If you have any questions or want more information about the home buying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

When you are starting the homebuying process, you’ll hear many real estate and mortgage industry terms that may sound the same. Two terms that often get confused for one another are “prequalified” and “preapproved”. What exactly is the difference between “prequalification” and “preapproval”? Both can be used to gauge your creditworthiness to be approved for a mortgage, but they are not the same thing. You should understand the difference.

Getting prequalified for a mortgage is a smart first step when you’re considering buying a home. A mortgage prequalification is when you provide basic financial information (such as your income and assets) to get a rough estimate of how much you may be approved for. You can get prequalified by speaking with a lender or even by going online. If you’re unsure of which lender to go with or how much of a loan you can expect to be approved for, prequalification is a good place to start.

Preapproval is a more formal version of prequalification. You’ll need to give your lender more in-depth information about you and your finances, such as proof of ID, W-2 forms, and pay stubs. The lender will also perform a credit check, so make sure you’re practicing good credit habits in the meantime. Once the lender determines how much you can be approved for, you will receive a letter stating so. Having a preapproval letter will be an asset when making an offer to a seller; it lets them know you’re able to obtain a mortgage and that you’re a serious buyer. Additionally, when you have a more concrete idea of how much you can afford, you can be a more informed buyer when searching for homes. A preapproval letter will only be good for 60-90 days, after which you’ll need to repeat the process to get an updated figure. Even though a preapproval isn’t a guarantee of loan approval, having it can expediate the process and will give you an advantage when you’re ready to present an offer.

Prequalification is a sensible jumping-off point when you start your homebuying journey, but it’s merely an informal way for you to see how much of a loan you might be eligible for. It holds no real weight when you’re on the market for a home. A preapproval, on the other hand, will give you firmer numbers to base your choices around and makes you a more attractive buyer to sellers.

If you have questions about getting prequalified or preapproved, contact one of our Licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

When you’re ready to start house hunting, you’ll likely come across homes in neighborhoods that have a rather consistent and harmonious look. It’s a good guess that these homes are part of an HOA, or Homeowners Association. What is an HOA, you ask?

An HOA is an organized group of homeowners within a particular subdivision, planned community, or condominium who create and enforce rules for their properties and residents. There is typically a board of directors who will hold regular meetings to discuss budgets and review rules and regulations. If you agree to live in an HOA community, those rules are legally binding.

Members of an HOA are required to pay dues on a monthly, quarterly, or yearly basis. They can range in cost from $50 to thousands of dollars, depending on the area and living situation. A community that offers a bunch of amenities will have higher fees than one that does not.

The fees you pay will cover the costs of varying things. Some communities might offer a pool or clubhouse, 24/7 security, trash pickup, a state-of-the-art gym, or even landscaping. It could also cover snow removal or emergency repairs. You should ask for a report of how fees are disbursed for a better understanding of what exactly you’re paying for.

You should be aware that an HOA can raise its fee. Make sure to ask what projects are in process and if there is an emergency fund before making a decision. If they don’t have a reserve fund, you could be on the hook to pay extra or raised fees to fix something unpredictable, such as a roof on a communal building after a storm.

Homes in an HOA are held to a higher standard than you might find elsewhere. The value of your property can increase because the community is going to remain visually appealing; lawns will be mowed, no scrap cars in the front yard, etc. Any issues you have regarding a neighbor can be handled through the HOA rather than personally getting involved. However, an HOA can become a nuisance if they are poorly managed or are extremely limiting.

Every HOA has different rules, known as covenants, conditions and restrictions, or CC&Rs. Depending on the conditions, you might not be able to make changes to your home that are seemingly insignificant. This can include painting your home a new color, installing solar panels, making renovations, or even changing the color of your front door. You might have to keep your lawn manicured to a certain length or watered even during a drought. Review the CC&Rs so you know all the details before you make a final decision.

When looking for your future home, you should carefully weigh the pros and cons of living in an HOA. Make sure to consider all factors, including costs and rules, to help you determine if this is the right option for you.

