LINTHICUM, MD, March 23, 2018— NFM Lending is celebrating the two-year anniversary of its NFM Salute program. They honored their first NFM Salute on March 23, 2016.

NFM Salute is an initiative dedicated to recognizing the brave men and women who have fought and continue to fight for our freedom and our country. Every month, a nominated military service member or Veteran is chosen to be honored as the “Salute of the Month.” A brief biography and information about the Salute’s service is featured on both the website and NFM Lending’s social media. The Salute receives a gift and a donation is made by NFM Lending on behalf of the monthly Salute to one of three chosen non-profits: Platoon 22, AnySoldier, or the Gary Sinise Foundation. Since the start of the NFM Salute initiative, NFM Lending has donated over $50,000 to these military focused charities.

“Two years has flown by,” said Greg Sher, NFM’s Chief Business Development Officer. “The NFM Salute has fulfilled its promise to honor those who have and continue to serve our country. I just love reading the stories of our honorees and always look forward to the next one.”

NFM Lending is thankful for the opportunity to continue honoring U.S. military service members and Veterans through the NFM Salute initiative. Nominations are always welcome. For more information about the NFM Salute initiative, to read the stories of past Salutes, or to nominate a soldier or Veteran, visit www.nfmsalute.com.

NFM Salutes honored during the last year.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998 and this year it celebrates its 20th Anniversary. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.

