When applying for a loan, one of the most important factors that will come into play is your credit score. Before you start the loan application process, you should have a clear understanding of how your credit score affects your mortgage rate so you can assess your financial situation.

Most lenders use the FICO (Fair Isaac Corporation) model for credit scores. This model provides consumers a numerical value on a scale between 300-850. Typically, the higher your credit score, the lower the interest rate the lender will offer to you. Lenders use your credit score to determine how reliable you’ll be as a borrower and the likelihood that you’ll repay the loan as agreed upon. Essentially, they want to make sure you’ll make your mortgage payments on time each month. A lower score might indicate that a borrower could make late payments or even miss some. This is all part of your credit history, which they will also take into consideration.

Not necessarily. It mostly impacts which type of loan you’ll qualify for and the interest rate you’ll receive. A conventional loan usually requires a minimum of a 620 credit score, whereas an FHA loan has a minimum of 580. However, it’s important to note that while some loan programs accept lower credit scores, they might require a larger down payment or some other way to mitigate the lender’s risk in taking on the loan. In addition, even though someone with a 580 credit score COULD qualify for an FHA loan, it does not mean that they will; it is at the discretion of the lender within the guidelines of the loan programs.

A borrower has obtained a conventional fixed-rate 30-year loan of $200,000 with 10% down, meaning the amount borrowed is $180,000. She has a 750 credit score and received a 4% interest rate. Her monthly mortgage payment is $859 (not factoring in other fees, such as private mortgage insurance (PMI) or real estate taxes that may be included in the payment). Now, say that borrower dropped to a 650 credit score. She instead received a 5% interest rate. That increases her monthly mortgage payment to $966. That 100 point difference between credit scores ultimately means an extra $107 added to her mortgage payment each month. While that might not seem like a big deal, keep in mind the duration of the loan is 30 years. Having a higher interest rate means a yearly difference of $1,284; over 30 years that totals $38,520.

If you’re interested in comparing interest rates and monthly mortgage payments, use our mortgage calculator.

Don’t worry if your credit isn’t the best right now. Raising your credit score can take a lot of time, patience, and discipline. However, if you follow these simple guidelines you will soon notice a positive change in your credit and ultimately your financial future. You’ll be able to qualify for better rates when it’s finally time to buy a home.

To learn more about credit scores and interest rates, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

*The figures used in this example are hypothetical and the results are intended for illustrative and educational purposes only. **NFM Lending is not a credit repair company. Please contact a credit repair company for more information on how to improve your credit score.

Getting ready to buy a home requires setting a few ducks in a row. For example, ensuring your credit is in the best possible standing. This might require some time (and patience) but it needs to be done. The better your credit score is, the higher the possibility that you will be approved for a loan, as well as receive a better interest rate. The following are ways you can avoid running into common credit issues.

Incorrect Information: It is recommended to obtain your credit report every year, so you can review your information. When you receive it, ensure your name is spelled correctly. If this is inaccurate, there could be data on your report from someone else with the same name. Likewise, double-check all your information, including your address, birthday, employer data and Social Security number. If you do find an error in your credit report, write, don’t email or call, the credit reporting company. While the three credit reporting companies, Equifax, Experian, and TransUnion, offer the option to dispute errors online or by phone, most experts recommend mailing a certified letter, so you have documentation in case your dispute isn’t resolved. In the letter, you should explain what the error is, include photocopies of any documents that support your claim, and ask them to correct the error. You can also include a copy of your report with the error highlighted. Make sure to keep copies of your letter and all documents. Lastly, keep in mind that through the three credit bureaus you are entitled to a free report every year. Therefore, you should request a free credit report from one bureau each quarter to monitor your credit score.

Identity Theft: Identity theft occurs when someone uses your name, Social Security number, date of birth, or other identifying information, without your permission to commit fraud. There are several steps you can take to protect your credit and identity. These are just a few:

Missed or Late Payments: Everyone can be a little forgetful, so if you find you’re having a hard time remembering to make credit card payments, this could affect your credit score. Making credit card payments on time is the fastest way you can enhance your FICO score. If you miss any payments, you will see your score drop rapidly. If you have trouble remembering to make payments, try setting up a calendar reminder on your computer/social device. Every little reminder will help. You might also want to consider setting up automatic payments but be careful not to overdraw your account.

Overspending: Using a credit card is a fast and easy payment method, but if you are not cautious, you could sink into debt before long. It is important to recognize that credit is not free money and must be paid back. Your credit score will reflect the negative impact of having a lot of unpaid debt. The best way to avoid this situation is to curb your spending as much as possible. You don’t want to completely stop using your credit card, but if you create a budget, have a little self-control, and can afford to make larger payments towards your debt, you can improve the state of your credit.