If you have questions about HOAs or the homebuying process, contact one of our Licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

When applying for a loan, one of the most important factors that will come into play is your credit score. Before you start the loan application process, you should have a clear understanding of how your credit score affects your mortgage rate so you can assess your financial situation.

Most lenders use the FICO (Fair Isaac Corporation) model for credit scores. This model provides consumers a numerical value on a scale between 300-850. Typically, the higher your credit score, the lower the interest rate the lender will offer to you. Lenders use your credit score to determine how reliable you’ll be as a borrower and the likelihood that you’ll repay the loan as agreed upon. Essentially, they want to make sure you’ll make your mortgage payments on time each month. A lower score might indicate that a borrower could make late payments or even miss some. This is all part of your credit history, which they will also take into consideration.

Not necessarily. It mostly impacts which type of loan you’ll qualify for and the interest rate you’ll receive. A conventional loan usually requires a minimum of a 620 credit score, whereas an FHA loan has a minimum of 580. However, it’s important to note that while some loan programs accept lower credit scores, they might require a larger down payment or some other way to mitigate the lender’s risk in taking on the loan. In addition, even though someone with a 580 credit score COULD qualify for an FHA loan, it does not mean that they will; it is at the discretion of the lender within the guidelines of the loan programs.

A borrower has obtained a conventional fixed-rate 30-year loan of $200,000 with 10% down, meaning the amount borrowed is $180,000. She has a 750 credit score and received a 4% interest rate. Her monthly mortgage payment is $859 (not factoring in other fees, such as private mortgage insurance (PMI) or real estate taxes that may be included in the payment). Now, say that borrower dropped to a 650 credit score. She instead received a 5% interest rate. That increases her monthly mortgage payment to $966. That 100 point difference between credit scores ultimately means an extra $107 added to her mortgage payment each month. While that might not seem like a big deal, keep in mind the duration of the loan is 30 years. Having a higher interest rate means a yearly difference of $1,284; over 30 years that totals $38,520.

If you’re interested in comparing interest rates and monthly mortgage payments, use our mortgage calculator.

Don’t worry if your credit isn’t the best right now. Raising your credit score can take a lot of time, patience, and discipline. However, if you follow these simple guidelines you will soon notice a positive change in your credit and ultimately your financial future. You’ll be able to qualify for better rates when it’s finally time to buy a home.

To learn more about credit scores and interest rates, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

*The figures used in this example are hypothetical and the results are intended for illustrative and educational purposes only. **NFM Lending is not a credit repair company. Please contact a credit repair company for more information on how to improve your credit score.

Getting ready to purchase a home is a huge financial undertaking. While you are probably aware of having to save up for a down payment, you might not know about closing cost fees. Don’t be taken by surprise at the closing table; here’s what you need to know about closing costs.

Closing costs are the fees charged for services performed during the home purchasing process that you will pay at closing. Closing is the final step of the loan process and is a meeting between you (the buyer), the seller, and closing officer (a lawyer or title/escrow company representative, depending on the state). You will review the legal documents provided in your loan package and execute all required documents. This step is extremely important, as it is the final confirmation of the loan terms as discussed with your lender.

The closing costs you might have to pay will vary based on the property, where you live, and the loan you choose. The following are a few of the most common fees you may see.

Again, closing costs will not be the same for everyone as they vary by region. On average, most homebuyers typically pay about 2 to 5 percent of the home purchase price. For example, if the home costs $250,000, you might pay between $5,000 and $12,500 in closing fees.

It is likely you might be able to avoid some closing cost, but not all. Here a few ways to save on closing costs.

Your lender will provide you with an estimate of what closing costs will be at the beginning of your application process, which will allow you the chance to shop around to find the best lender and deal for you. After finding a lender and going through the loan process, you will receive a closing disclosure, or the final closing cost total, at least 3 business days prior to closing. This is your time to make sure everything looks right and if you have questions or find a mistake, you have time to contact your lender. If you’re worried about how much you’ll pay in closing costs, there’s plenty of options for you! NFM participates in most state bond programs that provide closing cost assistance.

To learn more about closing costs or bond programs, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

Are you ready to purchase your first home? The homebuying process can get overwhelming, especially when considering all your financing options. While there are several mortgage options available, these are the top loan products for first-time homebuyers.

