If you have any questions or want more information about the home buying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

Not many people like filing their taxes, but there is a bright spot to completing all those forms: getting that sweet, sweet refund. You can use the money any way you’d like, but why not put it towards having a more financially stable future? Here are some great ways you can get the most out of your tax refund.

Whenever you come into extra money, it’s always a wise decision to pay off any existing debt you may have. Reducing your debt will help improve your credit score, which in turn will make it easier for you to be approved for a mortgage, car loan, or even a job. If you already own a home, put some of the extra cash towards paying off your mortgage. Applying extra payments toward to your debts now will allow you to save money going forward, because you’ll be paying down the principal and any interest that has accumulated. Having less debt not only gives you more financial freedom, but also more peace of mind.

Buying a home involves more than the cost of the actual house, and two such fees you will need to consider are down payment and closing costs. While it might not be necessary to have a 20% down payment anymore, you should still try to save at least 3-5%, and closing costs are typically 2-5% of the home price. Depending on the price of the home you want, this can be a sizable amount of money. If you put your refund towards your house fund and continue to add to it, you’ll soon save enough to cover all expenses of buying a house.

Another practical use for your refund is to finance home repairs or improvements. Most households have at least one feature that needs to be fixed or updated, and you’ll increase your home’s livability by making those needed repairs. Maintaining the upkeep of your home and making improvements can add to your home’s equity. The cost of the upgrade could even be tax deductible; you should speak with a tax preparer to see what you’re qualified to deduct. If it comes time to sell your home, it will only benefit you to already have everything in good shape.

It may be tempting to blow your refund check on a huge TV or an extravagant dinner, but consider investing in your financial future instead. By spending your refund on things that can make positive and lasting changes to your life, you can make your money work for you!

If you have any questions about using your tax return to purchase a home or for home improvements, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

NFM Lending is not a Financial Adviser or Tax Consultant. Please make sure to consult your own Financial Adviser or Tax Consultant regarding the use of your personal tax refund.

When you are starting the homebuying process, you’ll hear many real estate and mortgage industry terms that may sound the same. Two terms that often get confused for one another are “prequalified” and “preapproved”. What exactly is the difference between “prequalification” and “preapproval”? Both can be used to gauge your creditworthiness to be approved for a mortgage, but they are not the same thing. You should understand the difference.

Getting prequalified for a mortgage is a smart first step when you’re considering buying a home. A mortgage prequalification is when you provide basic financial information (such as your income and assets) to get a rough estimate of how much you may be approved for. You can get prequalified by speaking with a lender or even by going online. If you’re unsure of which lender to go with or how much of a loan you can expect to be approved for, prequalification is a good place to start.

Preapproval is a more formal version of prequalification. You’ll need to give your lender more in-depth information about you and your finances, such as proof of ID, W-2 forms, and pay stubs. The lender will also perform a credit check, so make sure you’re practicing good credit habits in the meantime. Once the lender determines how much you can be approved for, you will receive a letter stating so. Having a preapproval letter will be an asset when making an offer to a seller; it lets them know you’re able to obtain a mortgage and that you’re a serious buyer. Additionally, when you have a more concrete idea of how much you can afford, you can be a more informed buyer when searching for homes. A preapproval letter will only be good for 60-90 days, after which you’ll need to repeat the process to get an updated figure. Even though a preapproval isn’t a guarantee of loan approval, having it can expediate the process and will give you an advantage when you’re ready to present an offer.

Prequalification is a sensible jumping-off point when you start your homebuying journey, but it’s merely an informal way for you to see how much of a loan you might be eligible for. It holds no real weight when you’re on the market for a home. A preapproval, on the other hand, will give you firmer numbers to base your choices around and makes you a more attractive buyer to sellers.

If you have questions about getting prequalified or preapproved, contact one of our Licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

Getting ready to purchase a home is a huge financial undertaking. While you are probably aware of having to save up for a down payment, you might not know about closing cost fees. Don’t be taken by surprise at the closing table; here’s what you need to know about closing costs.

