Do you know what the difference is between Interest Rate and APR? These two items are key terms to know when researching mortgage loans. Here are their definitions:

Interest rate is the rate at which interest is paid by borrowers for the use of money that they borrow from a lender. This is important to note when comparing quotes for different loans since it directly affects your monthly payments.

Annual Percentage Rate (APR) describes the interest rate for a whole year (annualized), rather than just a monthly fee/rate, or more simply, it is a finance charge expressed as an annual rate. The APR is a broader measure of cost to you of borrowing money, and reflects not only the interest rate but also the points, broker fees, and other charges that you have to pay to get the loan, including some of your closing costs. For that reason, your APR is usually higher than your interest rate. The APR can help consumers understand the differences between the interest rate and the fees paid at closing. This was established as a part of the Truth in Lending Act.

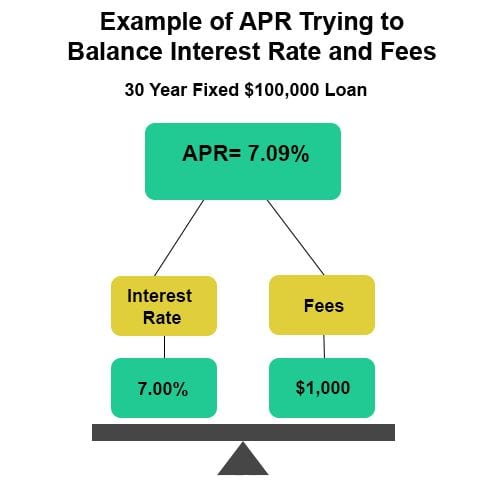

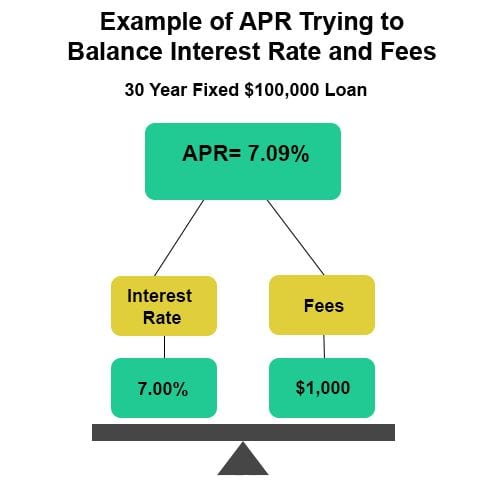

Below is a diagram that shows how APR tries to balance (and incorporate) both interest rates and fees.

How APR is Determined

To calculate the APR, the fees required to finance the loan are added to the interest rate. These are able to be combined by amortizing (paying off debt in regular installments over a period of time) the fees over the course of the loan, and calculating a new rate.

If you have any questions about interest rate and APR during your loan process, click here to talk to one of our Licensed Mortgage Loan Originators today!

What is the LTV on a home? The Loan to Value Ratio (LTV) calculates how much equity you have in your home. Equity is the difference between your home’s fair market value and the balance you owe on the property.

It is important because it helps lenders determine a borrower’s qualification for loans and rates. Your LTV has a direct effect on your rate. In many cases, a lower LTV can mean you can obtain a lower rate.

The LTV is calculated by dividing the amount of the mortgage by the appraised value or the purchase price of the home, whichever is less.

Here is an example of how the LTV is determined:

A loan applicant applies for a mortgage to purchase a home which the seller has agreed to sell for $350,000. The purchase price is $5,000 less than the home’s appraised value of $355,000. The loan applicant has savings of $70,000 to use for a down payment. The lender performs the following calculations:

{Purchase Price} – {Down Payment} = {Mortgage Amount}

{$350,000} – {$70,000} = {$280,000}

{Amount of Mortgage} ÷ {Purchase Price} = {LTV}

{$280,000} ÷ {$350,000} = {80%}

It’s important to note, however, if the appraisal is less than the purchase price, the borrower will have to increase his/her down payment or obtain mortgage insurance. For a loan amount over 80% LTV (loan to value ratio), Private Mortgage Insurance is required and must be obtained by the Lender.

If you have any questions about the LTV during your loan process, click here to ask a Licensed Mortgage Loan Originator.

LINTHICUM, MD., September 16th , 2013—NFM, Inc. is proud to have sponsored the NCADD-MD’s Recovery Golf Classic on Monday, August 26.