Conventional

A conventional, or conforming, loan is not insured or guaranteed by the federal government. This loan option adheres to guidelines set by Fannie Mae and Freddie Mac. With this loan, you can choose between a 15 or 30-year term, with a fixed or adjustable interest rate. Conventional loans are typically used by borrowers with good/great credit and typically require a higher income.

FHA

An FHA (Federal Housing Administration) is a government-insured loan. This loan is popular among first-time homebuyers because of their low minimum down payment. This loan requires only a 3.5% minimum, which is much lower than other loan options. You might also pay fewer closing costs.

VA

VA loans are guaranteed by the United States Department of Veterans Affairs for eligible American Veterans and active duty service members. These loans were designed to guarantee service members a federally funded home with their no down payment requirement and up to 100% financing. Information on eligibility for VA loans can be found on the VA website.

Purchasing your first home is a huge milestone. Having a qualified mortgage professional by your side to help you choose the right loan option will ensure a smooth homebuying experience. Let them help you start the homebuying process by getting pre-approved today!

If you have any questions about these loan products, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the homebuying process, click here to get started!

Buying a home is one of the most significant financial decisions you will make in your life. In order to make an informed decision, doing some research for each step of the process can help ensure a smooth transaction. Here are the 6 basic steps needed to purchase a home.

Step 1: Get Pre-Qualified

It is important to get pre-qualified so that you will know what you can afford, what you will qualify for, and what types of homes you should be looking at. Pre-qualification allows you to enter the home buying process prepared. It makes your home search more efficient and ensures that when it comes time to make an offer on a home, you are ready.

Step 2: Determine Your Loan Type

Conventional? FHA? USDA? VA? 203K? Find the best loan for you based on your personal financial situation, how long you plan to live in your home, how quickly you plan on paying your mortgage back, etc.

Step 3: Find Your Home (and Make an Offer!)

It’s finally time to begin your home search. This may be the most exciting part of the process, and it can be easy to get caught up in that excitement. It’s important to make this decision carefully, consider your options, and to work with knowledgeable professionals who can help you make the best choice.

Step 4: Apply for the Loan

This is the time to assemble and submit all your financial information and documentation to your lender for evaluation. Once you signed a contract, contact your Loan Originator to submit your loan. They are there to help you figure out what documentation you need to provide, and ask you questions about your financing so that you can submit the best possible loan application.

Step 5: Processing and Underwriting

Once you apply for a home loan, your Mortgage Loan Originator will submit all your documentation to processing, and from there, your loan will be sent to underwriting. Processing will order a title search to make sure that the seller has legal rights to the property and schedule an appraisal to determine the value of the property. From there, your loan will be sent to Underwriting where it will be determined if the loan is a good fit. A clear-to-close (CTC) will be issued if approved.

Step 6: Go to Closing (and enjoy your new home!)

At closing, all the necessary paperwork is presented and signed by both the sellers and the buyers, the title of the property is transferred, and all the documents are recorded. Congratulations, you are officially a homeowner!

Homeownership is a rewarding achievement. The home buying process may present challenges but having qualified mortgage professionals by your side can make all the difference. If you have any questions about the home buying process, contact one of our licensed Mortgage Loan Originators. If you are ready to buy a home, click here to get started!

