NFM Lending sponsored and participated in the 6th annual Red Shoe Shuffle on Sunday, April 2, 2017. The Red Shoe Shuffle is an annual 5k walk or run around downtown Baltimore, benefitting the Ronald McDonald House Charities of Baltimore. This is NFM Lending’s 6th year sponsoring this event.

In addition to sponsoring the Shuffle, a number of NFM Lending staff members and their families participated as “Shufflers,” and employees raised $470 for the Ronald McDonald House Charities of Baltimore. In total, this year’s event raised over $310,000. To see Team NFM in action at the Red Shoe Shuffle, click here.

The Ronald McDonald House Charities is an international nonprofit that provide housing to families of seriously ill children while they undergo hospital treatment. The Baltimore chapter is located near many of the area’s hospitals, including Johns Hopkins, the Kennedy Krieger Institute, and more. The Baltimore Ronald McDonald House has been home to over 35,000 families since it opened its doors in 1982. NFM Lending is proud to sponsor this event, and to support this amazing organization.

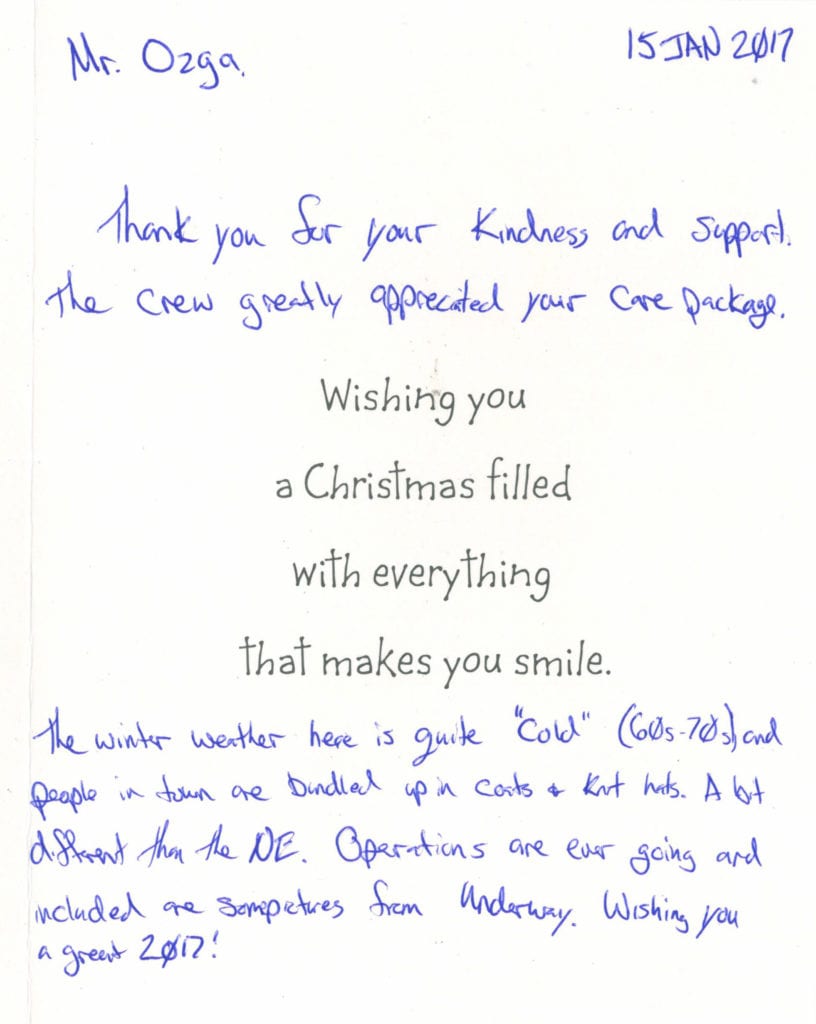

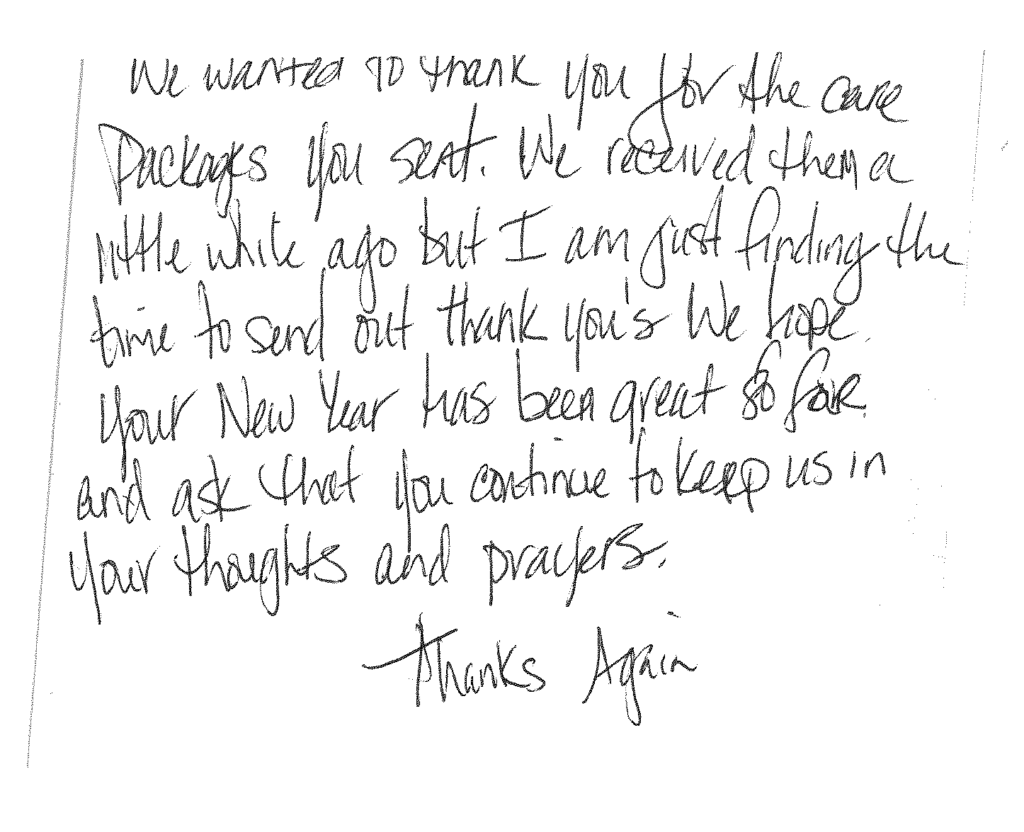

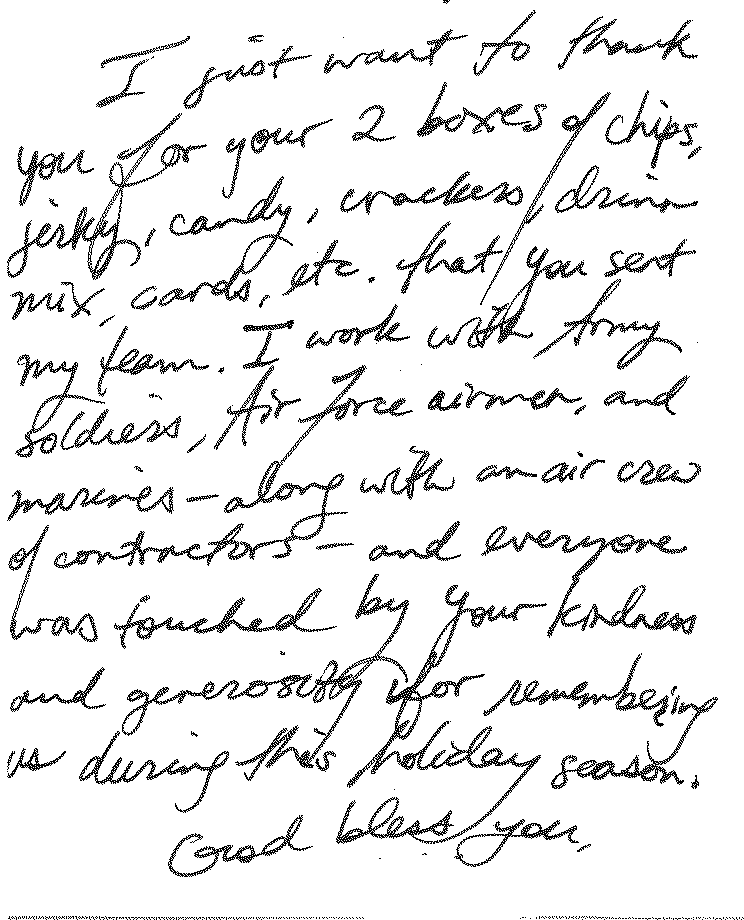

NFM Lending has completed its 9th Annual “Support Our Troops Drive”. On Wednesday, December 7, 2016, NFM sent 176 care packages to U.S. troops overseas. Employees spent the month of November collecting and filling boxes with snacks, toiletries, books, holiday decorations, and more. These care packages were sent in coordination with AnySoldier®.