Closing costs are the fees charged for services performed during the home purchasing process that you will pay at closing. Closing is the final step of the loan process and is a meeting between you (the buyer), the seller, and closing officer (a lawyer or title/escrow company representative, depending on the state). You will review the legal documents provided in your loan package and execute all required documents. This step is extremely important, as it is the final confirmation of the loan terms as discussed with your lender.

The closing costs you might have to pay will vary based on the property, where you live, and the loan you choose. The following are a few of the most common fees you may see.

Again, closing costs will not be the same for everyone as they vary by region. On average, most homebuyers typically pay about 2 to 5 percent of the home purchase price. For example, if the home costs $250,000, you might pay between $5,000 and $12,500 in closing fees.

It is likely you might be able to avoid some closing cost, but not all. Here a few ways to save on closing costs.

Your lender will provide you with an estimate of what closing costs will be at the beginning of your application process, which will allow you the chance to shop around to find the best lender and deal for you. After finding a lender and going through the loan process, you will receive a closing disclosure, or the final closing cost total, at least 3 business days prior to closing. This is your time to make sure everything looks right and if you have questions or find a mistake, you have time to contact your lender. If you’re worried about how much you’ll pay in closing costs, there’s plenty of options for you! NFM participates in most state bond programs that provide closing cost assistance.

To learn more about closing costs or bond programs, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

Buying a home is one of the most significant financial decisions you will make in your life. In order to make an informed decision, doing some research for each step of the process can help ensure a smooth transaction. Here are the 6 basic steps needed to purchase a home.

Step 1: Get Pre-Qualified

It is important to get pre-qualified so that you will know what you can afford, what you will qualify for, and what types of homes you should be looking at. Pre-qualification allows you to enter the home buying process prepared. It makes your home search more efficient and ensures that when it comes time to make an offer on a home, you are ready.

Step 2: Determine Your Loan Type

Conventional? FHA? USDA? VA? 203K? Find the best loan for you based on your personal financial situation, how long you plan to live in your home, how quickly you plan on paying your mortgage back, etc.

Step 3: Find Your Home (and Make an Offer!)

It’s finally time to begin your home search. This may be the most exciting part of the process, and it can be easy to get caught up in that excitement. It’s important to make this decision carefully, consider your options, and to work with knowledgeable professionals who can help you make the best choice.

Step 4: Apply for the Loan

This is the time to assemble and submit all your financial information and documentation to your lender for evaluation. Once you signed a contract, contact your Loan Originator to submit your loan. They are there to help you figure out what documentation you need to provide, and ask you questions about your financing so that you can submit the best possible loan application.

Step 5: Processing and Underwriting

Once you apply for a home loan, your Mortgage Loan Originator will submit all your documentation to processing, and from there, your loan will be sent to underwriting. Processing will order a title search to make sure that the seller has legal rights to the property and schedule an appraisal to determine the value of the property. From there, your loan will be sent to Underwriting where it will be determined if the loan is a good fit. A clear-to-close (CTC) will be issued if approved.

Step 6: Go to Closing (and enjoy your new home!)

At closing, all the necessary paperwork is presented and signed by both the sellers and the buyers, the title of the property is transferred, and all the documents are recorded. Congratulations, you are officially a homeowner!

Homeownership is a rewarding achievement. The home buying process may present challenges but having qualified mortgage professionals by your side can make all the difference. If you have any questions about the home buying process, contact one of our licensed Mortgage Loan Originators. If you are ready to buy a home, click here to get started!

