When applying for a loan, one of the most important factors that will come into play is your credit score. Before you start the loan application process, you should have a clear understanding of how your credit score affects your mortgage rate so you can assess your financial situation.

Most lenders use the FICO (Fair Isaac Corporation) model for credit scores. This model provides consumers a numerical value on a scale between 300-850. Typically, the higher your credit score, the lower the interest rate the lender will offer to you. Lenders use your credit score to determine how reliable you’ll be as a borrower and the likelihood that you’ll repay the loan as agreed upon. Essentially, they want to make sure you’ll make your mortgage payments on time each month. A lower score might indicate that a borrower could make late payments or even miss some. This is all part of your credit history, which they will also take into consideration.

Not necessarily. It mostly impacts which type of loan you’ll qualify for and the interest rate you’ll receive. A conventional loan usually requires a minimum of a 620 credit score, whereas an FHA loan has a minimum of 580. However, it’s important to note that while some loan programs accept lower credit scores, they might require a larger down payment or some other way to mitigate the lender’s risk in taking on the loan. In addition, even though someone with a 580 credit score COULD qualify for an FHA loan, it does not mean that they will; it is at the discretion of the lender within the guidelines of the loan programs.

A borrower has obtained a conventional fixed-rate 30-year loan of $200,000 with 10% down, meaning the amount borrowed is $180,000. She has a 750 credit score and received a 4% interest rate. Her monthly mortgage payment is $859 (not factoring in other fees, such as private mortgage insurance (PMI) or real estate taxes that may be included in the payment). Now, say that borrower dropped to a 650 credit score. She instead received a 5% interest rate. That increases her monthly mortgage payment to $966. That 100 point difference between credit scores ultimately means an extra $107 added to her mortgage payment each month. While that might not seem like a big deal, keep in mind the duration of the loan is 30 years. Having a higher interest rate means a yearly difference of $1,284; over 30 years that totals $38,520.

If you’re interested in comparing interest rates and monthly mortgage payments, use our mortgage calculator.

Don’t worry if your credit isn’t the best right now. Raising your credit score can take a lot of time, patience, and discipline. However, if you follow these simple guidelines you will soon notice a positive change in your credit and ultimately your financial future. You’ll be able to qualify for better rates when it’s finally time to buy a home.

To learn more about credit scores and interest rates, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

*The figures used in this example are hypothetical and the results are intended for illustrative and educational purposes only. **NFM Lending is not a credit repair company. Please contact a credit repair company for more information on how to improve your credit score.

If you’re looking to buy a home, be prepared to meet a few challenges with today’s housing market. Not only is there a shortage of homes, but the available housing stock is aging. These challenges might seem discouraging but taking a look at the 2018 housing market and what options you have as a homebuyer, it is still possible to find a home to make your own.