The NCADD-MD (National Council on Alcoholism and Drug Dependence, Maryland) held a Golf Classic this year at the Country Club of Maryland in Towson to benefit those suffering from alcohol and drug addiction.

NFM, Inc. was excited to be a Silver Sponsor and the very first company to become a sponsor for this year’s event.

Two of NFM’s finest and the company’s President, Jan Ozga, formed the NFM team. Participants enjoyed a patio cookout to start off the event, followed by the golf tournament, and finally a tasty buffet dinner and awards presentation.

David Nelson, the Board Chair of the NCADD-Maryland had this to say about the event: “The event was a huge success. We received our first check from NFM, Inc. and it was terrific to have that support. Jan Ozga, the President of NFM responded quickly when he found out about the event. People don’t understand how drug and alcohol addiction is a huge problem in our society. These diseases are non-discriminatory and can happen to anyone no matter what age or gender. We are glad to get the support of so many people so that we can provide treatment and help to those who are overcome with addiction.”

About NFM, Inc.

NFM, Inc. is a mortgage lending company currently licensed in twenty-seven states in the U.S. The company was founded in Baltimore in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM, Inc. has firmly planted itself in the home loan marketplace as “America’s Common Sense Lender.”

Government Insured

Conventional loans are not insured or guaranteed by the federal government. This mortgage type adheres to the guidelines set by Fannie Mae and Freddie Mac.

FHA loan is one of several government-insured/backed loans.

Credit Score

Having a good credit score is important for both loan types. Lenders are sometimes less stringent with your credit for FHA loans. Regardless of your actual credit, lenders typically require a credit score of at least 620 for qualification for all loans.

Down Payment

If you get a FHA loan there is a 3.5% minimum down payment requirement. These funds may be gifted from a family member of borrowed through a secured loan. The minimum down payment for Conventional financing is 3% but this must be from the Borrower’s own savings. This is one of the key differences between the mortgages that make people consider an FHA loan over a conventional.

Fixed/ Adjustable Rates

Both Conventional and FHA loans offer a wide variety of Fixed and Adjustable Rate Mortgages. Please consult our mortgage professionals to ascertain which is best suited for your needs.

Mortgage Insurance Premium

FHA financing requires the borrower to pay both an upfront mortgage insurance premium, which may be financed, and monthly mortgage insurance premiums, which are escrowed with the principle and interest payments.

If your down payment is equal to or greater than 20% of the sales price, you will not be required to pay mortgage insurance for Conventional financing. For down payments less than 20% , the amount of mortgage insurance varies with the amount of down payment. The mortgage premiums may, under certain circumstances, be financed in the loan. The premium may be paid monthly or in a lump sum at the time of closing. Please consult our mortgage professionals to ascertain which is best suited for your needs.

We hope this article will help you understand the differences between these two loan types. Remember, it is always best to go over your mortgage options with your Loan Originator.

If you are interested in learning more about each home loan or starting the mortgage process, please click here to talk to a Licensed Mortgage Loan Originator.

LINTHICUM, MD., August 12th, 2013—NFM, Inc. has received approval from the Better Business Bureau of Greater Maryland to become a BBB Accredited Business and has been assigned a rating of A-.

The BBB letter grades represent their opinion of businesses. According to the BBB website, some of the factors they take into account when choosing a grade: number of complaints filed against a business, whether the business has appropriately responded to the customer, and whether the business has resolved complaints in a timely manner.

NFM, Inc. has worked diligently to resolve consumer complaints in a respectful and timely manner. In an industry where customer complaints are high, NFM, Inc. strives to stand out with excellent customer service.

“I feel that approval as a BBB ‘accredited business’ with an A- rating reflects well on NFM, Inc.’s commitment to make a good faith effort to resolve any consumer complaint,” said Fred Sujat, NFM, Inc.’s Chief Compliance Officer.

NFM, Inc. ultimately hopes to receive an A+ from the BBB, and will continue to strive for excellence.

About the Baltimore Business Bureau

The BBB (Baltimore Business Bureau), founded in 1912, is an authority on trust in the marketplace. BBB sets and upholds high standards for ethical marketplace behavior. BBB accreditation is a coveted honor earned by elite businesses and charities. BBB is a valuable resource to turn to for objective, unbiased information on businesses and charities.

About NFM, Inc.