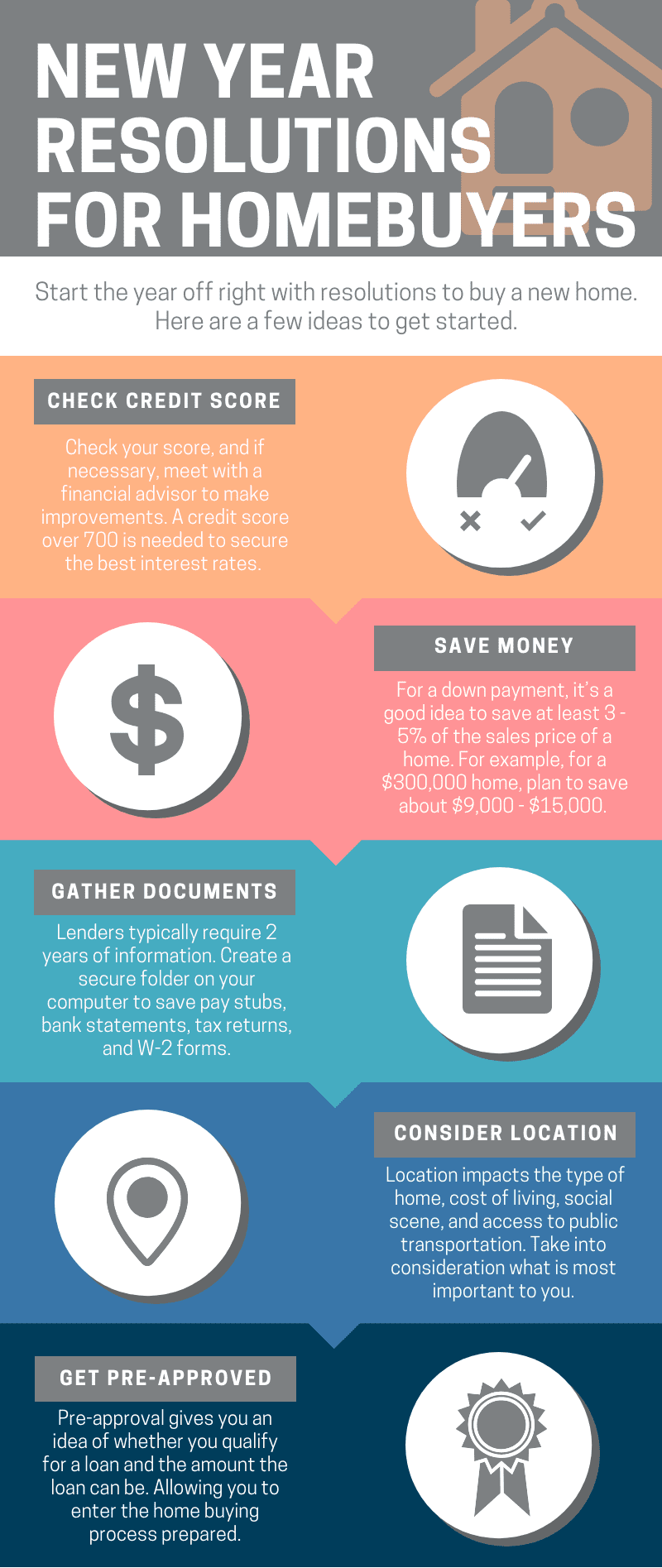

Make 2019 the year you become a home owner! Here are some new year resolutions for homebuyers to get you started.

If you have any questions or want more information about the home buying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

Congratulations! You’re married! If you are like many married couples, the next big step on your To-Do List is to buy a home. More and more couples are choosing to wait until after the wedding to buy a home because they don’t want the additional stress on top of wedding planning and work. Whatever your reasons are for waiting, you know that buying a home is a major milestone. We want to make sure you are prepared, so we’ve come up with a list of important things to know about buying a home after marriage.

