COVID-19 has shaken up most people’s lives and plans in a way many have never experienced before. If you were planning on selling, buying, or refinancing a home before COVID-19, you don’t need to put off your plans. NFM Lending is continuously adapting to market and industry changes to best serve you and your family. Read on to find out how NFM Lending can serve clients virtually.

NFM Lending’s ongoing initiative to reduce paper usage has moved us toward a virtual experience, for those who want one, even prior to the pandemic. Almost every step of the mortgage application process can be done electronically, making the process more efficient for everyone involved. Loan applications can be completed online, as can the list of documents needed to move the loan forward. All documents can also be submitted safely through our Secure Document Upload (SDU) at your convenience using the device of your choice. For forms that require a signature, you have the option to review and sign them electronically. Though final closing documents need to be signed in front of a notary, we will let you know prior to closing so you can make arrangements with a notary and your title company.

Regardless of environmental conditions, going through the mortgage or refinance process can be a daunting experience if you’re not fully informed. We have the ability to provide real-time electronic updates so you’re never in the dark about your loan. If you ever have questions about what’s going on, our loan originators and operations professionals are dedicated to answering questions and guiding you through the process. Whether you need a phone call, email, a quick text, or even a video call, NFM is here for you. Our staff is working remotely during this time, but still fully available to assist. We remain committed to ensuring you have an experience that’s as smooth as possible.

Even though there have been changes to the way we all normally do things, our mission to provide excellent service remains the same. The processes to purchase, sell, and refinance a home now may be a bit different, but they are still very doable. The technology available today will help minimize the challenges we’re facing during this pandemic. Together we will improvise, adapt, and overcome.

Mortgage calculators are important tools for both homebuyers and homeowners. These calculators can help estimate your monthly mortgage payments as well as how much you can afford when purchasing a home. There are various types of mortgage calculators out there, but NFM offers three of the most popular for free: Mortgage Payment Calculator, Affordable House Calculator, and Refinance Calculator. If you’re wondering exactly how mortgage calculators work, let us break it down.

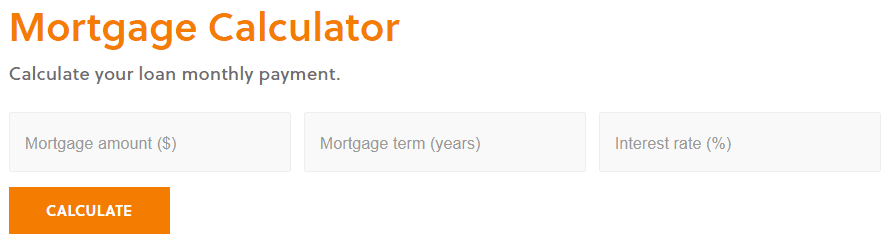

Mortgage Payment Calculator

If you just want a quick estimate of what your monthly mortgage payment should be, this calculator is ideal. Input your total mortgage, the mortgage term in years, and the interest rate. You will receive a monthly payment estimate (principle and interest) based on those numbers.

For example, if your total mortgage is $250,000 for a Conventional 30-year loan with a 5% interest rate, your principle and interest monthly payment would be $1,342.05.