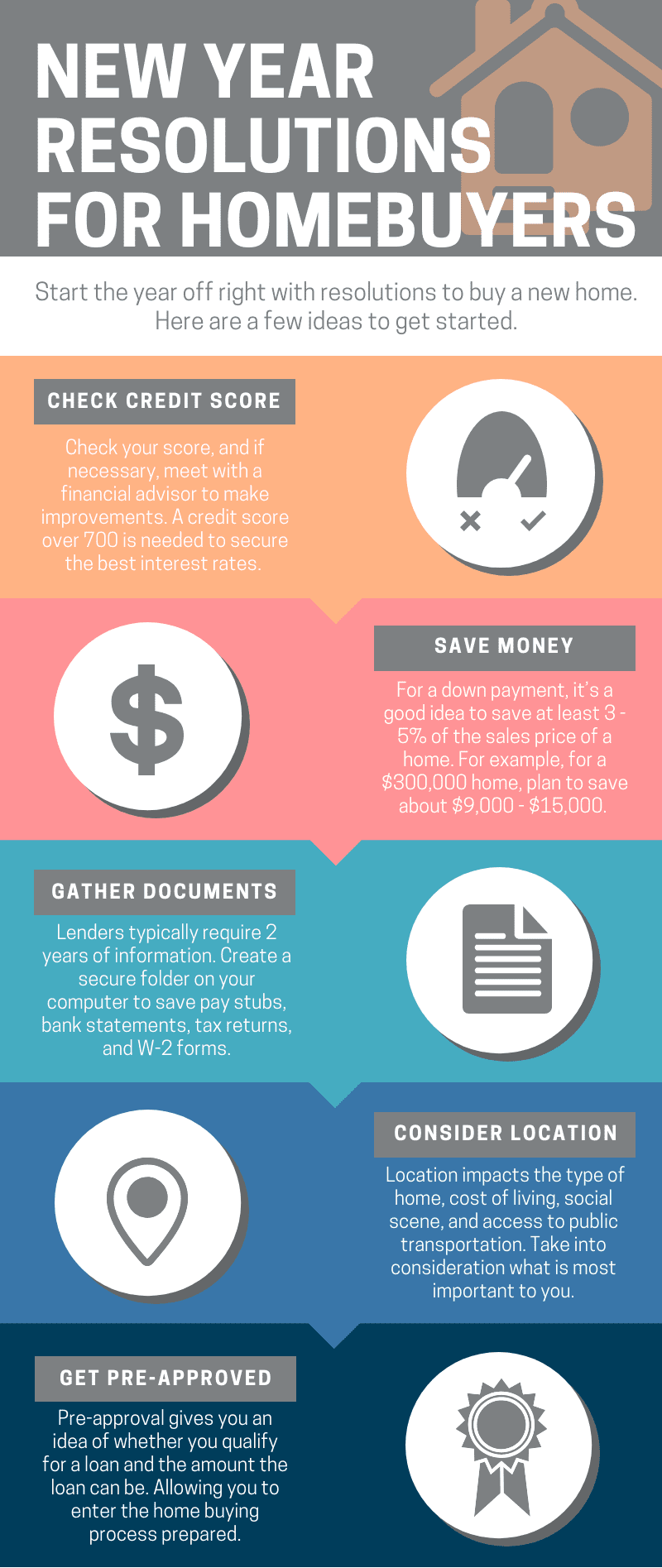

Make 2019 the year you become a home owner! Here are some new year resolutions for homebuyers to get you started.

If you have any questions or want more information about the home buying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

