Whether it’s time to down/up-size or your job requires you to move, buying a new house can be exciting. However, that doesn’t mean selling your current home will be easy. You might not realize how strong your emotional connection really is until you start the home selling process. Here are a few ways to help you handle the emotions of selling your home.

It is important to make sure you are 100% ready to move. Therefore, you should start preparing for the emotional side of home selling before your home hits the market. The earlier you start to work through your feelings, the smoother the process will be. This will allow you to evaluate your feelings and potentially realize that maybe you aren’t ready. The last thing you want is to do is get to closing and change your mind. Remind yourself of the reasons you have chosen to sell your home. Has your family outgrown the space, are you following a job, or is it time to downsize? Whatever it may be, you decided it was time to move on for a reason.

After accepting why you need to move, take some time to grieve. You are leaving a home full of memories. It is sad you might be leaving the first place you bought with your spouse or the place your child took their first steps, but it is important that you look beyond those memories and try to detach yourself. It will be a lot easier for you to sell a house, rather than a home. Removing your family pictures and other personal mementos will make it seem less like home to you and will allow potential buyers to more easily picture themselves in the house.

Prepare yourself for your life to become a lot more hectic. You will find your schedule changing to accommodate open houses, as well as having to keep on top of keeping everything clean and tidy. The housing market can be unpredictable, so there is no telling how long you will have to keep this up before your home is sold. It can become tiring but is vital to getting your home sold.

It is recommended that you don’t stick around when your home is open for showings. Not only could it damper the experience for the potential buyers, but it leaves open opportunities for your feelings to be hurt. Potential buyers might not give their honest opinion of the home at the chance they could offend you. On the other hand, if they do, you might not like what you hear and could take it personally. Buyers are there to evaluate your home and have their own ideas of how a house should look. Don’t take offense or be surprised if some buyers nit-pick and are extremely critical of little details. It’s better for everyone if the seller isn’t present.

Overall, don’t be surprised if selling your home has a much larger emotional toll on you than expected. If you are prepared to go through the emotions, you’ll get through and can enjoy the adventure of your new home.

If you have any questions or want more information about the home selling process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

Winter can be such a beautiful time of year, but hard on your wallet. Don’t worry if you can’t afford major improvement projects to make your home more energy efficient. Keep your money in the bank by using these tips to help save on energy costs this winter.

Bundle up in long sleeves, sweatshirts, warm socks and slippers. Keeping your home even just a few degrees cooler than normal can add up to big savings. Place plenty of big and soft blankets around the house on beds, couches, and arm chairs. Switch out bed sheets to thicker warm ones, such as flannel. No one enjoys walking on cold hardwood, concrete, or tiles floors; area or throw rugs are a great way to eliminate cold surfaces.

If you haven’t yet, invest in a programmable thermostat. To rack up savings, we recommend scheduling so it’s 7-10 degrees cooler when you’re not at home and when sleeping. Most people spend a good portion of the day at work, so don’t heat a house you’re not in. You should also take advantage of natural lighting to help heat your home. Be sure to open curtains during the day to allow the sun to shine through, but remember to close them at night to trap the heat in.

Hot air rises, which isn’t helpful in these cold winter months. Make sure your ceiling fans are adjusted so they run in clockwise, sending that wonderful warm air back down and ensuring the air is properly circulated. Getting tricked into thinking your home is colder than it really is means money out of your pocket.

After using the oven, take advantage of the free heat! Leave the door cracked to let the heat escape into your kitchen and nearby rooms, taking some of the pressure off your furnace.

Check the vents in your home for any furniture or items in the way. Covered vents are unable to properly deliver heat throughout your home. If you don’t use a room often, consider closing the vent in that spaces so the heat can be redirected. You don’t want any heat to go to waste.

As helpful as kitchen and bathroom exhaust fans are to remove unwanted odors, smoke, and excess moisture, they also get rid of a lot of hot air. If you want to save money, you should use them sparingly during the winter.

