Tax Day has come and gone, but while tax season isn’t on most people’s list of “favorite day of the year”, there’s a light at the end of the tunnel: your tax refund! The average refund in 2023 was $2,753, and with that kind of windfall, a tropical getaway might seem tempting. But before you jump on a plane, let’s explore how you can leverage your tax refund. A down payment for a first-time homebuyer, or long-term goals like financial freedom and building generational wealth!

Can I Use my Tax Refund for a Down Payment?

Are you dreaming of homeownership? Using your tax refund for a home purchase could lead to several advantages when owning your first home! Here are some benefits to a larger down payment on your loan:

- Lower Interest Rate: A larger down payment can qualify a first-time homebuyer for a more favorable interest rate on your mortgage.

- Smoother Pre-Approval Process: A bigger down payment strengthens your financial standing, with less “risk” for a lender to consider, this can make the pre-approval process smoother.

- Avoiding PMI: With a down payment of at least 20% of the home’s value, you will avoid private mortgage insurance (PMI), which adds to your monthly mortgage payment.

- Lower monthly payment: This one might be a no-brainer, but a larger down payment means a smaller loan amount. Smaller loan amount equals smaller monthly payment!

Related: Down-payment assistance programs can help first-time homebuyers get started and increase your down payment!

How Much do I Need for a Down Payment on my First Home?

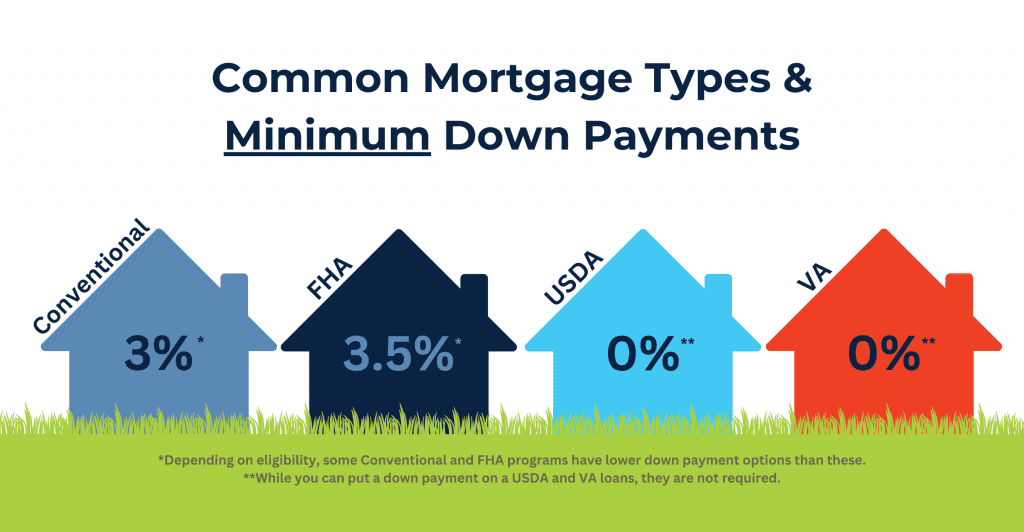

Down payment requirements vary by the type of loan you want to have. Lower down payment doesn’t always mean a better loan program; there are multiple different factors to decide which loan program is right for you. The best mortgage for a first-time homebuyer is the loan that you’re most qualified for. That will depend on several factors, including your debt-to-income ratio, credit score, and yes…down payment.

We take all of these factors into consideration and help you strategize between your options and choose the right one to fit your current and future goals.

Mortgage Types and Minimum Down Payments

Related: Check out our mortgage calculators to do the down payment math yourself!

It’s easy to see how a first-time homebuyer can use a tax refund for a down payment and boost their homebuying strategy, but what about people that already own a home? Other than using the funds for home renovations, how can you use your refund to set yourself up for a better future?

Can I Pay Down Principal or Refi with a Tax refund?

We understand the allure of a vacation, but here’s the thing: by putting your tax refund towards your mortgage, you’re essentially doing two things at once: saving money on interest payments in the long run and building equity in your home faster.

Your tax refund may also be able to help you pay fees associated with refinancing to save you money by:

- Lowering your interest rate

- Shortening your loan term (from 30yr to 15yr)

- Removing private mortgage insurance (PMI) that may have been required if your down payment wasn’t 20% or more of the cost of your home.

If you’ve decided to use your tax refund on your existing mortgage, there are a few ways to go about it:

1. Applying Tax Refund to Principal

A lump-sum payment directly to your principal balance, shortens your loan term, builds equity, and ultimately saves you on interest. The more you pay down the principal, the more interest you save.

Keep in mind:

- Ensure the payment goes towards your principal, not just a regular payment (principal + interest).

