortgage Employer 2017 by National Mortgage Professional Magazine. NFM Lending is proud of these accomplishments, and the work its team does to make it a Top Workplace.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998 and this year is celebrating its 20th anniversary. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.

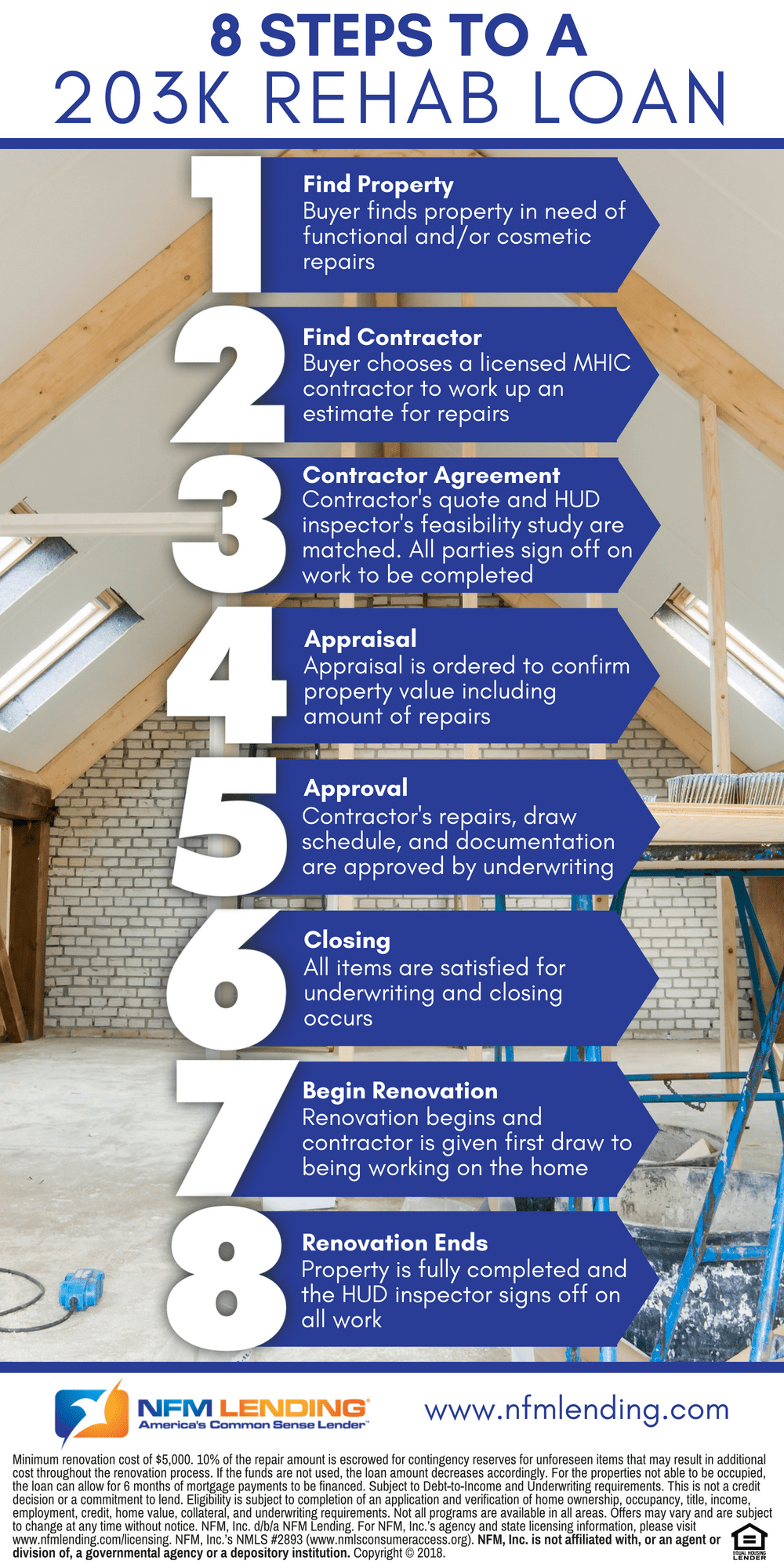

When house-hunting for your new home, you might discover one that would be perfect for you but needs a bit of TLC. Don’t worry! An FHA 203k rehab loan is there to make your dreams of homeownership come true. This loan allows you to borrow both what you need to purchase the home and what you need to make repairs—an all in one mortgage. If you think this might be the option for you, take a look at our 8 steps to a 203k rehab loan.

Don’t be under the impression that you have to buy a house that’s in perfect condition. Renovating and making repairs will allow you to create exactly what you want, so keep this option in mind when you’re ready to find the home of your dreams!

You can find out more about 203(k) rehab loans here. For questions or more information about the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!