Jane Floyd and her team at NFM Lending celebrated the opening of their new location on Wednesday, September 16, 2015. The new location is 14497 North Dale Mabry Highway Suite 235N, Tampa, FL 33618.

The branch celebrated the move by hosting a Grand Opening celebration. Jan Ozga, President of NFM Lending, attended with other Executives, management staff, and employees to congratulate the branch on this exciting change.

For more information about Jane Floyd and her branch, click here to visit their website.

Congratulations!

The new TILA-RESPA Integrated Disclosures (TRID) will take effect on October 3, 2015. As this date approaches, you may have heard a few terms and phrases you haven’t heard before. Whether you’ve been through the home purchase process many times before, or you’re preparing to buy your first home, it’s important to familiarize yourself with these terms and to understand what they mean for you, the consumer.

The new TILA-RESPA Integrated Disclosures (TRID) will take effect on October 3, 2015. As this date approaches, you may have heard a few terms and phrases you haven’t heard before. Whether you’ve been through the home purchase process many times before, or you’re preparing to buy your first home, it’s important to familiarize yourself with these terms and to understand what they mean for you, the consumer.

TILA-RESPA

TILA refers to the Truth in Lending Act. This law requires mortgage companies and other lending institutions to disclose all costs and fees associated with a borrower’s transaction. RESPA stands for Real Estate Settlement Procedures Act. This law requires lenders, loan servicers, and brokers to provide borrowers with disclosures regarding the costs associated with real estate settlements. RESPA also prohibits anti-competitive practices that can inflate the costs of real estate transactions, such as kickbacks.

TRID

TRID stands for TILA-RESPA Integrated Closing Disclosures. TRID is a new Rule which applies to most residential mortgage transactions, that combines the Good Faith Estimate, the Truth-in-Lending statement, and the HUD-1 into two new forms: the Loan Estimate and the Closing Disclosure. Therefore, TRID is the integration of the TILA and RESPA disclosures.

Loan Estimate

A Loan Estimate (LE) is a form that the consumer receives within three days of applying for a mortgage. It details everything you need to know about the loan you have applied for, including the estimated interest rate, monthly payment, closing costs, and any other fees. It will also inform you of any special features in the loan, such as a prepayment penalty.

Closing Disclosure

A Closing Disclosure (CD) is a form the consumer receives at least three days before closing on a residential mortgage. This form includes loan terms, projected monthly payments, and what closing costs will be involved. The three-day window allows you to compare these terms and costs to the ones estimated in your LE, and to ask your lender any questions you may have about your loan before closing.

Creditor

The Creditor in a mortgage transaction is your mortgage lender. This is the financial institution supplying the funds for the loan, and instituting the terms and conditions of the loan.

Consumer

The Consumer in a mortgage transaction is the borrower, or the person(s) taking out the loan.

Consummation

Consummation is the date on which the consumer becomes contractually obligated to the creditor on the loan.

Knowing the terminology involved in loan transactions that start after the TRID deadline will help you be better prepared and avoid delays in your loan closing. For more information about TRID, and about what NFM Lending is doing to prepare for TRID, click here. If you are ready to purchase a home, click here to contact one of our licensed mortgage Loan Originators today to get started!

LINTHICUM, MD, September 10, 2015 — LaTasha Rowe, General Counsel at NFM Lending, will speak on the TILA-RESPA Integrated Closing Disclosures (TRID) at the Maryland Land Title Association (MLTA) 2015 Fall Convention in Ocean City, Maryland, on Saturday, September 12, 2015.

Ms. Rowe is speaking at the convention in order to prepare and educate attendees on the implications of the new TRID rules.

“As we count down to the October 3, 2015 effective date for TRID, this conference could not be more timely.” said Rowe. “It is important to emphasize that a title company’s role is not diminished. They are still an integral part of the closing process as lenders will work more collaboratively with the settlement agent on obtaining closing costs earlier in the process. I look forward to speaking with the MLTA attendees on their preparation for TRID as well as relaying NFM’s expectations of our title partners.”

This year’s MLTA convention will feature continuing education, break-out sessions, and exhibits by various compliance vendors. The event is aimed at helping title professionals be better prepared for TRID.

The deadline for implementation of the TRID rule is October 3, 2015. NFM Lending will continue to prepare for the implementation of TRID, in addition to educating their employees and clients about these important industry changes.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states across the United States. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to their customers and their community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.”