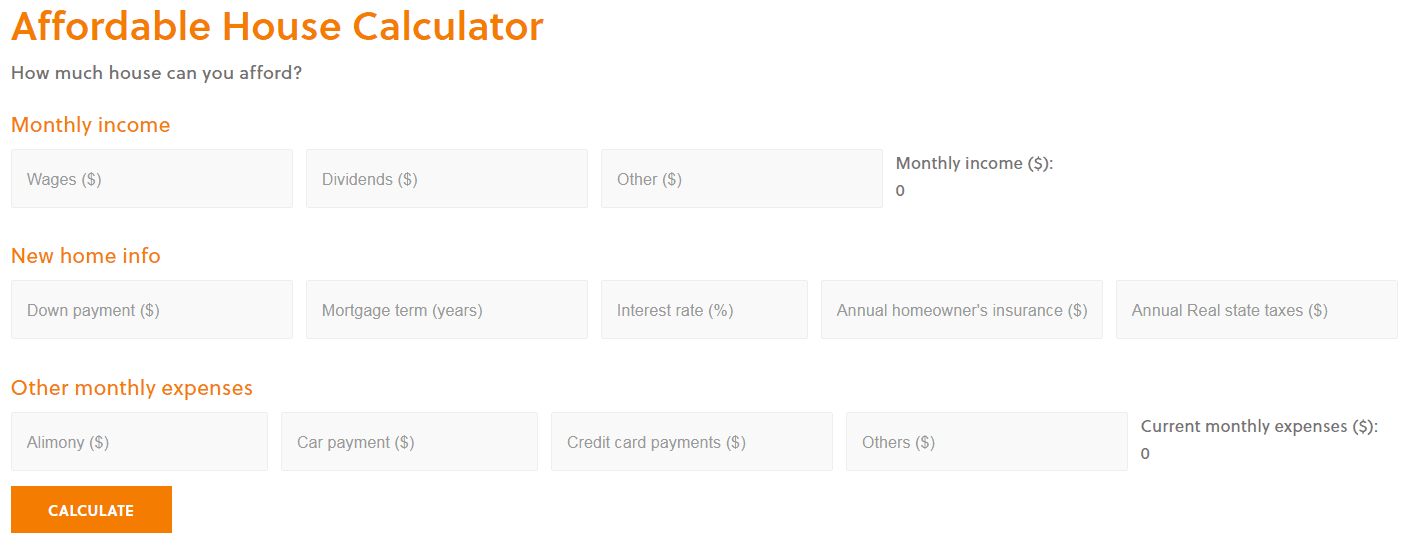

Affordable House Calculator

If you’re thinking of buying a home, the affordable house calculator should be the first one you use. This calculator predicts how much you can afford to spend on a home – which is important to know prior to starting the homebuying process. Input information about your monthly income (wages, dividends, and any other relevant income information), new home information (down payment, mortgage term in years, interest rate, annual home owner’s insurance, and annual real estate taxes), and other monthly expenses (such as alimony, car, or credit card payments). This calculator will provide a suggested new home value, mortgage amount, and affordable monthly payment so you have a better understanding of how much you can afford to spend on a home.

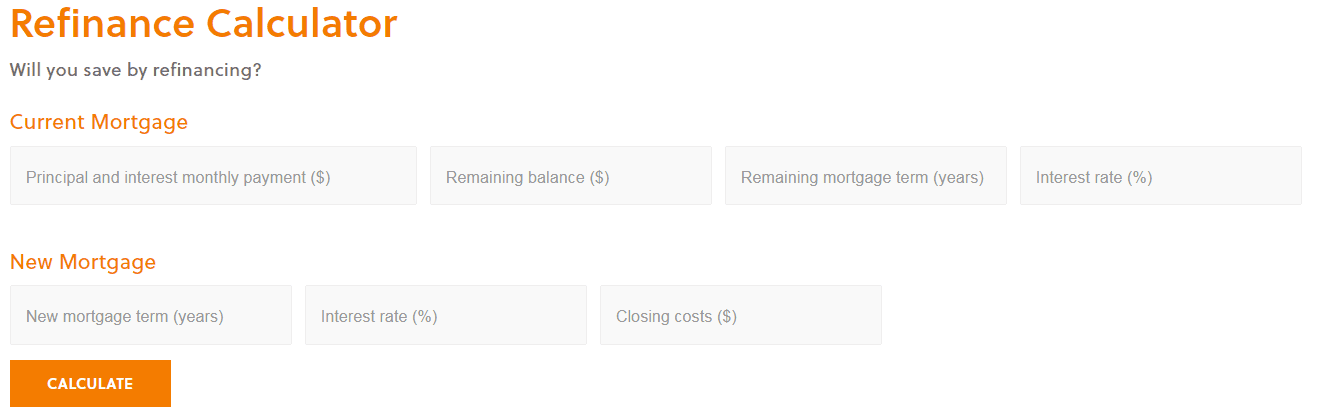

Refinance Calculator

Are you considering refinancing your mortgage? Use our refinance calculator to help you find out how much money you can save. You’ll need to input data about your current mortgage: principal and interest monthly payment, remaining balance, remaining mortgage term in years, and interest rate. Next, provide information about your new mortgage: mortgage term in years, interest rate, and closing costs. The calculator will then give an estimated new monthly payment, in addition to monthly savings, interest savings, closing costs, and the amount of time it will take for you to recoup your costs.

After using our calculators, you can email yourself the results. Remember, these calculators are for your convenience, and the figures input on these calculators are only estimates and are not 100% accurate.

To learn more about using one of our mortgage calculators or getting exact costs, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying or refinancing process, click here to get started!

If you have not been able to get traditional refinancing because the value of your home has declined, and you’re not behind on your mortgage payments, you may be eligible to refinance through the “Home Affordable Refinance Program.”

Definition

The Home Affordable Refinance Program (HARP) allows people who have loans that have been guaranteed by Fannie Mae or Freddie Mac on or before May 31, 2009, with little or negative equity to refinance and take advantage of the current low interest rates. NFM Lending offers HARP loans for homeowners that owe up to 150% more than their home is worth (LTV ratio). HARP loans are available for both primary and investment properties.

Requirements

In order to be eligible for a HARP loan you must have a current loan-to-value (LTV) ration greater than 80% and you must be current on your mortgage at the time of the refinance. You must have a good repayment history in the past 12 months. Also, you must have a mortgage that is owned or guaranteed by Freddie Mac or Fannie Mae; it needs to have been sold to them on or before May 31, 2009. Additionally, your mortgage cannot have been refinanced under HARP previously (unless it’s a Fannie Mae loan that was refinanced under HARP from March-May, 2009).

Getting the Loan

If you would like to see if you will qualify for this loan, contact one of our Licensed Loan Originators by clicking here.