By Maria Hinerman

Jul 30, 2015Your credit score is the numerical value assigned based on the information on your credit report. Credit-reporting bureaus use complex and proprietary algorithms to calculate these, but the most widely used are FICO scores. FICO scores can range from 300 to 850, and they give potential lenders an idea of how much of a financial risk you are. To them, the higher the score, the more likely you are to repay the debt and not be late on payments or go into default.

How Are Credit Scores Calculated

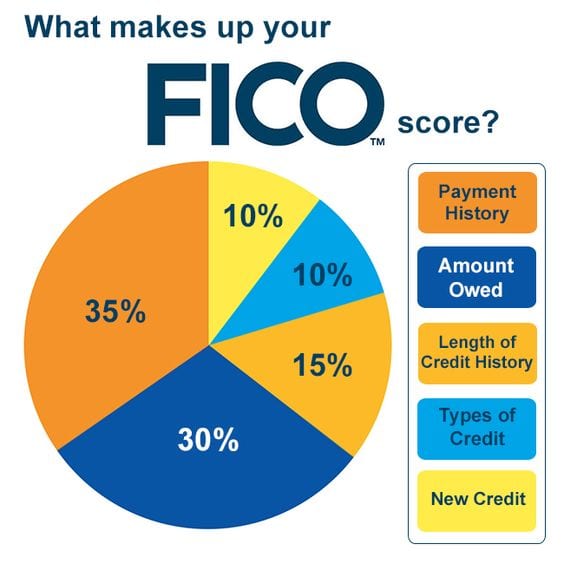

Each type of credit score uses algorithms to calculate the potential risk by adding value to items such as payment history and number of credit inquiries. For FICO scores, there are 5 factors used to calculate credit scores. Each factor has different weight in how much they affect your credit score.

- 35% – Payment History

The greatest impact on your credit score is paying off debts on time. If you have late payments, delinquencies, or charges, your score will be impacted negatively. However, having a few late payments doesn’t mean that you will automatically have a low score since this is just one piece of the information used to calculate the credit scores. - 30% – Amount Owed

The ratio between the amount owed and the remaining available credit has a high impact as well. Owing money on credit accounts doesn’t necessarily have a negative impact on the score, but having high balances can indicate that the person is overexerted and more likely to miss payments. - 15% – Credit History

The length of time credit lines have been opened increases your score. Note that it is also taken into consideration how long it has been since you used certain accounts.

- 10% – Type of Credit

Types of credit, such as credit cards, retail accounts, installment loans, and mortgage loans will be taken into consideration. Having good debt, such as credit cards and installment loans, will bring up your scores.

- 10% – Inquiries and New Credit

The number of inquiries and new credit accounts are taken into consideration since people that opened several credit accounts in a short period of time are a greater risk of not paying back their loans.

Knowing your FICO score and credit worthiness is important, especially if you are looking to get a new loan. You can use websites that provide free credit scores, but often these websites provide you with an estimate rather than your actual score. The Consumer Financial Protection Bureau (CFPB) published a report on the differences between credit scores available to consumers and those to lenders, so make sure you do your research before you submit an application for a loan. Should you have any questions about credit scores, whether you qualify for a mortgage loan with your current credit score, or how to apply for a loan, click here to contact one of our licensed mortgage loan originators today!

These blogs are for informational purposes only. Make sure you understand the features associated with the loan program you choose, and that it meets your unique financial needs. Subject to Debt-to-Income and Underwriting requirements. This is not a credit decision or a commitment to lend. Eligibility is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Not all programs are available in all areas. Offers may vary and are subject to change at any time without notice. Should you have any questions about the information provided, please contact us.