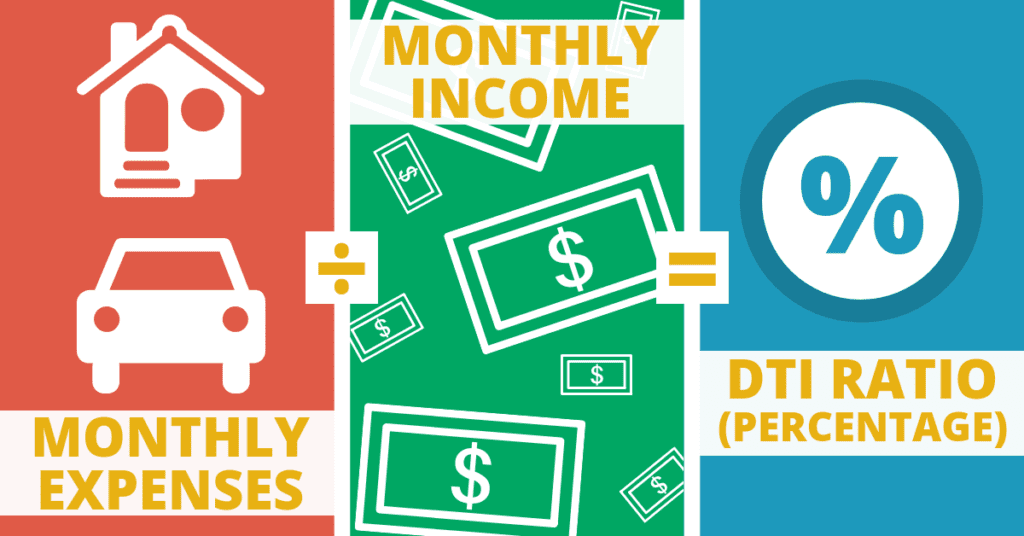

During the homebuying process, you’ll come across many terms, such as debt-to-income (DTI) ratio. This ratio allows your lender to see the balance you have between your income and your debts. You need to understand your DTI ratio, so you can be in the best financial standing before applying for a loan.

Simply put, the DTI ratio measures your ability to manage the monthly payments on your mortgage. This is done by taking all your debt payments (car, student loans, mortgage) and dividing them by your gross monthly income. Your gross monthly income is the amount of money you make before taxes and other deductions.

For example:

Every month you pay your mortgage ($1,400), car ($150), and student loans ($250). Your total monthly debt is $2,100 ($1,400 + $150 + $250 = $2,100). Your gross monthly income is $6,500, making your debt-to-income ratio .32 or 32% percent ($2,100 ÷ $6,500 = 32%).

So why is this ratio so important? When applying for a mortgage, your lender needs to ensure you will be able to handle your monthly mortgage payment. Your DTI is the percentage of your income that will be covering your mortgage payments. Don’t rely on your DTI when setting a budget, as it does not account for all costs of living. You will need to still consider your additional expenses, such as food and utilities.

If your ratio is too high, you might not qualify for certain programs. Most lenders have a set ratio they look for, typically less than 36%. The higher your DTI is the tighter your finances will be. Your lender wants to ensure you are able to live comfortably and can easily cover all of your debts and costs of living. Don’t worry, if your DTI is higher than 36% you can still qualify for a loan.

Before applying for a loan, you should calculate your DTI. If you find your ratio to be on the higher side, you can take some steps to lower it. Pay off as much of your debt as possible before applying. You should also avoid making any large purchases or obtaining any additional debt. If possible, you can also look for ways to increase your monthly income.

Becoming a homeowner requires a lot of preparation, especially financial. To increase the likeliness of obtaining the loan you want, calculate your DTI and adjust as needed.

For more information about DTI or the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

As you move through the homebuying process and have to choose a mortgage, each option will present an interest rate. This rate determines how much you must repay the lender as a part of your monthly mortgage payment. While you might be familiar with interest rates, there is probably a component of mortgage rates you haven’t heard of—the G-Fee. If you just asked yourself ‘what is a G-Fee and what does it have to do with my interest rate’, you’re not alone.

So, what is a G-Fee?

Short for ‘Guarantee Fee’, the G-Fee covers the servicing of Fannie Mae, Freddie Mac or Ginnie Mae (government-sponsored enterprises, or GSEs), who provide government backing for some mortgage loans. Think of it as insurance for the loans they buy and/or sell to ensure payments of both principal and interest are made in the instance the borrower defaults. This fee is only included in interest rates for single-family loans.

G-Fees are only a small contributor to the overall interest you pay. The majority goes to whoever bought your loan (a bank or investors) and the servicer who collects your monthly payments. The G-Fee is typically not disclosed to borrowers and if they have an impact on interest rates, it is usually minor. However, even as the smallest contributor, you should know how they could potentially impact your rate.

The Federal Housing Finance Authority (FHFA) oversee the GSEs and can adjust G-Fees if they choose. These adjustments don’t always have to do with the economy, the Federal Reserve policy, or even the housing market. In 2012, for example, Congress used increased G-Fees to bridge the gap incurred by payroll tax cuts.

What does it have to do with my interest rate?

You might be wondering if such a small fee can impede your ability to buy a home. Simply put—yes, it can. An increase in G-Fees means there could be an increase on interest rates in general. As the borrower paying interest, that means more money out of your pocket. However, if the G-Fee is lowered it benefits the borrower and makes buying a home more affordable.

