‘Staging’ is a term used by real estate agents that means to make your home appealing, therefore making it more marketable to potential buyers. Through this process, you increase your home value and become more emotionally detached from the house as it becomes less of your home. The ultimate goal of staging is to make your house feel like home to potential buyers, so they can easily envision themselves living there. Here are some tips if you are thinking about staging your home for sale.

De-clutter and De-personalize

The first step of staging is to de-clutter and de-personalize your home. Renting a storage space is a great idea. Take out any extraneous furniture so that you can maximize the space your home has to offer. Put away all personal photos and personal items, replacing a few with attractive professional photographs or prints. Furniture should be placed in groupings away from the wall. Not only will this visually create more space, but will also allow for buyers to easily move throughout the room. It is important to make sure every room is being used as it is intended to be. For example, don’t have your dining room set up as an office. Potential buyers often have a difficult time envisioning rooms differently than they appear and will want to see the room staged to meet their expectations.

It is important to have a good flow in the house. All hallways and entrances should be clear and traffic flow in rooms should be obvious. Consider putting away area rugs—showing exposed floors sometimes makes rooms appear to be bigger. If there are any built-in appliances, fixtures, or drapery that you would like to keep, remove them now. Buyers can get attached to objects they assume will come with the house and might be turned off from making an offer if they are not.

Before you show your house to potential buyers, it is a good idea to get a home inspection. In most cases, an inspection is going to be done regardless, so having it done before buyers walk through will let them see your home in its best condition. Make any minor repairs needed, such as replacing cracked or missing floorboards, updating some windows, etc. Any repairs you make will be easily paid off once you sell your home.

Ambiance

Paint color is very important when staging a house. White or off-white walls are the general rule of thumb as they create an illusion of open space and make the rooms appear as a blank canvas. Neutral colors are also great choices. Neutral include colors from nature, so think of a muted green or blue. If you want to make your home look even more spacious, paint adjacent rooms the same color. Having the color of the walls match the color of the drapes is also a great technique and makes for a seamless interior look. Darker colors can often make rooms look especially cozy, so don’t shy away from these in your bedrooms and powder rooms. If sticking with an all-white or neutral palette, considering using an accent color to give a room little bit of personality. Small pops of color will keep the room from feeling boring.

Lighting is of upmost importance during a house showing. Make sure all lights are on when showing your house and open blinds to let in as much natural light as possible. Pay attention to the lighting of each room individually. There should be three types of light in each—ambient lighting (overhead or general lighting), task lighting (under the cabinet, closet, or reading lights), and accent lighting (table or wall lamps). If the room is dark, mirrors are your best friend. Adding a large mirror or two will increase the amount of light and will even add depth to make the room feel bigger.

When staging your home, pay close attention to odors you may be releasing into the house. It is hard for people who live in a house to smell pet or smoke odors since they have become desensitized to them. Have your pets stay at a friend or family member’s house during this time, if possible. If there is a smoker who lives in the house, have them smoke outside. Don’t try to mask odors by burning scented candles or spraying air freshener—these smells can be equally as offensive as the odors can combine rather than be replaced. Get rid of odors at the source—scrub down the house, take out trash regularly, and don’t cook foods with strong odors.

As a finishing touch to your home’s ambiance, place freshly cut flowers or trimmings around the house. Not only are flowers visually appeasing, they will add a nice aroma to the air. If flowers aren’t in season, you can always create bouquets of holly, berries, and pine in the winter and branches with fall foliage in autumn.

Kitchen

Kitchens are perhaps the most important room that buyers look at when purchasing a house. Before you sell your house, update any outdated appliances. Even though appliances are a large expense, it is likely you will recoup every penny spent after selling. If you can’t afford to replace outdated cabinetry, invest in new doors, drawer faces, and knobs. Store away counter appliances like toasters and coffee makers and make sure your refrigerator is free of magnets and personal reminders. Remember, you want to make your home look as if it brand new and uninhabited.

Bathroom

When staging a bathroom, your goal is to make it look and feel spa-like. Remove your personal items, such used bars of soap, razors, and toothbrushes. Make sure your cabinets are clean, uncluttered, and presentable as buyers like to check out the available storage space. Use white linens to add a sense of elegance. Put out accessories like fresh rolled-up towels, baskets, and candles to complete the spa-like atmosphere. The goal is to create an oasis the buyer doesn’t want to leave.