Closing Old Credit Card Accounts: Closing old accounts can lower your credit score. Account history is an important factor of your credit score. Your mortgage lender will be able to see your financial responsibility throughout time, so the older the account is the better. Even if you pay off a credit card, you’re usually better off keeping that card open.

New Accounts: While you are trying to repair your credit score, don’t open any new credit card accounts or make any large purchases. It is best to focus on the accounts you have. It may be tempting to open a new department store credit card to receive a discount, but it may impact your credit negatively if you can’t afford to make the payments. If you really believe you should get one of these credit cards, review your financial plan and determine if you can truly manage the cost.

Achieving your dream of homeownership is possible, it just might take a bit of time and effort. Having good credit will make that dream more financially attainable.

If you have any questions about credit, mortgages, or the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

Congratulations! You’re married! If you are like many married couples, the next big step on your To-Do List is to buy a home. More and more couples are choosing to wait until after the wedding to buy a home because they don’t want the additional stress on top of wedding planning and work. Whatever your reasons are for waiting, you know that buying a home is a major milestone. We want to make sure you are prepared, so we’ve come up with a list of important things to know about buying a home after marriage.

Finances: Now that you are married and applying for a loan, you need to understand that your finances have also tied the knot. While you’ve probably discussed your spouse’s income or savings, there is much more you need to know. Make sure you thoroughly investigate all your finances before you begin the homebuying process to ensure you are aware of all potential issues that may come up. A lender will take both of your credit scores into consideration when reviewing your application, so it is vital you know where your partner stands financially. Bad credit scores and student debt can severely impact the loan value and interest rate a lender is able to offer you. If one of you has a poor score or a large sum of debt, it could influence how you choose to proceed with the loan. You may need to proceed with only one person on the loan and decide who should be on the title of the property. Once you are ready and have your finances straightened out, meet with a lender to get prequalified.

Finances: Now that you are married and applying for a loan, you need to understand that your finances have also tied the knot. While you’ve probably discussed your spouse’s income or savings, there is much more you need to know. Make sure you thoroughly investigate all your finances before you begin the homebuying process to ensure you are aware of all potential issues that may come up. A lender will take both of your credit scores into consideration when reviewing your application, so it is vital you know where your partner stands financially. Bad credit scores and student debt can severely impact the loan value and interest rate a lender is able to offer you. If one of you has a poor score or a large sum of debt, it could influence how you choose to proceed with the loan. You may need to proceed with only one person on the loan and decide who should be on the title of the property. Once you are ready and have your finances straightened out, meet with a lender to get prequalified.

Compromises: Whether you’ve been living separately prior to the wedding or if you have been living together for a while, there are some compromises to make when purchasing a home. Any couple buying a home together will face the typical issues: where do you want to live, what kind of house do you like, what size home, etc. If you were living separately, you could also face the discussion of whose furniture you’ll keep or whose appliances or electronics are better. It is likely you won’t be able to use everything both of you have. Get ready to spend time compromising on everything the two of you own, on top of the compromises involving the home you choose.

Compromises: Whether you’ve been living separately prior to the wedding or if you have been living together for a while, there are some compromises to make when purchasing a home. Any couple buying a home together will face the typical issues: where do you want to live, what kind of house do you like, what size home, etc. If you were living separately, you could also face the discussion of whose furniture you’ll keep or whose appliances or electronics are better. It is likely you won’t be able to use everything both of you have. Get ready to spend time compromising on everything the two of you own, on top of the compromises involving the home you choose.

Name Change: Waiting to purchase a home until after the wedding is great, but do not wait to change your name after you’ve begun the homebuying process. There is a significant amount of paperwork that is done by your lenders. If you decide to change your name in the middle of it, the process will be completely thrown off and even delayed. You should either change your name completely before you start the process, or wait until after you have closed on your home to avoid any conflict.

Name Change: Waiting to purchase a home until after the wedding is great, but do not wait to change your name after you’ve begun the homebuying process. There is a significant amount of paperwork that is done by your lenders. If you decide to change your name in the middle of it, the process will be completely thrown off and even delayed. You should either change your name completely before you start the process, or wait until after you have closed on your home to avoid any conflict.

It’s More than Just a Financial Purchase: Buying a home with your spouse is not just a financial investment, it is also an emotional one. The homebuying process is stressful and mentally draining; you are going to need to support one another. You are also going to have to discuss all possible future outcomes, such as divorce and separation—especially if your loan or title is going under one person. If your relationship turns to that direction, you don’t want to be caught off guard or have the obligation of a mortgage payment to fall on one of you. There needs to be an honest conversation between spouses to discuss every aspect of the homebuying process to ensure you are on the same page and completely ready.

