By Kelsey Trumbull

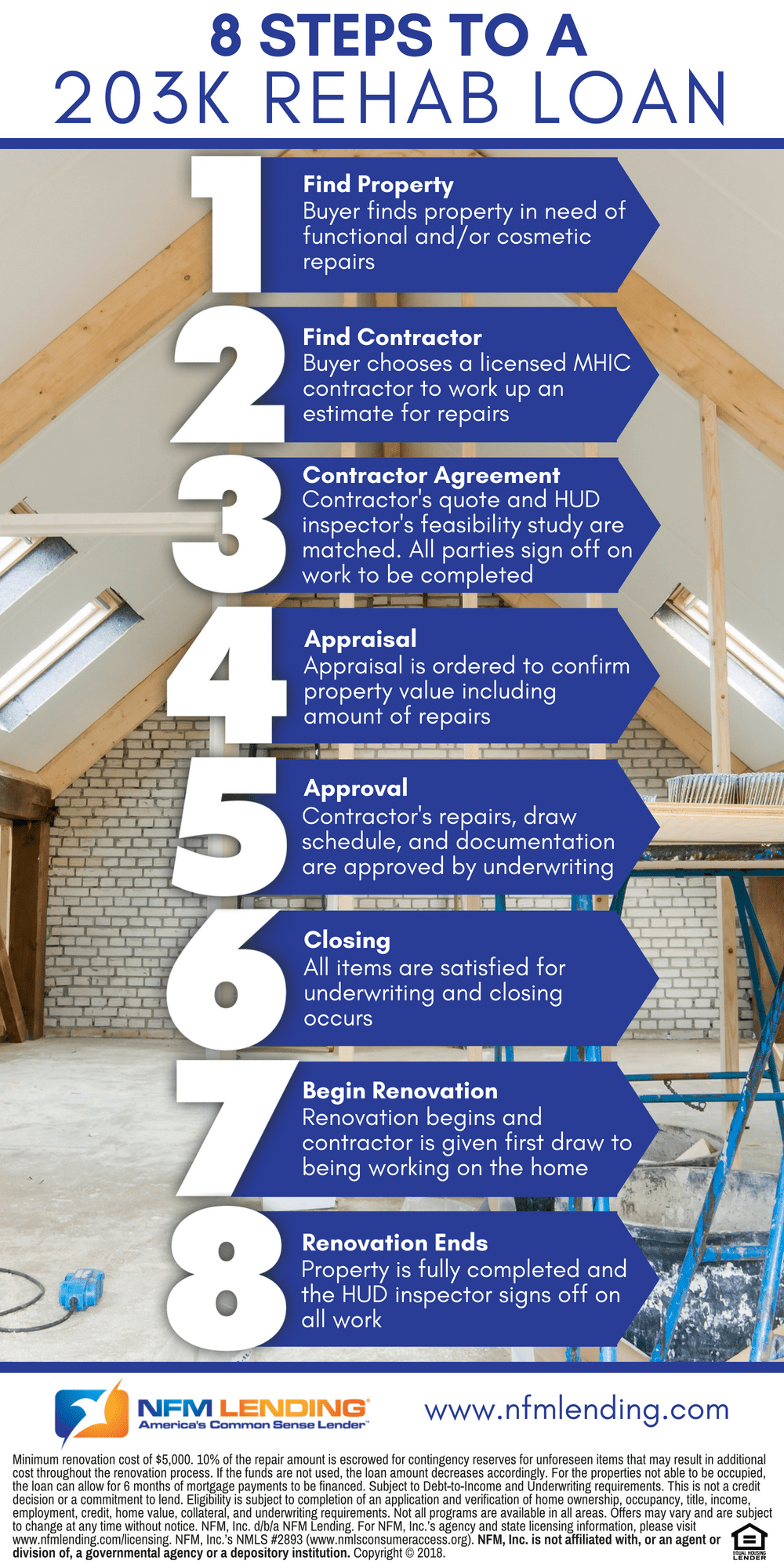

Jun 19, 2018When house-hunting for your new home, you might discover one that would be perfect for you but needs a bit of TLC. Don’t worry! An FHA 203k rehab loan is there to make your dreams of homeownership come true. This loan allows you to borrow both what you need to purchase the home and what you need to make repairs—an all in one mortgage. If you think this might be the option for you, take a look at our 8 steps to a 203k rehab loan.

Don’t be under the impression that you have to buy a house that’s in perfect condition. Renovating and making repairs will allow you to create exactly what you want, so keep this option in mind when you’re ready to find the home of your dreams!

You can find out more about 203(k) rehab loans here. For questions or more information about the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

These blogs are for informational purposes only. Make sure you understand the features associated with the loan program you choose, and that it meets your unique financial needs. Subject to Debt-to-Income and Underwriting requirements. This is not a credit decision or a commitment to lend. Eligibility is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Not all programs are available in all areas. Offers may vary and are subject to change at any time without notice. Should you have any questions about the information provided, please contact us.