Bedroom

Make sure the room is free of clutter and clothes. You want the bedroom to come across as a room that is only used for rest and relaxation and has an inviting atmosphere. Again, use fresh white linens and puffy pillows to give an air of luxury. Pay close attention to your closets as buyers will be sure to look. To make them look the most spacious, remove your belongings. If you can’t, keep everything clean and organized.

Curb Appeal

The exterior of a home is often the most important visual element of selling a house. This is where the buyer gets their first (and often lasting) impression of a house. Check that the house numbers are clearly visible from the street. Clear all sidewalks and driveways around the house. Make sure any cracks in the pavement are repaired. Your lawn should be well-kept and mowed and all leaves should be raked away. Trim shrubs and see that the gardens are properly weeded. When choosing a color for the front door pretty much anything goes, but try to aim for contrast. Pick a nice, bold color that will stand out from the rest of the house.

Staging Completion

The day of showing, make sure you stash away all personal items and empty wastebaskets and trash. It is also a great idea to leave the house before the buyers arrive. Following these steps should ensure that your house sells quickly and with great value. Once your house is sold, be sure to use our moving tips to help for a smooth transition to your new home. Good luck!

This blog was originally published in January 2013 and has been updated to reflect current trends.

Are you considering buying a short sale property? A short sale is the sale of a property where the net proceeds from the sale are short of the debts secured by the liens on the property. This can be a complex process with many moving pieces. But there are many reasons this may be a good choice for you. You will be competing with fewer buyers, and you may be able to purchase your home for well under market value. However, since the short sale process is different from a traditional home sale, here are 4 things you should know in order to have a successful short sale purchase.

Purchasing a short sale property can be complex, but often the reward can outweigh the challenge. If you have any questions about purchasing a short sale, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

Recently, we discussed the fifth step in the home buying process: Processing and Underwriting. Once the clear-to-close (CTC) is issued, your loan moves into the sixth step: Closing. This is the final step in the process before you move into your new home.

Recently, we discussed the fifth step in the home buying process: Processing and Underwriting. Once the clear-to-close (CTC) is issued, your loan moves into the sixth step: Closing. This is the final step in the process before you move into your new home.

What Happens at Closing

At closing, all the necessary paperwork is presented and signed by both the sellers and the buyers. At least three business days prior to closing, you will receive a Closing Disclosure (CD). The CD will detail all of your closing costs and factor in any down payments, credits or gift funds provided on the loan transaction.

When you close on your loan, the title of the property is transferred to the buyer, an escrow account is set up if applicable, funds are obtained by the buyer, and the security interest of the lender is recorded by the County or City Clerk. Should you need funds for closing, these must be in the form of a certified check.

After Your Loan Closes

You will make payments on your mortgage loan following an amortization schedule. An amortization schedule will show you the amount of principal versus interest you are paying each time you make a payment.

Once your loan has closed, your lender may transfer servicing of your loan to another lender or servicing company. You will be contacted both by your current lender and your new lender/servicer in the event that servicing is transferred. If you have any questions after your loan closes, you can reach out to your Loan Originator, or to your current loan servicer.

If you missed any of our 6 Step blogs, you can find them here:

Homeownership is a rewarding achievement. The home buying process may present challenges, but having qualified mortgage professionals by your side can make all the difference. If you have any questions about the home buying process, contact one of our licensed Mortgage Loan Originators. If you are ready to buy a home, click here to get started!

If you are a homeowner, you may have considered refinancing your current mortgage. Refinancing can offer many advantages to help you meet your financial goals. If you are just starting to look into refinancing, or have been thinking about it for a while, here are three benefits that you should consider.

If you are a homeowner, you may have considered refinancing your current mortgage. Refinancing can offer many advantages to help you meet your financial goals. If you are just starting to look into refinancing, or have been thinking about it for a while, here are three benefits that you should consider.

Lower Interest Rate

It may be possible to obtain a lower interest rate by refinancing your current mortgage loan.* A lower interest rate means that your monthly mortgage payments would be lower. This could save you money monthly or you could make payments directly to the principal of your loan, allowing you to build your home equity quicker and reducing your interest. A lower interest rate is the most popular reason that homeowners choose to refinance.