It’s More than Just a Financial Purchase: Buying a home with your spouse is not just a financial investment, it is also an emotional one. The homebuying process is stressful and mentally draining; you are going to need to support one another. You are also going to have to discuss all possible future outcomes, such as divorce and separation—especially if your loan or title is going under one person. If your relationship turns to that direction, you don’t want to be caught off guard or have the obligation of a mortgage payment to fall on one of you. There needs to be an honest conversation between spouses to discuss every aspect of the homebuying process to ensure you are on the same page and completely ready.

Waiting to purchase a home until after marriage can be beneficial, but there are some challenges that can arise. Have a complete picture of your spouse’s finances before you choose to move forward with this investment. Buying a home together should be an exciting milestone, so don’t let compromises or finances get in the way.

If you have any questions about the homebuying process, contact one of our licensed Mortgage Loan Originators.

If you are looking to purchase a home, you may have wondered what is needed to qualify for a mortgage. When your lender is determining whether you qualify for a home loan, many factors you may not have considered may come into play. Here are a few mortgage do’s and don’ts to keep in mind during your home buying process.

The mortgage process will require effort and patience, but moving into the home of your dreams will be worth it! If you have any questions about the mortgage or home buying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

One of our previous blogs on credit scores, Understanding Your Credit Score, talked about the factors used to calculate FICO scores (the most widely used scoring system). However, the blog did not go into detail on what a credit score is or the difference between credit report and credit score. The two are not only different, but they are used for different purposes. Here are the main differences:

One of our previous blogs on credit scores, Understanding Your Credit Score, talked about the factors used to calculate FICO scores (the most widely used scoring system). However, the blog did not go into detail on what a credit score is or the difference between credit report and credit score. The two are not only different, but they are used for different purposes. Here are the main differences:

Credit Report

A credit report is a record of your credit history. The report may include loan amounts, current balances, credit companies used, dates accounts were opened, recently opened lines of credit, payment history, third-party collections, and even details of public record, such as bankruptcies. These detailed reports are created by the three National Credit Reporting Bureaus: Experian, Equifax, and TransUnion. Each one of the Bureaus maintains one credit report per person. However, these reports can vary, since creditors do not have to report information to all three Bureaus. Federal law requires that each of the three Bureaus give consumers a free copy of their credit report every 12 months. You can receive a free copy of your credit report by going to www.annualcreditreport.com.

Credit Scores

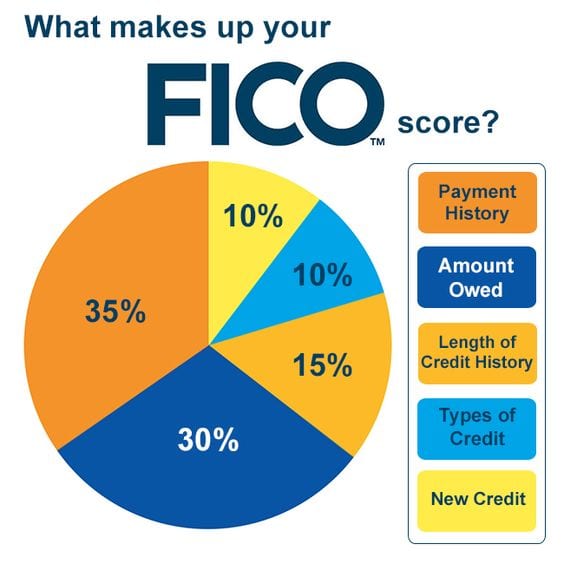

A credit score is an algorithm used to measure your financial risk based on the information on your credit report. FICO scores are the most widely used, but VantageScore, and banks have their own. FICO scores have 5 factors used to calculate credit scores, and it weighs each factor differently. The other credit companies use similar information but may have different weights and/or include other data.

Key Differences

Here are two key differences between credit reports and credit scores to consider:

Lenders use credit reports and credit scores to see if you are responsible for your finances, and to make sure that you won’t be overwhelmed if you take on another loan. When taking out a mortgage loan, lenders look at both your credit report and credit scores, and are required to show you the three credit scores that were pulled from each of the three National Credit Reporting Bureaus for the application.

Interest rates, terms, and whether you can apply for certain loans are factors that are affected by your credit score. Contact one of licensed mortgage loan originators today if you have any questions or would like to see if you qualify for a mortgage loan.

Your credit score is the numerical value assigned based on the information on your credit report. Credit-reporting bureaus use complex and proprietary algorithms to calculate these, but the most widely used are FICO scores. FICO scores can range from 300 to 850, and they give potential lenders an idea of how much of a financial risk you are. To them, the higher the score, the more likely you are to repay the debt and not be late on payments or go into default.

How Are Credit Scores Calculated

Each type of credit score uses algorithms to calculate the potential risk by adding value to items such as payment history and number of credit inquiries. For FICO scores, there are 5 factors used to calculate credit scores. Each factor has different weight in how much they affect your credit score.