When choosing a mortgage, there are options that impact the interest rate throughout the life of your mortgage, such as Fixed-Rate or Adjustable Rate (ARM) mortgages. You can also consider locking in your interest rate to ensure yours will stay the same regardless of changes.

As small as G-Fees may be, it is important to know what they are and the potential impact they present. You can consider your mortgage options and make an informed decision on which is right for you.

If you have any questions about G Fees, locking in an interest rate, mortgages, or the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

Who hasn’t dreamed of having a home on the water? Whether it’s beach, lake, or riverfront, a waterfront home can be a great investment but should not be made without the proper research and consideration. Before making any costly mistakes, you need to know what to consider when buying a waterfront home.

Use an Experienced Realtor: Not all realtors have worked with waterfront homes, and therefore are unaware of the complexity involved in buying one. Choose a realtor with plenty of experience so they can easily guide you through the unique homebuying process. While the cost of using someone with more waterfront know-how might be higher, they could save you a lot of money and heartbreak down the road.

Property > Structure: Before getting to far in love with a home, you need to really analyze the actual piece of property. If there is a dock with watercraft access, ensure the depth of the water is adequate. Make sure the water is safe to swim in, as you don’t want to have any unexpected injuries from murky water, large deposits of algae, or a rocky bottom. Don’t discover the view isn’t great until too late. Consider the amount of privacy you want, as there might not be as much as you think (there is a huge difference between a public and private beach). How easy is it to access the water from your home, and vice versa? Some homes might have stairs leading down to the water or other paths, so ensure you will be comfortable using the access both now and in years to come. Bottom line, it is possible to change the house, but not so much the piece of property. That doesn’t mean you should ignore the structure altogether. Waterfront homes require extra measures to ensure they can withstand the elements. For example, for homes on/near salt water need to use stainless steel metals to avoid corrosion and will be more likely to need storm shutter for potential hurricanes. Research the effect of the elements on all aspects of living before making any decisions, as it’s more than just the house that can be impacted.

Loan First, Then House: Since buying a waterfront home is usually more expensive than buying a landlocked home, you’ll most likely need to get a jumbo loan. Typically, these loans take longer to obtain so you’ll want to start the loan process early, so you don’t miss out on the home of your dreams. To find out how much home you can afford, contact a trusted lender to get pre-qualified for a loan.

Property Improvement: Don’t buy your dream home and then find out you can’t make any improvements to the property! Do your research and check with the city to see if there are any limitations on the property concerning the removal of trees/bushes, building a pool or other structure, or even adding a dock. Depending on the type of waterfront, you should also check to see what activities are allowed, such as jet skiing, as there could be restrictions.

Flood Insurance: Owning a waterfront home comes with the potential of floods. While flood insurance can be expensive, it is a necessity. You might want to consider the possibility of the sea level rising and what kind of flood mitigation the property has. Another consideration, dependent on the location you’re buying, is that you might need more insurance than just flood. Knowing exactly what kind of insurance you need and where to get it is why we emphasize the need for an experienced realtor and lender!

Talk Around: Utilize the neighbors! They have most likely lived in the area for a while and know all the ins and outs. They can tell you about what issues you might face and might even have ‘insider’ information about the home you’re interested in. Also, they went through the waterfront homebuying process and might have some tips for you.

Middle of Nowhere: If the property is in a rural location there might be some new experiences for those who’ve been spoiled with the city/suburban conveniences. You most likely had electricity, water, sewage, cable, internet, etc. readily available, but that is not always the case with homes that are remote areas. In some cases, you might have to bring those utilities onto the property, which can get expensive. Do some investigating to see what the property has to offer, and how much it would cost to get what you need.

Responsibilities: Becoming the owner of a waterfront property also comes with becoming the caretaker of said property. If you are part of a HOA, there could be specific rules regarding the upkeep and maintenance of the property. If you are unable to do so yourself, consider adding a caretaker or other services into your budget.

Owning a waterfront home can become a reality, but make sure you are educated in what it really takes to purchase one. Do thorough research to become aware of any potential issues or unexpected costs. With the help of a knowledgeable realtor, lender, and these tips, you should have no problem getting the waterfront home of your dreams.

If you have any questions or want more information about the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!