You don’t need to spend a ton of money to save on heating/energy costs. Work with what you have until you can afford those bigger changes later. All of these common-sense tips should cost a couple dollars and take only minutes to do.

Check out our tips on how to prepare your home for winter for more ways to get your home ready for these long and cold months!

LINTHICUM, MD, November 1, 2018— NFM Lending is pleased to honor Master Sergeant Paul Franks, USA, Retired, as the NFM Salute for November 2018.

MSG Franks joined the US Army out of Birmingham, Alabama in March 1984. After completing basic and individual training to become a Tactical Telecommunications Center Operator, he was assigned to the 24th Signal Battalion, Ft. Stewart, GA, providing vital communications support to the Commander of the 24th Infantry Division (M) headquarters. In February 1986 he was assigned to his first overseas post in Mannheim, Germany with the 97th Signal BN, Central Army Group NATO. He was responsible in providing communications support for the CENTAG commander at his Primary War Headquarters to his field commanders. In 1990, MSG Franks was assigned to the 501st MI Bn at Ft. Lewis, WA in support of the I Corps Commander during Desert Storm. The following year he moved to the I Corps Headquarters, G-6, where he was assigned as a Communications Security (COMSEC) NCO for the Corps. In 1992 MSG Franks was assigned to the Joint COMSEC Logistics Office in Pusan, South Korea, where he was responsible for providing COMSEC material throughout the ASIA Pacific region. After this tour he went back to Ft. Lewis to be assigned to the 1st Special Forces Group (A).

From 1992 through 1998, MSG Franks was deployed to numerous Southeast Asia countries, including eight deployments to the Kingdom of Thailand and Indonesia, where he provided communications support and taught indigenous forces American war-fighting techniques. During this time, he deployed to two Joint Task Force 6 drug interdiction missions in both Texas and Florida. He also completed numerous military schools and training, such as Basic Airborne school, Special Forces Static Line Jump Master course, Special Forces Communications school, SERE High-Risk Level C survival school, and the Air Force Load Master course. After this high demanding assignment, MSG Franks was assigned to the Allied Naval Forces Europe Headquarters in Naples, Italy to be the Circuit Control NCOIC responsible for setting up and coordinating ship to shore communications for the Admiral in charge, allowing him to communicate to his Commanders of the Sixth Mediterranean Fleet. He was instrumental in setting up the communications between the Headquarters and the Fleet in support of numerous exercises and real-world conflicts, such as the war efforts during the Bosnia conflict.

After this tour of duty, in 2000 MSG Franks was reassigned back to the US to the 5th Special Forces Group(A) S-6 at Ft Campbell, KY. 9/11 took place during his time at 5th Group, at which point he helped coordinate all aspects of secure communications between the Special Operations Joint Task Force-Dagger Headquarters and 5th Group ODA Teams on the ground in Afghanistan and surrounding areas. Once redeploying from Afghanistan in 2002, he went right into getting the Group Headquarters and ODA Teams ready on secure communications for Operation Iraqi Freedom, which kicked off in the Fall of 2002.

MSG Franks received orders to the 101st Airborne Division (A) Headquarters G-6 in November 2003, in which he was in charge of the Division Automation Management Office. He deployed to the Division’s Headquarters in Mosul, Iraq shortly afterwards and through the end of March 2004 he oversaw the Division’s Automation circuits for the war fighting campaign. Once redeploying back to the states, MSG Franks helped coordinate the Division’s complete automation communications transformation, so the Division had the cutting-edge communication capabilities needed for future war-fighting into the 21st century.

MSG Franks retired in July 2005 after over 22 years of dedicated service to his country. He achieved numerous awards and badges, including the Joint Meritorious Service Medal, Meritorious Service Medal with numeral 3, Army Commendation Medal with numeral 5, Army Achievement Medal with numeral 6, Master Parachutist Badge, and the Expert Marksmanship Badge for rifle and pistol. He currently resides in Clarksville, TN.

MSG Franks was nominated by his daughter, Rebecca.