Finances: Now that you are married and applying for a loan, you need to understand that your finances have also tied the knot. While you’ve probably discussed your spouse’s income or savings, there is much more you need to know. Make sure you thoroughly investigate all your finances before you begin the homebuying process to ensure you are aware of all potential issues that may come up. A lender will take both of your credit scores into consideration when reviewing your application, so it is vital you know where your partner stands financially. Bad credit scores and student debt can severely impact the loan value and interest rate a lender is able to offer you. If one of you has a poor score or a large sum of debt, it could influence how you choose to proceed with the loan. You may need to proceed with only one person on the loan and decide who should be on the title of the property. Once you are ready and have your finances straightened out, meet with a lender to get prequalified.

Finances: Now that you are married and applying for a loan, you need to understand that your finances have also tied the knot. While you’ve probably discussed your spouse’s income or savings, there is much more you need to know. Make sure you thoroughly investigate all your finances before you begin the homebuying process to ensure you are aware of all potential issues that may come up. A lender will take both of your credit scores into consideration when reviewing your application, so it is vital you know where your partner stands financially. Bad credit scores and student debt can severely impact the loan value and interest rate a lender is able to offer you. If one of you has a poor score or a large sum of debt, it could influence how you choose to proceed with the loan. You may need to proceed with only one person on the loan and decide who should be on the title of the property. Once you are ready and have your finances straightened out, meet with a lender to get prequalified.

Compromises: Whether you’ve been living separately prior to the wedding or if you have been living together for a while, there are some compromises to make when purchasing a home. Any couple buying a home together will face the typical issues: where do you want to live, what kind of house do you like, what size home, etc. If you were living separately, you could also face the discussion of whose furniture you’ll keep or whose appliances or electronics are better. It is likely you won’t be able to use everything both of you have. Get ready to spend time compromising on everything the two of you own, on top of the compromises involving the home you choose.

Compromises: Whether you’ve been living separately prior to the wedding or if you have been living together for a while, there are some compromises to make when purchasing a home. Any couple buying a home together will face the typical issues: where do you want to live, what kind of house do you like, what size home, etc. If you were living separately, you could also face the discussion of whose furniture you’ll keep or whose appliances or electronics are better. It is likely you won’t be able to use everything both of you have. Get ready to spend time compromising on everything the two of you own, on top of the compromises involving the home you choose.

Name Change: Waiting to purchase a home until after the wedding is great, but do not wait to change your name after you’ve begun the homebuying process. There is a significant amount of paperwork that is done by your lenders. If you decide to change your name in the middle of it, the process will be completely thrown off and even delayed. You should either change your name completely before you start the process, or wait until after you have closed on your home to avoid any conflict.

Name Change: Waiting to purchase a home until after the wedding is great, but do not wait to change your name after you’ve begun the homebuying process. There is a significant amount of paperwork that is done by your lenders. If you decide to change your name in the middle of it, the process will be completely thrown off and even delayed. You should either change your name completely before you start the process, or wait until after you have closed on your home to avoid any conflict.

It’s More than Just a Financial Purchase: Buying a home with your spouse is not just a financial investment, it is also an emotional one. The homebuying process is stressful and mentally draining; you are going to need to support one another. You are also going to have to discuss all possible future outcomes, such as divorce and separation—especially if your loan or title is going under one person. If your relationship turns to that direction, you don’t want to be caught off guard or have the obligation of a mortgage payment to fall on one of you. There needs to be an honest conversation between spouses to discuss every aspect of the homebuying process to ensure you are on the same page and completely ready.

It’s More than Just a Financial Purchase: Buying a home with your spouse is not just a financial investment, it is also an emotional one. The homebuying process is stressful and mentally draining; you are going to need to support one another. You are also going to have to discuss all possible future outcomes, such as divorce and separation—especially if your loan or title is going under one person. If your relationship turns to that direction, you don’t want to be caught off guard or have the obligation of a mortgage payment to fall on one of you. There needs to be an honest conversation between spouses to discuss every aspect of the homebuying process to ensure you are on the same page and completely ready.

Waiting to purchase a home until after marriage can be beneficial, but there are some challenges that can arise. Have a complete picture of your spouse’s finances before you choose to move forward with this investment. Buying a home together should be an exciting milestone, so don’t let compromises or finances get in the way.

