LINTHICUM, MD, February 28, 2023 — NFM Lending is pleased to announce the opening of a new branch led by Branch Manager Moumen Silk. Pending licensing finalizations, the branch will be located in Orlando, Florida. The NFM Lending branch will focus on expanding NFM’s flexible and powerful lending platform to better serve community families with exceptional customer service. NFM Lending offers Conventional, FHA, VA, USDA, FNMA, Jumbo, and many other loan options to fit every borrower’s needs.

“I am honored to be a part of the NFM Lending Family as a Branch Manager,” said Silk. “With its commitment to providing outstanding customer service and a wide selection of mortgage options, NFM sets the bar high in the industry. I am eager to utilize my expertise to help customers achieve their homeownership dreams while contributing to the continued success of NFM Lending.”

The branch’s goal is to continue to provide the same commitment and dedication to borrowers, ranging from first-time homebuyers to seasoned buyers looking for their next home, a second home, or investment properties.

“It’s an honor to welcome Mo Silk to the NFM Family,” said Branch Manager Danell Riggs from NFM’s Western Division. “We are fortunate to have him here and can’t wait to watch his continued growth!”

Silk is currently seeking qualified Mortgage Loan Originators for full and part-time positions.

For more information, please contact:

Moumen Silk

Branch Manager

NMLS# 1745974

407-885-8548

msilk@nfmlending.com

www.nfmlending.com/msilk

About NFM Lending

NFM Lending is a national mortgage lending company currently licensed in 49 states and the District of Columbia. The company was founded in Baltimore, Maryland in 1998. NFM Lending and its family of companies includes Main Street Home Loans, Bluprint Home Loans, Freedmont Mortgage Group, Elevate Home Loans, and Element Home Loans. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram.

Paying property taxes each year is part of the reality of being a homeowner, but there’s a way you could minimize this expense. A homestead exemption can save you money on your property taxes, and you don’t need to be a farmer to take advantage of it! Learn what the homestead exemption is and how it can give you a break on your taxes.

What is the Homestead Tax Exemption?

The homestead exemption benefits homeowners by offering two things: protection from certain creditors in case of bankruptcy or the death of a spouse, and a reduced property tax. We’ll be discussing the latter here. Property tax is determined by your home’s assessed value, which your local government determines based on several factors. The homestead exemption reduces how much of your assessed value gets taxed, potentially saving you hundreds of dollars in taxes.

For example, if your home’s assessed value is $250,000 and your property tax totals 1%, you would pay $2,500 in property taxes. However, if you have a homestead exemption of $20,000, only $230,000 of your home would be taxed, lowering your property tax to $2,300 and saving you $200.

The deduction amount varies widely by state and county; sometimes it’s a flat amount or a percentage of your assessed value or acreage. Having a homestead exemption in effect is beneficial outside of the upcoming tax season—it gives you a cushion against rising property values since you won’t have to pay the full amount.

Eligibility

Each participating state and county will have their own specifications, but a general requirement for eligibility is that you own your home and live in it as your primary residence. You can’t receive an exemption on a second home or investment property, and you’re limited to one per household. If you’re also part of a special population, such as being a senior citizen, a Veteran or surviving spouse, or disabled, you may qualify for additional property tax exemptions. Applying for the homestead exemption usually involves sending proof that you live in and own your home. Some local jurisdictions may require you to refile for an exemption each year, but some may not. If you move, you’ll have to file a new application. Similarly, if you bought a home within the past year, apply for a homestead exemption as soon as possible to reap the tax benefits. Be sure to consult a tax advisor for your area’s terms and eligibility requirements.

Few people like paying property taxes, but having a homestead exemption can ease your tax burden. It’s simple to find out whether you qualify, and any tax savings will truly add up when all is said and done.

If you have any questions about the home buying process, contact one of our licensed Mortgage Loan Originators. If you are ready to buy a home, click here to get started!

Terms and requirements vary by location, programs may not be available in all areas. NFM Lending is not a tax advisor. You should refer to a licensed tax advisor and your local area’s department of assessment and taxation regarding your unique financial situation.

In many ways, the home buying and selling process isn’t too different from dating. There’s back-and-forth discussions, compromises, trial and error, and the all-important profile pics (listing photos). In today’s digital world, using online multi-listing sites (MLS) is the most common way buyers shop for homes. Use these simple staging tips to get buyers to “swipe right” on your home.