“He’s been on some incredible adventures. The hard work, dedication, and sacrifices that he made also afforded my family the opportunity to travel and live all over the world.”

NFM Salute is an initiative in which one military member or Veteran is chosen each month to be honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” will be featured on the website with a brief biography and information about his or her service, and NFM Lending will make a $1,000 donation to a military or Veteran non-profit in the Salute’s name.

Selected NFM Salutes may choose from one of the following three non-profits: Platoon 22, AnySoldier, and the Gary Sinise Foundation. MSG Franks chose Any Soldier to receive this month’s donation. NFM looks forward to the opportunity to continue to honor military and Veterans through the NFM Salute initiative.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998 and this year is celebrating its 20th anniversary. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.

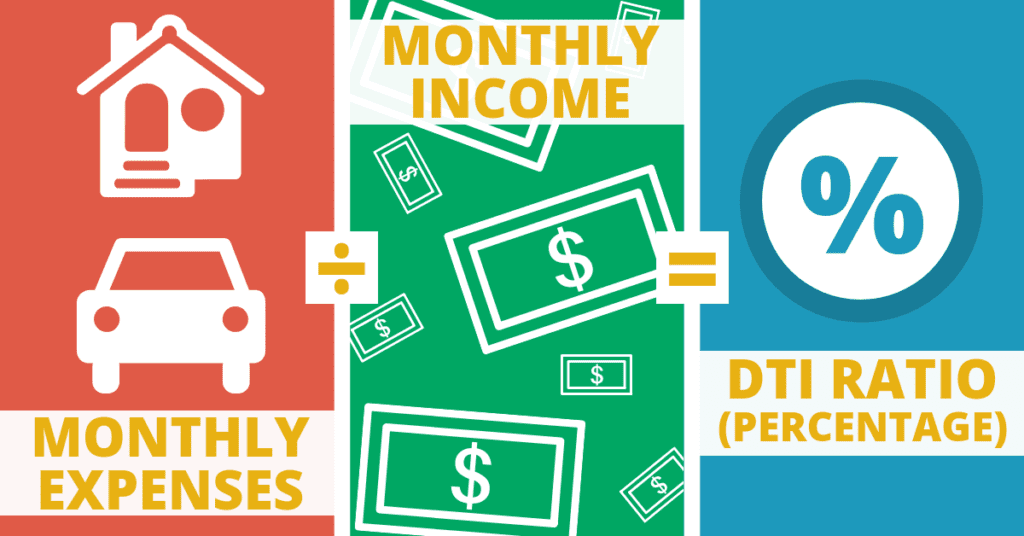

During the homebuying process, you’ll come across many terms, such as debt-to-income (DTI) ratio. This ratio allows your lender to see the balance you have between your income and your debts. You need to understand your DTI ratio, so you can be in the best financial standing before applying for a loan.

Simply put, the DTI ratio measures your ability to manage the monthly payments on your mortgage. This is done by taking all your debt payments (car, student loans, mortgage) and dividing them by your gross monthly income. Your gross monthly income is the amount of money you make before taxes and other deductions.

For example:

Every month you pay your mortgage ($1,400), car ($150), and student loans ($250). Your total monthly debt is $2,100 ($1,400 + $150 + $250 = $2,100). Your gross monthly income is $6,500, making your debt-to-income ratio .32 or 32% percent ($2,100 ÷ $6,500 = 32%).

So why is this ratio so important? When applying for a mortgage, your lender needs to ensure you will be able to handle your monthly mortgage payment. Your DTI is the percentage of your income that will be covering your mortgage payments. Don’t rely on your DTI when setting a budget, as it does not account for all costs of living. You will need to still consider your additional expenses, such as food and utilities.

If your ratio is too high, you might not qualify for certain programs. Most lenders have a set ratio they look for, typically less than 36%. The higher your DTI is the tighter your finances will be. Your lender wants to ensure you are able to live comfortably and can easily cover all of your debts and costs of living. Don’t worry, if your DTI is higher than 36% you can still qualify for a loan.