Knowing your FICO score and credit worthiness is important, especially if you are looking to get a new loan. You can use websites that provide free credit scores, but often these websites provide you with an estimate rather than your actual score. The Consumer Financial Protection Bureau (CFPB) published a report on the differences between credit scores available to consumers and those to lenders, so make sure you do your research before you submit an application for a loan. Should you have any questions about credit scores, whether you qualify for a mortgage loan with your current credit score, or how to apply for a loan, click here to contact one of our licensed mortgage loan originators today!

When applying for a purchase loan or refinance, your credit score is of great importance. Credit scores tell lenders how well a person manages their existing credit, and are telltale signs of how reliable they are with paying off loans. Lenders also use credit scores to determine the interest rate they will charge a borrower. People with higher credit scores are typically offered more competitive rates than people with lower scores. If you happen to have blemishes in your credit history, there are a few ways to improve your credit score.

Check Your Credit Report

Before you get started, make sure to check your credit report to see where you currently stand. You should be checking your report once a year to make sure there aren’t any errors that could hurt your credit score. This service is free and you won’t be penalized for checking your own accounts. Make sure to get a report from each of the three major credit reporters—Equifax, Transunion, and Experian.

Report any errors that you find on the reports that could lower your score. This includes late payments that were made on time or amounts owed that are incorrect. Make sure that any negative items older than seven years (ten if you have claimed bankruptcy) have automatically fallen off your report. You can dispute any credit report issues you have by contacting the credit bureau and reporting agency.

Understanding Your Credit Score

Your credit score is a number between 300 and 850. The higher the number, the better your credit is. If your score is 760 or above, you have proved to have excellent credit management and will be eligible for the best interest rates. Scores below 760 could use a little work to get better rates. If your score is 620 or lower, you have some serious changes to make. Unless you have major blemishes such as a bankruptcy or foreclosure, there are a few easy ways to boost your credit score in as little as a few months.

If You Don’t Have Credit, Start Building it Now

In order to apply for most major loans, you need to have some established form of credit so that creditors can see that you are responsible. If you are unable to obtain a credit card, a secured card is a great way to start establishing credit.[one_half]Secured credit cards typically require a few hundred dollars up front as collateral and have minimal credit limits, but the limits are usually raised after a few months of responsible use.

A gas card is another great way to establish credit. Gas cards enable people to establish credit by carrying a small balance every month—just make sure to pay off the balance on time each month.

Be careful not to open a lot of new accounts at once when you’ve had a short credit history. Having one line of revolving credit and one installment loan is a good start.

Having an installment loan is a great way to establish credit. Installment loans are different than revolving loans (i.e. credit cards) in that you take out a lump sum of money and pay it back over time. Examples of installment loans are student loans, car loans, mortgages, personal loans etc. A small personal loan with a competitive interest rate can be easily obtained from a bank, credit union, or other financial institution.

Make Payments on Time

One of the easiest ways to raise and maintain a good credit score is to make your payments on time. This also applies to bills such as energy, cable, and phone bills. If an account in your name is delinquent and goes to a collection agency, it can stay on your report for seven years even after it’s paid.

If you have trouble making payments on time, there are a few methods that can help. Set up alerts and calendar reminders that your bills are due. You can even arrange to have e-mail alerts sent from your debtors. Setting up automated payments is a foolproof way to make on-time payments but you will only be charged the minimum amount owed on credit cards.

Pay Down Existing Debt

This one is a no-brainer: if you have a lot of debt, stop using your credit cards and pay down the amount you owe. Lenders often prefer to see a large gap between the credit limit available and the balance carried forward. A good rule of thumb is to keep your balance at 30% of your credit limit or below, even if you pay off your balance each month. If you can, having a balance of 10% of your credit limit is ideal.

Set up a personal payment plan for yourself. If you have multiple cards, try to focus on paying down the accounts with the higher interest rates first while paying the minimum payments on accounts with lower rates. This will save you a good amount of money in interest paid. Avoid the temptation to transfer or consolidate balances to a new account. Having too many open lines of credit and unnecessary accounts can lower your score.

Good Credit Practices

If you have an established credit history, don’t close accounts that haven’t been used. Breaking out an old card for dinner or a tank of gas once a month will keep the account active and raise your score. Just make sure to pay off the balance each month.

When you’re shopping for a new loan, try to do so within a two-week period. Having your credit history pulled multiple times can decrease your score, but if it’s in a cluster it will not be treated unfavorably. To prepare for a major purchase, don’t open any new accounts eight months prior.

Raising your credit score can take a lot of time, patience, and discipline. However, if you follow these simple guidelines you will soon notice a positive change in your credit and financial future.