If you have any questions about the homebuying process, contact one of our licensed Mortgage Loan Originators.

Getting ready to meet with a mortgage lender can be exciting; you’re one step closer to the home of your dreams. Don’t let the paperwork put a damper on things! Your lender is there to help you through the homebuying process, so you’ll want to assist them as much as possible. The information lenders ask for is vital to getting the keys to your new home, so it is helpful for you both if you come prepared. These are 5 documents you’ll need to buy a home.

1. Paystubs: Your lender wants to see paystubs, award letters for Social Security, and pensions or retirement from the last 30 days. The paystubs are your proof of current income and allow lenders to get an understanding of how much money you’ll have flowing in each pay period. It also lets them know a little bit about your employer or if you are self-employed.

2. Taxes/W2s: Lenders usually require the past 2 years’ worth of tax information, including returns and W2s This is mostly to let your lender know how much you really made, but it also gives them the chance to compare your numbers. Your lender must be able to verify all the assets you have listed on your application, so all your documents must match.

3. Bank Statements: You should provide your lender with at least 2 months of recent bank statements. They need to see that your income is being deposited into your account, as well as whether any additional deposits being made or any significant expenses. If you are receiving additional income from somewhere else, be prepared to show your lender where it is coming from and why. This includes any kind of “gift” you might have gotten from a family member to help you buy a home. Keep in mind that your bank statements will show if you’ve had any “NSF” or Non-Sufficient Funds.

4. Divorce Decree: While asking for your divorce decree might seem unnecessary, it is incredibly important to provide. There might be documentation with a previous last name, which the decree can easily explain. Your lender also needs to see if your name is on another mortgage. If your ex-spouse is now responsible for making payments on the mortgage your name is on, you’ll need to provide either a friend of the court printout or 12 months of cancelled checks to show your ex-spouse has been covering payments from their own account. Your decree will also let your lender know if you are obligated to make or are receiving alimony or child support payments. You only need to disclose how much you receive in payments if you are depending on them to help you qualify for a loan and to make mortgage payments. If you are, you will also need to provide proof of that income being received on time. If you do have an obligation to pay alimony/child support, your lender needs to know how much, as it affects your income. Whether you are receiving or obligated, your lender needs to know how much the payments are for and how long they are to continue. Click here for more information on how divorce can impact your finances.

5. Explanations: This might be the most tedious task, but it will help you and your lender move through the homebuying process much faster. Find and provide your lender with explanations for absolutely everything that impacts your income or credit for the last 2 years. If you do have bank statements showing “NSF,” tell your lender why. Don’t be embarrassed to tell your lender if you lost your job at any point within the last two years, they want to know. If your credit score is not great because of a late payment or an emergency, explain what happened. Every detail you can provide your lender will allow them to help you to the best of their ability.

The documentation you must provide can be overwhelming and time consuming to track down, but don’t feel like you are doing so for no reason. The required documentation will help you get the loan you need. If you’re interested in getting pre-qualified, click here for a more detailed list of items you’ll need. Your lender is on your side and wants to make your homebuying experience as smooth and efficient as possible, so meet with them prepared and ready.

If you have any questions about the home buying process or documentation requirements, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

As a mid-to-late life homebuyer who is ready to change one’s lifestyle or downsize, finding your retirement home will be different than your previous homebuying experiences. This time, you’ll be looking for a home with a shifted focus on what features you find important. The home you buy needs to meet all your current and, more importantly, your future needs. Use these tips when house hunting for a retirement home.

Location: While previously a significant factor when purchasing a home, this time the location of your home needs to be top priority. Take into consideration that driving may not always be an option or even desirable. You’ll want to choose a place that allows you to easily access all the essential places you care about. Your hobbies and interests, such as the beach, golf courses, pools, etc., should be close and have a minimal commute. Cities have public transportation which allows residents to not even need a car. If your friends and family live in rural areas, perhaps moving closer to them might be another option to avoid commuting.