Before applying for a loan, you should calculate your DTI. If you find your ratio to be on the higher side, you can take some steps to lower it. Pay off as much of your debt as possible before applying. You should also avoid making any large purchases or obtaining any additional debt. If possible, you can also look for ways to increase your monthly income.

Becoming a homeowner requires a lot of preparation, especially financial. To increase the likeliness of obtaining the loan you want, calculate your DTI and adjust as needed.

For more information about DTI or the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

LINTHICUM, MD, October 9, 2018— NFM Lending is pleased to honor Hospital Corpsman Third Class Holden Hall as the NFM Salute for October 2018.

HM3 Hall grew up in small town Cameron, NC. During high school, he found success in the JROTC program, quickly excelling and earning leadership positions. At 16 years old, HM3 Hall joined his local fire department. He fell in love with the job and dedicated the next three years of his free time to helping the community through the fire service. HM3 Hall then joined the Navy at 19 years old and endured one of the hardest programs as a Corpsman. He graduated in the top of his class and spent the next two years in Beaufort, SC assisting Critical Care for Marines. HM3 Hall was recently moved to Jacksonville, NC to complete field medical training with Marines, in the event his skills are needed on deployment.

Now stationed in Jacksonville, HM3 Hall serves the intensive care unit (ICU) at the Naval Medical Center Camp Lejeune. He is still dedicated to his hometown fire department and spends every free weekend he has making the 3.5 hour drive back home to Cameron to serve his community. Recently, he worked four days straight during Hurricane Florence with the fire department, offering support anywhere he could.

HM3 Hall was nominated by his girlfriend, Alysia.

“I am nominating Holden because he truly is a one-of-a-kind person. His passion and love for serving the community truly burns inside him like ‘wildfire’. He shows up for every shift and puts in 120% effort with every moment. So many people love and adore Holden for how well he represents both Vass and Cameron North Carolina. He is a great role model and a true American Hero. He is also the love of my life and I could not have chosen a more selfless person to spend my life with.”

NFM Salute is an initiative in which one military member or Veteran is chosen each month to be honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” will be featured on the website with a brief biography and information about his or her service, and NFM Lending will make a $1,000 donation to a military or Veteran non-profit in the Salute’s name.

Selected NFM Salutes may choose from one of the following three non-profits: Platoon 22, AnySoldier, and the Gary Sinise Foundation. HM3 Hall chose Platoon 22 to receive this month’s donation. NFM looks forward to the opportunity to continue to honor military and Veterans through the NFM Salute initiative.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998 and this year is celebrating its 20th anniversary. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.

We all know just how stressful moving can be. There are a ton of decisions to make and plans to coordinate. It’s important to recognize that moving impacts everyone. Use this advice to help you ensure a successful experience moving with children or pets.

Children

Before

During

After

Pets

Before

During

Keep these tips in mind when selling your home.

After

As long as you keep in mind that moving can be just as hard on your children or pets as it can be for adults, you’ll have a smoother moving experience. Relieve yourself from additional stress by taking plenty of precaution and preparing well in advance. Use these additional moving tips to help keep you organized.

If you have any questions about the home buying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

With summer over, it’s the perfect time to start preparing for the approaching winter months. Here are some important tips to help you start getting your home ready for fall.

Clean your Chimney

One of the last things you want to worry about is having your chimney catch on fire. That’s why it is important you regularly check for any buildup of creosote. If there is a sticky black substance thicker than ¼ inch on the back of your chimney, you should schedule a cleaning and refrain from using your fireplace. Meanwhile, prepare by collecting plenty of firewood to last you in the upcoming colder months.

Inspect the Furnace

Check your furnace and other heating systems to ensure they are in good condition and ready to be used. Even if you don’t have your furnace professionally checked, give it a thorough visual inspection. You should replace your furnace filter, even if it looks fine. One important way to maintain your water heater’s lifetime is by cleaning sediment out, which reduces the chance of clogs and increases energy efficiency.

