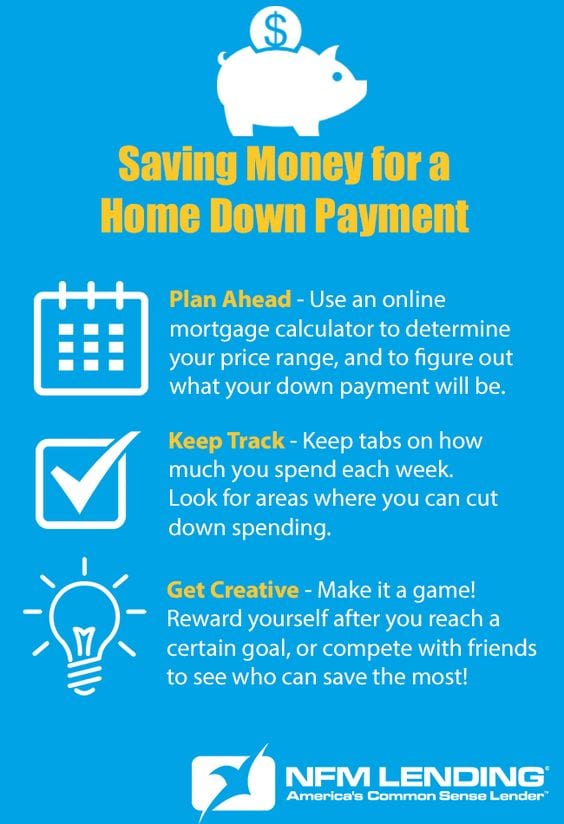

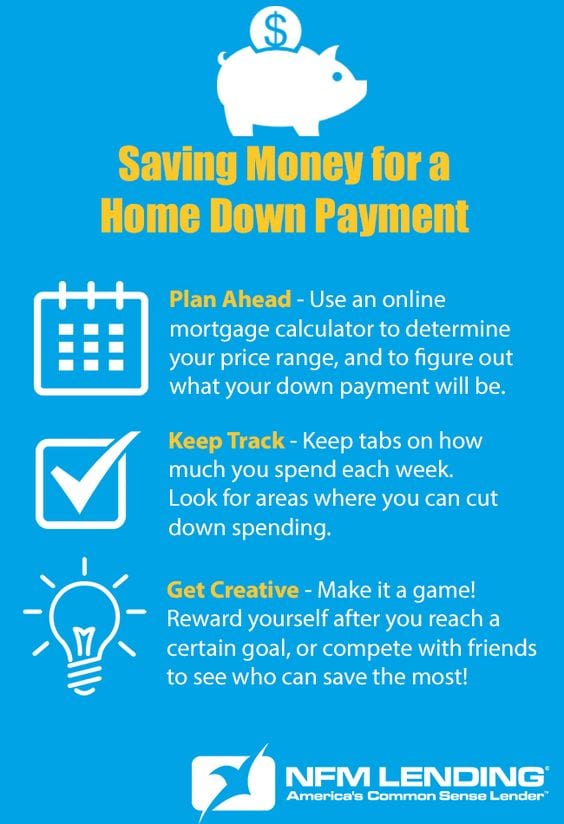

Like any major purchase, a home purchase will require you to put down a certain percentage of the total price as a down payment. The bigger the down payment, the less you will borrow from the mortgage company or bank, and the less your payments will be. With every day expenses and current bills, it can be difficult to find money to begin saving for a down payment. By planning ahead and getting creative, you can begin to save up for a down payment for the mortgage loan that best suits your needs. Here are three ways to save for a down payment and help come up with the savings you need to land the house of your dreams.

Planning Ahead

Saving money for a down payment may take a while, so it helps to have a plan. Start by researching what kind of home you are looking to buy, and the average price of those homes in the area. Then, use an online mortgage calculator to find out what kind of down payment options are best for you, based on your price range. For example, if the homes in the neighborhood you are looking to buy average at $200,000, the standard 20% down payment will be $40,000. Remember, there are loans available with lower down payment options, such as 10% and as low as 3.5%. Talk to your Loan Originator to find out which loan option is right for you.

Once you determine your down payment goals, open a separate savings account. If you’re a first-time home buyer, you can open an investment retirement account (IRA). An IRA will accumulate interest, and first-time home buyers can withdraw up to $10,000.00 from their IRA without a penalty fee. Consult a CPA for more information. Having a separate account for your down payment savings prevents you from accidentally confusing the money with your regular spending money, and it is a good way to track your progress.

Saving money will be easier if you have goals in mind. Set realistic weekly, biweekly, or monthly savings goals, and stick to them. If your workplace offers this option, set up your direct deposit so that a portion of each paycheck automatically goes into the savings account you have set aside for your down payment.

Hold Yourself Accountable

Saving money will probably require a lifestyle change, and some habits are difficult to break. For instance, if you are used to going out to eat for lunch five days a week, it will be hard to start trying to pack a lunch every day. Set up a time a few times a month, or even once a week, to sit down and go over your expenditures from the week(s) before. Seeing when and how often you make unnecessary purchases can motivate you to make the changes you need to make. Have a close friend or significant other help hold you accountable, (if you’re buying a home together, you can do this for one another).

Providing incentives for yourself can also be a helpful tactic. Set monthly savings goals, and reward yourself at the end of the month if you meet your goals. If your goal is to save $500.00 in a month, and you reach that goal, reward yourself with a small splurge—go out to dinner with friends, or buy yourself something new. This will encourage you to meet your savings goals, and the splurge will be guilt-free, because you have already met your goal for the month.

Get Creative

Although the process of saving for a down payment may seem daunting, it doesn’t have to be a chore. There are lots of fun, creative ways to save money. One idea is to earn extra money on the side. Offer to do some odd jobs, such as babysitting, dog walking, home repairs, or housework for your friends or neighbors. If you’re crafty, open an Etsy store and sell your items online. You might be surprised by how much your woodworking, knitting, graphic design, or other skills are in demand. You can also sell clothes or household goods that you’re not using anymore on sites like Craigslis and eBay, or at your local consignment store.

Another way to get creative about saving is to turn it into a game. Have a competition with a friend or family member who is also trying to save money, and see who can save the most by a particular deadline. If you’re buying a home with your significant other, compete with one another, and see how much you can save together!

The decision to buy a home is one of the biggest financial decisions you will ever make. It is important to plan and prepare carefully. Saving money for a down payment can be difficult, but it is well worth the challenge. If you’re thinking about buying a home soon, get started by talking to one of our licensed Mortgage Loan Originators today.