Since 2008, NFM Lending has sent over 800 packages to our service members in foreign countries. NFM Lending is proud to support the courageous men and women who serve our country, and wishes them a safe and happy holiday season.

“Myself along with my Marines are tremendously grateful and appreciative for you and your Company’s love and support. Nothing in this world makes me happier than seeing a smile on my Marines’ face, so again, thank you from the bottom of my heart.”

“Your care packages were the perfect holiday pick-me-up. Please pass our sincere appreciation to everyone for your generosity, time, and effort. It means so much to all of us here.”

Written by Guest blogger: Sherman Hardy

Foreclosures and its counterparts (short sales or deed-in-lieu of foreclosure) can be extremely problematic for military buyers. For those who have faced foreclosure may or may not know that it was not in their best interest. Having a foreclosure means you will not be eligible for a VA loan for at least two years. Borrowers who experienced the loss of a home due to a foreclosure proceeding will not be able to purchase for two years after the deed is transferred from their name.

I wanted to clear the misconception about VA Home Loan Guarantee Eligibility after a foreclosure; a veteran who has a VA loan foreclosed upon can obtain another VA loan in the future. Many service members have been told otherwise by bank officials, mortgage brokers and others who either didn’t understand the program or who were looking to make a buck with their own financing options.

When a veteran home has been foreclosed upon the lender must determine how much of a primary entitlement the borrower has left (if any at all). This is where a second-tier entitlement comes into play. One of the downsides to a second-tier entitlement is there’s a minimum loan amount of $144,000. This secondary entitlement is also used to allow a veteran to have two VA loans at the same time.

Sherman Hardy, Real Estate Professional, 301-659-5004 or www.localdmvhomes.com

*This blog is for information purposes only. NFM, Inc. accepts no liability for its content. Please visit the US Department of Veterans Affairs website for more information: http://www.benefits.va.gov/.

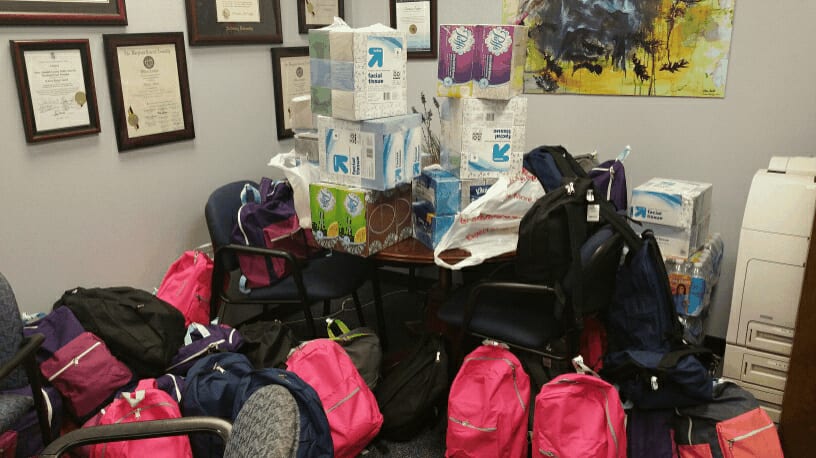

This August, NFM Lending held a Back-to-School Drive to collect school supplies for children in need in Anne Arundel County, Maryland. Throughout the month, NFM Lending employees collected new school supplies for children in grades 1-5, filling 50 backpacks with the school supplies required by the county, such as notebooks, pencils, erasers, scissors, and other school necessities.

Anne Arundel County Public Schools distribute donated school supplies to children who qualify for federal food assistance programs based on household income. In Anne Arundel County, over 14,000 students were participating in these programs in the 2010-2011 school years.

Since its foundation in 1998, NFM Lending has maintained a strong commitment to giving back to our communities. Each year, the company holds food drives for local food banks, collects care packages for our troops overseas, and participates in other charitable initiatives for charities such as the Ronald McDonald House of Baltimore, Habitat for Humanity, and more. For additional information about NFM Lending’s community involvement, visit www.nfmlending.org.