Organize your Tools

Gather your most used fall tools so they are easily accessible, such as a leaf blower or rake. This will keep you from rummaging through your garage or tool shed when you’re ready to use them. You can even pull out your winter tools (ice scraper, shovel, snow blower) to really get ahead of the game. When putting away your garden hoses, make sure you drain all the water out or you’ll risk having to replace them if they rip when frozen water is trapped inside. You should also drain your outdoor faucets and sprinklers after cutting off the water supply.

Empty the Gutters

It is a popular belief that you only need to clean your gutters out after leaves and other debris start falling, but that’s not true. Be proactive and clean the gutters regularly to prevent clogs before they happen. This will not only require less time and effort but will extend the lifetime of your gutters and could save you from unexpected costs, such as foundation or landscape damages. If you’re not one for maintenance, hire professionals or consider installing gutter guards to really remove the headache of cleaning.

Check your Windows and Doors

The weather stripping on your doors or windows might have leaks. This means that the hot air from your home could be leaking outdoors (and cool air might have been escaping all summer). If you do find leaks, replacing the stripping is a reasonably easy DIY project. If you have the funds, replacing windows or doors with more energy-efficient options will save money you in the long run.

Taking care and maintaining your home is your responsibility as a home owner. These tasks shouldn’t take more than a weekend to knock out. Even if you live in an area that doesn’t experience winter, some of these tasks still apply to your home. Once completed, you can have peace of mind knowing your home is ready for the change in season.

Fall is also a great time to purchase a home. For those looking for a dream home and finding one that needs a little TLC, there are renovation and rehab loan options that will help cover costs. For more information about renovation loans or the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

LINTHICUM, MD, September 5, 2018— NFM Lending is pleased to honor Captain Robert J. Swain as the NFM Salute for September 2018.

CPT Swain graduated from Texas A&M as a Second Lieutenant in the U.S. Army in 1962. His first assignment was as a Liaison Officer to the British delegation for a secret classified meeting between Great Britain, Australia and Canada. When his commander received an emergency discharge, CPT Swain assumed a Major’s position and conducted the conference successfully. He then served initially as an Infantry Platoon Leader before attending Army Helicopter Flight School. From there, he served in Korea as Aide and pilot to Brigadier General O.M. Barsanti and later in Korea with Brigadier General Thomas Andrews.

After a year at Fort Benning, GA in the 11th Air Assault Division (the test unit for the airmobile concept) he was assigned to Fort Lewis, WA where he commanded an Air Cavalry Troop as a Lieutenant. He deployed to Vietnam and served in the First Squadron, Ninth Cavalry, First Cavalry Division. The First of the Ninth was a helicopter reconnaissance unit in combat virtually every day. CPT Swain was Platoon Leader for the armed helicopter platoon and later the unit troop carrying platoon.

In November of 1966, CPT Swain was shot in the right arm and leg while on the ground in command of an infantry platoon. For his actions that day, he was awarded the Purple Heart and Silver Star. CPT Swain also received two Bronze Star Medals (one with V Device), twenty-one Air Medals (one with V Device), and the Army Commendation Medal. He recuperated in the Philippines for a month and returned to combat still bleeding from wounds in his leg. It was the last six months that were the hardest as he saw several of his closest friends lose their lives, some even days before going home. He left Vietnam with over 1300 combat flight hours.

CPT Swain was discharged in 1968. He then flew for United Airlines for the next 33 years. He also served as the Regional Vice President for the North Atlantic for the International Federation of Airline Pilots Association. In his spare time, he was appointed as a Judge for the Maryland State Orphans’ Court. After United, he worked as an Air Carrier inspector for the Federal Aviation Administration for another 5 years and became the United States Member to the International Civil Aviation Organization’s Separation and Air Space Safety Panel. While with the FAA CPT Swain taught at the FAA Academy in Oklahoma City.

CPT Swain is retired in College Station, Texas, the home of Texas A&M, where he is active in the Lettermen’s Association and enjoys the activities provided by a campus environment.