Clean Up

A clean home is a basic, yet crucial part of prepping your home to sell. When your home is clean and organized, it conveys to buyers that you take care of your property and that the home is pleasant to live in. Start decluttering your belongings to make organizing easier. If you have something that you hardly use or has lived past its usefulness, donate, sell, or toss it. Then, give your home a deep clean. Carpeted areas may benefit from professional cleaning if they still look dingy after vacuuming. In addition to the areas you usually clean, pay attention to baseboards, walls, shelving, and ceiling fans. These areas may not get cleaned often, but the dirt and dust can be apparent in photos. Next, polish up your home by organizing it. Make sure all the beds are made (no laundry piles allowed!) and that closet doors are closed. Clear the countertops in your kitchen and bathrooms from excessive appliances and personal care products. You want to show off all the counter space in your home, not hide it under a bunch of clutter! Store away piles of papers or organize them properly in a file sorter. Look at your bookcases—are the books stacked upright or laying wherever? Stand books up correctly and neatly. Never leave piles of clothes or knickknacks on the floor, as this looks sloppy and reduces visual floor space.

Decorate Strategically

Showcasing your personality is a key goal when creating a dating profile, but not so much when you’re staging your home. Buyers want to picture themselves living in your home, and it can be difficult to do that when you have family photos plastered everywhere. Go around your home and remove personal items from being displayed, including personal photos, your child’s drawings from the fridge or walls, and religious and political decor. Depersonalizing doesn’t mean your house needs to look boring and sterile—a few well-placed decor pieces can enhance your staging. Try using some cute, affordable throw pillows to jazz up seating. Natural elements are always a good staging accessory, and you can incorporate subtle seasonal elements into your home. A few real or faux houseplants on floors or tables adds a touch of greenery to your home, and it looks attractive no matter the season. Place vases of real or artificial flowers or bowls of fruit on tables to give a look of freshness. If you’re trying to make a room seem larger, hang a large mirror to give the illusion of increased space. Make sure your TV is turned off during staging photo sessions so as not to be a distraction.

Shed Some Light

Everyone knows the key to a great profile picture is good lighting, and the same goes for staging. Luckily, you don’t need fancy lighting equipment! Open your blinds to let the sun in, and leave the lights on for photos. If your existing lights aren’t brightening the room enough, consider replacing the bulb, as older bulbs dim over time. Pay attention to the warmth or coolness of the bulb, too. Warm light is yellow-tinged and less intense, while cool light is blue-toned and more intense.

Curb Appeal

Does your house look welcoming from the outside? A home that appears well-kept from the street draws buyers in and is one of the first pictures buyers see when browsing MLS sites. Your front porch is a prime area to add curb appeal. Try repainting your door, placing potted flowers near the stoop, and hanging a wreath on the door. It’s a good idea to clean the grime from your siding; check if the material is safe for power washing. Cleaning windows from the inside and outside will give your home extra sparkle; don’t forget the screens! For the surrounding land, trim overgrown grass, bushes, and tree branches. If you have fencing along your property, ensure there are no missing or damaged slats, and repaint panels if needed.

Don’t let poor or nonexistent staging hurt your home’s sale potential—show that your house is “forever home” material! Effective staging should make your home look like someone could live there, but doesn’t look lived in. You don’t have to spend a fortune—cleanliness and a little creativity can go a long way when selling your home.

If you want to know more about how to pay off your mortgage faster, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

Credit: Featured image created with Image by rawpixel.com on Freepik

LINTHICUM, MD, February 3, 2023 – NFM Lending is proud to announce that Energage has recognized it in their Top Workplaces USA list for 2023. Out of 100 mid-sized companies, NFM placed #22. NFM Lending has received this national award for the third straight year.

“It’s an honor to once again be recognized as a Top Workplace USA,” said NFM Lending President Jan Ozga. “This is really an award for our employees who are such an integral part of what we try to do culturally as a company. They believe in what we stand for and our mission and work hard every day toward that end to create a great experience for everyone with whom we come in contact.”

Energage’s Top Workplaces program distributes a survey to the employees of each nominated company, asking them to evaluate their workplaces. The survey asks participants to rank their companies on the quality of leadership, work-life balance, pay and benefits, and more.

