During the homebuying process, you’ll come across many terms, such as debt-to-income (DTI) ratio. This ratio allows your lender to see the balance you have between your income and your debts. You need to understand your DTI ratio, so you can be in the best financial standing before applying for a loan.

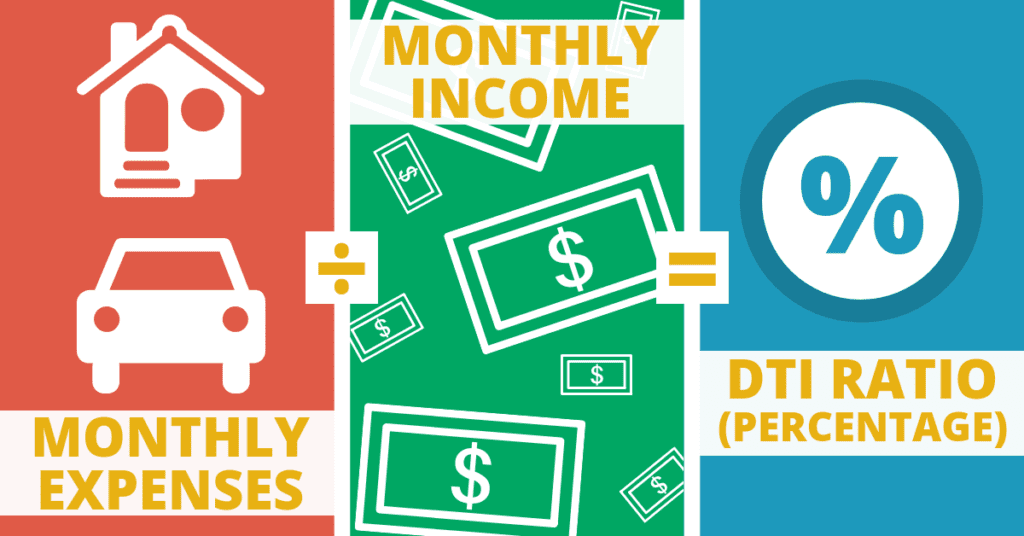

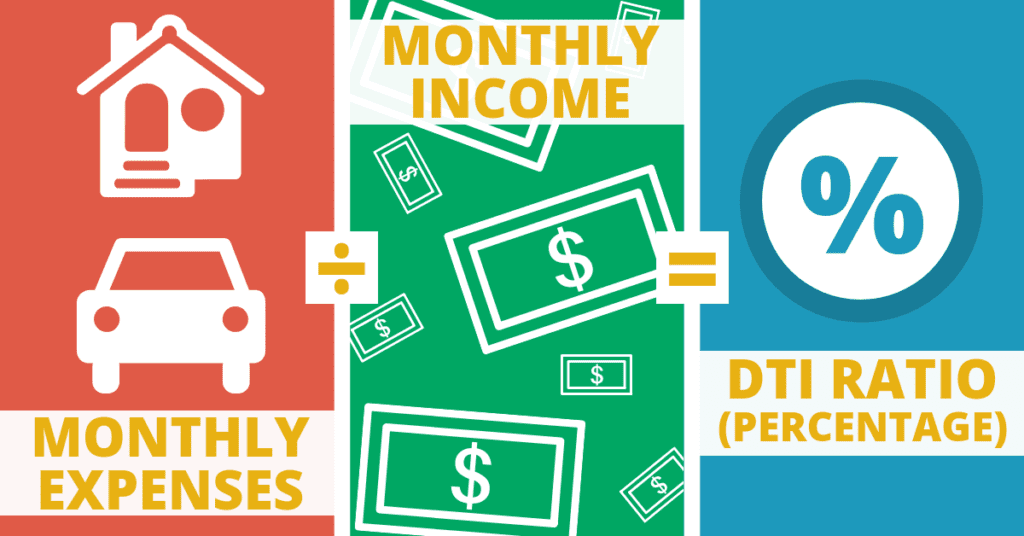

Simply put, the DTI ratio measures your ability to manage the monthly payments on your mortgage. This is done by taking all your debt payments (car, student loans, mortgage) and dividing them by your gross monthly income. Your gross monthly income is the amount of money you make before taxes and other deductions.

For example:

Every month you pay your mortgage ($1,400), car ($150), and student loans ($250). Your total monthly debt is $2,100 ($1,400 + $150 + $250 = $2,100). Your gross monthly income is $6,500, making your debt-to-income ratio .32 or 32% percent ($2,100 ÷ $6,500 = 32%).

So why is this ratio so important? When applying for a mortgage, your lender needs to ensure you will be able to handle your monthly mortgage payment. Your DTI is the percentage of your income that will be covering your mortgage payments. Don’t rely on your DTI when setting a budget, as it does not account for all costs of living. You will need to still consider your additional expenses, such as food and utilities.

If your ratio is too high, you might not qualify for certain programs. Most lenders have a set ratio they look for, typically less than 36%. The higher your DTI is the tighter your finances will be. Your lender wants to ensure you are able to live comfortably and can easily cover all of your debts and costs of living. Don’t worry, if your DTI is higher than 36% you can still qualify for a loan.

Before applying for a loan, you should calculate your DTI. If you find your ratio to be on the higher side, you can take some steps to lower it. Pay off as much of your debt as possible before applying. You should also avoid making any large purchases or obtaining any additional debt. If possible, you can also look for ways to increase your monthly income.

Becoming a homeowner requires a lot of preparation, especially financial. To increase the likeliness of obtaining the loan you want, calculate your DTI and adjust as needed.

For more information about DTI or the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!