For more information about NFM Lending, please contact:

NFM Lending

Toll Free: 1-888-233-0092

pr@nfmlending.com

Twitter: @NFM_Lending

For the online press release, click here.

Written by Guest blogger: Sherman Hardy

Foreclosures and its counterparts (short sales or deed-in-lieu of foreclosure) can be extremely problematic for military buyers. For those who have faced foreclosure may or may not know that it was not in their best interest. Having a foreclosure means you will not be eligible for a VA loan for at least two years. Borrowers who experienced the loss of a home due to a foreclosure proceeding will not be able to purchase for two years after the deed is transferred from their name.

I wanted to clear the misconception about VA Home Loan Guarantee Eligibility after a foreclosure; a veteran who has a VA loan foreclosed upon can obtain another VA loan in the future. Many service members have been told otherwise by bank officials, mortgage brokers and others who either didn’t understand the program or who were looking to make a buck with their own financing options.

When a veteran home has been foreclosed upon the lender must determine how much of a primary entitlement the borrower has left (if any at all). This is where a second-tier entitlement comes into play. One of the downsides to a second-tier entitlement is there’s a minimum loan amount of $144,000. This secondary entitlement is also used to allow a veteran to have two VA loans at the same time.

Sherman Hardy, Real Estate Professional, 301-659-5004 or www.localdmvhomes.com

*This blog is for information purposes only. NFM, Inc. accepts no liability for its content. Please visit the US Department of Veterans Affairs website for more information: http://www.benefits.va.gov/.

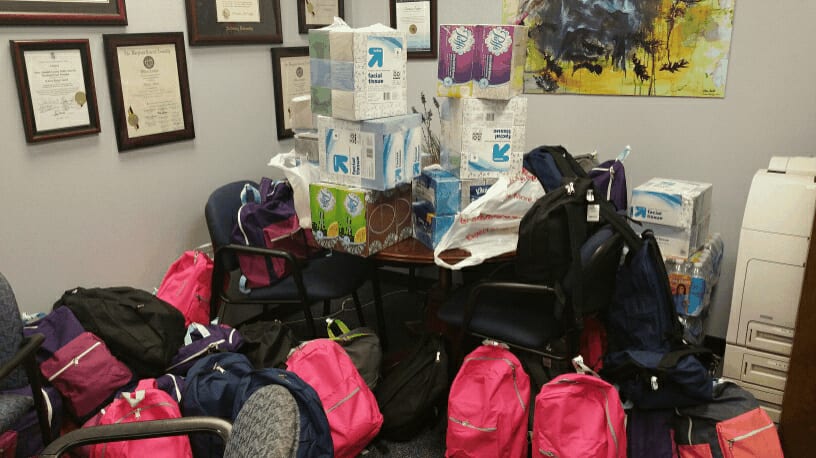

This August, NFM Lending held a Back-to-School Drive to collect school supplies for children in need in Anne Arundel County, Maryland. Throughout the month, NFM Lending employees collected new school supplies for children in grades 1-5, filling 50 backpacks with the school supplies required by the county, such as notebooks, pencils, erasers, scissors, and other school necessities.

Anne Arundel County Public Schools distribute donated school supplies to children who qualify for federal food assistance programs based on household income. In Anne Arundel County, over 14,000 students were participating in these programs in the 2010-2011 school years.

Since its foundation in 1998, NFM Lending has maintained a strong commitment to giving back to our communities. Each year, the company holds food drives for local food banks, collects care packages for our troops overseas, and participates in other charitable initiatives for charities such as the Ronald McDonald House of Baltimore, Habitat for Humanity, and more. For additional information about NFM Lending’s community involvement, visit www.nfmlending.org.

A Veterans Affairs (VA) loan allows you to buy your home with 100% financing or no down payment. However, there still will be other costs associated with the loan. You most likely still will need an earnest money deposit and closing costs to cover. You may be able to get the seller to cover some of the closing costs during settlement, up to 4% for a VA loan. When buying a home using VA financing, closing costs cannot be rolled into the loan. There are some costs that can be financed such as the VA funding fee.

For first-time home buyers, the VA funding fee ranges from 2.15% to 2.4% of the purchase price. If you are receiving any form of disability from Veterans Affairs, then the funding fee may be waived. The funding fee is based on various loan characteristics. On an Interest Rate Reduction Refinance Loan, an appraisal is not required, but the lender may require a drive-by-appraisal. Income documentation is not required, but source of income must be verified. On a purchase loan, the sales price cannot exceed the appraised value.

