When applying for a loan, one of the most important factors that will come into play is your credit score. Before you start the loan application process, you should have a clear understanding of how your credit score affects your mortgage rate so you can assess your financial situation.

Most lenders use the FICO (Fair Isaac Corporation) model for credit scores. This model provides consumers a numerical value on a scale between 300-850. Typically, the higher your credit score, the lower the interest rate the lender will offer to you. Lenders use your credit score to determine how reliable you’ll be as a borrower and the likelihood that you’ll repay the loan as agreed upon. Essentially, they want to make sure you’ll make your mortgage payments on time each month. A lower score might indicate that a borrower could make late payments or even miss some. This is all part of your credit history, which they will also take into consideration.

Not necessarily. It mostly impacts which type of loan you’ll qualify for and the interest rate you’ll receive. A conventional loan usually requires a minimum of a 620 credit score, whereas an FHA loan has a minimum of 580. However, it’s important to note that while some loan programs accept lower credit scores, they might require a larger down payment or some other way to mitigate the lender’s risk in taking on the loan. In addition, even though someone with a 580 credit score COULD qualify for an FHA loan, it does not mean that they will; it is at the discretion of the lender within the guidelines of the loan programs.

A borrower has obtained a conventional fixed-rate 30-year loan of $200,000 with 10% down, meaning the amount borrowed is $180,000. She has a 750 credit score and received a 4% interest rate. Her monthly mortgage payment is $859 (not factoring in other fees, such as private mortgage insurance (PMI) or real estate taxes that may be included in the payment). Now, say that borrower dropped to a 650 credit score. She instead received a 5% interest rate. That increases her monthly mortgage payment to $966. That 100 point difference between credit scores ultimately means an extra $107 added to her mortgage payment each month. While that might not seem like a big deal, keep in mind the duration of the loan is 30 years. Having a higher interest rate means a yearly difference of $1,284; over 30 years that totals $38,520.

If you’re interested in comparing interest rates and monthly mortgage payments, use our mortgage calculator.

Don’t worry if your credit isn’t the best right now. Raising your credit score can take a lot of time, patience, and discipline. However, if you follow these simple guidelines you will soon notice a positive change in your credit and ultimately your financial future. You’ll be able to qualify for better rates when it’s finally time to buy a home.

To learn more about credit scores and interest rates, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

*The figures used in this example are hypothetical and the results are intended for illustrative and educational purposes only. **NFM Lending is not a credit repair company. Please contact a credit repair company for more information on how to improve your credit score.

As you move through the homebuying process and have to choose a mortgage, each option will present an interest rate. This rate determines how much you must repay the lender as a part of your monthly mortgage payment. While you might be familiar with interest rates, there is probably a component of mortgage rates you haven’t heard of—the G-Fee. If you just asked yourself ‘what is a G-Fee and what does it have to do with my interest rate’, you’re not alone.

So, what is a G-Fee?

Short for ‘Guarantee Fee’, the G-Fee covers the servicing of Fannie Mae, Freddie Mac or Ginnie Mae (government-sponsored enterprises, or GSEs), who provide government backing for some mortgage loans. Think of it as insurance for the loans they buy and/or sell to ensure payments of both principal and interest are made in the instance the borrower defaults. This fee is only included in interest rates for single-family loans.

G-Fees are only a small contributor to the overall interest you pay. The majority goes to whoever bought your loan (a bank or investors) and the servicer who collects your monthly payments. The G-Fee is typically not disclosed to borrowers and if they have an impact on interest rates, it is usually minor. However, even as the smallest contributor, you should know how they could potentially impact your rate.

The Federal Housing Finance Authority (FHFA) oversee the GSEs and can adjust G-Fees if they choose. These adjustments don’t always have to do with the economy, the Federal Reserve policy, or even the housing market. In 2012, for example, Congress used increased G-Fees to bridge the gap incurred by payroll tax cuts.

What does it have to do with my interest rate?

You might be wondering if such a small fee can impede your ability to buy a home. Simply put—yes, it can. An increase in G-Fees means there could be an increase on interest rates in general. As the borrower paying interest, that means more money out of your pocket. However, if the G-Fee is lowered it benefits the borrower and makes buying a home more affordable.

When choosing a mortgage, there are options that impact the interest rate throughout the life of your mortgage, such as Fixed-Rate or Adjustable Rate (ARM) mortgages. You can also consider locking in your interest rate to ensure yours will stay the same regardless of changes.

As small as G-Fees may be, it is important to know what they are and the potential impact they present. You can consider your mortgage options and make an informed decision on which is right for you.

If you have any questions about G Fees, locking in an interest rate, mortgages, or the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

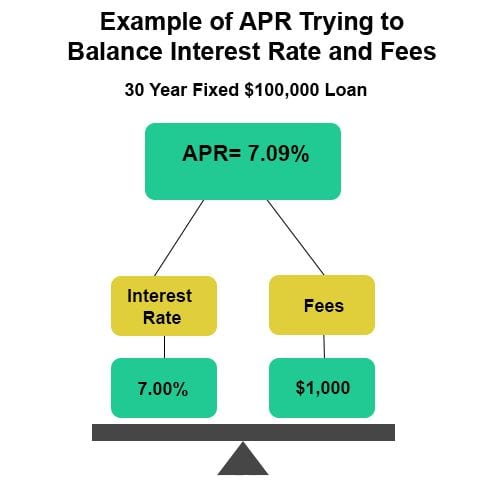

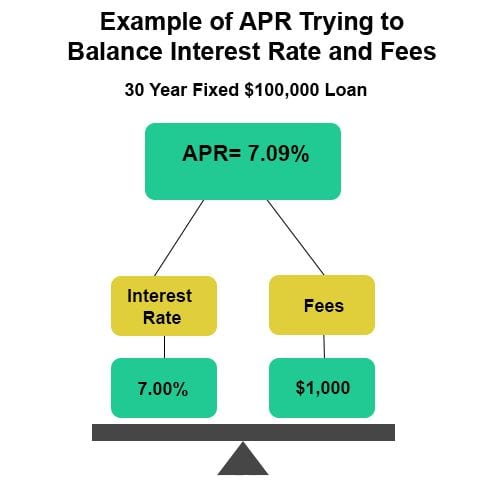

Do you know what the difference is between Interest Rate and APR? These two items are key terms to know when researching mortgage loans. Here are their definitions:

Interest rate is the rate at which interest is paid by borrowers for the use of money that they borrow from a lender. This is important to note when comparing quotes for different loans since it directly affects your monthly payments.

Annual Percentage Rate (APR) describes the interest rate for a whole year (annualized), rather than just a monthly fee/rate, or more simply, it is a finance charge expressed as an annual rate. The APR is a broader measure of cost to you of borrowing money, and reflects not only the interest rate but also the points, broker fees, and other charges that you have to pay to get the loan, including some of your closing costs. For that reason, your APR is usually higher than your interest rate. The APR can help consumers understand the differences between the interest rate and the fees paid at closing. This was established as a part of the Truth in Lending Act.

Below is a diagram that shows how APR tries to balance (and incorporate) both interest rates and fees.

How APR is Determined

To calculate the APR, the fees required to finance the loan are added to the interest rate. These are able to be combined by amortizing (paying off debt in regular installments over a period of time) the fees over the course of the loan, and calculating a new rate.

If you have any questions about interest rate and APR during your loan process, click here to talk to one of our Licensed Mortgage Loan Originators today!