By Kelsey Trumbull

Jul 17, 2018If you’re looking to buy a home, be prepared to meet a few challenges with today’s housing market. Not only is there a shortage of homes, but the available housing stock is aging. These challenges might seem discouraging but taking a look at the 2018 housing market and what options you have as a homebuyer, it is still possible to find a home to make your own.

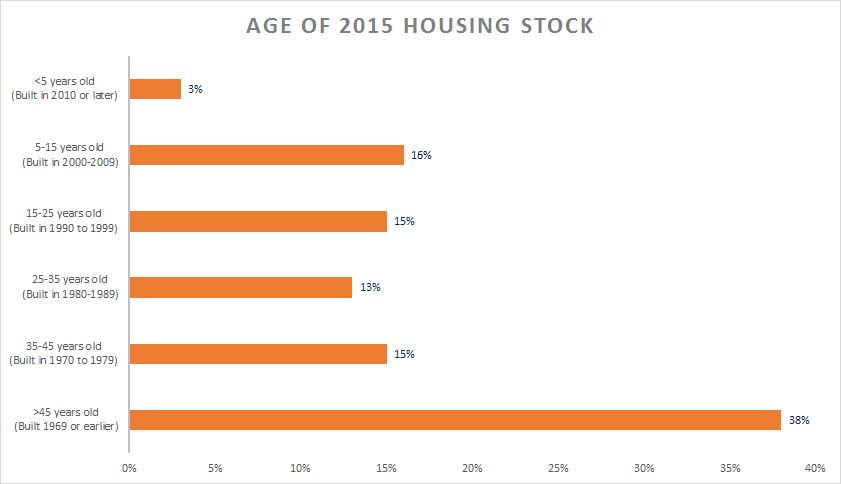

As of 2015, 66% of the US owner-occupied housing stock was built before 1980, with around 38% built before 1970, according to the National Association of Home Builders (NAHB). Many of these homes are going to need repairs, renovations, or updates.

And while there are a lot of new homes being built throughout the country, buyers should not turn away from an older home that may need some TLC. There are many renovation and repair loan options available, such as the FHA 203(K) or Fannie Mae’s HomeStyle® loan. FHA 203(k) are a type of federally insured mortgage loans that are used to fund renovations and repairs of single family properties. Fannie Mae’s HomeStyle® Renovationloan permits borrowers to include financing to renovate or make home repairs a purchase or refinance transaction. Find more information about how to finance renovations or home improvements.

Every home is unique and will require varying repairs and updates. But with these mortgage loan options, your dream of renovating an older home and becoming a homeowner are possible!

You can also keep in mind the possibility of building your home from the ground up as there are many construction loans options available as well.

If you have any questions about renovation loans or want more information about the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

These blogs are for informational purposes only. Make sure you understand the features associated with the loan program you choose, and that it meets your unique financial needs. Subject to Debt-to-Income and Underwriting requirements. This is not a credit decision or a commitment to lend. Eligibility is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Not all programs are available in all areas. Offers may vary and are subject to change at any time without notice. Should you have any questions about the information provided, please contact us.