Cash Out Your Home Equity

You can take advantage of the equity you have built in your home with a cash-out refinance. To take advantage of this, you would refinance your current mortgage for more than the amount you owe, and keep the extra money. For example, if you owe $150,000 on a home worth $250,000, you have $100,000 worth of equity in your home. You could refinance your home for $175,000, and receive a check for the $25,000 difference. You could use this money for home improvements and remodeling, or any other household needs you may have.

Change Your Loan Type or Term

Another refinancing option is to shorten your loan term, so you pay your home off in less time. For example, you might switch from a 30-year loan to a 20-year loan. This would allow you to build equity faster, and pay off your loan in less time, with the same (or marginally higher) monthly payments. If you have an adjustable-rate or interest-only loan, you may be able to refinance to a fixed-rate loan product that may save you money over the life of your loan, and may allow you to build equity.

Whether you want to lower your monthly payment, build equity, or get cash for projects, refinancing can be a step towards meeting your financial goals. To find out if refinancing is right for you, talk to one of our licensed Mortgage Loan Originators today!

*Refinancing an existing loan may result in the total finance charges being higher over the life of the loan.

Investing in a rental property can be a great way to earn additional revenue. Perhaps you’re a homeowner looking for wealth-building opportunities. Or perhaps you’re simply interested in property management. Owning a rental property is an investment of time and money, and it’s important to carefully consider everything that is involved before you make the decision. Here are some tips to consider if you’re thinking about becoming a landlord.

Investing in a rental property can be a great way to earn additional revenue. Perhaps you’re a homeowner looking for wealth-building opportunities. Or perhaps you’re simply interested in property management. Owning a rental property is an investment of time and money, and it’s important to carefully consider everything that is involved before you make the decision. Here are some tips to consider if you’re thinking about becoming a landlord.

Make Sure you Have Time

Owning a rental property isn’t your typical investment. You are responsible for the maintenance and upkeep of the property. If something breaks, it is your responsibility to fix it in a timely manner, or hire someone to fix it. If a tenant is late on rent, you need to make sure that the payment goes to the mortgage company on time regardless, and take the necessary steps to prevent future late payments. And if you want the property to appreciate in value, you need to take the time and money necessary to do routine maintenance to the property, and add updates. If you’re already working long hours, or have a family or kids to take care of, think carefully about the changes you would need to make to your current schedule before making your decision.

Choose the Right Property

The right rental property can make all the difference in the return you see on your investment. Make sure you take location into consideration. The school district, crime rate, amenities, and your potential renter base are all important factors in how profitable your property will be. Choose a neighborhood that you’re familiar with, and has a high demand for rentals. Unless you have the time and resources to devote to a fixer-upper, choose a property that requires minimal cosmetic maintenance. Bring a contractor with you to go and look at properties to determine what it will cost to renovate the property before it’s available to rent.

Choose the Right Tenants

Before you start to advertise your rooms/apartments for rent, take some time to come up with a screening process. Call your applicants’ previous landlords to make sure that they have a positive rental history, and use an online service to run a background check. It can also help to talk to more experienced landlords. They can give you tips and insight about what to look for in each applicant you screen.

Decide on a Rent Amount

Choosing tenants goes hand-in-hand with choosing a rent amount. Spend some time researching property values and rent amounts in the neighborhood where your property is. Sites like Zillow and Rentometer can provide you with a good starting point. Make sure you factor in not only the cost of the property, but maintenance costs, utilities (unless your tenants pay these themselves), and any updates you’ve made since purchasing the property.

Like any investment, purchasing a rental property comes along with risks. It is important to do your research, consult experts, and take your time to ensure you make the right decision. If you are ready to start looking at possible investment properties, click here to contact one of our licensed mortgage loan originators today!

When you think about branding yourself as a real estate agent on social media, Google Plus may not be the first social network that comes to mind. If you have a successful Facebook page or Twitter account, then another social media account might not seem necessary; however, Google Plus offers its users many perks that can benefit you and increase your online visibility. Here are four Google Plus tips to help improve your branding and online reach.