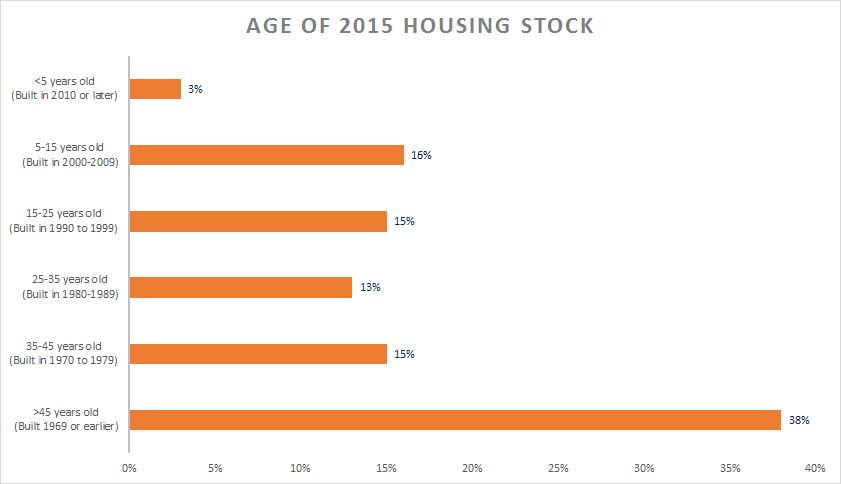

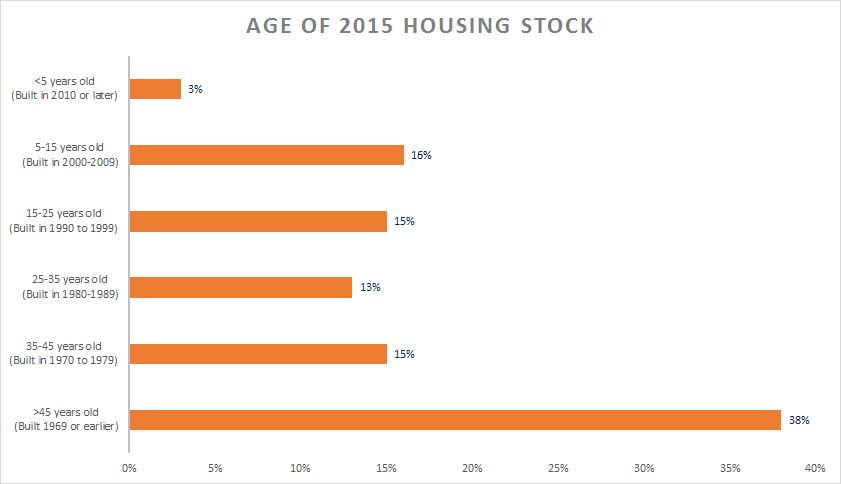

As of 2015, 66% of the US owner-occupied housing stock was built before 1980, with around 38% built before 1970, according to the National Association of Home Builders (NAHB). Many of these homes are going to need repairs, renovations, or updates.

And while there are a lot of new homes being built throughout the country, buyers should not turn away from an older home that may need some TLC. There are many renovation and repair loan options available, such as the FHA 203(K) or Fannie Mae’s HomeStyle® loan. FHA 203(k) are a type of federally insured mortgage loans that are used to fund renovations and repairs of single family properties. Fannie Mae’s HomeStyle® Renovationloan permits borrowers to include financing to renovate or make home repairs a purchase or refinance transaction. Find more information about how to finance renovations or home improvements.

Every home is unique and will require varying repairs and updates. But with these mortgage loan options, your dream of renovating an older home and becoming a homeowner are possible!

You can also keep in mind the possibility of building your home from the ground up as there are many construction loans options available as well.

If you have any questions about renovation loans or want more information about the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

Who hasn’t dreamed of having a home on the water? Whether it’s beach, lake, or riverfront, a waterfront home can be a great investment but should not be made without the proper research and consideration. Before making any costly mistakes, you need to know what to consider when buying a waterfront home.

Use an Experienced Realtor: Not all realtors have worked with waterfront homes, and therefore are unaware of the complexity involved in buying one. Choose a realtor with plenty of experience so they can easily guide you through the unique homebuying process. While the cost of using someone with more waterfront know-how might be higher, they could save you a lot of money and heartbreak down the road.

Property > Structure: Before getting to far in love with a home, you need to really analyze the actual piece of property. If there is a dock with watercraft access, ensure the depth of the water is adequate. Make sure the water is safe to swim in, as you don’t want to have any unexpected injuries from murky water, large deposits of algae, or a rocky bottom. Don’t discover the view isn’t great until too late. Consider the amount of privacy you want, as there might not be as much as you think (there is a huge difference between a public and private beach). How easy is it to access the water from your home, and vice versa? Some homes might have stairs leading down to the water or other paths, so ensure you will be comfortable using the access both now and in years to come. Bottom line, it is possible to change the house, but not so much the piece of property. That doesn’t mean you should ignore the structure altogether. Waterfront homes require extra measures to ensure they can withstand the elements. For example, for homes on/near salt water need to use stainless steel metals to avoid corrosion and will be more likely to need storm shutter for potential hurricanes. Research the effect of the elements on all aspects of living before making any decisions, as it’s more than just the house that can be impacted.