CPT Swain was nominated by his daughter, Melissa.

“What that man endured and didn’t speak of for so long, deserves to be recognized. The stories he can tell, and the sheer courage and perseverance throughout the rest of his life are awe-inspiring.”

NFM Salute is an initiative in which one military member or Veteran is chosen each month to be honored as the “Salute of the Month.” Salutes are chosen from nominations on the NFM Salute website, www.nfmsalute.com. The “Salute of the Month” will be featured on the website with a brief biography and information about his or her service, and NFM Lending will make a $1,000 donation to a military or Veteran non-profit in the Salute’s name.

Selected NFM Salutes may choose from one of the following three non-profits: Platoon 22, AnySoldier, and the Gary Sinise Foundation. CPT Swain chose Platoon 22 to receive this month’s donation. NFM looks forward to the opportunity to continue to honor military and Veterans through the NFM Salute initiative.

About NFM Lending

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998 and this year is celebrating its 20th anniversary. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.

One of the biggest reasons holding people back from becoming homeowners is lack of funds, specifically to cover the cost of a down payment on a loan. Luckily, there are several assistance programs available to help people in those financial situations become homeowners by covering the required down payment. If you’re in a tight financial situation, make this the year you become a homeowner by checking out the Chenoa Fund Program.

What is the Chenoa Fund Program?

The Chenoa Fund Program assists borrowers who lack funds by helping them finance the down payment requirement of an FHA loan, which is 3.5%. It essentially combines the ease of an FHA loan with a grant or second mortgage to cover the 3.5% down payment requirement, meaning you receive could receive up to 100% financing.

There are three different options to choose from based on your income. If your income is the same or less than 115% of your area median income, you might be eligible for a different program than if your income exceeds 115%. Let one of our Mortgage Loan Originators help you determine if and for what kind of assistance you may qualify.

Like any loan option, the Chenoa Fund does have a credit requirement. You must have a minimum of 620 FICO score and all additional FHA loan criteria must be met. In some instances, a non-occupant co-borrower is allowed.

As a homebuyer, you should research and discuss with your lender all the possible loan and program options available to you. If you’re thinking an FHA loan might be right for you, talk with your lender about the Chenoa Fund Program. Being unable to fulfill a down payment requirement is no longer a reason to stall your dreams of becoming a homeowner.

For more information about this program, other loan options, or the homebuying process, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the process, click here to get started!