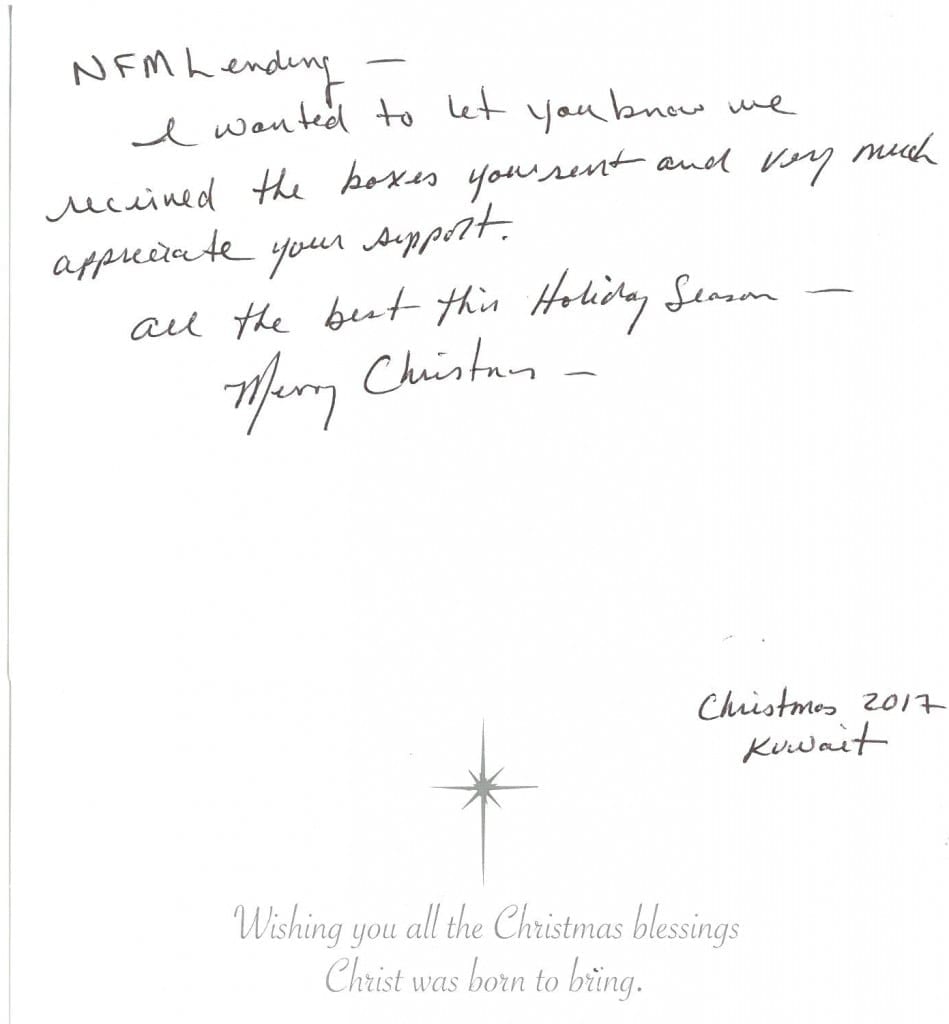

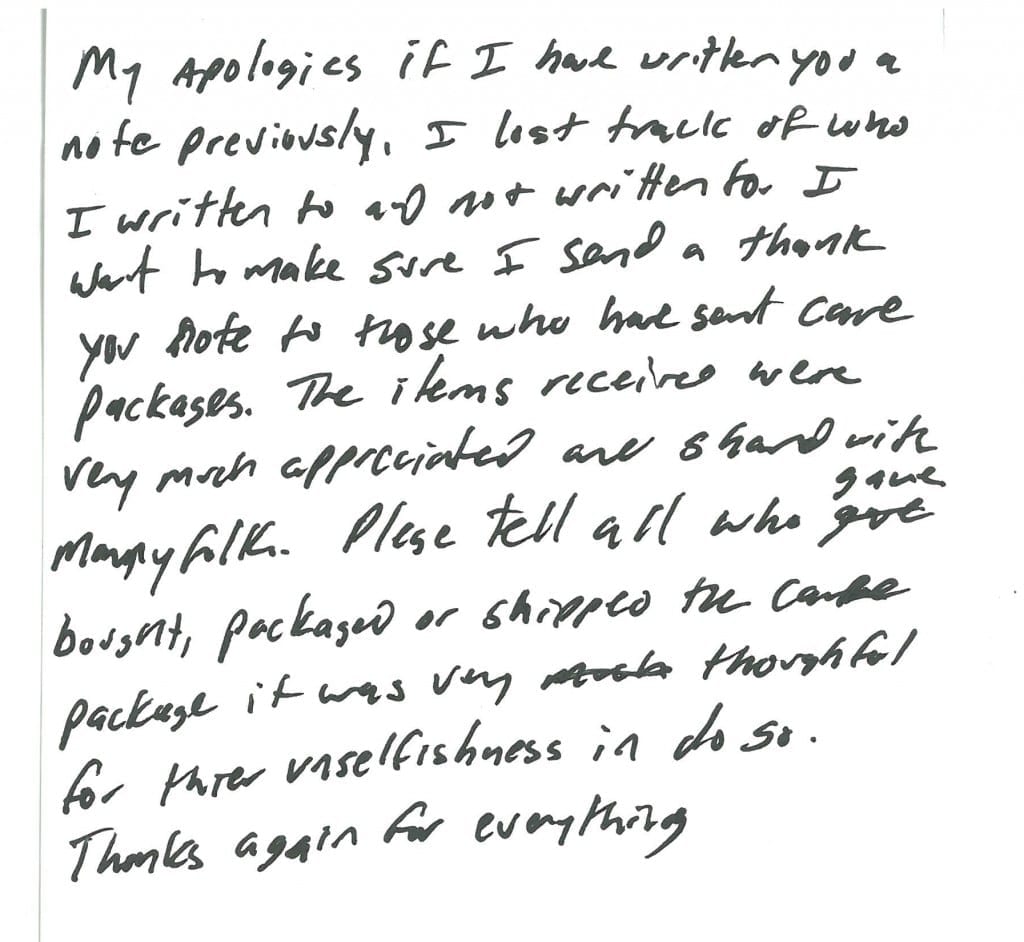

Since our 10th Annual Support Our Troops Drive in 2017, we have received some great correspondence from some of the U.S. troop members stationed around the world. In December, we sent 200 care packages to 100 groups of soldiers. Today, we continue to send 4 care packages every month as a small way to show our troops how much their bravery and sacrifice is truly appreciated.