In 2020, Energage added Top Workplaces USA as a national program to complement existing regional recognitions. For 18 years, NFM Lending has won the Top Workplace title regionally in the Baltimore and Washington, D.C. areas by The Baltimore Sun and the Washington Post, respectively.

In addition to this award, NFM Lending is consistently recognized for its exceptional company culture. Other awards include: ‘Top Mortgage Employer’ by National Mortgage Professional Magazine; ‘Top Workplace’ by The Baltimore Sun and the Washington Post; ‘Great Place to Work’ by Great Place to Work, and ‘Best Mortgage Companies to Work For’ by National Mortgage News, and ‘50 Best Places to Work For’ by Mortgage Professional Magazine. NFM Lending is proud of these accomplishments and each team member for their work to make NFM a Top Workplace.

About NFM Lending

NFM Lending is a national mortgage lending company currently licensed in 49 states and the District of Columbia. The company was founded in Baltimore, Maryland in 1998. NFM Lending and its family of companies includes Main Street Home Loans, Bluprint Home Loans, Freedmont Mortgage Group, Elevate Home Loans, and Element Home Loans. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram.

LINTHICUM, MD, February 1, 2023 – NFM Lending is pleased to honor Lieutenant Denis Oliverio, USMC, Retired, as the NFM Salute for February 2023.

Oliverio was born and raised in Boston, Massachusetts, where he was one of ten children. He recalled he was interested in joining the military from a young age, partly due to his brother’s Air Force service and his mother’s strong military support. After graduating high school, Oliverio and five friends went to a military recruiter’s office to enlist. “When I looked around the military branches, I wanted it all. I wanted to do the best I could; I wanted it to be as tough as it could be,” he said. Oliverio decided on his service branch, and in 1987, he became a U.S. Marine.

After finishing boot camp and attending training schools, Oliverio deployed twice to the Mediterranean region. Then, from 1990 to 1991, he deployed to Northern Iraq to assist with the end of Operation Desert Storm. Being in a combat zone changed his perspective forever. “Coming from the United States and the way our life is and going over to another country is significant. It can change your opinion on how you have life but let alone that going into a country that’s at war and seeing how things are there,” he said. Oliverio had numerous adventures in the Marines including flying developmental flight tests on the V22 Osprey, working as a helicopter gunner, and teaching the Survival, Evasion, Resistance, and Escape (SERE) program.

In 2005, Oliverio was a tank platoon commander with Bravo Company out of Twentynine Palms, California, when he deployed to western Al Anbar Province for Operation Iraqi Freedom. During a firefight with insurgents, a sniper shot through Oliverio’s upper left arm while standing in the commander’s hatch. Oliverio struggled to get back into the tank with his severely damaged arm. However, his comrade, Lance Corporal Jared Malone, took immediate action and left his position in the loader’s hatch to push Oliverio into the tank. Malone also put a tourniquet on Oliverio’s wounds, further saving his life.

Back in the States, Oliverio had a long road to recovery. The bullet shattered his humerus into five pieces and severed his median nerve and brachial artery. He endured 16 surgeries at Bethesda National Naval Medical Center, eventually regaining partial mobility in his left arm. After 20 years of military service, Oliverio took a medical retirement in 2007. He was awarded a Purple Heart for injuries sustained due to enemy action in combat. The symbolism of the medal is extremely meaningful to him. “A Purple Heart is a very significant medal, and it’s the one no one wants to get, but if you do get it and you’re able to hold it in your hands, you gotta be thankful because there’s so many that don’t get to hold it in their hands,” he said.

Oliverio lives in St. Augustine, Florida, with his wife, Kate, and his daughter. He leads an active lifestyle, including woodworking, golfing, horseback riding, and team roping/roping steer.

The NFM Salute is an initiative in which one military member or Veteran is honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” is featured on the website with a biography and information about their service. NFM Lending will donate to a nonprofit in the Salute’s name. NFM Lending is proud to present $2,500 to IHOOT in honor of Oliverio. NFM looks forward to the opportunity to continue to honor military service members and Veterans through the NFM Salute initiative.

About NFM Lending

NFM Lending is a national mortgage lending company currently licensed in 49 states in the U.S. The company was founded in Baltimore, Maryland in 1998. NFM Lending and its family of companies includes Main Street Home Loans, Bluprint Home Loans, Freedmont Mortgage Group, Elevate Home Loans, and Element Home Loans. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram.