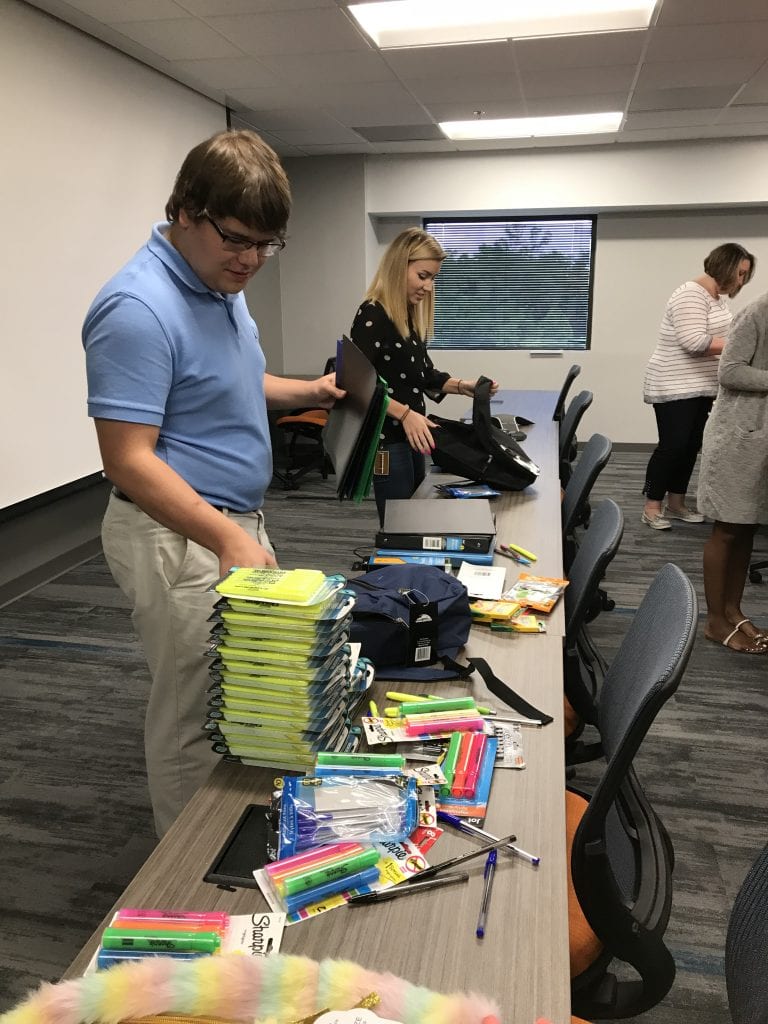

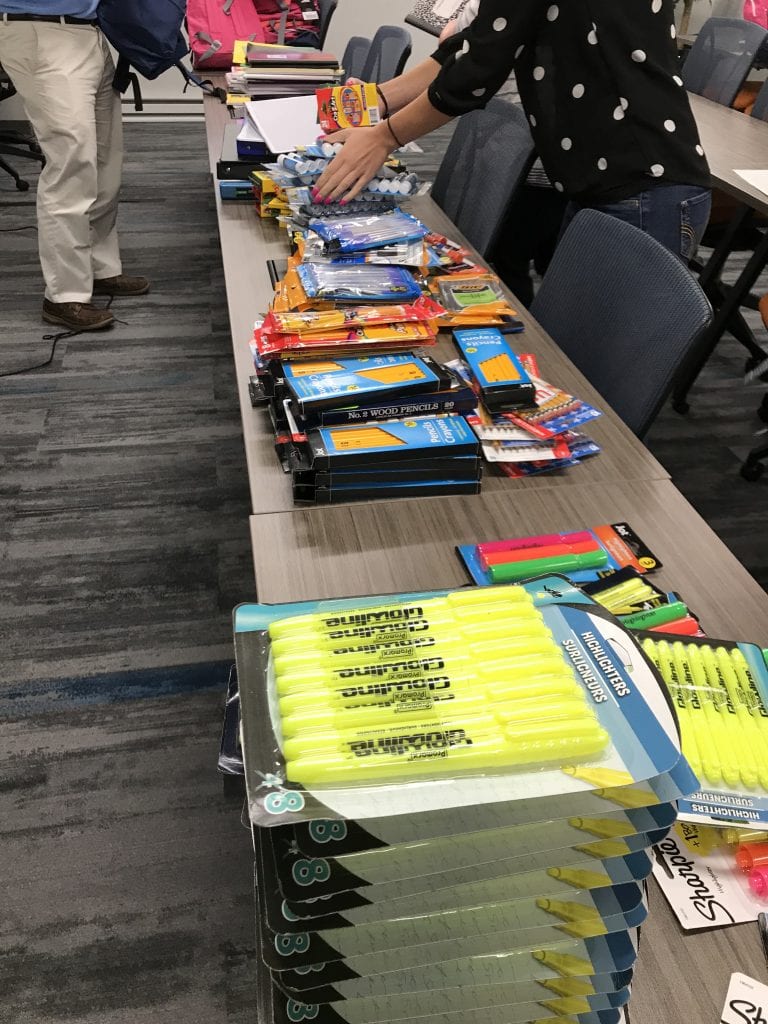

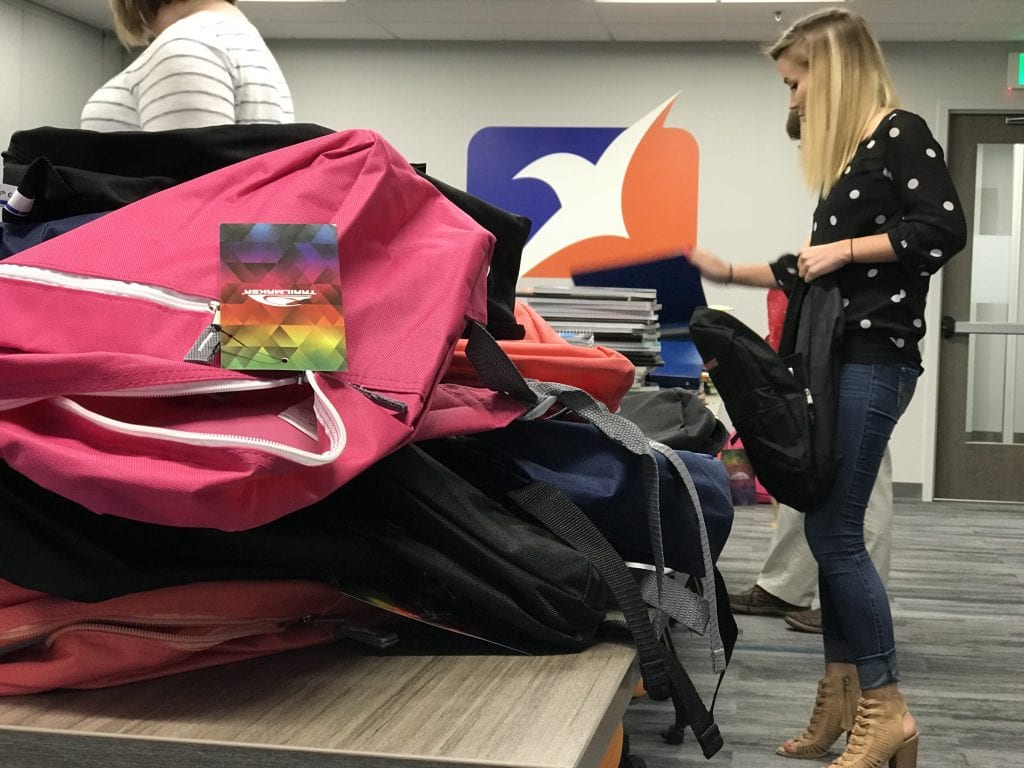

LINTHICUM, MD, August 29, 2018— NFM Lending is pleased to announce the successful completion of its fourth annual School Supply Drive. From July 30th to August 13th, NFM Lending collected school supplies to fill backpacks with tools that will prepare students in Anne Arundel County for a successful school year. This year, NFM Lending provided the Anne Arundel County Public School District with 50 filled backpacks for children attending third and fourth grade.

“NFM Lending leads the charge once again,” said Madison Grey, HR Director and team lead for the drive. “For the fourth year in a row, we have answered the call of the underserved children in our communities. We understand the importance of family – we live it every day when a family turns the key to their new home. It is both exciting and inspirational, so we are thankful to be able to play a part. It brings us joy to send these children back to school with all the tools they need to succeed. NFM wishes all families success!”

NFM Lending is proud to support many charities and non-profits through donations and volunteer work. NFM has also been involved in charitable efforts with The Ronald McDonald House Charities of Baltimore, AnySoldier, Johns Hopkins Department of Gynecology and Obstetrics, and St. Jude’s Children’s Research Hospital, to name a few. For more information about NFM Lending’s charitable work, click here.

NFM Lending is a mortgage lending company currently licensed in 29 states in the U.S. The company was founded in Baltimore, Maryland in 1998 and this year is celebrating its 20th anniversary. They attribute their success in the mortgage industry to their steadfast commitment to customers and the community. NFM Lending has firmly planted itself in the home loan marketplace as “America’s Common Sense Residential Mortgage Lender.™” For more information about NFM Lending, visit www.nfmlending.com, like our Facebook page, or follow us on Twitter.