Some interesting news broke last Thursday. President Barack Obama announced plans for the FHA (Federal Housing Administration) to take steps to reduce the annual insurance premium for new borrowers. This will potentially drastically change the way upcoming years of home buying looks like. The plan is estimated to be enacted on January 26th, 2015. This is one way in which the White House is attempting to establish a firm footing in the area of housing (in response to the housing crisis).

With the new reduction plan, one can expect the following:

Housing and Urban Development Secretary Julián Castro stated the following in regard to the policy adjustment:

“This action will make homeownership more affordable for over 2 million Americans in the next three years. By bringing our premiums down, we’re helping folks lift themselves up so they can open new doors of opportunity and strengthen their financial futures.”

It shall be interesting to see where this decision takes the housing industry in the upcoming years. Most certainly, it will make a change in the dynamics of the process and hopefully make buying a home easier.

Read the official White House press release regarding this matter here.

If you are looking to purchase a home or are looking for more information on these FHA changes, click here to contact one of our Licensed Mortgage Loan Originators today.

Earlier in 2014, the Consumer Financial Protection Bureau (CFPB) issued a report on its plan, purpose, and proposed action on how to address issues within the subject of Fair Lending.

Earlier in 2014, the Consumer Financial Protection Bureau (CFPB) issued a report on its plan, purpose, and proposed action on how to address issues within the subject of Fair Lending.

But one might first ask the question: “What is Fair Lending?” Fair Lending falls under the Fair Housing Act and the Equal Credit Opportunity Act. Under both Acts, it is unlawful for a lender to discriminate on a prohibited basis in a residential real estate-related transaction.

The CFPB’s report addresses how they would deal with certain issues regarding Fair Lending. The Director of the CFPB, Richard Cordray, makes this statement in the beginning of the report:

“At the Consumer Bureau, we are fierce advocates for a consumer financial marketplace that allows all Americans to pursue a path to greater opportunity. To that end, we are working to remove the unnecessary obstacles too many Americans face in the consumer financial marketplace.”

In the report, the CFPB touches on:

NFM Lending strongly supports the CFPB’s efforts and takes this matter very seriously. If you would like to learn more about Fair Lending or to read the CFPB report in its entirety, it can be located here.

If you are looking to purchase or refinance a home, click here to contact one of our Licensed Mortgage Loan Originators to learn what mortgage loan is right for you. NFM Lending is an Equal Housing Lender.

Another #NFMLending Support Our Troops Drive complete! Last week, we sent 100 supply boxes to troops stationed overseas. We sent two boxes per location: one box with food items, clothing, and items to help with morale (Nerf balls, Frisbee, books, magazines, small board games, playing cards, etc.); another contained toiletries, small over-the-counter medicine, and RuckPack energy drinks. We hope they enjoy the goodies and supplies and know there are people back home that care about them.

Check out our Support Our Troops Pinterest gallery to view more pictures.

Selling your home is hard. Such an arduous process can take weeks, if not months, even in the preliminary stages of house preparation. Indeed this paints an ominous picture of the whole experience; but not to worry, there is light at the end of the tunnel.

You may be wondering, is there a way to make home selling any easier? Is there a course of action that would constitute a much less hair-graying experience? The following tips might help you to prepare your home to sell, and consequently sell it quicker.

Here are 6 tips on how to get your home ready to sell:

Natural lighting and lighting fixtures

One of the best things you can do to present your house is to rip down those curtains and setup interior lighting. Natural sunlight combined with good interior lighting feels welcoming and engaging to potential buyers. It will also open up the rooms, making them appear more spacious and attractive. Here is a link to some tips regarding interior lighting.

De-personalizing your “home” to make it their “house”

Even though it is hard to admit, your home is slowly but surely becoming less of your “home” and becoming more a “house” on the market for another buyer. You may have to consider removing such items as: family photos, heirlooms, personalized touches, knickknacks, etc. By removing these items, you will enable the potential buyers to picture themselves living in that space. Then they are able to visualize their own possible memories and experiences. This could play a huge factor in their desire to move forward in the deal.

Pave the way with stunning flooring

Beautiful floors can be crucial to displaying your house properly; but at the same time, you don’t want to spend an arm and a leg (or lose one) replacing all the flooring in your house. Nor do you have the time. Try to clean and salvage what you already have (polishing up hardwood floors, shampooing carpets and area rugs, replace cracked tiles, etc.) to save time and money. If necessary, be willing to replace the flooring in certain rooms that may be outdated or dilapidated. Check out this link on how to clean certain types of floors.