In general, when buying a home using 100% VA financing, the closing costs can range from 3.5% to 5.5% of the purchase price of the home. Closing cost can range from loan origination fees from the lender, credit report cost, appraisal, recordation cost, title fees, and transfer taxes, to name a few. If the 4% in closing cost assistance from the seller doesn’t cover these costs, then the remaining difference is the responsibility of the buyer. Also note, as a new home owner you will want to have some savings available after settlement in case of an emergency, and to pay for any added expenses once you move in, such as moving and purchasing curtains, lawnmowers, appliances, etc.

If you are ready to purchase a home with your VA benefits, keep in mind that there is a difference between down payment and closing cost.

Enjoy your home search and good luck!

Bruce Dorsey is employed by NFM, Inc. as a Mortgage Loan Originator, NMLS #174898. NFM, Inc. is a Veterans Affairs Automatic Lender (659985-00-00) under the trade name NFM Lending. NFM, Inc. is licensed as: Maryland Mortgage Lender (5330) under the trade name NFM Lending. For NFM lending’s complete licensing information, please go to www.nfmlending.com/licensing. NFM, Inc.’s Nationwide Mortgage Licensing System (NMLS) Company Identifier Number is 2893. NFM, Inc. is not affiliated with, or an agent or division of, a governmental agency or a depository institution. NFM, Inc. is an equal housing lender.

One of our previous blogs on credit scores, Understanding Your Credit Score, talked about the factors used to calculate FICO scores (the most widely used scoring system). However, the blog did not go into detail on what a credit score is or the difference between credit report and credit score. The two are not only different, but they are used for different purposes. Here are the main differences:

One of our previous blogs on credit scores, Understanding Your Credit Score, talked about the factors used to calculate FICO scores (the most widely used scoring system). However, the blog did not go into detail on what a credit score is or the difference between credit report and credit score. The two are not only different, but they are used for different purposes. Here are the main differences:

Credit Report

A credit report is a record of your credit history. The report may include loan amounts, current balances, credit companies used, dates accounts were opened, recently opened lines of credit, payment history, third-party collections, and even details of public record, such as bankruptcies. These detailed reports are created by the three National Credit Reporting Bureaus: Experian, Equifax, and TransUnion. Each one of the Bureaus maintains one credit report per person. However, these reports can vary, since creditors do not have to report information to all three Bureaus. Federal law requires that each of the three Bureaus give consumers a free copy of their credit report every 12 months. You can receive a free copy of your credit report by going to www.annualcreditreport.com.

Credit Scores

A credit score is an algorithm used to measure your financial risk based on the information on your credit report. FICO scores are the most widely used, but VantageScore, and banks have their own. FICO scores have 5 factors used to calculate credit scores, and it weighs each factor differently. The other credit companies use similar information but may have different weights and/or include other data.

Key Differences

Here are two key differences between credit reports and credit scores to consider:

Lenders use credit reports and credit scores to see if you are responsible for your finances, and to make sure that you won’t be overwhelmed if you take on another loan. When taking out a mortgage loan, lenders look at both your credit report and credit scores, and are required to show you the three credit scores that were pulled from each of the three National Credit Reporting Bureaus for the application.

Interest rates, terms, and whether you can apply for certain loans are factors that are affected by your credit score. Contact one of licensed mortgage loan originators today if you have any questions or would like to see if you qualify for a mortgage loan.

LINTHICUM, MD, August 28, 2015— NFM Lending is proud to announce David Silverman, CEO, has been named one of the 100 Most Influential Mortgage Executives in America by Mortgage Executive Magazine for 2015.

LINTHICUM, MD, August 28, 2015— NFM Lending is proud to announce David Silverman, CEO, has been named one of the 100 Most Influential Mortgage Executives in America by Mortgage Executive Magazine for 2015.

Each year, Mortgage Executive Magazine recognizes mortgage executives that have built their companies and service their clients and employees through service, dedication and hard work. The winning executives were asked to provide their insights on the mortgage industry’s opportunities and challenges today. Silverman spoke about NFM Lending’s increased focus on selective recruiting:

“The biggest opportunity for NFM Lending this year is to be selective with our origination recruits and focus on better, not bigger. Fortunately, the demand for service and product remains very high with a smaller supply of human capital across the industry. We believe this is a great time to be selective as well as bring new blood into the mortgage space and train them up.”

This is the third year in a row that Silverman has received this award.