Flooring is anything but boring! The type of flooring you choose for your home contributes to your home’s aesthetic and comfort—it shouldn’t be an afterthought! If you’re debating what flooring you should use in your home, read up on these different types of flooring.

Carpet

Not a fan of having to walk on cold, hard floors? Carpeted floors are what you want! Carpets come in a rainbow of colors to coordinate with your decor, as well as various textures and densities. Common carpet types include loop pile, plush pile, frieze, Berber, and twist pile. Aside from aesthetics, the carpet’s characteristics impact its durability and care. Padding is placed under carpet during installation; choose carefully, as the padding affects the carpet’s longevity and your walking comfort. Many brands offer stain resistant carpeting, but clean up messes as soon as possible to prevent permanent stains or smells. Regular vacuuming is sufficient for regular cleaning, but have your carpets deep cleaned once a year to remove embedded dirt. Carpeting often ranges from .65 cents-$12 per square inch, making it a very affordable choice.

Standard and Engineered Hardwood

Hardwood has an irreplaceable warmth and feel—it’s a true classic! Being made of solid wood, hardwood handles foot traffic well and can be refinished multiple times. With proper care, it can last generations. Be sure to dry dust regularly, use wood floor-friendly cleaning products, and dry well afterwards. Moisture doesn’t play well with hardwood, so avoid installing it in bathrooms and kitchens, and wipe up spills quickly. Hardwood tends to cost around $6-18 per square foot with installation, though engineered hardwood can be a good alternative.

Engineered hardwood is composed of several thin layers of wood, topped with a veneer of real hardwood. This gives you the hard-to-replicate look and feel of hardwood. If the veneer is thick enough, it can be refinished 1-2 times during its lifetime. This flooring type typically ranges from $3-11 per square foot but can be more depending on the quality. Sweep floors clean or use products designed for engineered floors. Like hardwood and laminate, don’t let water sit on the surface for long or install in humid areas.

Vinyl

For homeowners looking for durable, low-maintenance flooring that’s easy to maintain, vinyl is an excellent choice. Vinyl can be made to look like other materials, and it works well in high traffic areas or in high moisture areas. The most common forms of vinyl flooring are sheet, tile, and plank. Vinyl sheets and tiles need to be glued to the floor’s underlayment, but planks can snap together to be laid over the existing floor. Vinyl floors are either waterproof or water resistant, making cleaning a breeze. The price per square foot ranges from .50 cents to $10, depending on the type and quality. Keep in mind that vinyl isn’t the most eco-friendly option since it’s synthetic, and removing glued-on flooring is difficult.

Stone and Ceramic Tile

Stone and ceramic tile floors add a touch of sophistication to your home and can last for decades with the right care. Popular types of stone flooring include marble, granite, limestone, and slate. It’s compatible with every room in your home and handles foot traffic well. Because stone is porous, the surface needs to be sealed to prevent water damage. Depending on the material and location, resealing should be done every 18 months or 3-4 years. Bathroom and kitchen floors may need to be resealed more often due humidity levels. To preserve the stone’s unique characteristics and finish, use mild, non-abrasive cleaning products and clean up messes quickly. Stone is among the pricier flooring types; expect to pay $8-40 per square foot.

Ceramic and porcelain floors are available in many shapes, colors, and patterns to give your home flair. Both materials work well in damp areas, are hygienic, and quite durable against scratches. Though they’re sturdy, they aren’t immune to damage. Tiles can crack if something extremely heavy falls on them and may chip at corners. Basic cleaning can be done with a mild solution, though it’s a good idea to scrub any grout lines every so often to prevent dinginess. While the tiles themselves don’t require sealing (most come glazed), cement-based grout should be sealed to protect the integrity of your flooring. Ceramic tiles start around $1-6 per square foot, and porcelain is about $3-9. Be aware that flooring and installation costs will be higher if you’re using nonstandard tile shapes or want an intricate layout.

Laminate

Laminate floors are a cheaper alternative to hardwood floors and feature a printed veneer over a wood composite base. At around $3-8 per square foot, it’s a great option if you want the look of hardwood on a budget. You can even install it yourself! Laminate flooring has come a long way and is more durable than in the past. When shopping for laminate, pay attention to its abrasion criteria (AC) rating. The AC rating shows how durable it is in relation to how much foot traffic it will receive. Avoid installing in areas with high humidity, as the floor can warp. Caring for laminate requires care and vigilance; never clean with a wet mop or let liquids sit too long on the surface, as it can damage the floor. Instead, use a broom or a laminate-friendly cleaning solution to maintain it.