Google Plus is a highly valuable tool for real estate professionals. In this competitive industry, online presence and branding are essential. Using Google Plus business pages can improve your online visibility, help you educate potential clients more effectively, and build relationships with other industry professionals. Click here for more information about Google Plus.

Google Plus is a highly valuable tool for real estate professionals. In this competitive industry, online presence and branding are essential. Using Google Plus business pages can improve your online visibility, help you educate potential clients more effectively, and build relationships with other industry professionals. Click here for more information about Google Plus.Like any major purchase, a home purchase will require you to put down a certain percentage of the total price as a down payment. The bigger the down payment, the less you will borrow from the mortgage company or bank, and the less your payments will be. With every day expenses and current bills, it can be difficult to find money to begin saving for a down payment. By planning ahead and getting creative, you can begin to save up for a down payment for the mortgage loan that best suits your needs. Here are three ways to save for a down payment and help come up with the savings you need to land the house of your dreams.

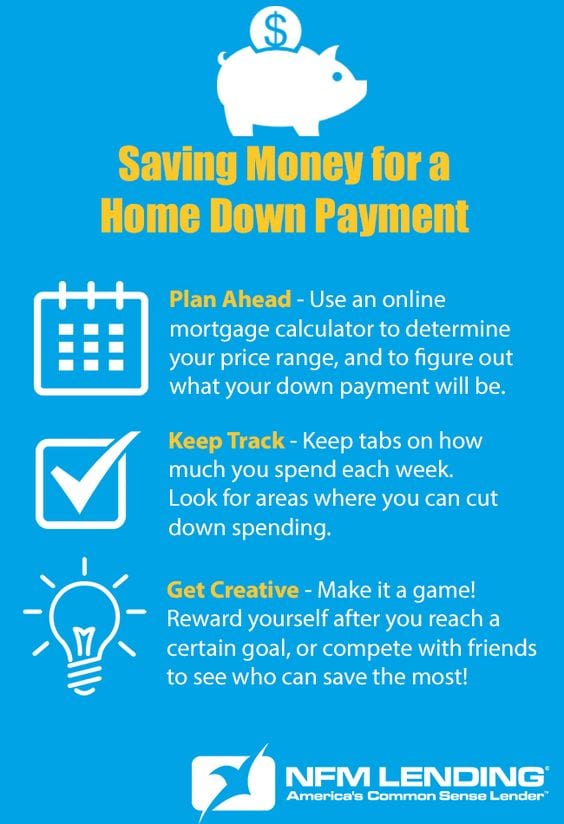

Planning Ahead

Saving money for a down payment may take a while, so it helps to have a plan. Start by researching what kind of home you are looking to buy, and the average price of those homes in the area. Then, use an online mortgage calculator to find out what kind of down payment options are best for you, based on your price range. For example, if the homes in the neighborhood you are looking to buy average at $200,000, the standard 20% down payment will be $40,000. Remember, there are loans available with lower down payment options, such as 10% and as low as 3.5%. Talk to your Loan Originator to find out which loan option is right for you.

Once you determine your down payment goals, open a separate savings account. If you’re a first-time home buyer, you can open an investment retirement account (IRA). An IRA will accumulate interest, and first-time home buyers can withdraw up to $10,000.00 from their IRA without a penalty fee. Consult a CPA for more information. Having a separate account for your down payment savings prevents you from accidentally confusing the money with your regular spending money, and it is a good way to track your progress.

Saving money will be easier if you have goals in mind. Set realistic weekly, biweekly, or monthly savings goals, and stick to them. If your workplace offers this option, set up your direct deposit so that a portion of each paycheck automatically goes into the savings account you have set aside for your down payment.

Hold Yourself Accountable

Saving money will probably require a lifestyle change, and some habits are difficult to break. For instance, if you are used to going out to eat for lunch five days a week, it will be hard to start trying to pack a lunch every day. Set up a time a few times a month, or even once a week, to sit down and go over your expenditures from the week(s) before. Seeing when and how often you make unnecessary purchases can motivate you to make the changes you need to make. Have a close friend or significant other help hold you accountable, (if you’re buying a home together, you can do this for one another).