“I am truly honored to be recognized again amongst so many spectacular leaders in our industry,” said Silverman. “All I can do is continue to work towards being the best leader I can be for my company and those that I am blessed to have on my team making me look good. I surround myself with the best, and occasionally some of it rubs off on me.”

NFM Lending has prospered under Silverman’s leadership, and continues to receive national recognition. The company was named one of the 50 Best Companies to Work For in 2015 by Mortgage Executive Magazine; one of the Washington Post’s Top Work Places in the Washington, D.C. area in 2015; a Top Mortgage Employer by National Mortgage Professional Magazine in 2015; and a Top Work Place in the Baltimore area by The Baltimore Sun in 2012, 2013, and 2014.

NFM Lending was founded in March of 1998 by David Silverman and his wife Sandy. The company started as a small brokerage shop with 4 loan originators and is now a multi-state lender with more than 350 employees, 39 retail branches, and is licensed in 29 states.

For more information please contact:

NFM Lending

Toll Free: 1-888-233-0092

pr@nfmlending.com

www.nfmlending.com

Twitter: @nfm_lending

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.”

For information on NFM Lending, please email pr@nfmlending.com.

To view the online press release, click here.

Investing in a rental property can be a great way to earn additional revenue. Perhaps you’re a homeowner looking for wealth-building opportunities. Or perhaps you’re simply interested in property management. Owning a rental property is an investment of time and money, and it’s important to carefully consider everything that is involved before you make the decision. Here are some tips to consider if you’re thinking about becoming a landlord.

Investing in a rental property can be a great way to earn additional revenue. Perhaps you’re a homeowner looking for wealth-building opportunities. Or perhaps you’re simply interested in property management. Owning a rental property is an investment of time and money, and it’s important to carefully consider everything that is involved before you make the decision. Here are some tips to consider if you’re thinking about becoming a landlord.

Make Sure you Have Time

Owning a rental property isn’t your typical investment. You are responsible for the maintenance and upkeep of the property. If something breaks, it is your responsibility to fix it in a timely manner, or hire someone to fix it. If a tenant is late on rent, you need to make sure that the payment goes to the mortgage company on time regardless, and take the necessary steps to prevent future late payments. And if you want the property to appreciate in value, you need to take the time and money necessary to do routine maintenance to the property, and add updates. If you’re already working long hours, or have a family or kids to take care of, think carefully about the changes you would need to make to your current schedule before making your decision.

Choose the Right Property

The right rental property can make all the difference in the return you see on your investment. Make sure you take location into consideration. The school district, crime rate, amenities, and your potential renter base are all important factors in how profitable your property will be. Choose a neighborhood that you’re familiar with, and has a high demand for rentals. Unless you have the time and resources to devote to a fixer-upper, choose a property that requires minimal cosmetic maintenance. Bring a contractor with you to go and look at properties to determine what it will cost to renovate the property before it’s available to rent.

Choose the Right Tenants

Before you start to advertise your rooms/apartments for rent, take some time to come up with a screening process. Call your applicants’ previous landlords to make sure that they have a positive rental history, and use an online service to run a background check. It can also help to talk to more experienced landlords. They can give you tips and insight about what to look for in each applicant you screen.

Decide on a Rent Amount

Choosing tenants goes hand-in-hand with choosing a rent amount. Spend some time researching property values and rent amounts in the neighborhood where your property is. Sites like Zillow and Rentometer can provide you with a good starting point. Make sure you factor in not only the cost of the property, but maintenance costs, utilities (unless your tenants pay these themselves), and any updates you’ve made since purchasing the property.

Like any investment, purchasing a rental property comes along with risks. It is important to do your research, consult experts, and take your time to ensure you make the right decision. If you are ready to start looking at possible investment properties, click here to contact one of our licensed mortgage loan originators today!

When you think about branding yourself as a real estate agent on social media, Google Plus may not be the first social network that comes to mind. If you have a successful Facebook page or Twitter account, then another social media account might not seem necessary; however, Google Plus offers its users many perks that can benefit you and increase your online visibility. Here are four Google Plus tips to help improve your branding and online reach.

Google Plus is a highly valuable tool for real estate professionals. In this competitive industry, online presence and branding are essential. Using Google Plus business pages can improve your online visibility, help you educate potential clients more effectively, and build relationships with other industry professionals. Click here for more information about Google Plus.

Google Plus is a highly valuable tool for real estate professionals. In this competitive industry, online presence and branding are essential. Using Google Plus business pages can improve your online visibility, help you educate potential clients more effectively, and build relationships with other industry professionals. Click here for more information about Google Plus.