Flooring has come a long way to make our homes more attractive and complementary to our lives. When shopping for flooring, always keep your budget, lifestyle, home aesthetic, and the installation area in mind. Be sure to take home samples to compare quality. Well-chosen flooring is sure to enhance your home and make you love it even more!

If you have any questions about the home buying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

LINTHICUM, MD, JANUARY 27, 2023- NFM Lending is proud to announce it has received the Silver Level Healthy Workforce Designation for 2022 by healthcare provider Cigna. The Healthy Workforce Designation assesses a company’s wellness initiatives based on five factors: culture and leadership, holistic health, program foundations, program implementation, and use of Cigna’s resources.

“NFM Lending and the Human Resources squad are beyond proud to receive the Healthy Workforce Designation by Cigna,” said Human Resources Director Madison Grey. “Our internal initiatives, as well as the dedication and commitment of our employees to embrace a healthier lifestyle, have helped distinguish us as a healthy place to work.”

NFM Lending’s Benefits and Wellness Administrator is dedicated to promoting a healthy lifestyle for employees and has created a variety of initiatives to this end. Regular communications go out regarding wellness information and advice for better living. The monthly “Live Well, Work Well” newsletters feature a highlighted health topic, food and exercise inspiration, and safety tips. Throughout the year, everyone in the NFM Family participates in various challenges that encourage mindfulness or physical activity. Every week, employees are provided healthy snacks as an educational tool to help them understand what constitutes healthy food choices, as well as offering a tasty treat. No doubt, healthy living is engrained in the NFM culture.

In fact, NFM Lending is consistently celebrated for its exceptional company culture. Other awards include: ‘Top Mortgage Employer’ by National Mortgage Professional Magazine; ‘Top Workplace’ by The Baltimore Sun and the Washington Post; ’50 Best Places to Work For’ by Mortgage Professional Magazine; and finalist in the “Best Places to Work” by Baltimore Business Journal. NFM Lending is honored to have been recognized for its commitment to employee welfare.

About NFM Lending

NFM Lending is a national mortgage lending company currently licensed in 49 states and the District of Columbia. The company was founded in Baltimore, Maryland, in 1998. NFM Lending and its Family of Lenders include Main Street Home Loans, Freedmont Mortgage Group, Bluprint Home Loans, Elevate Home Loans, and Element Home Loans. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram.

###

The Veterans Affairs (VA) loan is just one benefit military members can use as a reward for their service. Its generous terms and flexible requirements have helped numerous families achieve homeownership, but there are still things many people get wrong about the VA loan. Here are some of the most common myths about the VA loan, debunked.

Myth: The VA loan is Only for Active-Duty Military and Veterans

You wouldn’t be wrong if you thought active-duty service members and veterans were the most prominent beneficiaries of the VA loan, but they aren’t the only populations that can use it. National Guard and Reserve members may be eligible for a VA loan if they have served six or more years or have at least 90 consecutive days of active duty, as well as an acceptable type of discharge as determined by the VA. Surviving spouses may also be able to use a VA loan if they can obtain a certificate of eligibility (COE) and meet certain conditions, like remaining unmarried at the time of application and if the Veteran died while serving or due to a service-related disability.

Myth: The VA Loan is Bad for Sellers

The VA loan has made homeownership possible for millions of military families since 1944, but there are still sellers who are wary of it. Some believe that because VA loans don’t require a down payment or private mortgage insurance (PMI), military buyers are riskier. This couldn’t be further from the truth. VA financing can fully cover the mortgage prices in many cases, and it will guarantee up to 25% of the loan in case of default. VA buyers also have more money to put towards the offer.

Another misconception is that sellers have to pay all of the buyer’s fees at closing. To maintain affordability, the VA limits homebuyers from paying certain unallowable fees. The VA states sellers have to pay for a termite inspection, real estate agent fees, brokerage fees, and buyer broker fees. There are more closing costs that VA buyers can’t pay, but that doesn’t mean the seller is obligated to pick up the tab for all of them. Lenders and agents may cover some of the unallowable fees, and buyers can negotiate with sellers to pay them. It’s important to note that sellers can’t pay more than 4% in seller’s concessions for a VA loan.