“We recently received a care package from you, thank you so much for the outstanding support! A little bit really goes a long way out here in Djibouti, Africa. Thanks again!”

“Thank you so much for thinking of me and the soldiers here overseas. We appreciate all of the support and kindness that you and your company have shown to us while we are currently stationed here. We hope you have a safe and a Happy holiday season.!! We also send our Blessing to you all into the New Year as well. Thank you!”

“I have received your 2 packages today. Thank you, the components were perfect & now we have a little something to decorate our office to make it feel more like Christmas here 🙂 Thank you very much for your support!”

“Thank you so much for supporting us troops here in Baghdad, Iraq! Your care package truly raised moral in our unit. We appreciate all the hard work, love, and patriotism it took to create and mail out the package you sent. All the items were distributed throughout our medical team. We are the 47th Combat Support Hospital based out of Fort Lewis, WA. We will be deployed until the end of June and appreciate your dedication to us deployed soldiers! Happy Holidays!”

LINTHICUM, MD, August 1, 2017— NFM Lending is pleased to honor Captain (CPT) Omayra Velez (ret.), as the NFM Salute for August 2017.

CPT Velez received her commission into the Army in October 2007. She received a direct commission as a Medical Service Corp Officer, and later became an Environmental Science Engineering Officer. Her first duty stationed was with the 705th Military Police Battalion at Fort Leavenworth, Kansas, with which she deployed to Iraq in support of Operation Iraqi Freedom from August 2009 to August 2010. On her return from Iraq, CPT Velez was assigned to the 21st Theater Sustainment Command in Kaiserslautern, Germany for two years, and then to the Army Public Health Command Europe in Landstuhl, Germany. She earned a coveted one-year “Training with Industryt the Lawrence Livermore National Laboratories in Livermore, California, from 2013 to 2014. After the training, she was assigned to Aberdeen Proving Grounds in Aberdeen, Maryland. She medically retired due to injury in January 2017. In her 9-year career, CPT Velez earned two Meritorious Service Medals, four Army Commendations Medals, one Army Achievement Medal, the Overseas Service Ribbon with two numeral devise, and the Iraq Campaign medal with one Campaign Star.

CPT Velez was nominated by NFM Lending Branch Manager Jennifer Cook.

“I have known Omayra for several years,” said Cook. “When I first met her, she was active duty. She recently retired from service, and I wanted to recognize Omayra for her many years of service and being a loyal client of NFM Lending. Congrats Omayra! It’s always a pleasure working with you.”

The NFM Salute is an initiative in which one military member or Veteran is chosen each month to be honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” will be featured on the website with a brief biography and information about his or her service, and NFM Lending will make a $2,500 donation to a military or Veteran non-profit in the Salute’s name. Velez chose Platoon 22 to receive this month’s donation.

Selected NFM Salutes may choose from one of the following three non-profits: Platoon 22, AnySoldier, and the Gary Sinise Foundation. NFM looks forward to the opportunity to continue to honor military and Veterans through the NFM Salute initiative.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.

LINTHICUM, MD, March 23, 2017— NFM Lending is pleased to celebrate the one year anniversary of its NFM Salute program.

NFM Salutes is an initiative in which one military service member or Veteran is chosen each month to be honored as the “Salute of the Month.” The “Salute of the Month” is then featured on the website with a brief biography and information about his or her service, and NFM Lending makes a $2,500 donation to one of the following four non-profits in the Salute’s name: Platoon 22, AnySoldier, Soldier’s Wish, and the Gary Sinise Foundation. NFM Lending honored its first NFM Salute on March 23, 2016.

“Everyone at NFM is proud of the work that we do in supporting our Veteran community,” said Bob Tyson, COO/CAO of NFM Lending. “The NFM Salute was born from that promise to give back to those who have served us. The one year anniversary of the program is an important milestone as it allows us to reflect and reaffirm our commitment. Reading the stories of those who have served or are serving is a reminder to all of us of the sacrifice made for us by these men and women, and their families.”