Providing incentives for yourself can also be a helpful tactic. Set monthly savings goals, and reward yourself at the end of the month if you meet your goals. If your goal is to save $500.00 in a month, and you reach that goal, reward yourself with a small splurge—go out to dinner with friends, or buy yourself something new. This will encourage you to meet your savings goals, and the splurge will be guilt-free, because you have already met your goal for the month.

Get Creative

Although the process of saving for a down payment may seem daunting, it doesn’t have to be a chore. There are lots of fun, creative ways to save money. One idea is to earn extra money on the side. Offer to do some odd jobs, such as babysitting, dog walking, home repairs, or housework for your friends or neighbors. If you’re crafty, open an Etsy store and sell your items online. You might be surprised by how much your woodworking, knitting, graphic design, or other skills are in demand. You can also sell clothes or household goods that you’re not using anymore on sites like Craigslis and eBay, or at your local consignment store.

Another way to get creative about saving is to turn it into a game. Have a competition with a friend or family member who is also trying to save money, and see who can save the most by a particular deadline. If you’re buying a home with your significant other, compete with one another, and see how much you can save together!

The decision to buy a home is one of the biggest financial decisions you will ever make. It is important to plan and prepare carefully. Saving money for a down payment can be difficult, but it is well worth the challenge. If you’re thinking about buying a home soon, get started by talking to one of our licensed Mortgage Loan Originators today.

NFM will be ready for August 1st

On August 1, 2015, the mortgage industry will introduce two new loan disclosures. The Loan Estimate and the Closing Disclosure will be utilized on most applications taken after the effective date. These changes will be implemented by the Consumer Financial Protection Bureau (CFPB) under the CFPB’s rule making authority pursuant to the Dodd Frank Wall Street Reform and Consumer Protection Act.

Good Bye to the 2010 Disclosures

Good Bye to the 2010 Disclosures

The Good Faith Estimate (GFE) and the Truth in Lending (TIL) disclosures will now be combined into the Loan Estimate for most transactions. Certain loans such as HELOC’s and reverse mortgage will still utilize the current disclosures. In addition the Closing Disclosure will replace the HUD-1, GFE, and TIL disclosures provided at settlement and must be delivered to the consumer three (3) business days prior to consummation.

The 1,888 pages of regulation that mandates the new disclosures and delivery requirements will not only impact lenders, but also other industry professionals. Because the rule expressly holds lenders liable for the accuracy and delivery of the Closing Disclosure, settlement agents companies and realtors must work closely to deliver all of the information necessary to ensure settlement is not delayed as a result of the three (3) business day delivery requirement.

NFM Lending is preparing for these changes and is constantly training our loan originators, realtors, settlement agents, and other industry partners to be up to date on this important industry change.

To view the new disclosures, visit the CFPB’s website at:

http://www.consumerfinance.gov/knowbeforeyouowe/#disclosure

If you have any questions about NFM’s loan programs, please click here to contact one of our licensed loan originators.

Home inspections are a very important part of both the home buying and selling process. It is always a good idea to hire a Home Inspector to properly inspect a house. Home Inspectors are professionals who are trained to have a keen eye for catching things that a normal homeowner (or potential homebuyer) may not notice.

Here are some of the things that a professional inspector might check for:

Although a home inspection costs extra money and may not be the most exhilarating experience, it is necessary when buying a home. It is in your best interest (and for your own safety) to have a professional look over the home before you purchase it. Even if a house looks to be move-in ready, there could be hidden issues throughout the house.

If big issues are found by the Home Inspector, speak with your Real Estate Agent. In some cases, your Agent can work with the seller’s Agent to have some, if not all, of the necessary repairs paid for by the sellers. This could be done by either the sellers paying for the repairs prior to the home being sold, or by giving the buyer closing cost assistance at the time of closing. If the seller is not willing to assist, talk to your Mortgage Loan Originator to see if you will have enough money available to make the necessary repairs after closing, or if you need a home improvement loan to be able to afford the repairs. If the costs end up being overwhelming, it might be best to speak with your Agent and move on to another property.

For more information regarding home inspections and their benefits, click here.

If you are looking to purchase a home, contact one of our Licensed Mortgage Loan Originators today to pre-qualify and begin the home searching process with confidence.