NFM, Inc. is a mortgage lending company currently licensed in twenty-seven states in the U.S. The company was founded in Baltimore in 1998. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM, Inc. has firmly planted itself in the home loan marketplace as “America’s Common Sense Lender.”

# # #

If you have not been able to get traditional refinancing because the value of your home has declined, and you’re not behind on your mortgage payments, you may be eligible to refinance through the “Home Affordable Refinance Program.”

Definition

The Home Affordable Refinance Program (HARP) allows people who have loans that have been guaranteed by Fannie Mae or Freddie Mac on or before May 31, 2009, with little or negative equity to refinance and take advantage of the current low interest rates. NFM Lending offers HARP loans for homeowners that owe up to 150% more than their home is worth (LTV ratio). HARP loans are available for both primary and investment properties.

Requirements

In order to be eligible for a HARP loan you must have a current loan-to-value (LTV) ration greater than 80% and you must be current on your mortgage at the time of the refinance. You must have a good repayment history in the past 12 months. Also, you must have a mortgage that is owned or guaranteed by Freddie Mac or Fannie Mae; it needs to have been sold to them on or before May 31, 2009. Additionally, your mortgage cannot have been refinanced under HARP previously (unless it’s a Fannie Mae loan that was refinanced under HARP from March-May, 2009).

Getting the Loan

If you would like to see if you will qualify for this loan, contact one of our Licensed Loan Originators by clicking here.

You’ve spent months trying to find your dream home. You finally find a house you could see you and your family in that is affordable. You may have been pre-approved for the property’s asking price and you’re ready to take the next steps to secure a loan. Before a lender can determine how much money you can obtain in the form of a loan, an appraisal needs to take place.

Appraisal Overview

An appraisal is a document which determines an opinion of value on residential real estate. A certified residential/general real estate appraiser will be contracted to determine the current value of the property. An appraiser is a state-licensed professional who is considered an expert at property evaluations. If an appraiser determines that your house is worth less than the asking price, you may request a reduction in the sales price from the seller based on this appraised value in accordance with the conditions of the Real Estate Contract of Sale you may have already signed.

Inside the Appraisal Process

The appraisal process can vary slightly depending on what lender you use but in general it is as follows:

Once a borrower finds a lender they would like to use, an appraisal is required to ascertain the current value of the subject property. The lender will contact an Appraisal Management Company (AMC). The AMC in turn contacts a local appraiser within the area that the property exists, and then the borrower is contacted to schedule an appointment. The appraiser will go to the property to ascertain the condition of the home, take measurements and pictures while making notes about any upgrades, deferred maintenance, materials used during construction of the home, amenities located within the neighborhood, etc. The appraiser will then review recent sales of similar homes within the subject’s market area to compare with the borrower’s property. An appraisal report is then prepared comparing the borrower’s property to the others as adjustments are made for differences in each home such as: size, room count, condition of home and other amenities to ascertain the subject’s market value and within the next few days the report will be sent back to the AMC, who in turn sends it to the lender.

At NFM Lending

After obtaining an accurate appraisal from a state certified general/residential appraiser, a processor who works in conjunction with a licensed Mortgage Loan Originator, packages the appraisal with other documents in the file for submission to an underwriter who determines the acceptability of the appraisal and borrower’s credit/income worthiness.

Should you have any questions regarding appraisals and your home, please contact a Licensed Mortgage Loan Originator by clicking here.

LINTHICUM, MD., July 3rd, 2013—NFM, Inc. is proud to have donated over 20 boxes of food and other essentials to local food banks in Maryland and New Jersey.

World hunger is a very important cause to the people at NFM, Inc. They decided to tackle the problem one location at a time. The employees in their corporate office, in Linthicum, Maryland, as well as the Bethesda, Maryland, Frederick, Maryland and Penns Grove, New Jersey branch coordinated with their local food banks to make donations.

NFM, Inc. encouraged all employees to participate in this event along with their friends, families, and any vendors.

The food drive ran from Monday, June 10th- Friday, June 28th. Employees donated food items such as pasta, cereal, soup and non-food items such as toilet paper, diapers, and more.

“When I was shopping for food for our food drive at work, I couldn’t help but think about how fortunate my family and I are, and how we tend to take for granted that food is always available in our cabinets or refrigerators when we are hungry. It made me want to donate that much more,” said Sandy Kick, HR Assistant.

A few employees from the HR department at the corporate office dropped off the items at Maryland Food Bank, and the food weighed in at 415 pounds.