Myth: VA Loans Have No Closing Costs

Even with the cost-saving features of the VA loan, it’s not entirely a free ride. There are still closing costs, including a funding fee unique to the VA loan. The funding fee is a one-time payment that helps reduce taxpayer expense to fund the loan. The fee ranges from 1.4-3.6% of the loan amount depending on the down payment amount. Though a down payment isn’t required, the more you can contribute, the lower your fee. You can pay it upfront at closing, roll it into your mortgage, or ask the seller to pay it. For any subsequent uses of your VA loan, the funding fee can be higher if you have a down payment less than 5%. There are a few situations in which the fee may be waived, like in cases of a service-related disability or for an eligible surviving spouse. If you’re concerned about closing costs, consider asking your lender for a lender credit or negotiate with the sellers for a contribution. Again, sellers can pay up to 4% in closing costs.

Myth: The VA Appraisal is Too Strict

The mandatory VA appraisal is another thing that makes the VA loan distinct from other loans, and many people are intimidated by it. Properties need to have an appraisal done to assess fair market value and the home’s safety and sanitary conditions. The appraisal is not the same as a home inspection, as a true inspection is more thorough. An independent appraiser will review the home against the VA’s list of minimum property requirements (MPRs). Issues appraisers will look for include exposed wiring, termite damage, and adequate drainage. If the home doesn’t meet the MRPs, the problems will need to be fixed before proceeding. Sellers and buyers should negotiate expenses. An appraisal also uses housing market data to see whether the proposed loan amount is comparable to that of similarly valued homes. Though the VA appraisal may seem tedious, it’s not much different than a standard appraisal. Homeowners who have maintained their home shouldn’t be too worried about major issues appearing.

Myth: VA Loans Can Only be Used Once

Luckily, the VA loan can be taken out multiple times as long as you have entitlement to use. Entitlement is how much the VA will guarantee the lender if you default. When you first use a VA loan, you have full entitlement. This means you can buy a home at any given price with no down payment, so long as your lender approves you for a mortgage. If you’ve fully paid off and sold your VA-financed home, your full entitlement is restored for your next purchase. It’s even possible to have more than one loan out at once if you use any remaining entitlement to buy another home. Be aware that if you’re buying with reduced entitlement, you’ll likely need a down payment.

The VA loan isn’t just a lucrative loan program, it’s a benefit you’ve earned through service. The intricacies of the loan have led to misunderstandings among military homebuyers and home sellers alike, which is why it’s crucial to work with a lender and real estate agent with a strong track record of working with VA homebuyers.

If you have any questions about the home buying process, contact one of our licensed Mortgage Loan Originators. If you are ready to buy a home, click here to get started!

For informational purposes only. You should refer to the VA for specific guidelines regarding your eligibility.

LINTHICUM, MD, January 3, 2023 – NFM Lending is pleased to honor Staff Sergeant George Foster Jr., USMC, as the NFM Salute for January 2023.

Foster was born in 1929 in Woburn, Massachusetts. He grew up on a dairy farm and spent much of his childhood milking cows and doing farm work. In 1951, Foster’s idyllic small-town life changed forever when he was drafted into the Korean War. At 21 years old, Foster joined the U.S. Marine Corps.

After completing training in Parris Island, South Carolina, Foster deployed to Korea. He fought in several key battles, including the Battle of the Punchbowl, Operation Bumblebee, and the Battle of Heartbreak Ridge. Having lost many close friends to the war, Foster volunteered to do a second tour of duty in 1953 to honor their sacrifices. When he returned stateside in 1954, he was assigned to be a security guard at the American embassies in Moscow, Russia, and Munich, Germany. One of his proudest moments in the Marine Corps was guarding King Saud of Saudi Arabia for President Eisenhower’s 1957 inauguration and walking in the inaugural parade. After six years of unforgettable experiences, Foster was honorably discharged from the military in 1957.

Foster graduated from college in 1960 at 30 years old with an accounting degree. He soon became a licensed CPA and worked as an accountant in Los Angeles for the U.S. General Accounting Office. Foster was devoted to his family and cherished spending time with his children. The values he learned in the Marines stayed with him after he left the service, and he passed them on to his loved ones. His daughter, Meg Christ, said, “He always taught me when I was a little girl, ‘When you fall down, you get back up.'” In 2022, Foster passed away from cancer, leaving his family with many rich memories and a time capsule of his life that he had hidden away. “He was just a kind soul, was very humble,” said Christ. “So after he passed, finding all of these amazing things he had done, I wish he were here to ask more questions. There’s so many questions. He was amazing.”