Location: While previously a significant factor when purchasing a home, this time the location of your home needs to be top priority. Take into consideration that driving may not always be an option or even desirable. You’ll want to choose a place that allows you to easily access all the essential places you care about. Your hobbies and interests, such as the beach, golf courses, pools, etc., should be close and have a minimal commute. Cities have public transportation which allows residents to not even need a car. If your friends and family live in rural areas, perhaps moving closer to them might be another option to avoid commuting.

Single-story Homes: If you are thinking about downsizing, now is the time. A single-story home is ideal for older homebuyers. Eventually, going up and down stairs will become troublesome, and there is always the possibility of needing to accommodate a wheelchair or walker. Stairs, even just a few, can make getting around your home more difficult. If you’d like to buy a two-story home, consider having the master bedroom on the first floor. The rooms upstairs can be used for grandchildren or guests. Whichever way you decide to go, plan for the house that will be best for you later, not just what works for you right now.

Single-story Homes: If you are thinking about downsizing, now is the time. A single-story home is ideal for older homebuyers. Eventually, going up and down stairs will become troublesome, and there is always the possibility of needing to accommodate a wheelchair or walker. Stairs, even just a few, can make getting around your home more difficult. If you’d like to buy a two-story home, consider having the master bedroom on the first floor. The rooms upstairs can be used for grandchildren or guests. Whichever way you decide to go, plan for the house that will be best for you later, not just what works for you right now.

Space: Luckily, space is a popular feature in many new homes so it shouldn’t be hard to find. “Open” room concept homes allow for your kitchen, living and dining rooms to flow together. You’ll have less clutter and easier navigation. You should also keep an eye out for larger bathrooms and entryways. More importantly, look for extra-wide hallways and doorways. These will accommodate wheelchairs/walkers and you won’t have to avoid or move around tight spots.

Space: Luckily, space is a popular feature in many new homes so it shouldn’t be hard to find. “Open” room concept homes allow for your kitchen, living and dining rooms to flow together. You’ll have less clutter and easier navigation. You should also keep an eye out for larger bathrooms and entryways. More importantly, look for extra-wide hallways and doorways. These will accommodate wheelchairs/walkers and you won’t have to avoid or move around tight spots.

Important Amenities: A walk/step-in shower will reduce some of the risks that accompany using a bathtub at an older age. Instead of having to step over the side of a tub, having a small step or no step at all is much safer and wheelchair friendly. A larger shower will also come in handy if a beach seat or railing needs to be added. Ramps into your home are not only a wheelchair/walker friendly accommodation, but removes the risk of falling from carrying anything up or down stairs, such as groceries. Keep an eye out for kitchens with lower counters and easy to access cabinets. Use a checklist when touring to keep track of what each home has to offer.

Important Amenities: A walk/step-in shower will reduce some of the risks that accompany using a bathtub at an older age. Instead of having to step over the side of a tub, having a small step or no step at all is much safer and wheelchair friendly. A larger shower will also come in handy if a beach seat or railing needs to be added. Ramps into your home are not only a wheelchair/walker friendly accommodation, but removes the risk of falling from carrying anything up or down stairs, such as groceries. Keep an eye out for kitchens with lower counters and easy to access cabinets. Use a checklist when touring to keep track of what each home has to offer.

Property: Consider a yard that will fit your needs fifteen years down the road. While you might be able to cut the grass, pick weeds, rake leaves, and shovel snow now, that might change. Paying someone to do those tasks for you will get more expensive the larger the piece of property, so factor in the additional costs when making a budget.

Property: Consider a yard that will fit your needs fifteen years down the road. While you might be able to cut the grass, pick weeds, rake leaves, and shovel snow now, that might change. Paying someone to do those tasks for you will get more expensive the larger the piece of property, so factor in the additional costs when making a budget.