NFM looks forward to the opportunity to continue to honor military and Veterans through the NFM Salute initiative. For more information, or to nominate a salute, visit www.nfmsalute.com.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.

For the online press release, click here.

LINTHICUM, MD, February 1, 2017— NFM Lending is pleased to honor Lea Everette as the NFM Salute for February 2017.

Everette is a Technical Sergeant in the U.S. Air Force. She is an F-22 Avionics Systems Maintainer at Langley Air Force Base in Hampton, VA, and has been a member of the Air Force for nine years. She is a wife and a mother to four daughters and two dogs, and has traveled everywhere from California to Japan during her service.

“It’s been an honor and a privilege to maintain this 5th Generation Weapons system and serve my country,” said Everette.

Everette was nominated by her father, Grafton Davis.

“Lea has always strived to do her best, and she has always been a high achiever,” said Davis. “In elementary school, she was one of a few students chosen to attend Space Camp in Florida. I think that was when she decided on an AERO career. But rather than select a NASA career, she decided to join the Air Force and ROTC. She was at the top of her class in leadership school, and before graduation from high school she signed up for the U.S. Air Force (USAF). And it’s been the USAF since. She also is involved with an organization that helps Veterans upon return. She loves ocean fishing too, and has caught some real trophy-size fish!”

NFM Salutes is an initiative in which one military member or Veteran is chosen each month to be honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” will be featured on the website with a brief biography and information about his or her service, and NFM Lending will make a $2,500 donation to a military or Veteran non-profit in the Salute’s name. Everette chose the Gary Sinise Foundation to receive this month’s donation.

Selected NFM Salutes may choose from one of the following four non-profits: Platoon 22, AnySoldier, Soldier’s Wish, and the Gary Sinise Foundation. NFM looks forward to the opportunity to continue to honor military and Veterans through the NFM Salute initiative.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.

For the online press release, click here.

LINTHICUM, MD, January 3, 2017— NFM Lending is pleased to honor Tom Wycall as the NFM Salute for January 2017.

Wycall served in the Navy from 1965 to 1968, and spent some 20 months offshore during the Vietnam War supporting operations in the Gulf of Tonkin. As a Gunnery Officer, his offshore ship supported shore bombardment, served as a plane guard for aircraft carriers, and as a search and rescue station for downed pilots and servicemen. Wycall worked his way from Ensign to Lieutenant during his 3 and a half years of service and won a Silver Star for writing the operational orders for the Search and Rescue Station located at the 18th Parallel outside of Hanoi.

To view a video about Wycall’s story in his own words, click here.

NFM Salutes is an initiative in which one military member or Veteran is chosen each month to be honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” will be featured on the website with a brief biography and information about his or her service, and NFM Lending will make a $2,500 donation to a military or Veteran non-profit in the Salute’s name. Wycall chose the Gary Sinise Foundation to receive this month’s donation.

Selected NFM Salutes may choose from one of the following four non-profits: Platoon 22, AnySoldier, Soldier’s Wish, and the Gary Sinise Foundation. NFM looks forward to the opportunity to continue to honor military and Veterans through the NFM Salute initiative.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.

LINTHICUM, MD, December 1, 2016— NFM Lending is pleased to honor Master Sergeant Joseph Bluver, Ret. as the NFM Salute for December 2016

Joseph joined the Illinois Air National Guard in 1984 at the age of 17. After graduating in 1985, he left for Lakeland Air Force Base (AFB) in San Antonio. While attending technical school training at Lowry AFB in Denver, he studied Air Force food service. During his first assignment with the 126th Air Refueling Wing Services Flight, he began his career as an apprentice Cook, advancing quickly through the ranks to hold positions such as Senior Cook, Supervisor, and Food Production Manager.