NFM, Inc. looks forward to partnering with local food banks to donate food and other items in the future.

About NFM, Inc.

NFM, Inc. is a mortgage lending company currently licensed in twenty-seven states in the U.S. The company was founded in Baltimore in 1998. They attribute their success in the mortgage industry to heir steadfast commitment to their customers and the community. NFM, Inc. has firmly planted itself in the national home loan marketplace as “America’s Common Sense Lender.”

# # #

LINTHICUM, M.D., June 7th , 2013— NFM, Inc. is proud to announce that they have been ranked 54 out of 100 top mortgage lenders by the Scotsman Guide. The Scotsman Guide ranks the lenders based on their overall loan volume for the year.

March marked NFM’s 15th anniversary of being in business. NFM, Inc. has 21 locations in Maryland, Virginia, Pennsylvania, New Jersey, Alabama, Indiana, North Carolina, Ohio, and Illinois. NFM’s corporate office is located in Linthicum, Maryland and it is 16,800 square feet. Since 2004, NFM, Inc. has closed roughly 30,000 loans. In 2012, their annual volume was roughly one billion dollars.

David Silverman, NFM, Inc.’s CEO, started the company in 1998 with his wife, Sandy, as a small mortgage brokerage establishment in Baltimore with just four loan originators by their side. Today the company has over 225 employees and is licensed in 27 states.

NFM, Inc. has prospered under David’s leadership. NFM, Inc. has been recognized by The Baltimore Sun as one of the Top Workplaces in 2012; ranked by the Baltimore Business Journal as the 11th largest mortgage lending firm in the region in 2010; David was ranked one of the Top 100 CEOs in Baltimore in 2009 by SmartCEO magazine; NFM, Inc. has been recognized by SmartCEO magazine as one of Baltimore’s 50 fastest growing companies in 2006; Also, NFM, Inc. was ranked for two consecutive years (2004 and 2005) on the INC 500 list of fastest growing private companies in the country.

NFM, Inc.’s primary goal has always been service. NFM, Inc. strives to assist clients in obtaining a loan that meets their needs by providing exemplary services through a variety of mortgage solutions.

NFM’s focus is not solely in servicing borrowers, it is also on serving the communities their borrowers and employees live and work in. NFM, Inc. has been involved in over 25 charitable organizations including the Ronald McDonald House Charities of Baltimore and Habitat for Humanity.

NFM, Inc. works very hard to give their employees the tools they need to succeed in business and help clients. Everyone is instrumental in the company’s success from the executive team to the administration team.

NFM, Inc. is honored to be named one of the Top 100 Mortgage Lenders and looks forward to being on the list next year.

There are many factors that go into deciding where to purchase a home. At the top of many home-buyers’ list is the quality of the school district. This is an obvious concern for many parents and parents-to-be as attending a good public school is essential to their children’s future. It can also save you thousands of dollars that would otherwise be spent on private school tuition. School districts are also a concern for buyers who do not have children as they affect how much is paid in property tax and can greatly affect the resale value of a home.

How do I determine how good the school district is?

When evaluating a school district, there are a few things to take into consideration. Take a look at the quality, age, and facilities of the schools themselves. Look into how students perform on standardized tests. Check out the student-to-teacher ratio to see how much personalized attention the students receive. The amount of spending per pupil at the school will tell you how much of the budget is allocated for each student. Most importantly, talk to people who have lived in the area for a while and have children enrolled in the schools. You may even want to schedule an interview with a teacher or administrator at the school.

Advantages of Being in a Good School District

Whether you have children, are planning to, or are not planning to, it can be advantageous to purchase a home in a good school district. It is shown that houses in good school districts typically have higher resale values and sell faster. Typically, when housing markets go down, areas with high quality schools are more likely to hold their values.

School Districts If You Don’t Have Children

If you don’t have and aren’t planning to have children, living in a good school district definitely has its advantages as seen above. However, affordable homes can be hard to find in these areas as they typically sell faster than others. You might also want to take the amount you are paying in property taxes into consideration. Property taxes pay for local services that benefit residents in the area. Areas with good schools tend to have higher property taxes as a lot of the money is allocated to the schools.

As you can see, school districts are an important factor to consider when purchasing real estate. When deciding where to buy your home, remember that the most important consideration is what feels right for you and your family. The rest will fall into place.