Don’t let remnants of food, smoke, or pet odor linger

We all have things in our house that emit malodorous scents. It could be a pet, fridge, sink, or even a person. Regardless of what it is, do what you need to do to clear out the smell and replace it with a fragrant substitute. There’s no need to be embarrassed, but the fact is that it will affect the buyer’s impression of the house. This is often something that can be easily addressed. Here’s how.

Don’t forget the exterior of your house

The outside of the house is the very first thing potential buyers will see. All the more reason why curb appeal is crucial to the selling process. You don’t have to go crazy and dig up your entire yard, planting exotic trees and garden gnomes, or add a pool or garage. There are some very simple things you can do to enhance the external portion of your house and yard to carry it from decent to stellar. Here are some great ideas of how to do this.

Leave the walls a neutral color

The goal here is to wipe the walls and provide a clean slate for the buyers to imagine their possibilities. When walls are already painted in very specific colors, they may look nice and presentable, but it could potentially lock the buyers into a particular look and feel that they may not desire. It proves difficult for the buyer to picture it any other way. It’s “better safe than sorry” in this case. Touch up the walls if there are marks, chips, or stains. Even consider repainting the walls with fresh coats of very neutral shades or off-whites. Now, if you think that there is only one shade of off-white to choose from, think again.

Though there are probably a hundred more tips that could be offered, hopefully you were able to gain some new insight on how to prepare your house to sell with these 6 tips. These tips can help speed up the home selling process and make the entire experience a little less stressful.

If you are looking to sell your home, be sure to click here to contact one of our Licensed Mortgage Loan Originators today to learn about what mortgage loan is right for you.

Caring for rescue animals requires a lot of time, love, money, and supplies. Throughout the month of June, employees from the NFM Lending corporate office and nearby Maryland branches collected items for the Maryland SPCA and the Baltimore Animal Rescue and Care Shelter, Inc. (BARCS). The items collected were chosen from the rescue groups’ “Wish Lists” located in their websites. The wish lists included items such as pet food, dog and cat treats, toys, beds, and cleaning supplies.

We would like to thank everyone who participated in the wish list collection. It was a great success! Each animal rescue group received a wide variety of items from their list, and was extremely grateful for the donations. We hope we helped lots of dogs and cats have an easier transition to their new forever homes.

NFM Lending (formerly NFM, Inc.) is pleased to announce they ranked in the “Top Mortgage Lenders 2013” by the Scotsman Guide.

Scotsman Guide compiled a list of the nation’s top 75 mortgage lenders by overall volume. Entries were accepted between February 10 and March 28, 2014, along with written verification of each company’s loan volume from a certified public accountant, the company’s chief financial officer, or a similar source.

“We are honored to be included amongst so many well accomplished and successful companies,” said David Silverman, CEO of NFM Lending. “We are especially proud that our quick transformation from primarily refinance to over 80% purchase has happened so successfully and quickly. I am proud of our team and with our collective efforts we will climb this list rapidly towards the top.”

NFM Lending (formerly NFM, Inc.) was founded in March 3, 1998 by David Silverman and his wife Sandy. The company started as a small brokerage shop with 4 loan officers, and it is now a multi-state lender with more than 200 employees, over 29 retail branches, and is licensed in 30 states.

For more information please contact:

NFM Lending

Toll Free: 1-888-233-0092

pr@nfmlending.com

www.nfmlending.com

About NFM Lending

Come join NFM Lending, a highly successful and multi-state company that is at the forefront of the mortgage lending industry. NFM Lending started out as a small brokerage shop and has grown to be an award winning full-service residential mortgage lender. We have been ranked one of the “Top Mortgage Lenders” in 2012 and 2013 by the Scotsman Guide; one of the “Top 100 Mortgage Companies in America 2013” by Mortgage Executive Magazine; and one of the “Fastest-Growing and Largest Private Companies” by the Baltimore Business Journal for 2012.

At NFM Lending, we pride ourselves on working hard to build a positive and collaborative work environment for its employees. We have an open door policy which allows an open line of communication between management and employees. And it is because of these values that NFM Lending has been named one of the “Top 50 Best Companies to Work for in America” in 2013 by Mortgage Executive Magazine; and named a “Top Workplace in Baltimore” by The Baltimore Sun in 2012 and 2013.

If you want to work for a company that has a deep commitment for our communities, dedication for building a positive culture for our employees, and passion for servicing our clients, come work with us!

Link to online press release: www.wiredprnews.com