In 1991, during Operation Desert Storm, Bluver was put on active duty, and stationed at Grissom Air Force Base in Indiana. He left the Illinois National Guard after 16 years and joined the Air Force Reserves. In 2000, he transferred to the Air Force Reserves 440th Services Flight in Milwaukee. In 2003, during Operation Iraqi Freedom, Bluver was once again placed on active duty. He was stationed in North Dakota at Grand Forks Air Force Base attached to the 319th Services Squadron, where he was the assigned Safety and Training Manager in areas such as lodging, base gym, and the dining hall. Bluver retired from the Air Force Reserves in 2004 after more than 20 years of service. Bluver was nominated by his wife, Terri Landey-Bluver whom he married in 1999. They live with their two sons in Lake in the Hills, Illinois.

“There isn’t anything Joe wouldn’t do for you,” said Landey-Bluver. “He would give you the shirt off his back if you asked him for it. He was always there for his servicemen. He would always go beyond on his duties. He was always the first to volunteer to go on a deployment, whether it was stateside or overseas. It was hard once we had children, but he was up for the challenge and continued his service for several years once we had kids. Joe is very committed to everything he does, and does it very well.”

NFM Salutes is an initiative in which one military member or Veteran is chosen each month to be honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” will be featured on the website with a brief biography and information about his or her service, and NFM Lending will make a $2,500 donation to a military or Veteran non-profit in the Salute’s name. Bluver chose Platoon 22 to receive this month’s donation.

Selected NFM Salutes may choose from one of the following four non-profits: Platoon 22, AnySoldier, Soldier’s Wish, and the Gary Sinise Foundation. NFM looks forward to the opportunity to continue to honor military and Veterans through the NFM Salute initiative.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.

Recently, we answered the Top Five Questions About Jumbo Loans. This week, we will discuss VA loans. If you or your spouse is a Veteran or serving in the military and planning to purchase a home soon, these tips will help you decide whether a VA loan is right for you.

Recently, we answered the Top Five Questions About Jumbo Loans. This week, we will discuss VA loans. If you or your spouse is a Veteran or serving in the military and planning to purchase a home soon, these tips will help you decide whether a VA loan is right for you.

VA Loans

The Veterans Affairs (VA) loan program was introduced by the Servicemen’s Readjustment Act, also known as the GI Bill of Rights. These loans are insured by the United States Department of Veteran Affairs, and were designed to provide Veterans and service members with a federally guaranteed home loan with little or no down payment, so that they and their families can take part in the American Dream of homeownership.

Veterans and active duty service members are eligible for the VA loan program. The surviving unmarried spouse of a deceased Veteran may also be eligible for a VA loan. More information about eligibility for VA loans can be found on the VA website.

VA loan limits are the amount a qualified Veteran or active duty service member with full entitlement may be able to borrow without making a down payment. How much you can borrow with a VA loan will depend on your lender and the county you are buying your home in. The basic entitlement available to each eligible Veteran or active duty service member is $36,000; lenders will typically lend up to 4 times a Veteran’s available entitlement, if the Veteran’s income and credit qualify.

VA loans will finance up to 100% of your home purchase, meaning that you may be able to purchase a home with no down payment.

Most Veterans purchasing a home with a VA loan will be required to pay a VA funding fee. The purpose of this fee is to reduce the cost of the loan to taxpayers, as the VA loan requires no down payment and often no private mortgage insurance (PMI). The amount of the funding fee depends on the loan amount, loan type, and your military category. Some VA home buyers are exempt from having to pay the VA funding fee.

VA loans offer no down payment requirement (for qualifying consumers) and often do not require PMI. Additionally, Cash Out Refinance loans allow you to take out up to 95% of the appraised value of your home as determined by VA. Some states also offer additional resources to Veteran homeowners, such as property tax reductions.

If you are a Veteran or active duty service member, you may be able to take advantage of the benefits offered by the VA loan program. For more information about VA loans, please visit the VA website. If you have more questions about buying a home with a VA loan, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

*100% financing is available, sales price cannot exceed the appraised value. ** Veterans Affairs loans require a 1st time funding fee, which is based on various loan characteristics, your actual loan amount may be higher than the purchase price.