The NFM Salute is an initiative in which one military member or Veteran is honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” is featured on the website with a biography and information about their service. NFM looks forward to the opportunity to continue to honor military service members and Veterans through the NFM Salute initiative.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 49 states and the District of Columbia. The company was founded in Baltimore, Maryland in 1998. NFM Lending and its family of companies includes Main Street Home Loans, BluPrint Home Loans, Freedmont Mortgage Group, Elevate Home Loans, and Element Home Loans. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Instagram.

“Amortization” might sound complex and confusing, but it’s easy to understand once you know how it works.

What is Loan Amortization?

Amortization is when a loan’s balance is gradually reduced through routine payments. With an amortized loan (such as a mortgage), most of the initial loan payments will go towards the interest but will increasingly go towards the principal over time until the balance is zero. An amortized repayment structure makes becoming a homeowner more accessible and beneficial. Instead of having to pay back all the money you borrowed to buy a home in one large payment, amortization lets you pay off your mortgage in manageable chunks. Another perk is that with every principal payment, you’re increasing home equity and paying down your home faster. Making extra principal payments can help you pay off your mortgage early and save money in the long run; check that doing so will not result in prepayment penalties.

Mortgage Amortization: A Closer Look

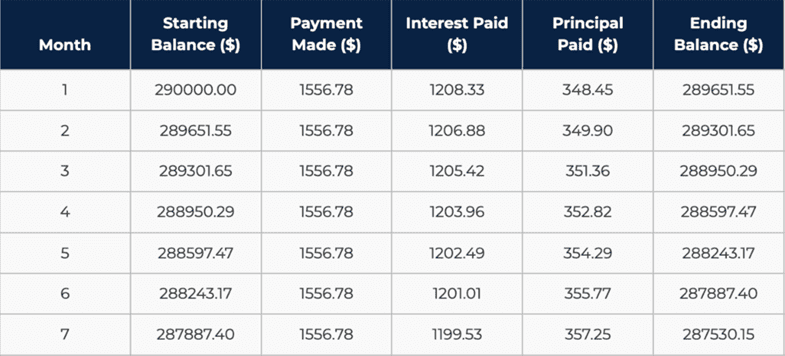

If you were to get a 30-year fixed-rate mortgage of $290,000 at 5% interest, your monthly payment would be $1,556.78. In the first month, $1208.33 of that payment goes towards the interest, while only $348.45 is distributed to the principal. Each month afterward, a little bit more of the payment contributes to the principal.

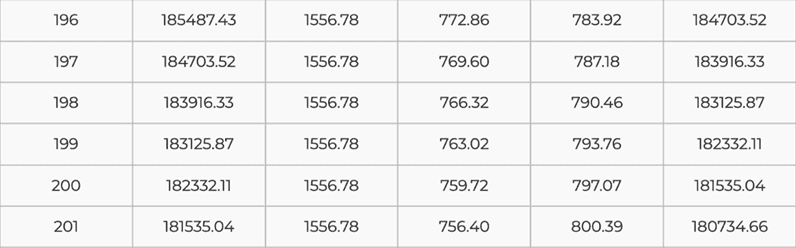

At 196 months, the portion that goes to your principal becomes greater than the interest portion, $783.92 versus $772.86, respectively. This shift continues for the rest of the 30-year loan term until the loan is paid off.

Most adjustable-rate mortgages (ARM) are amortizing, too. For hybrid ARMs where there’s an initial fixed-rate period, the loan follows a normal amortization schedule. Once the adjustable period begins, the loan will re-amortize each time the rate and monthly payment adjust. When you’re reviewing mortgage options with your Loan Originator, they’ll give you an amortization schedule so you can see the payment breakdown. You can also use an amortization calculator to get an estimate for a rough calculation.

Maintaining a mortgage is a massive financial responsibility, and it takes time to pay it off. When you understand how mortgage repayment is structured, you can make better financial decisions and feel confident that you’re breaking down your loan, one payment at a time.

If you want to know more about how to pay off your mortgage faster, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!