Loan First, Then House: Since buying a waterfront home is usually more expensive than buying a landlocked home, you’ll most likely need to get a jumbo loan. Typically, these loans take longer to obtain so you’ll want to start the loan process early, so you don’t miss out on the home of your dreams. To find out how much home you can afford, contact a trusted lender to get pre-qualified for a loan.

Property Improvement: Don’t buy your dream home and then find out you can’t make any improvements to the property! Do your research and check with the city to see if there are any limitations on the property concerning the removal of trees/bushes, building a pool or other structure, or even adding a dock. Depending on the type of waterfront, you should also check to see what activities are allowed, such as jet skiing, as there could be restrictions.

Flood Insurance: Owning a waterfront home comes with the potential of floods. While flood insurance can be expensive, it is a necessity. You might want to consider the possibility of the sea level rising and what kind of flood mitigation the property has. Another consideration, dependent on the location you’re buying, is that you might need more insurance than just flood. Knowing exactly what kind of insurance you need and where to get it is why we emphasize the need for an experienced realtor and lender!

Talk Around: Utilize the neighbors! They have most likely lived in the area for a while and know all the ins and outs. They can tell you about what issues you might face and might even have ‘insider’ information about the home you’re interested in. Also, they went through the waterfront homebuying process and might have some tips for you.

Middle of Nowhere: If the property is in a rural location there might be some new experiences for those who’ve been spoiled with the city/suburban conveniences. You most likely had electricity, water, sewage, cable, internet, etc. readily available, but that is not always the case with homes that are remote areas. In some cases, you might have to bring those utilities onto the property, which can get expensive. Do some investigating to see what the property has to offer, and how much it would cost to get what you need.

Responsibilities: Becoming the owner of a waterfront property also comes with becoming the caretaker of said property. If you are part of a HOA, there could be specific rules regarding the upkeep and maintenance of the property. If you are unable to do so yourself, consider adding a caretaker or other services into your budget.

Owning a waterfront home can become a reality, but make sure you are educated in what it really takes to purchase one. Do thorough research to become aware of any potential issues or unexpected costs. With the help of a knowledgeable realtor, lender, and these tips, you should have no problem getting the waterfront home of your dreams.

If you have any questions or want more information about the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

As a mid-to-late life homebuyer who is ready to change one’s lifestyle or downsize, finding your retirement home will be different than your previous homebuying experiences. This time, you’ll be looking for a home with a shifted focus on what features you find important. The home you buy needs to meet all your current and, more importantly, your future needs. Use these tips when house hunting for a retirement home.

Location: While previously a significant factor when purchasing a home, this time the location of your home needs to be top priority. Take into consideration that driving may not always be an option or even desirable. You’ll want to choose a place that allows you to easily access all the essential places you care about. Your hobbies and interests, such as the beach, golf courses, pools, etc., should be close and have a minimal commute. Cities have public transportation which allows residents to not even need a car. If your friends and family live in rural areas, perhaps moving closer to them might be another option to avoid commuting.

Location: While previously a significant factor when purchasing a home, this time the location of your home needs to be top priority. Take into consideration that driving may not always be an option or even desirable. You’ll want to choose a place that allows you to easily access all the essential places you care about. Your hobbies and interests, such as the beach, golf courses, pools, etc., should be close and have a minimal commute. Cities have public transportation which allows residents to not even need a car. If your friends and family live in rural areas, perhaps moving closer to them might be another option to avoid commuting.

Single-story Homes: If you are thinking about downsizing, now is the time. A single-story home is ideal for older homebuyers. Eventually, going up and down stairs will become troublesome, and there is always the possibility of needing to accommodate a wheelchair or walker. Stairs, even just a few, can make getting around your home more difficult. If you’d like to buy a two-story home, consider having the master bedroom on the first floor. The rooms upstairs can be used for grandchildren or guests. Whichever way you decide to go, plan for the house that will be best for you later, not just what works for you right now.