LINTHICUM, MD, November 1, 2016— NFM Lending is pleased to honor Edward Strine as the NFM Salute for November 2016

Strine served in the U.S. Navy from 1944-1946, and spent much of his time in the military in the keel of a ship serving in the engine and fire rooms as a Fireman First Class. One of the carriers he served on during WWII was the USS Aaron Ward. On May 3, 1945, the Aaron Ward was attacked by Kamikaze airplanes, leaving Strine on the deck severely burned and dying. While one of his friends was loading up the soldiers who had not survived the attack into body bags to be thrown overboard, he noticed that Strine was still breathing and got him medical help, saving his life. Strine is featured in a book about the attack, and recently hosted a Navy Pilot who has been trying to meet the 13 remaining survivors of the 360 men aboard the USS Aaron Ward.

To view a video about Strine’s story in his own words, click here.

NFM Salutes is an initiative in which one military member or Veteran is chosen each month to be honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” will be featured on the website with a brief biography and information about his or her service, and NFM Lending will make a $2,500 donation to a military or Veteran non-profit in the Salute’s name. This month, NFM Lending will donate to Soldier’s Wish in Strine’s name.

Selected NFM Salutes may choose from one of the following four non-profits: Platoon 22, AnySoldier, Soldier’s Wish, and the Gary Sinise Foundation. NFM looks forward to the opportunity to continue to honor military and Veterans through the NFM Salute initiative.

For more information, please contact:

NFM Lending

Toll Free: 1-888-233-0092

pr@nfmlending.com

www.nfmlending.com

Twitter: @nfm_lending

About NFM Lending

“NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender™.”

LINTHICUM, MD, September 2, 2016— NFM Lending is pleased to honor Shad Lorenz as the NFM Salute for September 2016.

Shad is a 12 year United States Army Veteran with two combat deployments in support of Operation Iraqi Freedom. During his 12 years of service, he has conducted extensive military training both physically and mentally challenging. After September 11th , Shad enlisted in the United States Army. Enlisting in the Infantry was a big step towards his interest in fitness. Outside of the Military, Shad was introduced to weightlifting through friends, who would lift weights after work and on weekends. It started out as a hobby, but began to evolve the more he looked into the sport of weightlifting. Lorenz and his wife eventually would open CrossFit Germantown Performance, a gym in Germantown, MD.

“I joined the Army on September 11, 2001 because of the attack on our soil,” said Lorenz. “I wanted to serve and do my part for my country. After spending 12 years in active duty and serving with some of the finest soldiers I have had the privilege to meet, serving my country with the people I have and supporting this country is the greatest honor I have ever been a part of.”

Lorenz was nominated by his wife, Beth Piantone.

“Shad is a wonderful, loving and extremely giving person,” said Piantone. “He loves to train people in physical fitness to help them be the best version of themselves possible. He is a selfless bleeding heart who would give you the shirt off his back while he’s fiercely protecting his family and community from enemies and dangers.”

NFM Salute is an initiative in which one military member or Veteran is chosen each month to be honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” will be featured on the website with a brief biography and information about his or her service, and NFM Lending will make a $2,500 donation to a military or Veteran non-profit in the Salute’s name. Lorenz chose The Gary Sinise Foundation to receive this month’s donation.

Selected NFM Salutes may choose from one of the following four non-profits: Platoon 22, AnySoldier, Soldier’s Wish, and the Gary Sinise Foundation. NFM looks forward to the opportunity to continue to honor military and Veterans through the NFM Salute initiative.

For more information please contact:

NFM Lending

Toll Free: 1-888-233-0092

pr@nfmlending.com

www.nfmlending.com

Twitter: @nfm_lending

About NFM Lending

“NFM Lending is a mortgage lending company currently licensed in 28 states in the U.S. The company was founded in Baltimore, Maryland in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender™.”