- Check for prepayment penalties – some mortgages have them for early large payments. Review your loan terms and talk to your lender if needed.

- Some lenders might offer “loan recasting,” which recalculates your remaining loan term with the lower principal balance, potentially reducing your monthly payments.

If you’re looking for options to lower your monthly payments specifically, refinancing might be a good fit if rates have lowered since you first bought your home.

2. Using a Tax Refund for Refinancing Fees

Refinancing your mortgage means replacing your existing loan with a new one, potentially with a lower interest rate, better terms, or you could take cash out for projects or major life changes. Here’s where your tax refund can come in handy – it can help cover the refinancing fees, including closing costs and appraisals.

Is refinancing a good option for me?

- Lower Interest Rates: Perhaps interest rates have dropped since you first took out your mortgage, offering an opportunity to save.

- Improved Credit Score: If your credit score has improved significantly since the last time you bought a home, you might qualify for a lower interest rate.

- Debt Reduction: Have you paid off other debts since buying your home? A lower debt-to-income ratio can improve your eligibility for a better interest rate.

Related: How Important is Credit Score When Buying a Home?

How much does a refinance cost?

While refinancing can save you money in the long run, there are upfront costs involved that you should consider. The Mortgage Reports estimates closing costs to range between 2-6% of your loan amount.

Here are some situations where refinancing might not be the best move for you:

- Recently Closed Loan: Many lenders and loan programs have restrictions on how soon you can refinance after taking out a new mortgage. For almost everyone, you’ll want to wait 180 days before refinancing after your most recent loan began.

- Minimal Interest Rate Drop: Aim for a rate reduction of at least 1.5-2% to make the refinancing process worthwhile compared to the cost.

- Short-Term Ownership: If you plan to sell your home soon, refinancing might not make financial sense.

- Longer Loan Term: Since a refinance is a new loan on the same property, you’ll be starting your loan term over again. A longer loan term might seem appealing for lower monthly payments, but it ultimately means paying more interest overall.

Not sure if refinancing is right for you? That’s why we’re here! Our team can do a complete cost analysis for you before you start the process, making sure you’re confident in your decision before taking the first step.

Boost Next Year’s Tax Refund

Let’s say your tax refund this year wasn’t quite enough to make a huge dent on your homeownership goals today. Don’t worry, there are still ways to optimize your tax situation for next year’s return, potentially putting more money back in your pocket to fuel your homeownership dreams.

Here are some key strategies to consider:

Tax Credits for Homeowners

- Mortgage Credit Certificates (MCCs): These state-issued tax credits can be a game-changer, allowing you to claim a portion of your annual mortgage interest as a federal tax credit, effectively lowering your monthly payments.

Reach out to us to learn more about MCCs and eligibility requirements in your area!

Homeownership Tax Deductions

- Mortgage Interest: You can typically deduct your mortgage interest payments, up to a certain limit depending on your loan amount and filing status.

- Mortgage Points: If you paid upfront points to lower your interest rate, you might be able to deduct them as well, subject to specific IRS qualifications.

- Property Taxes: The property taxes you pay on your home are generally deductible. If you dedicate a specific space in your home exclusively for work purposes, you might be eligible to deduct a portion of your related expenses like utilities and internet.

- Home Office Expenses: If you dedicate a specific space in your home exclusively for work purposes, you might be eligible to deduct a portion of your related expenses like utilities and internet.

- Find out more here: The IRS published a great resource for homeowners in 2023 regarding what you can and cannot deduct, MCC credit and other information.

Keeping good records of your mortgage-related expenses is crucial. This includes your loan documents, receipts for points paid, and documentation of any home improvements you make.

It’s important to note that tax laws can be complex, and eligibility for deductions and credits can vary depending on your specific circumstances. Consulting with a tax professional is always recommended to ensure you’re taking advantage of all the benefits available to you and remaining compliant with federal tax law. We can help you explore these options, or get you in contact with a great Tax Advisor.

In Conclusion

By implementing these strategies and working with a trusted loan officer, you can turn your tax refund into a springboard for achieving your homeownership dreams. We’re here to guide you through every step of the journey, from maximizing your tax refund to navigating the mortgage process.

Get a no-cost pre-approval and explore down payment options for first-time homebuyers – click the Apply Now button above!

* NFM Lending is not a Financial Advisor, Tax Advisor or Credit Repair Company. You should consult with a Financial Advisor, Tax Advisor or Credit Repair Company to learn more. The pre-approval may be issued before or after a home is found. A pre-approval is an initial verification that the buyer has the income and assets to afford a home up to a certain amount. This means we have pulled credit, collected documents, verified assets, submitted the file to processing and underwriting, ordered verification of rent and employment, completed an analysis of credit, debt ratio and assets, and issued the pre-approval. The pre-approval is contingent upon no changes to financials and property approval/appraisal.