Pets: Your pet should absolutely go with you wherever you move, however, some places might have specific pet policies. Be sure to check for any restrictions before deciding on a home, especially if you’re thinking about a retirement community or condo. If you are considering a new home in a multiple story building, be prepared to take your pet on an elevator.

Pets: Your pet should absolutely go with you wherever you move, however, some places might have specific pet policies. Be sure to check for any restrictions before deciding on a home, especially if you’re thinking about a retirement community or condo. If you are considering a new home in a multiple story building, be prepared to take your pet on an elevator.

When preparing to take the next step for your future keep some of these ideas in mind. Homebuying is exciting but can be stressful, especially if this is going to be your retirement home. Knowing what to look for and expect will help ease your mind. Thinking ahead by choosing a home that will meet both your current and future needs will save you time, money, and stress down the road. If you’re thinking about a new construction home, you can use these tips as a guide when thinking about layout and design. Here are some additional items to consider if you are a single homebuyer.

If you have any questions or want more information about the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

When starting the homebuying process as an individual buyer, there are some unique aspects you’ll face that don’t require as much attention from co-borrowers. While it might seem intimidating, all you need to do is spend a little extra time preparing. These 5 tips for single home buyers will lead to a smooth homebuying experience.

1. Affordability: When buying a home with a co-borrower, there’s usually two sources of income to cover a down payment, mortgage, and other bills. As a single buyer, you must be able to cover costs on your own. Take into consideration every possible expense—maintenance fees, HOAs, utilities, an emergency fund—when deciding on a budget. It’s important to make sure you’ll be comfortable in affording the home you choose. Consider saving more money than if you were to buy a home with a co-borrower. Doing so will provide peace of mind in knowing you can afford your home. For ideas on how to save money for a down payment, click here.

2. Maintenance: While you need to factor fees into your budget, maintenance might require more attention than expected. As the sole homeowner, you’ll be the one to take care of your home. Be confident in knowing you can maintain the home you choose.

3. Safety: Picking a neighborhood is just as important as picking a home. Your home should leave you feeling completely safe and secure, so be sure you choose a neighborhood or community that lets you be completely at ease. For more information about choosing a neighborhood, click here.

4. Choosing a Home: You don’t have to go through the home purchasing process on your own. Single buyers, especially first-time buyers, might feel overwhelmed or have skewed judgement from excitement. Take a family member or trusted friend along when house hunting for a second opinion or to be a voice of reason. They only want what is best for you, so they’ll make sure the home you buy is perfect for you.

5. Thinking ahead: Buying a home is best as a long-term investment, but keep an eye on what your future may hold. Down the road you could find a partner, or your job might need you to relocate. The resale value of the property might be something you should seriously consider. Just because it’s only you right now doesn’t mean the addition of a partner or child is out of the question. It could be worth it to think about going bigger now, even if it is just a spare room. The extra space could come in handy—but only if the addition fits comfortably within your set budget.

The bottom line is simply to do your homework. Thoroughly research what you can afford that leaves you some wiggle room. Talk to your family and friends about their experiences with homeownership, especially if they did so on their own. Realtors are also there to provide information, give their advice, and to answer questions you may have.

For more information on the home purchasing process, click here, or you can contact one of our licensed Mortgage Loan Originators with any questions.

If you are looking to buy a home, the process may seem overwhelming. Planning well in advance can save you time, money, and stress. Whether you’re ready to start preparing or just wondering about the home buying process, we’ve created a list of important steps to lead to a smooth home purchase:

18 months before your home purchase

12 months before your home purchase

6 months before your home purchase

3 months before your home purchase

The home buying process can be long and daunting, but adequate preparation truly is the key to your new home. If you have any questions about the home buying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

* NFM Lending is not affiliated with any real estate companies. You are entitled to shop around for the best lender/real estate company for you.

** NFM Lending is not a Financial Advisor or Tax Consultant. Please make sure to consult your own Financial Advisor or Tax Consultant regarding the use of your personal tax refund.