Mortgage calculators are important tools for both homebuyers and homeowners. These calculators can help estimate your monthly mortgage payments as well as how much you can afford when purchasing a home. There are various types of mortgage calculators out there, but NFM offers three of the most popular for free: Mortgage Payment Calculator, Affordable House Calculator, and Refinance Calculator. If you’re wondering exactly how mortgage calculators work, let us break it down.

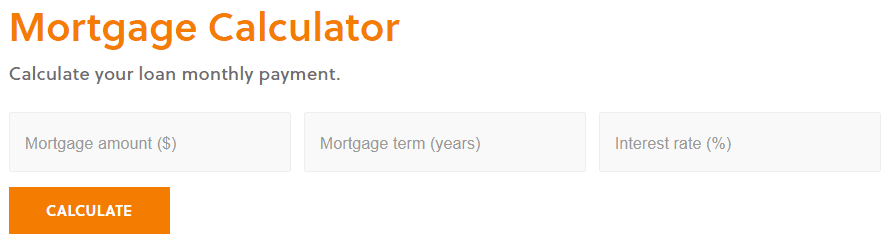

Mortgage Payment Calculator

If you just want a quick estimate of what your monthly mortgage payment should be, this calculator is ideal. Input your total mortgage, the mortgage term in years, and the interest rate. You will receive a monthly payment estimate (principle and interest) based on those numbers.

For example, if your total mortgage is $250,000 for a Conventional 30-year loan with a 5% interest rate, your principle and interest monthly payment would be $1,342.05.

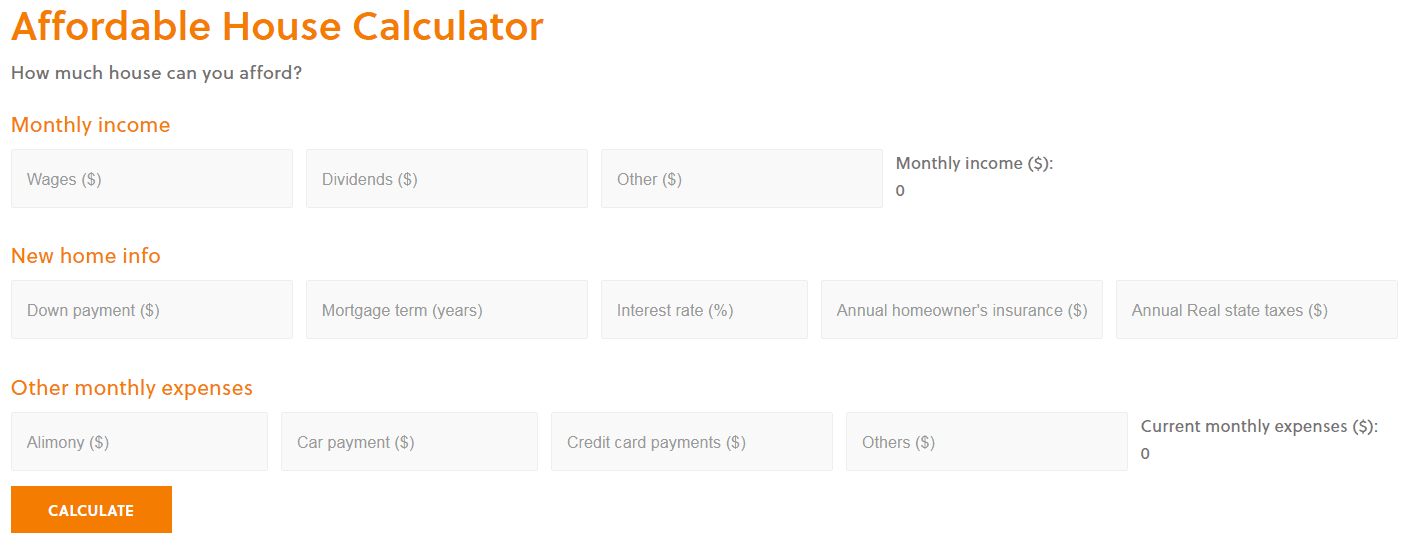

Affordable House Calculator

If you’re thinking of buying a home, the affordable house calculator should be the first one you use. This calculator predicts how much you can afford to spend on a home – which is important to know prior to starting the homebuying process. Input information about your monthly income (wages, dividends, and any other relevant income information), new home information (down payment, mortgage term in years, interest rate, annual home owner’s insurance, and annual real estate taxes), and other monthly expenses (such as alimony, car, or credit card payments). This calculator will provide a suggested new home value, mortgage amount, and affordable monthly payment so you have a better understanding of how much you can afford to spend on a home.

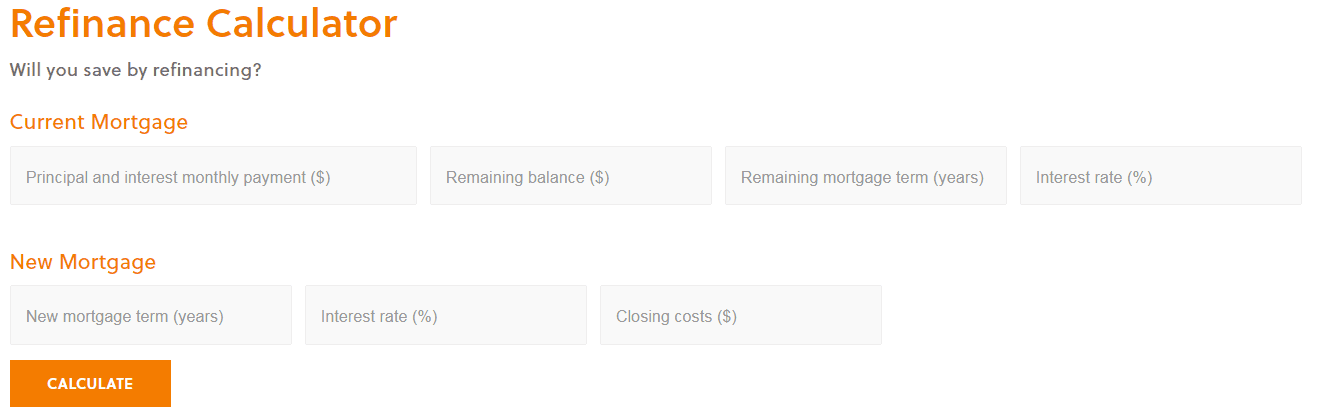

Refinance Calculator

Are you considering refinancing your mortgage? Use our refinance calculator to help you find out how much money you can save. You’ll need to input data about your current mortgage: principal and interest monthly payment, remaining balance, remaining mortgage term in years, and interest rate. Next, provide information about your new mortgage: mortgage term in years, interest rate, and closing costs. The calculator will then give an estimated new monthly payment, in addition to monthly savings, interest savings, closing costs, and the amount of time it will take for you to recoup your costs.

After using our calculators, you can email yourself the results. Remember, these calculators are for your convenience, and the figures input on these calculators are only estimates and are not 100% accurate.

To learn more about using one of our mortgage calculators or getting exact costs, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying or refinancing process, click here to get started!