Single-story Homes: If you are thinking about downsizing, now is the time. A single-story home is ideal for older homebuyers. Eventually, going up and down stairs will become troublesome, and there is always the possibility of needing to accommodate a wheelchair or walker. Stairs, even just a few, can make getting around your home more difficult. If you’d like to buy a two-story home, consider having the master bedroom on the first floor. The rooms upstairs can be used for grandchildren or guests. Whichever way you decide to go, plan for the house that will be best for you later, not just what works for you right now.

Space: Luckily, space is a popular feature in many new homes so it shouldn’t be hard to find. “Open” room concept homes allow for your kitchen, living and dining rooms to flow together. You’ll have less clutter and easier navigation. You should also keep an eye out for larger bathrooms and entryways. More importantly, look for extra-wide hallways and doorways. These will accommodate wheelchairs/walkers and you won’t have to avoid or move around tight spots.

Space: Luckily, space is a popular feature in many new homes so it shouldn’t be hard to find. “Open” room concept homes allow for your kitchen, living and dining rooms to flow together. You’ll have less clutter and easier navigation. You should also keep an eye out for larger bathrooms and entryways. More importantly, look for extra-wide hallways and doorways. These will accommodate wheelchairs/walkers and you won’t have to avoid or move around tight spots.

Important Amenities: A walk/step-in shower will reduce some of the risks that accompany using a bathtub at an older age. Instead of having to step over the side of a tub, having a small step or no step at all is much safer and wheelchair friendly. A larger shower will also come in handy if a beach seat or railing needs to be added. Ramps into your home are not only a wheelchair/walker friendly accommodation, but removes the risk of falling from carrying anything up or down stairs, such as groceries. Keep an eye out for kitchens with lower counters and easy to access cabinets. Use a checklist when touring to keep track of what each home has to offer.

Important Amenities: A walk/step-in shower will reduce some of the risks that accompany using a bathtub at an older age. Instead of having to step over the side of a tub, having a small step or no step at all is much safer and wheelchair friendly. A larger shower will also come in handy if a beach seat or railing needs to be added. Ramps into your home are not only a wheelchair/walker friendly accommodation, but removes the risk of falling from carrying anything up or down stairs, such as groceries. Keep an eye out for kitchens with lower counters and easy to access cabinets. Use a checklist when touring to keep track of what each home has to offer.

Property: Consider a yard that will fit your needs fifteen years down the road. While you might be able to cut the grass, pick weeds, rake leaves, and shovel snow now, that might change. Paying someone to do those tasks for you will get more expensive the larger the piece of property, so factor in the additional costs when making a budget.

Property: Consider a yard that will fit your needs fifteen years down the road. While you might be able to cut the grass, pick weeds, rake leaves, and shovel snow now, that might change. Paying someone to do those tasks for you will get more expensive the larger the piece of property, so factor in the additional costs when making a budget.

Pets: Your pet should absolutely go with you wherever you move, however, some places might have specific pet policies. Be sure to check for any restrictions before deciding on a home, especially if you’re thinking about a retirement community or condo. If you are considering a new home in a multiple story building, be prepared to take your pet on an elevator.

Pets: Your pet should absolutely go with you wherever you move, however, some places might have specific pet policies. Be sure to check for any restrictions before deciding on a home, especially if you’re thinking about a retirement community or condo. If you are considering a new home in a multiple story building, be prepared to take your pet on an elevator.

When preparing to take the next step for your future keep some of these ideas in mind. Homebuying is exciting but can be stressful, especially if this is going to be your retirement home. Knowing what to look for and expect will help ease your mind. Thinking ahead by choosing a home that will meet both your current and future needs will save you time, money, and stress down the road. If you’re thinking about a new construction home, you can use these tips as a guide when thinking about layout and design. Here are some additional items to consider if you are a single homebuyer.

If you have any questions or want more information about the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!